- Joined

- Aug 8, 2008

- Messages

- 28,991

- Points

- 113

Any signals that 50 days moving average is turning?

Who did you vote for?:oIo: Ask so much for fuck? :oIo:

Any signals that 50 days moving average is turning?

Nin nah beh, linpeh wanna hedge my positions by shorting, cannot is it ?Who did you vote for?:oIo: Ask so much for fuck? :oIo:

Nin nah beh, linpeh wanna hedge my positions by shorting, cannot is it ?

Singapore Adopts 2008 Crisis Policy as Growth Grinds to Halt

Bloomberg

April 14, 2016

Singapore’s central bank unexpectedly eased its monetary stance, moving to a policy last adopted during the 2008 global financial crisis, as economic growth in the trade-dependent city-state ground to a halt.

The Monetary Authority of Singapore moved to a neutral policy of zero percent appreciation in the local dollar, it said in a statement on Thursday. The currency slid the most in five months after the announcement, which came as a surprise to 12 of 18 economists surveyed by Bloomberg, who had seen no change in policy.

“The Singapore economy is projected to expand at a more modest pace in 2016 than envisaged in the October policy review,” the central bank said. “Core inflation should also pick up more gradually over the course of 2016 than previously anticipated.”

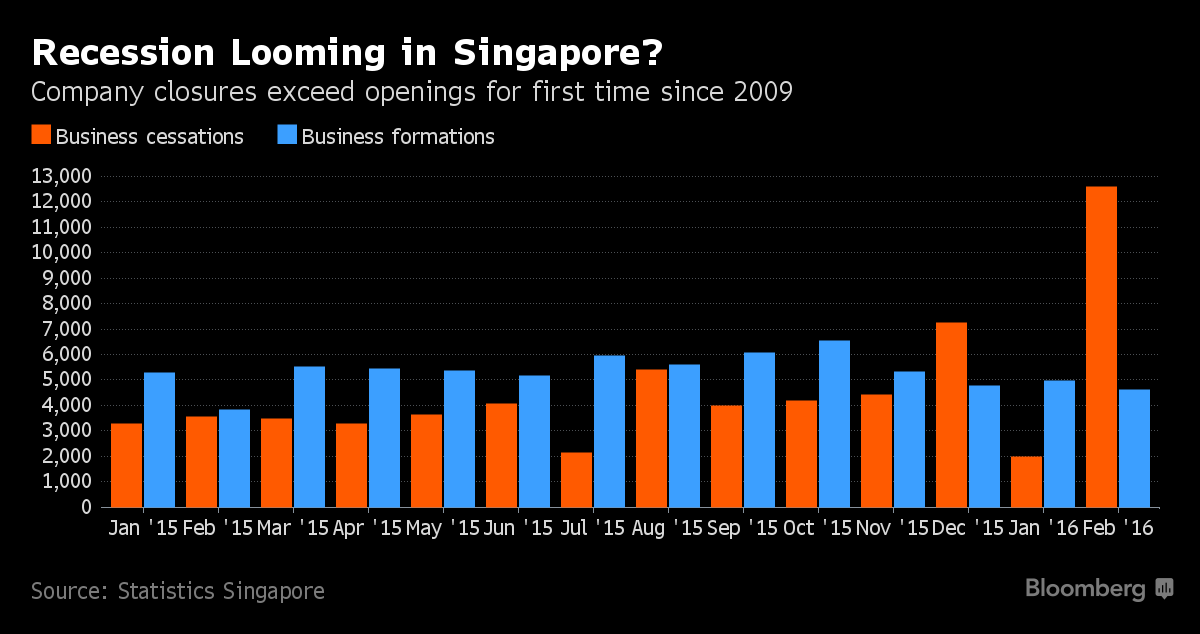

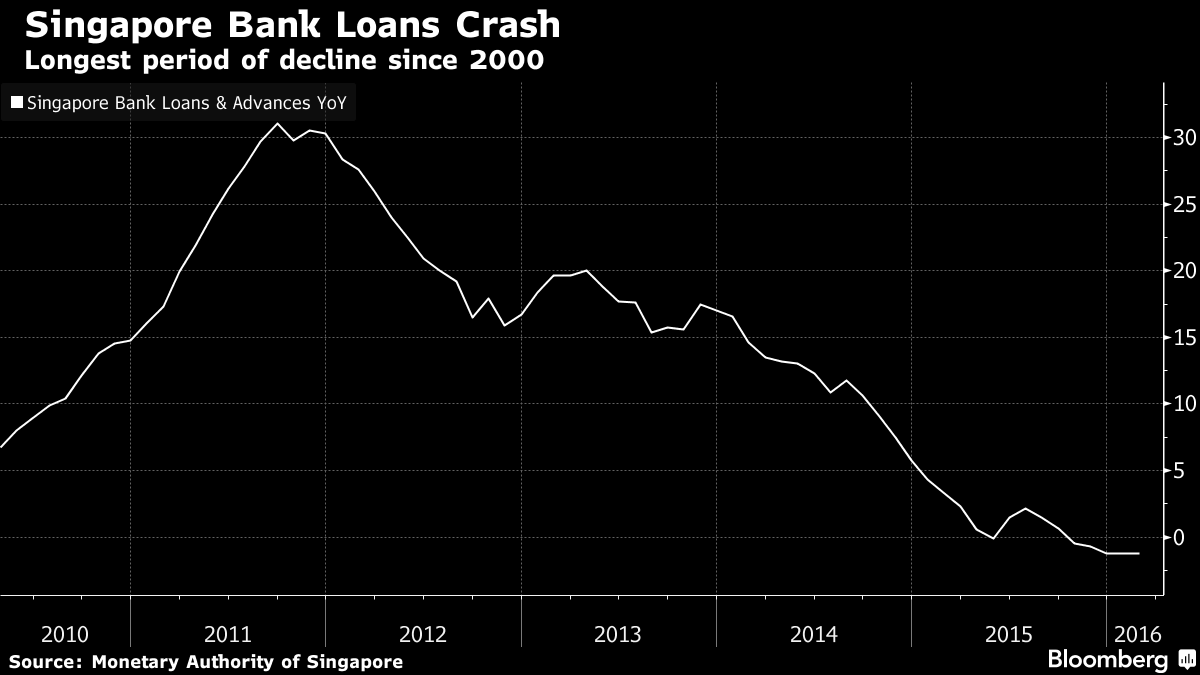

As Asia’s financial hub, Singapore is feeling the effects of the global downturn and China’s weakening economy. More businesses were shut than opened in December and February, while bank loans have dropped every month since October, the longest period of declines since 2000.

Growth was stagnant in the first quarter, with gross domestic product posting zero expansion on an annualized basis compared with the fourth quarter, the trade ministry said in a separate report Thursday. That was in line with the median forecast of 12 economists surveyed by Bloomberg.

“The economy remains mired in an extended spell of deflation and steadily lower growth,” Andrew Wood, an economist with BMI Research in Singapore, said by e-mail. The central bank needed to adjust the currency because “Singapore’s competitiveness has taken a hit,” he said.

The last time the MAS shifted its currency policy to zero appreciation was in October 2008, when the economy was in a recession. Thursday’s move was the bank’s second unexpected decision in less than 16 months, following an emergency policy change in January last year to combat the threat of deflation.

Citigroup Inc. economist Kit Wei Zheng said in a report last month that the decline in net new businesses for the first time since 2009 signals a possible recession. In the past two decades, the only times that business closures exceeded openings came during contractionary periods -- in 2009, 2001 and 1995 to 1997, he said.

Companies are in retrenchment moving forward.

Malls are deserted nowadays.....

