-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Serious PAP Forced To Raise Transport Fees From 28 Dec 2024! Pay Extra 10 Cents Per Trip Only Lah!

- Thread starter JohnTan

- Start date

- Joined

- Dec 6, 2018

- Messages

- 16,393

- Points

- 113

Not to mention also the 70% coolie gene retards.No worry, PAP surely wins big in the next election, with almost half of the voters are new citizens.

- Joined

- Aug 10, 2008

- Messages

- 104,818

- Points

- 113

Any free bus rides in 2025 to celebrate SG60? Back in 2015 (SG50 and LKY's death), I made use of the free bus rides to explore the eastern parts of Sinkieland. Managed to see Bedok town before it got 'redeveloped' and had some vintage buildings demolished.

- Joined

- May 16, 2023

- Messages

- 33,753

- Points

- 113

Subscribe

Markets

By Abhishek Vishnoi and Winnie Hsu

September 10, 2024 at 10:21 AM GMT+8

Updated on

September 10, 2024 at 11:18 AM GMT+8

Save

A deepening selloff in Chinese stocks is exacerbating a crisis of confidence in the world’s second-largest economy, heaping pressure on policymakers to halt the downward spiral.

A benchmark of the nation’s onshore shares is approaching its lowest close since January 2019, one of many grim milestones that reflect the depth of the gloom in the $8 trillion market.

Down about 7% this year, the CSI 300 Index is staring at an unprecedented fourth annual drop, while an MSCI Inc. gauge of Chinese stocks is heading for its longest stretch of underperformance to global equities since the turn of the century.

Markets

China’s $6.5 Trillion Stock Rout Worsens Economic Peril for Xi

- Chinese equities trail global ones for a fourth year running

- CSI 300 extends slide, nears lowest close since early 2019

By Abhishek Vishnoi and Winnie Hsu

September 10, 2024 at 10:21 AM GMT+8

Updated on

September 10, 2024 at 11:18 AM GMT+8

Save

A deepening selloff in Chinese stocks is exacerbating a crisis of confidence in the world’s second-largest economy, heaping pressure on policymakers to halt the downward spiral.

A benchmark of the nation’s onshore shares is approaching its lowest close since January 2019, one of many grim milestones that reflect the depth of the gloom in the $8 trillion market.

Down about 7% this year, the CSI 300 Index is staring at an unprecedented fourth annual drop, while an MSCI Inc. gauge of Chinese stocks is heading for its longest stretch of underperformance to global equities since the turn of the century.

- Joined

- Oct 30, 2014

- Messages

- 36,768

- Points

- 113

View attachment 206026

MIWs getting more and more CECA roaches in every year to dilute Sinkaporeans votes and to deprive Singaporeans of money

Roaches also got to be positioned and paid to help MIWs to tiew and kann and fuck Stinkaporeans

Using their cheebye fake papers to blow smoke into local degree and Phds to show them how fucked up they are in voting for MIWs

View attachment 206027View attachment 206028

Sinkies don't seem deprived of money.

View attachment 206026

MIWs getting more and more CECA roaches in every year to dilute Sinkaporeans votes and to deprive Singaporeans of money

Roaches also got to be positioned and paid to help MIWs to tiew and kann and fuck Stinkaporeans

Using their cheebye fake papers to blow smoke into local degree and Phds to show them how fucked up they are in voting for MIWs

View attachment 206027View attachment 206028

Sinkies don't seem deprived of money. Are you personally deprived of money? Apply at your nearest RC for financial assistance.

- Joined

- Jul 14, 2008

- Messages

- 18,139

- Points

- 113

Any of the fuckers who sign off on the increase take public transport ?

- Joined

- May 16, 2023

- Messages

- 33,753

- Points

- 113

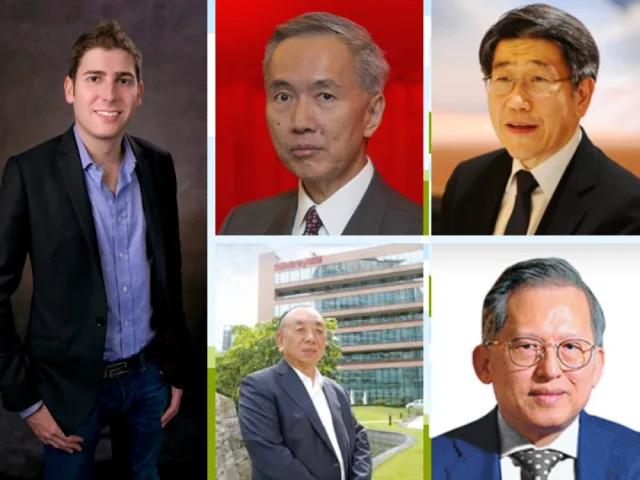

Singapore’s top 50 richest see 10pc wealth surge to US$195b; Meta’s Eduardo Saverin retains prime spot on Forbes’ list with US$29b

Malay MailFri, 6 September 2024 at 4:37 pm GMT+83-min read

Malay Mail

SINGAPORE, Sept 6 — The combined fortune of Singapore’s 50 wealthiest individuals has surged by over 10 per cent to US$195 billion (RM844 billion) in 2024, up from US$177 billion the previous year.

