-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

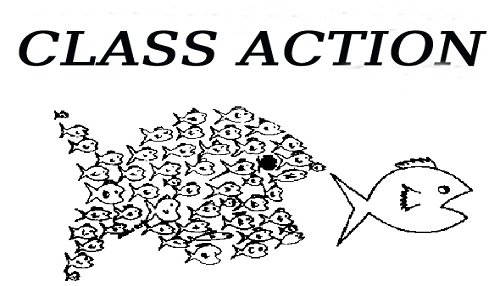

Regulators Refusing to Act - Hyflux & Noble Group's Decline

- Thread starter JustLikeThis

- Start date

Wong Partnership conflict of interests with Simon Tay still can get award?

https://www.straitstimes.com/singapore/singapore-lawyer-snags-global-award-for-restructuring-in-asia

WongPartnership's Smitha Menon, 39, received the 2020 Woman of the Year In Restructuring (Asia) award by the International Women's Insolvency and Restructuring Confederation (IWIRC).

WongPartnership said Ms Menon is one of the leaders in the firm's restructuring and insolvency and special situations advisory practices.

"At under 40 years of age, Smitha has advised on some of the most high-profile and complex restructuring matters involving prominent organisations such as the Noble Group, Emas Chiyoda, Hyflux, Wirecard Asia Holdings and the Xihe Holdings group," said the firm.

https://www.straitstimes.com/singapore/singapore-lawyer-snags-global-award-for-restructuring-in-asia

WongPartnership's Smitha Menon, 39, received the 2020 Woman of the Year In Restructuring (Asia) award by the International Women's Insolvency and Restructuring Confederation (IWIRC).

WongPartnership said Ms Menon is one of the leaders in the firm's restructuring and insolvency and special situations advisory practices.

"At under 40 years of age, Smitha has advised on some of the most high-profile and complex restructuring matters involving prominent organisations such as the Noble Group, Emas Chiyoda, Hyflux, Wirecard Asia Holdings and the Xihe Holdings group," said the firm.

- Joined

- Jul 13, 2018

- Messages

- 1,630

- Points

- 113

Noble Group Holdings Ltd., the commodity trader shrunken by years of losses and a multibillion dollar restructuring, has paid US$20 million ($27.0 million) to former Chief Executive Officer Ricardo Leiman. https://www.theedgesingapore.com/ne...group-ex-ceo-gets-us20-mil-after-legal-battle

The payment to Leiman, who left the company in 2011 -- several years before its 2018 restructuring -- was disclosed in a presentation accompanying Noble’s third-quarter results on Friday. It followed a long legal battle concluded in May, when Singapore’s Court of Appeal ruled that Noble had deprived Leiman of entitlements including the right to exercise share options when he left.

The payment to Leiman, who left the company in 2011 -- several years before its 2018 restructuring -- was disclosed in a presentation accompanying Noble’s third-quarter results on Friday. It followed a long legal battle concluded in May, when Singapore’s Court of Appeal ruled that Noble had deprived Leiman of entitlements including the right to exercise share options when he left.

- Joined

- Jul 13, 2018

- Messages

- 1,630

- Points

- 113

Multiple lawsuits added up can be material so why does Oxley Holdings not disclose them?

https://www.businesstimes.com.sg/co...erial-so-why-does-oxley-holdings-not-disclose

https://www.businesstimes.com.sg/co...erial-so-why-does-oxley-holdings-not-disclose

Hyflux only work before court hearings (next monday). SGI came into the picture for a month, just right before hearing then issue term sheet that needs time to clarify futher.