People are hunkering down, buying only what is necessary

https://vulcanpost.com/534241/list-of-companies-cutting-jobs/

Singapore Downturn? Here's The List Of Companies Cutting Jobs in Singapore Over The Past Few Months

Here’s the list of the companies laying off Singapore employees since late last year:

1. Standard Chartered

2. HSBC

3. RWS

4. Rakuten

5. Maersk

6. Yahoo Singapore

7. Barclays

8. Royal Bank of Scotland

9. Credit Suisse

10. Deutsche Bank AG

11. Goldman Sachs

Companies that have closed down all their Singapore outlets recently and retrenched their Singapore staff:

12. California Fitness

13. Comics Connection

14. M)phosis

15. Evernote Singapore

Property rental is crashing, causing property prices to slump. The crash has already hit the CCR and it will soon hit the rest of Sinkieland as vacancy rates and interest rates continue to rise, and the economy heads for a recession.

https://sg.finance.yahoo.com/news/luxury-home-prices-slump-amid-rental-rout-030517649--sector.html

Luxury home prices slump amid rental rout

Property Guru – April 19, 2016

Prices of high-end condominiums in Singapore have slumped to new lows as owners dispose their units due to falling rents, reported The Straits Times.

For instance, a four-bedroom unit measuring around 3,000 sq ft at Cairnhill Plaza is understood to have been sold for about $1,300 psf, a price not seen since 2007.

A 678 sq ft studio apartment at The Sail @ Marina Bay also changed hands in February for $1,475 psf, the lowest price in more than five years.

Although the previous owner of the apartment at The Sail is unlikely to have incurred losses, as units there were originally priced at $900 psf during its launch in 2004, other sellers have suffered losses in the past few months.

For example, all three deals at Orange Grove Residences so far this year reported losses of nearly $1 million each.

Data shows that 63 second-hand condos were sold at a loss during Q1 2016 in the Core Central Region (CCR), which includes Sentosa Cove and the downtown core, compared to 60 in the previous quarter.

According to experts, a major reason for the significant drop in luxury home prices is the large supply and sluggish rental demand.

“Many of the apartments are vacant and it is quite difficult to get leases renewed at a good rate. The returns are not that great and if owners have made capital gains, it may be time to recycle (the asset),” said Suzie Mok, Senior Director of Investment Sales at Savills Singapore.

Furthermore, expatriates arriving nowadays are usually at the middle-management or executive level, but with smaller housing budgets than in the past, noted Desmond Sim, CBRE’s Research Head for Singapore and Southeast Asia.

As such, demand for large and posh condos that are common in the CCR has weakened substantially, he added.

That's the reason they allow to remove!ABSD will be removed soon......

Problem is even after removal, there will be no buyers.......