Facebook Shares Plunge Again: Will Options Trading Fuel More Volatility?

By Matt Nesto | Breakout – 2 hours 28 minutes ago<object width="576" height="324">

<embed width="576" height="324" allowfullscreen="true" src="http://d.yimg.com/nl/techticker/breakout/player.swf" type="application/x-shockwave-flash" flashvars="browseCarouselUI=show&vid=29497213&"></object>

"If you have nothing good to say, don't say anything at all" your mother probably told you many times, and yet, when it comes to Facebook (FB), the doomsayers are ruling the day, while fanatics are nowhere to be found.

As much as options trading is the norm for most large cap stocks, in the case of the newly minted social media stock, the trading debut of its puts and calls has brought with it another new low and more volatility.

"Options allow for people to take long and short positions and levered positions," says Bruno Del Ama, CEO of Global X Funds -creator of the Social Media etf (SOCL)- in the attached video. "So that may add to volatility, but it also adds to price discovery of the stock." And that, he says, is a process that needs to play out, and one that makes deriving early valuation estimates very difficult.

Facebook has its detractors, Del Ama points out that the street's beef is overwhelmingly about price and has little to do with the underlying franchise or network, which continues to garner tremendous respect and admiration. And ultimately, he says, it will gain converts and earn the market premium he thinks it deserves.

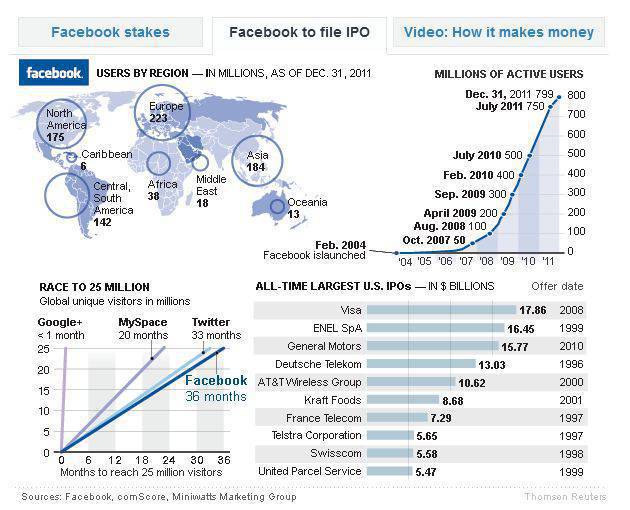

"I think the thing people are overlooking on the positive side is what the company will do with revenues," Del Ama says, reminding investors that it is a "very unique asset" that also happens to be "growing very, very quickly."

While he characterizes Facebook's first week as ''awful," he's confident better days and better news flow will come. "Starting now and going forward, there's going to be more focus in the fundamentals," he says, although admits to be worried about choppy trade ahead of 2nd quarter earnings, as well as when the 3-month and 6-month insider lock-up periods are lifted.

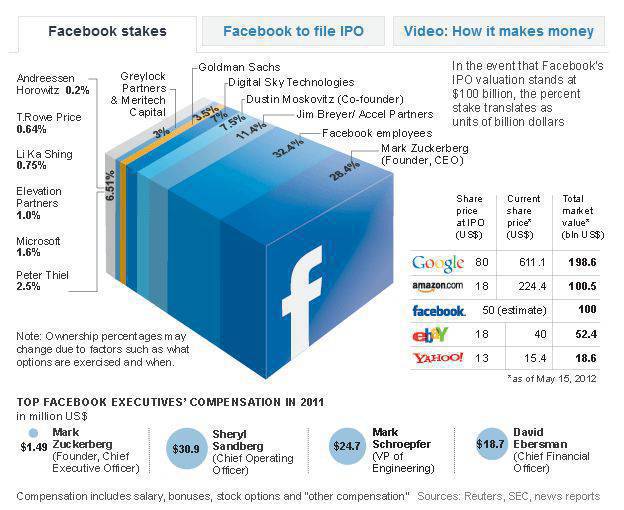

In the meantime, the disappointment of the year nominee has now shed 35%, or about $45 billion from it's momentary peak of $45 a share. That plunge makes it about 1/3 as valuable as Google (GOOG), down from about half its size just 10 days ago.

And as much as the criticism of Facebook is currently flowing freely, the day will soon come when someone has something nice to say.