Brazil Joins India in Rejecting China's BRI

By

K J M Varma,

Beijing

Oct 29, 2024 11:00

Brazil becomes the second BRICS nation, after India, to decline participation in China's Belt and Road Initiative (BRI), citing concerns over potential risks and a desire for alternative collaborations.

Beijing, Oct 29 (PTI) In a major setback to China's BRI, Brazil has decided against joining Beijing's multi-billion-dollar initiative becoming the second country after India in the BRICS bloc not to endorse the mega project.

Brazil, headed by President Lula da Silva, will not join the Belt and Road Initiative (BRI) and instead seek alternative ways to collaborate with Chinese investors, Celso Amorim, special presidential adviser for international affairs, said on Monday.

Brazil wants to take the relationship with China to a new level, without having to sign an accession contract, he told Brazilian newspaper O Globo.

We are not entering into a treaty, Amorim said, explaining that Brazil does not want to take Chinese infrastructure and trade projects as an insurance policy.

According to Amorim, the aim is to use some of the Belt and Road framework to find synergy between Brazilian infrastructure projects and the investment funds associated with the initiative, without necessarily formally joining the group, the Hong Kong-based South China Morning Post quoted him as saying.

The Chinese call it the belt [and road] and they can give whatever names they want, but what matters is that there are projects that Brazil has defined as a priority and that may or may not be accepted [by Beijing], Amorim said.

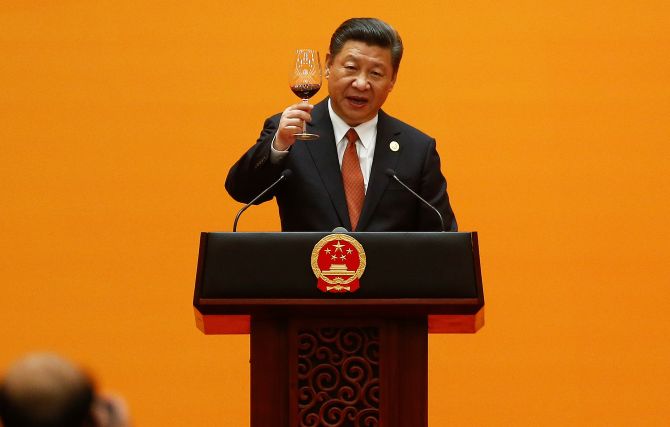

The decision contradicts China's plans to make Brazil's joining of the initiative a centrepiece of Chinese President Xi Jinping's state visit to Brasilia on November 20, the Post reported.

Officials from Brazil's economy and foreign affairs ministries recently voiced opposition to the idea, it said.

The prevailing opinion in Brazil was that joining China's flagship infrastructure project would not only fail to bring any tangible benefits for Brazil in the short term but could also make relations with a potential Trump administration more difficult.

Last week, Amorim and the president's chief of staff Rui Costa travelled to Beijing to discuss the initiative. According to sources, they returned unconvinced and unimpressed by China's offers, the Post reported.

Lula did not attend this month's BRICS summit at Kazan due to an injury and his close associate and former Brazilian President Dilma Rousseff currently heads the Shanghai-based BRICS New Development Bank (NDB).

BRICS originally consisted of Brazil, Russia, India, China and South Africa. Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates have been admitted as new members.

Brazil will be the second member of the BRICS after India not to endorse the BRI.

India was the first country to voice reservations and stood steadfast in its opposition to BRI, a pet project of Chinese President Xi Jinping to further the global influence of China with investments to build infrastructure projects.