-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Singapore Bonds

- Thread starter Runifyouhaveto

- Start date

Re: Interesting Bond issues

You can ignore personal attack and go back there.. In Internet, everywhere also got mad people. Here also same.. even more crazy people.

Dear good O'brother, RUN became a refugee in SBF after CNA forum closed. An old CNA contact found RUN and encouraged RUN to go sgfuck.

After a while there, RUN left because discovering some things there and also kanna personal attacks in pm.

You can ignore personal attack and go back there.. In Internet, everywhere also got mad people. Here also same.. even more crazy people.

Re: Interesting Bond issues

30 yrs yield of 3.85% from Apple is really pathetic. I have some Google bond 10 years with 3+ % yield which I think it is better investment

30 yrs yield of 3.85% from Apple is really pathetic. I have some Google bond 10 years with 3+ % yield which I think it is better investment

Bond-financing: Margin calls for even the safest bets

Based on the assumption that all investment-grade bonds (eg. sg govt bonds, local banks) will be redeemed upon maturity. bond investors (without bond-financing) are not concerned about bond prices.

However, bonds can bankrupt a speculator who took up Bond-financing (borrow money to buy bonds). Eg. Apple issued a 3.85% bond due to in 2043 a few years ago and the price crashed to 20% below par value in Nov 2013. Any speculator with 70% or 80% LTV for these "safe" Apple Bonds would be hurt by margin call = lose more than your capital invested.

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

Re: Interesting Bond issues

good brother, the personal attacks are just the catalyst, an excuse for RUN to walk away. In fact, the SBF is a tougher drome. RUN started to feel uneasy when people there defended fiercely about the notion of owning/buying/selling physical gold and silvers + investments in specific stock counters, eg REITs.

Ok, it is perfectly ok to have differing opinions on shares but RUN came to realized that it is likely that some of team/moderators might be making a living out of web-traffic and peddling physical-gold. Absolutely nothing wrong but they didn't read carefully that RUN is also vested in similiar areas; just that i was advocating the investment in miners instead of physical gold/silver because RUN shared his field experience that our local precious metal market was inefficient and cornered by a few middlemen. Then they not happy wor =). So unfortunate, RUN also have about 30K worth of pure silver investment. I was just being less biased.

As days passes by, RUN suspects that the team/moderators behind the site contains either non-singaporean or new-immigrants with other agendas. There might be foreign-govt elements inside, systematically bashing and flaming true locals (in my opinion), and spreading neo-nazi anti-west beliefs . The nice guys (in my opinion) got silenced. These people never got banned or warned yet rewarded with repute points.

Too complicated city life over there, RUN is just a country mouse, that's why he walked away.

You can ignore personal attack and go back there.. In Internet, everywhere also got mad people. Here also same.. even more crazy people.

good brother, the personal attacks are just the catalyst, an excuse for RUN to walk away. In fact, the SBF is a tougher drome. RUN started to feel uneasy when people there defended fiercely about the notion of owning/buying/selling physical gold and silvers + investments in specific stock counters, eg REITs.

Ok, it is perfectly ok to have differing opinions on shares but RUN came to realized that it is likely that some of team/moderators might be making a living out of web-traffic and peddling physical-gold. Absolutely nothing wrong but they didn't read carefully that RUN is also vested in similiar areas; just that i was advocating the investment in miners instead of physical gold/silver because RUN shared his field experience that our local precious metal market was inefficient and cornered by a few middlemen. Then they not happy wor =). So unfortunate, RUN also have about 30K worth of pure silver investment. I was just being less biased.

As days passes by, RUN suspects that the team/moderators behind the site contains either non-singaporean or new-immigrants with other agendas. There might be foreign-govt elements inside, systematically bashing and flaming true locals (in my opinion), and spreading neo-nazi anti-west beliefs . The nice guys (in my opinion) got silenced. These people never got banned or warned yet rewarded with repute points.

Too complicated city life over there, RUN is just a country mouse, that's why he walked away.

