Nanofilm (SGX: MZH) down 15% in 3 days - Those results weren’t good at all

09 Nov 2023, 03:43 PM

Bad financial results lead to a falling share price - this is not one of those grand surprises

Nanofilm technologies International Ltd logo. P

Publish : 09 Nov 2023, 03:43 PMUpdate : 09 Nov 2023, 03:43 PM

Nanofilm (SGX: MZH) shares are down 15% over the past three days, 6% just today. The cause of the fall in MZH shares is simply that the results recently announced were just not

very good. “Shares of Nanofilm Technologies fell sharply on Tuesday after the company warned of a net loss of approximately $8 million for the first six months ended June 30 due to a fall in revenue. Nanofilm, which specialises in advanced materials and coatings, said in a regulatory filing on Monday that it is expecting to post a 34 per cent fall in revenue to $73 million for the first half-year.” There would still be an EBITDA profit, but that’s not, as they say, a real profit, an addition to shareholder value. It’s the $8 million that matters.

The reason: “The company attributed the decline to the challenging operating environment, which resulted in lower production volumes.” This is reasonable enough in one sense. At this high end of manufacturing the actual raw materials costs are very little to do with the total cost base. It’s the overhead of being able to manufacture that is the real costs base. So, falling sales - falling revenue - doesn’t reduce costs much. The costs of even being in business are still there.

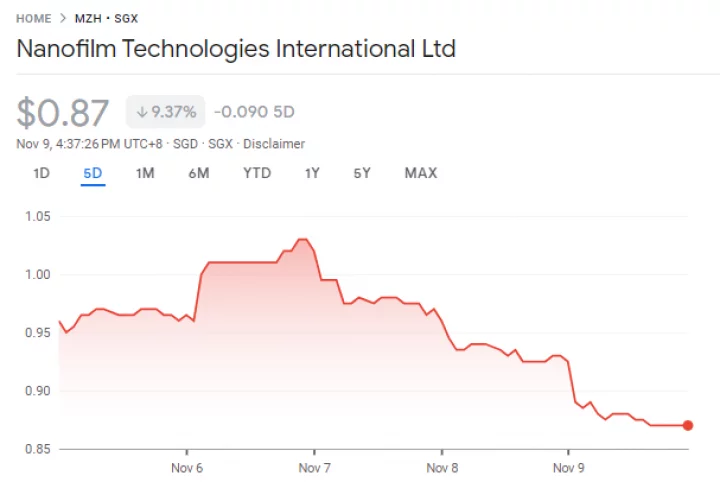

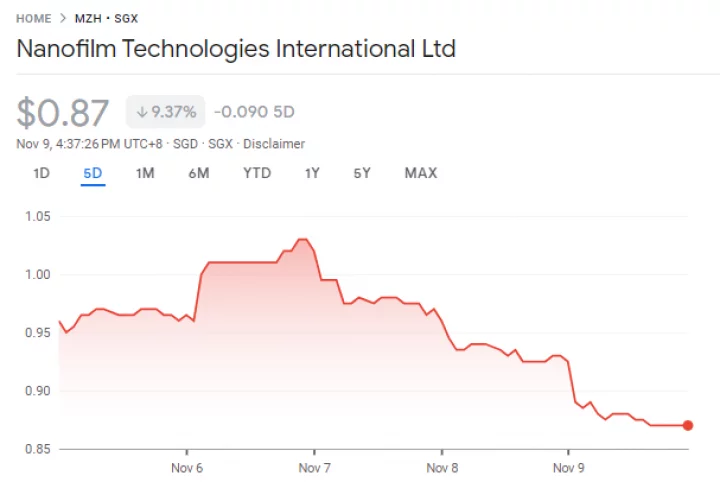

Nanofilm share price from

Google Finance

As we

say above: “It added that gross profit declined 28 per cent year on year over the same period as lower production volumes led to reduced economies of scale.” The gross margin on each unit of sales remains the same but falling sales opens up a gap between total gross profit and those overheads.

It is possible for the company to increase gross margins, cut per unit cost and so on. Even to reduce overheads costs. But while that can be done - and is being done - there’s still that basic problem of the macroeconomic headwinds. It might well be worth thinking about Nanofilm as something to look at when we think the economy more generally is about to turn around. As we’ve said about

Petra Diamonds before now, some firms and share prices simply are more recession vulnerable than others.