* UPDATE ON REORGANISATION PROCESS

* GOT TERM SHEET FOR A NEGOTIATED TRANSACTION FROM STRATEGIC GROWTH INVESTMENTS LLC REGARDING PROPOSED REORGANISATION AND RESTRUCTURING OF CO

* CONSIDERING CONTENT OF TERM SHEET AND EXPECTS TO NEED FURTHER CLARIFICATION AND DETAILS FROM SGI

https://sg.news.yahoo.com/brief-hyflux-updates-reorganisation-process-151910279.html

* UPDATE ON REORGANISATION PROCESS

* GOT TERM SHEET FOR A NEGOTIATED TRANSACTION FROM STRATEGIC GROWTH INVESTMENTS LLC REGARDING PROPOSED REORGANISATION AND RESTRUCTURING OF CO

* CONSIDERING CONTENT OF TERM SHEET AND EXPECTS TO NEED FURTHER CLARIFICATION AND DETAILS FROM SGI

https://sg.news.yahoo.com/brief-hyflux-updates-reorganisation-process-151910279.html

I know we might not see change in Singapore, but we have to believe it will come.PAP ALREADY SPENT $0 TO BUY YOUR TUAS SPRING , BE THANKFUL .

PAP can't just take and take and take from the people.

- Joined

- Oct 5, 2018

- Messages

- 17,570

- Points

- 113

I know we might not see change in Singapore, but we have to believe it will come.

PAP can't just take and take and take from the people.

LMFAO, now Utico cannot claim they have overwhelming support from retail investors. Why did Temasek save PIL and not Hyflux?

Perpetually over 50000 investors, retirees and their families will hold the government accountable for wiping out their savings.

Temasek unit Heliconia throws $810m lifeline to troubled PIL

https://www.straitstimes.com/busine...eline-to-troubled-pacific-international-lines

- Joined

- Oct 5, 2018

- Messages

- 17,570

- Points

- 113

Hyflux only work before court hearings (next monday). SGI came into the picture for a month, just right before hearing then issue term sheet that needs time to clarify futher.

* UPDATE ON REORGANISATION PROCESS

* GOT TERM SHEET FOR A NEGOTIATED TRANSACTION FROM STRATEGIC GROWTH INVESTMENTS LLC REGARDING PROPOSED REORGANISATION AND RESTRUCTURING OF CO

* CONSIDERING CONTENT OF TERM SHEET AND EXPECTS TO NEED FURTHER CLARIFICATION AND DETAILS FROM SGI

https://sg.news.yahoo.com/brief-hyflux-updates-reorganisation-process-151910279.html

I got a feeling tonight or this weekend will have Hyflux announcement because the JM hearing is coming.

- Joined

- Oct 5, 2018

- Messages

- 17,570

- Points

- 113

Temasek unit Heliconia throws $810m lifeline to troubled PIL

https://www.straitstimes.com/busine...eline-to-troubled-pacific-international-lines

Temasek so helpful to PIL.

Temasek already pumped US$110m to PIL four months ago.

https://www.wsj.com/articles/singapores-pil-gets-110-millionlifeline-from-temasek-fund-11596048364

Help Hyflux a little bit can?

I got a feeling tonight or this weekend will have Hyflux announcement because the JM hearing is coming.

Thank you Ms Kok Xinghui for the write-up, frank and clear, and thank you for your wise and brutal choice of photos to remind policymakers of their duty to Hyflux investors. I hope you get to know my heartfelt appreciations. Not just from me, many of us.

https://www.scmp.com/week-asia/econ...rporate-darling-hyflux-and-founder-olivia-lum

Retail investors such as teacher Paul Lim, 40, are suspicious that Hyflux is using the prospect of suitors to extend their court protection. Investors like him had bought into Hyflux, believing the Singapore government would not let it fail. Said Lim, who bought S$37,000 worth of PnPs, said: “Notice how they reveal new suitors whenever a court date is near.”

Mak Yuen Teen, an associate professor of accounting at NUS Business School and corporate governance expert, said: “The board would prefer deals that release them from any potential liabilities. The proposed Utico deal would not do that, and a judicial manager may well take action against the directors if there are breaches of duties.”

Having Hyflux go under judicial management also meant legal processes such as civil suits and criminal proceedings could go ahead, said Lawrence Loh, an associate professor of business administration at the National University of Singapore (NUS). This is an outcome retail investors are hoping for. Lim, the teacher who invested S$37,000 in PnPs, wants this to happen so independent third parties can “dig out evidence of their non-disclosures and that they already knew Hyflux was insolvent when they sold S$500 million PnPs to the public”.