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

Re: Interesting Bond issues

Good question Mr Fire. RUN has no knowledge of sg govt bond investment. However, i think you can buy here

https://secure.fundsupermart.com/main/sgs/SGShome.tpl

Or even buy through your stock broker/remisier as the prices are listed on sgx website (go to prices -> choose fixed income -> select sgs bonds)

Hi Mr RUN, I have an bond account with a local bank but have yet to make any transaction so far. For SG Govt bond, how do purchase it? Charges and fees? Thank you

Good question Mr Fire. RUN has no knowledge of sg govt bond investment. However, i think you can buy here

https://secure.fundsupermart.com/main/sgs/SGShome.tpl

Or even buy through your stock broker/remisier as the prices are listed on sgx website (go to prices -> choose fixed income -> select sgs bonds)

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

Re: Interesting Bond issues

the chart was an example of premium good-investment bonds going below par. it doesn't really matter for those who holds till maturity but it served as a warning that investors who got tempted by evil RMs to use bond financing can be bankrupted overnight during margin-calls (like shares-financing) when bond prices drop.

30 yrs yield of 3.85% from Apple is really pathetic. I have some Google bond 10 years with 3+ % yield which I think it is better investment

the chart was an example of premium good-investment bonds going below par. it doesn't really matter for those who holds till maturity but it served as a warning that investors who got tempted by evil RMs to use bond financing can be bankrupted overnight during margin-calls (like shares-financing) when bond prices drop.

Re: Interesting Bond issues

Your contribution in alternative investment like gold,reits and bonds are valuable especially in an increasing risky environment for investment. Why don't you go to fuckwarezone moneymind forum (http://forums.fuckwarezone.com.sg/money-mind-210/) .At least in that forum there are more like-minded people who are interested in diversifying their investment and more focus in discussing financial stuffs.

Your contribution in alternative investment like gold,reits and bonds are valuable especially in an increasing risky environment for investment. Why don't you go to fuckwarezone moneymind forum (http://forums.fuckwarezone.com.sg/money-mind-210/) .At least in that forum there are more like-minded people who are interested in diversifying their investment and more focus in discussing financial stuffs.

good brother, the personal attacks are just the catalyst, an excuse for RUN to walk away. In fact, the SBF is a tougher drome. RUN started to feel uneasy when people there defended fiercely about the notion of owning/buying/selling physical gold and silvers + investments in specific stock counters, eg REITs.

Ok, it is perfectly ok to have differing opinions on shares but RUN came to realized that it is likely that some of team/moderators might be making a living out of web-traffic and peddling physical-gold. Absolutely nothing wrong but they didn't read carefully that RUN is also vested in similiar areas; just that i was advocating the investment in miners instead of physical gold/silver because RUN shared his field experience that our local precious metal market was inefficient and cornered by a few middlemen. Then they not happy wor =). So unfortunate, RUN also have about 30K worth of pure silver investment. I was just being less biased.

As days passes by, RUN suspects that the team/moderators behind the site contains either non-singaporean or new-immigrants with other agendas. There might be foreign-govt elements inside, systematically bashing and flaming true locals (in my opinion), and spreading neo-nazi anti-west beliefs . The nice guys (in my opinion) got silenced. These people never got banned or warned yet rewarded with repute points.

Too complicated city life over there, RUN is just a country mouse, that's why he walked away.

- Joined

- Jul 12, 2008

- Messages

- 9,884

- Points

- 0

Re: Interesting Bond issues

Bond basically the borrower issue the buyer post dated cheque eg. 5 or 10 year in future.

By then(10 year in future) the cheque maybe bounce cheque because borrower may have bankrupt no money to pay for the bond(cheque) issue by the borrower.

Bond basically the borrower issue the buyer post dated cheque eg. 5 or 10 year in future.

By then(10 year in future) the cheque maybe bounce cheque because borrower may have bankrupt no money to pay for the bond(cheque) issue by the borrower.

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

Re: Interesting Bond issues

thanks bro. You know, those places are like hospitals. The gurus there are like specialists, got brain specialists(bonds), eye specialists (shares), ENT specialists(gold), breast specialists(FX), penis specialist (derivatives).

RUN did not even go uni, a specialist of none. RUN come here, can be himself.

RUN has his own problems, RUN is also patient, stilling on over 300K realized losses. Here nice, got similiar patients discuss thingies with me.

Your contribution in alternative investment like gold,reits and bonds are valuable especially in an increasing risky environment for investment. Why don't you go to fuckwarezone moneymind forum (http://forums.fuckwarezone.com.sg/money-mind-210/) .At least in that forum there are more like-minded people who are interested in diversifying their investment and more focus in discussing financial stuffs.

thanks bro. You know, those places are like hospitals. The gurus there are like specialists, got brain specialists(bonds), eye specialists (shares), ENT specialists(gold), breast specialists(FX), penis specialist (derivatives).

