- Joined

- Jul 13, 2018

- Messages

- 1,630

- Points

- 113

Bloomberg:

Rift Between Hyflux, Suitor Remains With Offer Deadline Looming

https://www.bloomberg.com/news/arti...ux-suitor-remains-with-offer-deadline-looming

Utico expects the revised offer, which also seeks the immediate resignation of Hyflux’s board if approved, to be passed by investors.

“We are more confident now that the proposal, the only one in court, will be approved by all the stakeholders,” Richard Menezes, Utico’s managing director, said in a text message. “We don’t see any reason for the court to reject the proposal once the investors approve it.”

Utico’s initial deal in November last year to invest a total of S$400 million ($287 million) is the only one with a definite timeframe. Spain’s FCC Aqualia SA and Longview International Holdings Pte separately announced their interest in investing in the Singaporean company earlier this year, while little-known Aqua Munda Pte in December offered to purchase debt of Hyflux noteholders and unsecured creditors.

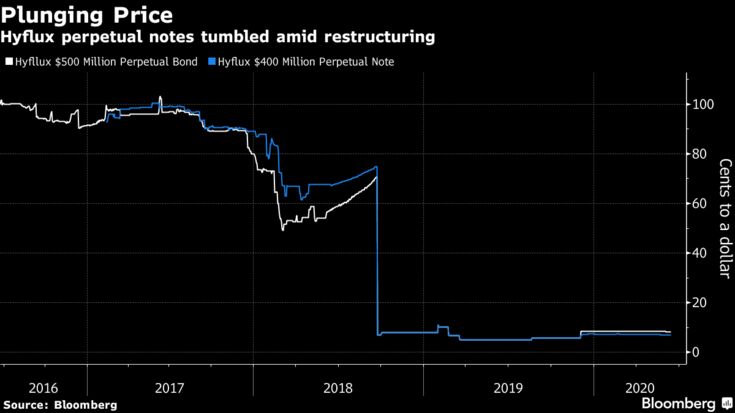

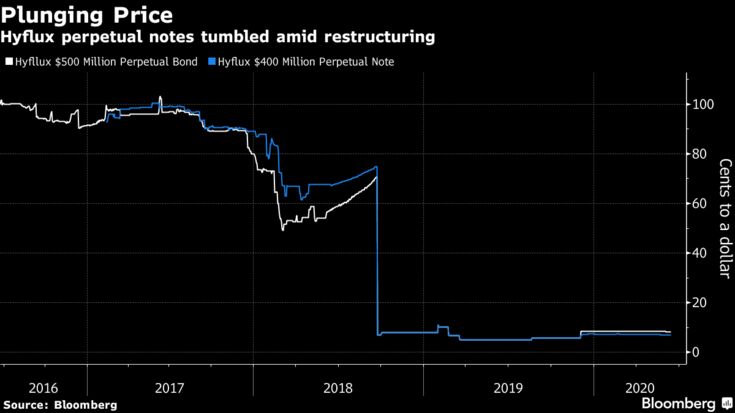

The prolonged process has compounded frustrations for about 34,000 retail investors in Hyflux.

Rift Between Hyflux, Suitor Remains With Offer Deadline Looming

https://www.bloomberg.com/news/arti...ux-suitor-remains-with-offer-deadline-looming

Utico expects the revised offer, which also seeks the immediate resignation of Hyflux’s board if approved, to be passed by investors.

“We are more confident now that the proposal, the only one in court, will be approved by all the stakeholders,” Richard Menezes, Utico’s managing director, said in a text message. “We don’t see any reason for the court to reject the proposal once the investors approve it.”

Utico’s initial deal in November last year to invest a total of S$400 million ($287 million) is the only one with a definite timeframe. Spain’s FCC Aqualia SA and Longview International Holdings Pte separately announced their interest in investing in the Singaporean company earlier this year, while little-known Aqua Munda Pte in December offered to purchase debt of Hyflux noteholders and unsecured creditors.

The prolonged process has compounded frustrations for about 34,000 retail investors in Hyflux.