Another investor, an investment specialist who works in a private bank but asked to not be named, hopes the outcome of the investigations will ensure a Singapore bank that issued the PnPs is held accountable for its role. “The bank has to do due diligence … The banks need to ask hard questions, stress test financial models and business plans to make sure the company can repay their debts in a variety of scenarios, not just take in the case the company is presenting to them.”

Allow me to share the discussions in my chatgroup with a handful of MTN investors regarding SGI's term sheet last night:

Point 1: Free Option to Purchase (OTP) to SGI for at least 60 days.

SGI has no plan for Hyflux in the term sheet. The whole term sheet is structured like a FREE OTP for SGI. In these 60 days or longer, they can freely transfer their OTP to any party for an immediate gain and definitely no loss to them for walking away, because no tangible deposit is paid.

Anyone can outbid SGI by paying $1 to Hyflux under the same term sheet.

Bankers will not accept such nonsense. Neither will my MTN chatgroup. In property market, you need to pay at least non-refundable 1% deposit to get OTP for 14 days. (In the same context. SGI should at least pay Hyflux 4% to get the 60 days OTP).

Point 2: No Binding Time for Completion

SGI mentioned "COVID-19 pandemic may cause unexpected delays on a continuing basis". For amateurs, it sounds like this proposal's underlying objective is to buy time for Olivia Lum, Simon Tay and Gay Chee Cheong to avoid JM.

It sound so incredible to try telling a property seller "COVID-19 pandemic may cause unexpected delays on a continuing basis". It means property seller cannot impose any penalty on me or hold me responsible for any losses if I keep postponing the property purchase completion.

For banking professionals, they will just tell you that any delay means that Banks can charge them interests or damages.

Point 3: All Creditors have no say in the payroll of New Hyflux. SCI likely to reward themselves very well, regardless of Hyflux's future performance.

Banks, MTN and PnP will not get much even if Hyflux does very well in future. In addition, we have no say on the payroll of the new management, and the employee stock options alone is more than double of what PnP will get. In this aspect, JM is cheaper for all creditors.

Point 4: JM is not Liquidation (Ask the lawyers if you don't believe)

JM is not liquidation. JM takes care of the interest of creditors, except Hyflux's management.

The real objection of entering JM is to go after the management of Hyflux. JM makes it easy for us to dig for evidence. Hyflux is broke but Hyflux's corrupted management is worth hundreds of millions. Fear not of them transferring wealth to family members, trusts or overseas because CFR will exposure any of such ill-intended moves. We can get a higher payout by suing the directors for their false accounting practices because these bastards sat onboard for many years.

I don't want to speculate why ACRA and CAD don't dare to touch these whitehorses. Parti Liyani clearly proved to us that Singapore's Jurisdiction is all about "who you know"; rule of law is secondary.

Point 5: Two Suspicious Points about SGI

Other than the suspicious timing of this term sheet before an important hearing, a corporate lawyer among us pointed out two points that hints that SGI is a proxy for management.

1. The following statements "customary commercial diligence to align interests" and "Successful discharge by court of all liabilities and claims, outstanding and potential" hints at the ceding of rights to pursue past wrongdoings.

2. SGI is supposed to be US company, formed 8 years ago. They sounded so shrewd in the term sheet but they stated that the Governing Law and Jurisdiction is Singapore. The corporate lawyer said that in the course of his career, he had never seen any party with the upper hand, in such early stage of negotiation, to select the weaker party's jurisdiction in the event of any dispute or clarity is required. SGI should be state Delaware or New York which are more closely aligned to their interests.

Point 1: Free Option to Purchase (OTP) to SGI for at least 60 days.

SGI has no plan for Hyflux in the term sheet. The whole term sheet is structured like a FREE OTP for SGI. In these 60 days or longer, they can freely transfer their OTP to any party for an immediate gain and definitely no loss to them for walking away, because no tangible deposit is paid.

Anyone can outbid SGI by paying $1 to Hyflux under the same term sheet.

Bankers will not accept such nonsense. Neither will my MTN chatgroup. In property market, you need to pay at least non-refundable 1% deposit to get OTP for 14 days. (In the same context. SGI should at least pay Hyflux 4% to get the 60 days OTP).