RUN did not even go uni, a specialist of none. RUN come here, can be himself.

RUN has his own problems, RUN is also patient, stilling on over 300K realized losses. Here nice, got similiar patients discuss thingies with me.

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

Re: Interesting Bond issues

Choose the finest among them. Eg. covered bonds, local banks or ultra deepblue local listed blue chips.

Bond basically the borrower issue the buyer post dated cheque eg. 5 or 10 year in future.

By then(10 year in future) the cheque maybe bounce cheque because borrower may have bankrupt no money to pay for the bond(cheque) issue by the borrower.

Choose the finest among them. Eg. covered bonds, local banks or ultra deepblue local listed blue chips.

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

Re: Interesting Bond issues

China Sees First Domestic Junk Bond Default

http://www.nytimes.com/2014/04/02/b...na-sees-first-domestic-junk-bond-default.html

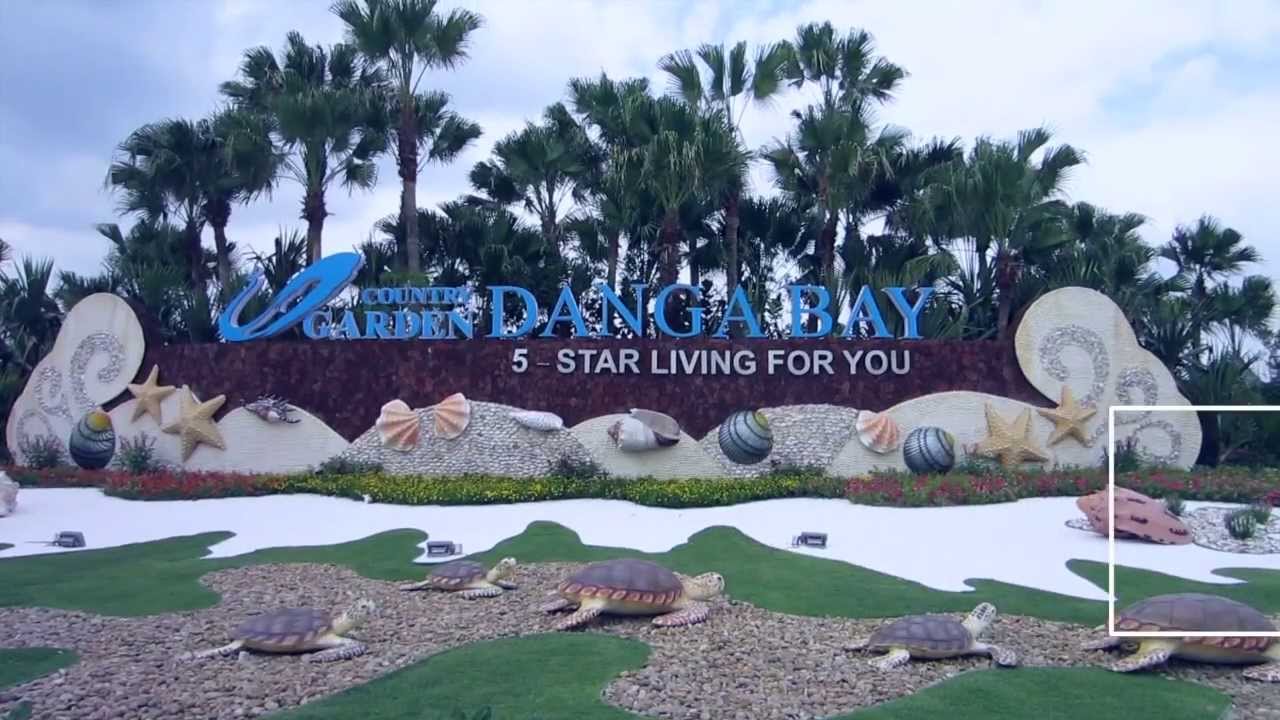

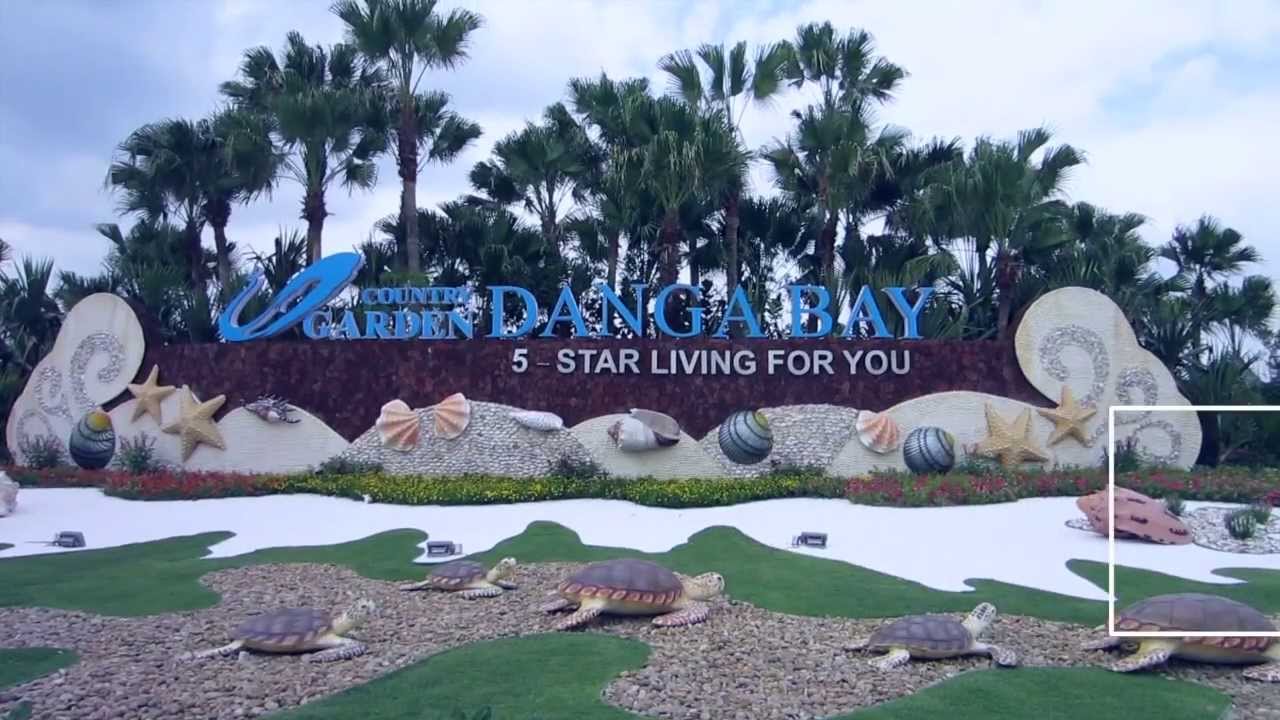

Even China's famous high-class developer Country Garden issues (junk) bonds at >10% yields.

http://www.poems.com.hk/en-us/product-and-service/bonds/price