Despite this significant rise, their collective wealth still falls short of the US$208 billion recorded in 2021, Forbes Asia said in a statement yesterday.

The latest Forbes list reveals that nearly two-thirds of the individuals featured saw their fortunes increase, buoyed by Singapore’s robust economic growth and a buoyant stock market.

ADVERTISEMENT

This positive shift is attributed to a series of factors according to Forbes, including the swearing-in of Prime Minister Lawrence Wong in May and a boost from the influx of visitors for sold-out concerts by pop star Taylor Swift and rock band Coldplay.

Eduardo Saverin, co-founder of Meta Platforms (formerly Facebook), retains his position as Singapore’s richest individual for the second consecutive year.

His net worth has soared to US$29 billion, marking a remarkable US$13 billion increase from 2023, thanks to Meta’s rising stock prices driven by substantial investments in artificial intelligence.

Holding on to second place are the Ng siblings, Robert and Philip, of Far East Organization, with a combined wealth of US$14.4 billion, despite a slight decrease from US$14.8 billion last year.

- Joined

- May 16, 2023

- Messages

- 33,753

- Points

- 113

Goldman Trading Set to Fall More Than Expected With 10% Drop

- Trading decline driven by fixed-income weakness versus 2023

- Solomon disclosed $400 million pre-tax hit from retail retreat

Unmute

LISTEN: Goldman Sachs CEO Solomon says the bank’s trading unit is on track to drop about 10% from the prior year.Source: Bloomberg

By Sridhar Natarajan

September 10, 2024 at 4:47 AM GMT+8

Updated on

September 10, 2024 at 5:14 AM GMT+8

Save

Goldman Sachs Group Inc. is signaling a note of caution to investors after posting some of the biggest stock advances among its peers this year.

The bank’s trading unit is on track to drop 10% from the prior year, led by declines in the fixed-income business, Chief Executive Officer David Solomon said at a Barclays Plc conference Monday. The New York-based company will also take a $400 million pre-tax hit in its narrowing consumer business as it moves away from its credit card tie-up with General Motors Co. and its seller-financing operatio

- Joined

- Jul 25, 2018

- Messages

- 4,593

- Points

- 113

Sinkies don't seem deprived of money.

Sinkies don't seem deprived of money. Are you personally deprived of money? Apply at your nearest RC for financial assistance.

View attachment 206057

As if any charts and numbers from MIWs linked organisation can ever be trusted

- Joined

- Sep 2, 2023

- Messages

- 3,169

- Points

- 113

Yes SPF calling back reservist at this time of the year is weirdSo the erections will definitely happen before 28 Dec

- Joined

- Aug 10, 2008

- Messages

- 104,818

- Points

- 113

Any of the fuckers who sign off on the increase take public transport ?

Does it matter who signed off? Or to put it in another way, would those in charge dissent against the 'revision' of fares?

- Joined

- Apr 14, 2011

- Messages

- 17,588

- Points

- 113

We are in good hands!

- Joined

- Oct 30, 2014

- Messages

- 36,768

- Points

- 113

View attachment 206061

View attachment 206062

As if any charts and numbers from MIWs linked organisation can ever be trusted

But your charts and numbers can be trusted??

- Joined

- Jul 25, 2018

- Messages

- 4,593

- Points

- 113

- Joined

- Jul 25, 2018

- Messages

- 4,593

- Points

- 113

- Joined

- May 16, 2023

- Messages

- 33,753

- Points

- 113

Fix all our problemsWe are in good hands!

- Joined

- May 16, 2023

- Messages

- 33,753

- Points

- 113

U must see our milluon dollar HDBee resale...so many million dollar HDBee listed liaoBut your charts and numbers can be trusted??

So pitiful. Raise only 10cents. How to huat for private transport operators?

Do the memorial park best. Straightaway public fund $335 million flows down to lucky pte companies.

https://www.straitstimes.com/singap...morial-s-construction-set-to-cost-335-million

Do the memorial park best. Straightaway public fund $335 million flows down to lucky pte companies.

https://www.straitstimes.com/singap...morial-s-construction-set-to-cost-335-million

Similar threads

- Replies

- 6

- Views

- 497

- Replies

- 17

- Views

- 612

- Replies

- 0

- Views

- 117