Point 2: No Binding Time for Completion

SGI mentioned "COVID-19 pandemic may cause unexpected delays on a continuing basis". For amateurs, it sounds like this proposal's underlying objective is to buy time for Olivia Lum, Simon Tay and Gay Chee Cheong to avoid JM.

It sound so incredible to try telling a property seller "COVID-19 pandemic may cause unexpected delays on a continuing basis". It means property seller cannot impose any penalty on me or hold me responsible for any losses if I keep postponing the property purchase completion.

For banking professionals, they will just tell you that any delay means that Banks can charge them interests or damages.

Point 3: All Creditors have no say in the payroll of New Hyflux. SCI likely to reward themselves very well, regardless of Hyflux's future performance.

Banks, MTN and PnP will not get much even if Hyflux does very well in future. In addition, we have no say on the payroll of the new management, and the employee stock options alone is more than double of what PnP will get. In this aspect, JM is cheaper for all creditors.

Point 4: JM is not Liquidation (Ask the lawyers if you don't believe)

JM is not liquidation. JM takes care of the interest of creditors, except Hyflux's management.

The real objection of entering JM is to go after the management of Hyflux. JM makes it easy for us to dig for evidence. Hyflux is broke but Hyflux's corrupted management is worth hundreds of millions. Fear not of them transferring wealth to family members, trusts or overseas because CFR will exposure any of such ill-intended moves. We can get a higher payout by suing the directors for their false accounting practices because these bastards sat onboard for many years.

I don't want to speculate why ACRA and CAD don't dare to touch these whitehorses. Parti Liyani clearly proved to us that Singapore's Jurisdiction is all about "who you know"; rule of law is secondary.

Point 5: Two Suspicious Points about SGI

Other than the suspicious timing of this term sheet before an important hearing, a corporate lawyer among us pointed out two points that hints that SGI is a proxy for management.

1. The following statements "customary commercial diligence to align interests" and "Successful discharge by court of all liabilities and claims, outstanding and potential" hints at the ceding of rights to pursue past wrongdoings.

2. SGI is supposed to be US company, formed 8 years ago. They sounded so shrewd in the term sheet but they stated that the Governing Law and Jurisdiction is Singapore. The corporate lawyer said that in the course of his career, he had never seen any party with the upper hand, in such early stage of negotiation, to select the weaker party's jurisdiction in the event of any dispute or clarity is required. SGI should be state Delaware or New York which are more closely aligned to their interests.

Last edited:

- Joined

- Jul 13, 2018

- Messages

- 1,630

- Points

- 113

Allow me to share the discussions in my chatgroup with a handful of MTN investors regarding SGI's term sheet last night:

Point 1: Free Option to Purchase (OTP) to SGI for at least 60 days.

SGI has no plan for Hyflux in the term sheet. The whole term sheet is structured like a FREE OTP for SGI. In these 60 days or longer, they can freely transfer their OTP to any party for an immediate gain and definitely no loss to them for walking away, because no tangible deposit is paid.

Anyone can outbid SGI by paying $1 to Hyflux under the same term sheet.

Bankers will not accept such nonsense. Neither will my MTN chatgroup. In property market, you need to pay at least non-refundable 1% deposit to get OTP for 14 days. (In the same context. SGI should at least pay Hyflux 4% to get the 60 days OTP).

Point 2: No Binding Time for Completion

SGI mentioned "COVID-19 pandemic may cause unexpected delays on a continuing basis". For amateurs, it sounds like this proposal's underlying objective is to buy time for Olivia Lum, Simon Tay and Gay Chee Cheong to avoid JM.

It sound so incredible to try telling a property seller "COVID-19 pandemic may cause unexpected delays on a continuing basis" property seller cannot impose any penalty on me or hold me responsible for any losses if I keep postponing the property purchase completion.

For banking professionals, they will just tell you that any delay means that Banks can charge them interests or damages.

Point 3: All Creditors have no say in the payroll of New Hyflux. SCI likely to reward themselves very well, regardless of Hyflux's future performance.

Banks, MTN and PnP will not get much even if Hyflux does very well in future. In addition, we have no say on the payroll of the new management, and the employee stock options alone is more than double of what PnP will get. In this aspect, JM is cheaper for all creditors.