COUNTRY GARDEN HLDG CO 02/23/18 - 11.125%

COUNTRY GARDEN HLDG CO 09/10/14 - 11.75%

COUNTRY GARDEN HLDG CO 08/11/15 - 10.5%

COUNTRY GARDEN HLDG CO 04/22/17 - 11.25%

China Sees First Domestic Junk Bond Default

http://www.nytimes.com/2014/04/02/b...na-sees-first-domestic-junk-bond-default.html

Even China's famous high-class developer Country Garden issues (junk) bonds at >10% yields.

http://www.poems.com.hk/en-us/product-and-service/bonds/price

COUNTRY GARDEN HLDG CO 02/23/18 - 11.125%

COUNTRY GARDEN HLDG CO 09/10/14 - 11.75%

COUNTRY GARDEN HLDG CO 08/11/15 - 10.5%

COUNTRY GARDEN HLDG CO 04/22/17 - 11.25%

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

Re: Interesting Bond issues

That was a significant event for the week, 8x oversubscribed. However, RUN could not understand why a powerful bank like Deutsche bank needs to give 6.25-7.5% for perpetual securities, my OCBC only gives me 4% for their preference shares.

Then i came across this article,

http://ftalphaville.ft.com/2014/05/21/1856372/about-that-deutsche-bank-capital

Alamak, these are Cocos bonds (Contingent convertible). More dangerous than preference shares.

