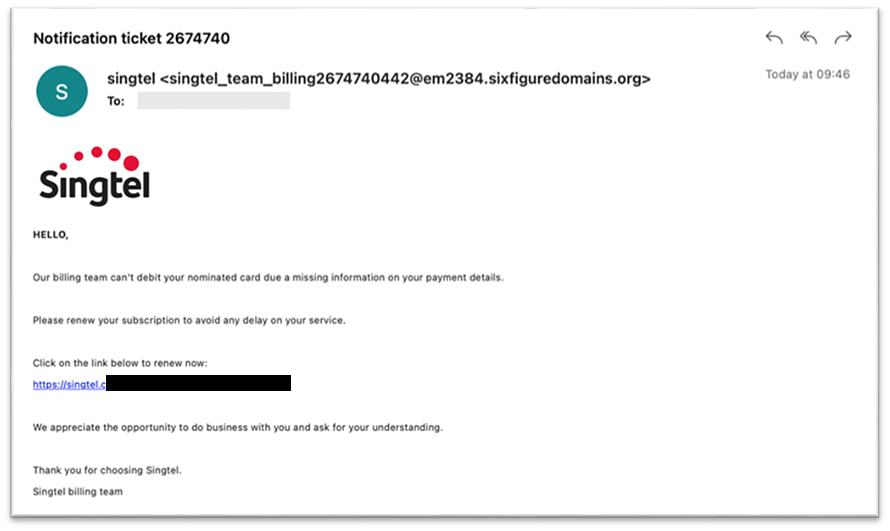

Singapore investors in bankrupt FTX crypto exchange resigned to writing off losses

Institutional investors who backed FTX may face scrutiny for possibly allowing the company to run with little oversight. PHOTO: REUTERS

Yong Li Xuan

NOV 12, 2022

SINGAPORE - When news broke earlier this week about

a liquidity crunch at cryptocurrency exchange FTX, financial adviser Ng Ming Jie was among those who tried to withdraw crypto from the platform.

The 33-year-old, who had been trading on FTX since mid-2021, was introduced to the platform by financial influencers, or finfluencers, online and stayed because of the comparatively low fees and functionality.

After FTX filed for bankruptcy on Friday and began investigating a potential hack, Mr Ng has accepted he may never recover the “tens of thousands of dollars” he had invested on the platform.

“I didn’t put my life savings into it,” he said. “But it’s tens of thousands of dollars. I could have bought a new MacBook, television, refrigerator, washing machine and gone on a trip to Japan and still have money left over.

“That little bit of faith I had left in cryptocurrency is lost,” added Mr Ng who had invested about $70,000 in crypto exchanges since 2020.

Due to the volatility of crypto and the interest rate hike at the start of 2022, he had pulled back on his crypto investments from 30 per cent to less than 10 per cent of his investment portfolio.

Still, Mr Ng said

FTX’s collapse was “super unexpected” because it was one of the largest crypto exchanges and many finfluencers such as personal finance expert Graham Stephan had promoted the platform actively on social media. “It’s almost equivalent to DBS, OCBC or UOB going under,” he added.

Due to backing from institutional investors such as Sequoia Capital and Singapore global investment company Temasek and a high trading volume, FTX was one of the more reputable exchanges, said Blockchain Association Singapore co-chairman Chia Hock Lai.

But after a CoinDesk article claimed last week that much of sister company Alameda’s assets were made up of FTX tokens (FTT) issued by FTX, allegations that FTX had offered extreme leverage – borrowing from some customers to lend to others – also surfaced.

“No one could have known they had bad practices,” said Mr Chia, noting that an exchange this large has never failed in this manner.

Institutional investors who backed FTX may face scrutiny for possibly allowing the company to run with little oversight.

“This is going to be a drawn-out process. A lot of skeletons in the closet will be dug out,” Mr Chia said.

Temasek, which is among FTX’s prominent institutional investors, said it had no further comments at this time. Temasek had previously told Reuters: “We are aware of the developments between FTX and Binance, and are engaging FTX in our capacity as shareholder.”

Mr Chia said he expects regulators to clamp down on crypto exchanges by restricting them from using customers’ funds or offering leverage, which will increase the cost of compliance to exchanges.

The Monetary Authority of Singapore (MAS) on Oct 26 published two consultation papers proposing regulatory measures to reduce the risk of consumer harm from cryptocurrency trading and support the development of stablecoins.

Some of the proposed measures could require exchanges to disclose risks to retail investors so they can make informed decisions, as well as ban leverage by retail investors for crypto trading.

Ironically, some investors said in WhatsApp and Telegram crypto chats that they had moved to FTX because MAS stopped Binance from operating in Singapore.

For now, industry players are concerned about how FTX’s meltdown would affect its projects and other companies linked to it.

Though crypto prices across the board have fallen because of the collapse, crypto that FTX invested in, such as Solana, have seen prices plummet because investors expect FTX to liquidate all assets during the bankruptcy process.

Mr Daniel Lee, head of Web3 at Banking Circle who helped to set up the DBS Digital Exchange in 2018, expressed concern for the industry.

“Like it or not, crypto is part of the financial infrastructure. It is no longer just a small sideshow,” the 53-year-old said. “People could lose their jobs and there are a lot of jobs related to crypto.”

Mr El Lee, who invested in FTT and used FTX, said he is saddened by how the collapse transpired, but he remains committed to crypto.

“The industry will recover from the incident, but FTX will not,” said the co-founder of Digital Treasures Center who has been in the crypto industry since 2015. “I’ve never sold any of my major cryptocurrencies before. People might think it’s silly, but I’m a believer.”

The 36-year-old has written off all his investments tied to FTX and does not intend to try to recover them, but he may move his crypto assets to exchanges or wallets closer to home because of tighter regulations and accountability.

Bloomberg reported that investors with crypto on the FTX platform numbered more than five million worldwide at its peak, and many are resigning themselves to the fact that their holdings may be gone forever.

Investors who traded on the platform will have an idea of how much FTX’s assets are worth after the bankruptcy is finalised, but they are unlikely to recover much of their assets, Mr Chia said.

“Crypto is a very risky asset class, retail investors should avoid it,” he said, adding that retail investors should invest not more than 5 per cent of their net worth in it. “You could lose everything.”