Point 4: JM is not Liquidation (Ask the lawyers if you don't believe)

JM is not liquidation. JM takes care of the interest of creditors, except Hyflux's management.

The real objection of entering JM is to go after the management of Hyflux. JM makes it easy for us to dig for evidence. Hyflux is broke but Hyflux's corrupted management is worth hundreds of millions. Fear not of them transferring wealth to family members, trusts or overseas because CFR will exposure any of such ill-intended moves. We can get a higher payout by suing the directors for their false accounting practices because these bastards sat onboard for many years.

I don't want to speculate why ACRA and CAD don't dare to touch these whitehorses. Parti Liyani clearly proved to us that Singapore's Jurisdiction is all about "who you know"; rule of law is secondary.

Point 5: Two Suspicious Points about SGI

Other than the suspicious timing of this term sheet before an important hearing, a corporate lawyer among us pointed out two points that hints that SGI is a proxy for management.

1. The following statements "customary commercial diligence to align interests" and "Successful discharge by court of all liabilities and claims, outstanding and potential" hints at the inclusion of waivers in restructuring terms to pursue past wrongdoings.

2. SGI is supposed to be US company, formed 8 years ago. They sounded so shrewd in the term sheet but they stated that the Governing Law and Jurisdiction is Singapore. The corporate lawyer said that in the course of his career, he had never seem any party with the upper hand, in such early stage of negotiation, to select the weaker party's jurisdiction in the event of any dispute or clarity is required. SGI should be state Delaware or New York which are more closely aligned to their interests.

Great analysis! And thanks for the great SCMP article.

Temasek so helpful to PIL.

Temasek already pumped US$110m to PIL four months ago.

https://www.wsj.com/articles/singapores-pil-gets-110-millionlifeline-from-temasek-fund-11596048364

Help Hyflux a little bit can?

Help yourself. Try suing the courts for their bias.

Hyflux trying to use SGI to checkmate the UWG on Monday.

Hope the UWG group will send Olivia and Simon to jail.

The biggest target is Wong Partnership. Simon Tay convinced Hyflux to default on the perpetual's coupons and bring in his Wong Partnership to harvest Hyflux.

- Joined

- Nov 12, 2018

- Messages

- 315

- Points

- 43

Hi all, thanks for being around. Our politicians don't care, our regulators and court turned a blind up to protect these cronies.

Let's do our part to expose the elites who exploit the retail investors. We will bite and not let go regardless it is JM or not.

Let's do our part to expose the elites who exploit the retail investors. We will bite and not let go regardless it is JM or not.

- Joined

- Oct 5, 2018

- Messages

- 17,570

- Points

- 113

Hi all, thanks for being around. Our politicians don't care, our regulators and court turned a blind up to protect these cronies.

Let's do our part to expose the elites who exploit the retail investors. We will bite and not let go regardless it is JM or not.

Singapore needs a great reset.

Last edited:

- Joined

- Jul 13, 2018

- Messages

- 1,630

- Points

- 113

According to Edge's summary, SGI proposal is just to buy time to delay JM

SGI will terminate the deal should Hyflux go into judicial management.

https://www.facebook.com/permalink.php?id=1494800797442605&story_fbid=2815228565399815

I personally understand that Aqua Munda is the real deal, but I don't know why the proposal is not released.

SGI will terminate the deal should Hyflux go into judicial management.

https://www.facebook.com/permalink.php?id=1494800797442605&story_fbid=2815228565399815

I personally understand that Aqua Munda is the real deal, but I don't know why the proposal is not released.

Today is the JM hearing day. I hope will not extend further.

Hyflux in JM now. It is good for two reasons. It stopped Hyflux management from paying huge amount to restructuring managers, and time to go after wong partnership.

https://www.businesstimes.com.sg/companies-markets/hyflux-placed-under-judicial-management

Similar threads

- Replies

- 11

- Views

- 1K

- Replies

- 0

- Views

- 182

- Replies

- 10

- Views

- 824

- Replies

- 3

- Views

- 281

- Replies

- 9

- Views

- 884