Here's my layman explanation:

- Issuing ordinary shares will dilute current shareholders'control. So good and bad Banks are issuing perpetual securities or preference shares to increase capital-base to do larger business. (BASEL-III)

- There is no compulsory redemption or maturity dates for perpetual securities. The good banks don't really need our money, so they will explicitly hint that they will redeem back at first-call date with a self-imposed heavy penalty for not being able to do so. (maturity).

- Cocos are like preference shares BUT BUT BUT these shares can eventually be converted to ordinary shares (equities) in the event that banks face a sudden massive write-down, eg. lehman brother, citigroup, bank of america (back in 2008-10).

Note: Cocos are still quite rare. RUN will avoid Cocos. This is a superb write-up on Cocos.

http://www.bis.org/publ/qtrpdf/r_qt1309f.pdf

DEUTSCHE BANK Perpetual

http://www.reuters.com/article/2014/05/19/deutsche-bank-bonds-at-idUSL6N0O54X620140519

USD Bonds: 6.25%, callable 6 years later

EUR Bonds: 6.35%, callable 8 years later

GBP Bonds: 7.5%, callable 12 years later

Listed in Luxembourg, needs to open custodian account with your local bank RM to own it.

Note:

Perpetual Bonds has no guaranteed redemption date but usually banks will self-impose some penalties on call-date to hint to you that they will redeem. They are issued by top banks to meet Basel-III requirements = larger capital-base to do bigger business.

That was a significant event for the week, 8x oversubscribed. However, RUN could not understand why a powerful bank like Deutsche bank needs to give 6.25-7.5% for perpetual securities, my OCBC only gives me 4% for their preference shares.

Then i came across this article,

http://ftalphaville.ft.com/2014/05/21/1856372/about-that-deutsche-bank-capital

Alamak, these are Cocos bonds (Contingent convertible). More dangerous than preference shares.

Here's my layman explanation:

- Issuing ordinary shares will dilute current shareholders'control. So good and bad Banks are issuing perpetual securities or preference shares to increase capital-base to do larger business. (BASEL-III)

- There is no compulsory redemption or maturity dates for perpetual securities. The good banks don't really need our money, so they will explicitly hint that they will redeem back at first-call date with a self-imposed heavy penalty for not being able to do so. (maturity).

- Cocos are like preference shares BUT BUT BUT these shares can eventually be converted to ordinary shares (equities) in the event that banks face a sudden massive write-down, eg. lehman brother, citigroup, bank of america (back in 2008-10).

Note: Cocos are still quite rare. RUN will avoid Cocos. This is a superb write-up on Cocos.

http://www.bis.org/publ/qtrpdf/r_qt1309f.pdf

Re: Interesting Bond issues

There is no absolute guru on investment in internet forum..even the best hedge fund can lose money.. Because u lose 300K, u r a good learning lesson. I believe the reason u dabble in bond now is because it is a safer investment.

There is no absolute guru on investment in internet forum..even the best hedge fund can lose money.. Because u lose 300K, u r a good learning lesson. I believe the reason u dabble in bond now is because it is a safer investment.

thanks bro. You know, those places are like hospitals. The gurus there are like specialists, got brain specialists(bonds), eye specialists (shares), ENT specialists(gold), breast specialists(FX), penis specialist (derivatives).

RUN did not even go uni, a specialist of none. RUN come here, can be himself.

RUN has his own problems, RUN is also patient, stilling on over 300K realized losses. Here nice, got similiar patients discuss thingies with me.

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

Re: Interesting Bond issues

For 2 reasons bro,

- Bond is part of my portfolio.

- Bond is an important indicator of what to expect

Straits times got an article today called "For stock direction, look to bond market"

The global bond market value is nearly double of the global equity market value...... and the global derivatives market is more than 12x the value of the global bond market. Penis specialists peddles porn derivatives like accumulators, structured notes, CBBCs, futures n options to make us erect. Please don't learn from the penis specialists; penis erections don't last permanently.

Porn makes men impotent

There is no absolute guru on investment in internet forum..even the best hedge fund can lose money.. Because u lose 300K, u r a good learning lesson. I believe the reason u dabble in bond now is because it is a safer investment.

For 2 reasons bro,

- Bond is part of my portfolio.

