Get ready for banking's next headache

A weak economy and frozen financing markets could spell trouble for regional banks with big commercial loan portfolios.

By Colin Barr, senior writer

Last Updated: July 27, 2009: 9:20 AM ET

Fed chief Ben Bernanke said he is watching commercial real estate trends.

NEW YORK (Fortune) -- Regional banks can no longer ignore the elephant in the room -- their exposure to the

<blink>commercial real estate bust</blink>.

Though housing markets remain weak, analysts expect credit problems over the next year to center on commercial real estate -- mortgages on office and apartment buildings and shopping malls, as well as construction, development and industrial loans.

U.S. banks hold some $1.8 trillion worth of commercial loans, according to Federal Reserve data. Big regional banks, including PNC (PNC, Fortune 500) of Pittsburgh, KeyCorp (KEY, Fortune 500) of Cleveland and BB&T (BBT, Fortune 500) of Richmond, Va., have more than half their loan books in commercial loans.

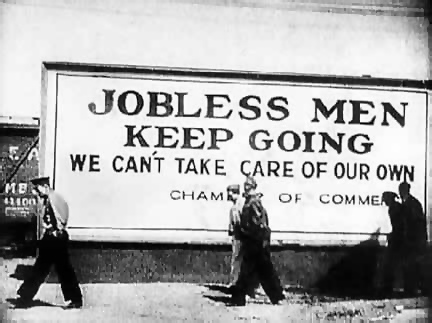

With financing markets locked up and the economy still mired in recession -- unemployment is at a 26-year high while capacity utilization, a key measure of industrial production, recently hit a record low -- observers fear a wave of loans will go bad in coming quarters.

"The problems facing commercial real estate are severe and will likely take many years to resolve," Deutsche Bank analyst Richard Parkus told the Joint Economic Committee of Congress this month. He said the biggest losses are likely to come from banks' $550 billion of construction loans, such as loans to homebuilders.

Banks are already bracing for impact. Higher credit costs led to second-quarter losses at banks ranging from Atlanta's SunTrust (STI, Fortune 500) to Delaware's Wilmington Trust (WT). Zions Bancorp (ZION), which operates primarily in Utah, California, Texas and Nevada, was among those forecasting deeper losses on problem commercial real estate loans.

"It is still a pretty crummy economy out there and we are seeing deterioration in all of it," Zions Bancorp chief financial officer Doyle Arnold said in a conference call with analysts and investors.

Accordingly, banks have been adding to their reserves for future credit losses. But with more borrowers falling behind on their loans, it's not clear that these so-called reserve builds will be enough.

SunTrust, for instance, added $161 million in the latest quarter to its loan loss reserve, citing continuing housing market deterioration and "increasing economic stress in the commercial market."

But nonperforming assets rose even more, jumping to 4.48% of total loans from 2.09% a year earlier. As a result, the bank's loan loss reserve tumbled to 53% of nonperforming assets from 70% a year earlier. Investors like to see a number nearer 100%. BB&T, for instance, has 101% coverage.

Thin reserves mean SunTrust "may face material provisions ahead," according to a report from analysts at research firm CreditSights. That could take a toll on profits over the next year.

Similar trends are playing out at Comerica (CMA), whose loan loss reserve has fallen to 78% of nonperforming loans from 91% a year ago, and Zions, which fell to 65% from 79%.

The increase in nonperforming assets comes as some real estate players complain that banks are sitting on bad loans rather than liquidating them -- a trend they claim is suppressing new lending and compounding the problems in a falling market.

<script src="http://i.cdn.turner.com/money/.element/script/3.0/video/evp/module.js?loc=dom&vid=/video/news/2009/06/15/news.shiller.housing.cnnmoney" type="text/javascript"></script><noscript>Embedded video from <a href="http://money.cnn.com/video">CNNMoney.com Video</a></noscript>

"The rate at which these troubled loans are being resolved has been sluggish," James Helsel, treasurer of the National Association of Realtors, told the Joint Economic Committee July 10. "Over $60 billion in assets have become distressed this year but only $4 billion worth of commercial loans have been resolved so far."

Though the banking industry succeeded in raising tens of billions of dollars in new equity in the second quarter, some expect the financing picture to remain cloudy, adding to price declines.

Office rental rates have fallen 23% in New York and 11% in Washington from their 2008 highs, commercial property manager Jones Lang LaSalle said in its monthly market perspective newsletter this month. Meanwhile, office vacancy rates jumped to 14% in Manhattan and 11% in Washington in the first quarter, reflecting the economic slump.

"Debt will remain constricted as banks continue to adopt the 'delay and pray' approach to their real estate holdings, extending loan terms in the hope that better economic conditions will obviate the need to foreclose," Jones Lang LaSalle said in its report.

For their part, bankers blame the problems on weak loan demand and deny they're kicking the can down the line on troubled credits.

"We are managing these problem loans effectively," Comerica chief executive officer Ralph Babb said in the bank's second quarter earnings statement.

Still, the banks have underestimated their problems before. Comerica forecast in January that this year's credit-related charge-offs, or writedowns of uncollectible loans, would be in line with last year's level of $472 million.

But the bank said last week that charge-offs were $405 million in the first half alone, with even "modest" improvement not expected until the fourth quarter.