Despite all the negative comments, Ryan Khoo does it again! His articles are fill of inspiration for those who want to invest in Iskandar. Basically, he thinks Singapore-Iskandar is the same model as the HK-Shenzhen story. So Iskandar population will boom in future, manufacturing companies are moving from Singapore to Iskandar, and many will feel that Singapore properties are too expensive to buy.

Iskandar Malaysia: Why are the Chinese here?

By Ryan Khoo / Alpha Marketing, The Edge Property | June 30, 2015 9:00 AM MYT

When news broke out in early 2013 that Country Garden, a top 10 Chinese developer had bought land in Iskandar Malaysia, the response was quite positive and highlighted that Iskandar was able to attract other international investors than just Singapore. Fast forward 18 months later to late 2014, a slew of other Chinese developers such as R&F Guangzhou and Greenland Group entered the Iskandar property market as well.

However it was still Country Garden that created the biggest stir by announcing details of their massive 3,400 acre Forest City development off the 2nd Link between Singapore's Tuas and Johor's Nusajaya.

Why are the Chinese so interested in Iskandar Malaysia? What is so attractive for them to invest millions into the region?

1. A replica of the Hong Kong - Shenzhen story

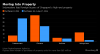

Country Garden and R&F Guangzhou, arguably the 2 developers with the biggest investments in Iskandar Malaysia, are both developers from China's southern Guangdong region. Both developers have seen the growth of Shenzhen and Guangzhou in the 80s and 90s driven by large economic spillovers from Hong Kong and increased high-speed rail connectivity within China. To the Chinese, Singapore and Iskandar present very similar dynamics with the High Speed Rail (HSR) and the Rapid Transit System (RTS) being the key catalysts. Manufacturing will be the key economic driver just like Hong Kong and evidence shows that this is already the case. According to the Malaysian Investment Development Authority (MIDA), Johor state enjoyed the highest committed manufacturing investments in Malaysia in 2013 (RM14.4bil) and 2014 (RM21.1bil), beating heavyweights Kuala Lumpur, Selangor and Penang. And Singapore still retains its position as the biggest foreign investor in Iskandar, reflecting the on-going migration of Singapore manufacturers into Johor.

2. Expectations of a population boom in Iskandar a.k.a. Shenzhen

Shenzhen back in the early 80s was basically a collection of fishing villages and a relatively small population. As then Chinese leader Deng Xiao Ping kick-started economic reforms across China, Shenzhen was opened up as a free trade zone betting that Hong Kong companies would come over due to the much lower costs. Shenzhen's maturity took 10-15 years and in that time frame, thousands of jobs were created and people from all over China moved to Shenzhen to take advantage of the jobs opportunities created. Today, you will see that many people living in Shenzhen are actually not Shenzhen natives and are from other parts of China. And this is what the Chinese developers are looking at when they see Iskandar - Singapore. Iskandar's population today may only be in the 1.6 - 1.8 million range, but an accelerated push to the 3 million target is an easy target in the eyes of the Chinese since Malaysia has hit a 30 million population.

3. Private property Singapore gets more expensive in the medium term

Singapore private property prices have fallen 4% in 2014 and probably another 4-5% in 2015. If expectations are that some cooling measures will be relaxed in 2016, it looks like those who are waiting for Singapore private property prices to plummet further are going to be disappointed. If a majority in Singapore still see prices as too high even after the cooling measures, what more when the property cycle turns upward again in 3-5 years? More and more Singaporean residents will find Iskandar Malaysia an enticing option, as a 2nd property in Singapore becomes increasingly expensive and un-attainable. Out of Singapore's 5.5mil population, there are more than 2mil who are non-citizens, many of whom are Malaysians working in Singapore who might be priced out of the Singapore private market and more amenable to buying homes in Iskandar.

4. An Aging population in Singapore

Like Hong Kong, Singapore faces an aging population problem. If not for immigration, both countries would be facing an abnormally low birth rate and a higher median age. The median age in Singapore is 40.4 years while in Hong Kong its 42.8 years versus Malaysia's young 27.7 years. As the living environment, security and transport links in Iskandar improve, many in Singapore will see Iskandar Malaysia as a viable option for retirement and to reduce healthcare costs. Singapore will have 900,000 residents aged 65 and above by the year 2030; a big market for various services that Iskandar Malaysia is poised to offer.

5. Chinese property buyers are going global

According to the Chinese luxury events group Hurun Report, one in three wealthy Chinese own properties overseas. Both Malaysia and Singapore are in the top 10 countries where Chinese own properties and in the first half of 2014 alone, US$5.4 billion of overseas properties were bought by the Chinese. The Malaysia My Second Home(MM2H) program offers a multi-entry 10 year visa for the applicant as well as their direct family members and the Chinese are the highest number of applicants in 2013, 2014 and 2015 thus far for the MM2H program. As the Chinese middle class expands and more and more Chinese travel abroad, Iskandar Malaysia will enjoy increased visibility driven by the Chinese property developers who are present here.

6. Chinese companies doing business in South East Asia

Chinese companies are rapidly expanding globally. South East Asia is no exception. Greenland Group's decision to develop some 3,000 acres of industrial land at Pasir Gudang in partnership with the Johor government is a signal that Chinese manufacturers see Iskandar favourably and are looking for proper solutions. Many Chinese businesses are flush with cash and looking to produce and market their products globally. One example is in the rail business. Chinese rail companies are in the running to build the HSR and RTS. If they clinch either or both projects, expect to see a flood of Chinese contractors and specialists to start business in Malaysia. In fact Chinese construction companies are bidding heavily for projects across South East Asia as many countries here upgrade their infrastructure.

While the general public may dismiss the Chinese property developers as being overconfident or even irresponsible in Iskandar Malaysia, it would do well for us to remember that these developers are giants and that their decisions to come to Iskandar Malaysia are not made lightly. Their investments in Iskandar Malaysia could pay off in the long run as they rush to landbank the best land plots today and bide their time for the above trends to play out and then their investments will bear fruit. Even if 50% of these trends take place in a small way, it is already a big boon to Iskandar Malaysia which today is still at a low base comparatively.

http://www.theedgeproperty.com.sg/content/iskandar-malaysia-why-are-chinese-here