- Bond is an important indicator of what to expect

Straits times got an article today called "For stock direction, look to bond market"

The global bond market value is nearly double of the global equity market value...... and the global derivatives market is more than 12x the value of the global bond market. Penis specialists peddles porn derivatives like accumulators, structured notes, CBBCs, futures n options to make us erect. Please don't learn from the penis specialists; penis erections don't last permanently.

Porn makes men impotent

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

Re: Interesting Bond issues

due to temasek's takeover of Olam, current SGX-mainboard listed shareholders may choose to redeem their bonds (at par value) before 2020 maturity due ""Change of Control Put Option"

- Change of Control because of temasek

- Put option = right to offload (earlier)

Last day to offload: 25 June 2014.

Based on today's closing price, i think most bondholders will choose to offload in open market if they wanna stop holding the bond (to enjoy some price premium).

Announcement:

Following the occurrence of a Change of Control, holders of Bonds have the right, at such

holder's option, to require the Issuer to redeem all or some only of their Bonds (the "Change

of Control Put Option") on the Change of Control Redemption Date referred to below at 100

per cent. of their principal amount together plus unpaid accrued interest (calculated up to but

excluding the Change of Control Redemption Date) (the "Change of Control Redemption").

http://infopub.sgx.com/FileOpen/26M...50m_Bonds.ashx?App=Announcement&FileID=298743

due to temasek's takeover of Olam, current SGX-mainboard listed shareholders may choose to redeem their bonds (at par value) before 2020 maturity due ""Change of Control Put Option"

- Change of Control because of temasek

- Put option = right to offload (earlier)

Last day to offload: 25 June 2014.

Based on today's closing price, i think most bondholders will choose to offload in open market if they wanna stop holding the bond (to enjoy some price premium).

Announcement:

Following the occurrence of a Change of Control, holders of Bonds have the right, at such

holder's option, to require the Issuer to redeem all or some only of their Bonds (the "Change

of Control Put Option") on the Change of Control Redemption Date referred to below at 100

per cent. of their principal amount together plus unpaid accrued interest (calculated up to but

excluding the Change of Control Redemption Date) (the "Change of Control Redemption").

http://infopub.sgx.com/FileOpen/26M...50m_Bonds.ashx?App=Announcement&FileID=298743

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

Re: Interesting Bond issues

Hyflux 6% was a milestone in local investment scene:

- Hyflux issued the pref shares to finance their 2010 delisting of hyflux water trust cheaply after the subprime crisis. They have no problem servicing 6% coupon with income from the delisted water trust. It was delisted at $0.78 when last annual distribution was appx $0.12 = 15% yield back then.

- RUN likes the leadership because she choose to peg her wealth against the performance of the company, drawing a small salary.

- Hyflux 6%, educated public about the possibility of owning fixed income instruments directly. It is better than investing in bonds unit trusts which gives medicore 2-4% annual returns?

- It included cumulative feature = this year no pay coupon, next year still must pay. This feature is not found in many blue chips preference shares.

ok, the price premium is an added bonus. Bond investors should not be really looking at this feature unless they loves flipping (with leveraged positions).

I am vested in Hyflux 6% CPS 10 ..Seldom monitor since I treated it like a FD.. Today I checked unusual huge sell order for Hyflux 6% CPS 10!!

Hyflux 6% was a milestone in local investment scene:

- Hyflux issued the pref shares to finance their 2010 delisting of hyflux water trust cheaply after the subprime crisis. They have no problem servicing 6% coupon with income from the delisted water trust. It was delisted at $0.78 when last annual distribution was appx $0.12 = 15% yield back then.

- RUN likes the leadership because she choose to peg her wealth against the performance of the company, drawing a small salary.

- Hyflux 6%, educated public about the possibility of owning fixed income instruments directly. It is better than investing in bonds unit trusts which gives medicore 2-4% annual returns?

- It included cumulative feature = this year no pay coupon, next year still must pay. This feature is not found in many blue chips preference shares.

ok, the price premium is an added bonus. Bond investors should not be really looking at this feature unless they loves flipping (with leveraged positions).

- Joined

- Aug 3, 2008

- Messages

- 2,620

- Points

- 48

Re: Interesting Bond issues

From now till 2020, still 5.5 years to maturity.

Wouldn't it be better to hold on to it till 2020 rather then redeem at par?.

Unless there is an early clause where it's stated they are allowed to redeem it earlier.

due to temasek's takeover of Olam, current SGX-mainboard listed shareholders may choose to redeem their bonds (at par value) before 2020 maturity due ""Change of Control Put Option"

- Change of Control because of temasek

- Put option = right to offload (earlier)

Last day to offload: 25 June 2014.

Based on today's closing price, i think most bondholders will choose to offload in open market if they wanna stop holding the bond (to enjoy some price premium).

Announcement:

Following the occurrence of a Change of Control, holders of Bonds have the right, at such

holder's option, to require the Issuer to redeem all or some only of their Bonds (the "Change

of Control Put Option") on the Change of Control Redemption Date referred to below at 100

per cent. of their principal amount together plus unpaid accrued interest (calculated up to but

excluding the Change of Control Redemption Date) (the "Change of Control Redemption").

http://infopub.sgx.com/FileOpen/26M...50m_Bonds.ashx?App=Announcement&FileID=298743

From now till 2020, still 5.5 years to maturity.

Wouldn't it be better to hold on to it till 2020 rather then redeem at par?.

Unless there is an early clause where it's stated they are allowed to redeem it earlier.

- Joined

- Aug 3, 2008

- Messages

- 2,620

- Points

- 48

Re: Interesting Bond issues

At 6% is definitely attractive, except that buying it now, is on the high side, last saw was almost at 106.5.

What's the yield if I were to buy it at 106.5, in this case.

Hyflux 6% was a milestone in local investment scene:

- Hyflux issued the pref shares to finance their 2010 delisting of hyflux water trust cheaply after the subprime crisis. They have no problem servicing 6% coupon with income from the delisted water trust. It was delisted at $0.78 when last annual distribution was appx $0.12 = 15% yield back then.

- RUN likes the leadership because she choose to peg her wealth against the performance of the company, drawing a small salary.

- Hyflux 6%, educated public about the possibility of owning fixed income instruments directly. It is better than investing in bonds unit trusts which gives medicore 2-4% annual returns?

- It included cumulative feature = this year no pay coupon, next year still must pay. This feature is not found in many blue chips preference shares.

ok, the price premium is an added bonus. Bond investors should not be really looking at this feature unless they loves flipping (with leveraged positions).

At 6% is definitely attractive, except that buying it now, is on the high side, last saw was almost at 106.5.

What's the yield if I were to buy it at 106.5, in this case.

- Joined

- Dec 17, 2013

- Messages

- 4,115

- Points

- 0

Re: Interesting Bond issues

Based on this information

http://hyflux.listedcompany.com/newsroom/20110413_112303_600_4A38112CA5F055CD48257871000FD2A5.3.pdf

First Call Date: 25 April 2018 (will usually redeem back, self-imposed penalty to hint redemption: coupon increase to 8% after that FCD)

Months Till FCD: 47 months

Remaining Coupon Payouts: 8 x 3% (semi annual) = 24%

Premium Based on today's price = 6.5% (including accrued interests, excluding commission)

Yield Estimate till FCD = (24 - 6.5) * 12/47months = 4.468%pa (note: not fully accurate due to appx 1-mth of underlying accrued interests adjustment)

This is an online bond yield calculator, (commissions excluded)

http://www.quantwolf.com/calculators/bondyieldcalc.html

At 6% is definitely attractive, except that buying it now, is on the high side, last saw was almost at 106.5.

What's the yield if I were to buy it at 106.5, in this case.

Based on this information

http://hyflux.listedcompany.com/newsroom/20110413_112303_600_4A38112CA5F055CD48257871000FD2A5.3.pdf

First Call Date: 25 April 2018 (will usually redeem back, self-imposed penalty to hint redemption: coupon increase to 8% after that FCD)

Months Till FCD: 47 months

Remaining Coupon Payouts: 8 x 3% (semi annual) = 24%

Premium Based on today's price = 6.5% (including accrued interests, excluding commission)

Yield Estimate till FCD = (24 - 6.5) * 12/47months = 4.468%pa (note: not fully accurate due to appx 1-mth of underlying accrued interests adjustment)

This is an online bond yield calculator, (commissions excluded)

http://www.quantwolf.com/calculators/bondyieldcalc.html

Last edited:

Similar threads

- Replies

- 8

- Views

- 935

- Replies

- 32

- Views

- 1K

- Replies

- 8

- Views

- 682