- Joined

- May 16, 2023

- Messages

- 36,079

- Points

- 113

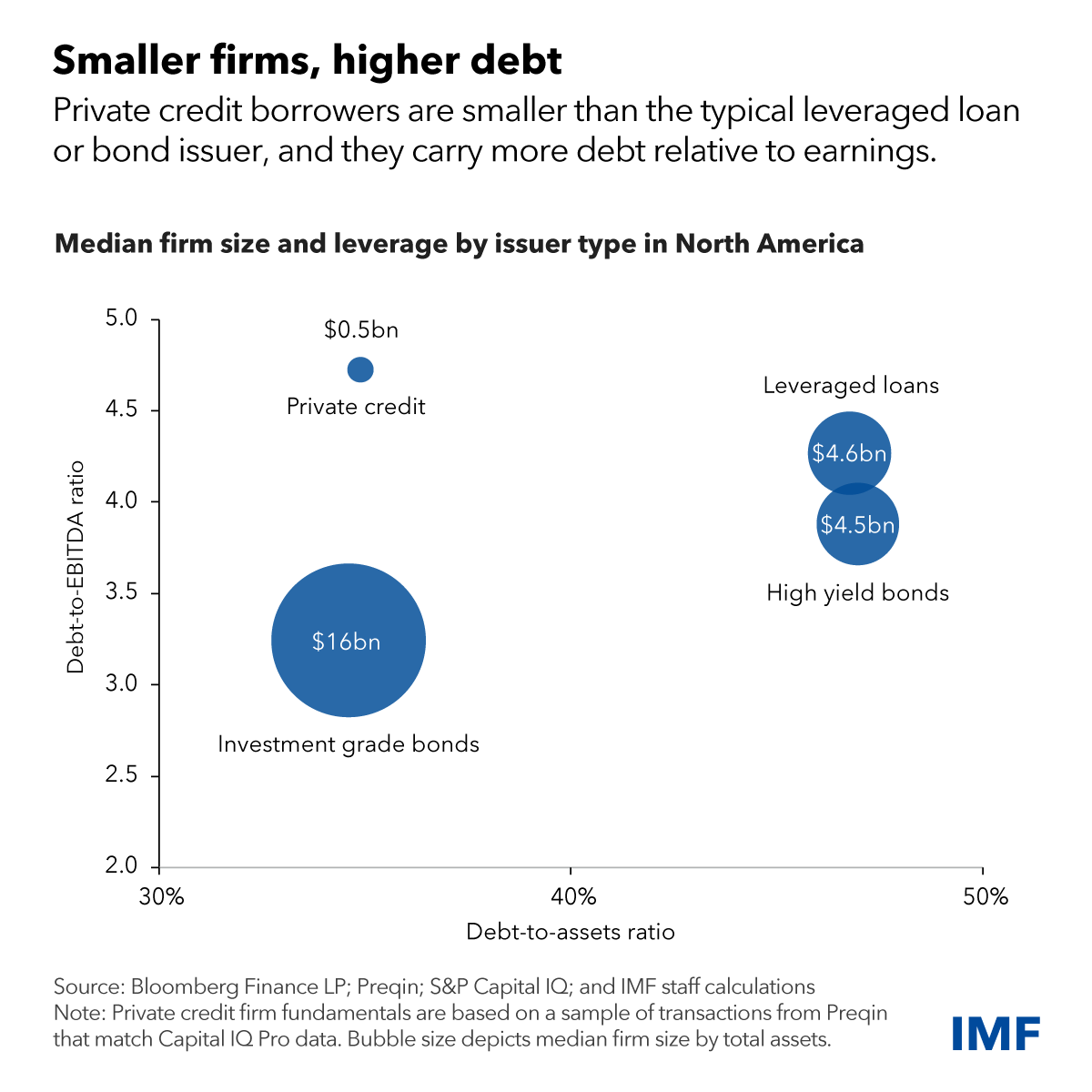

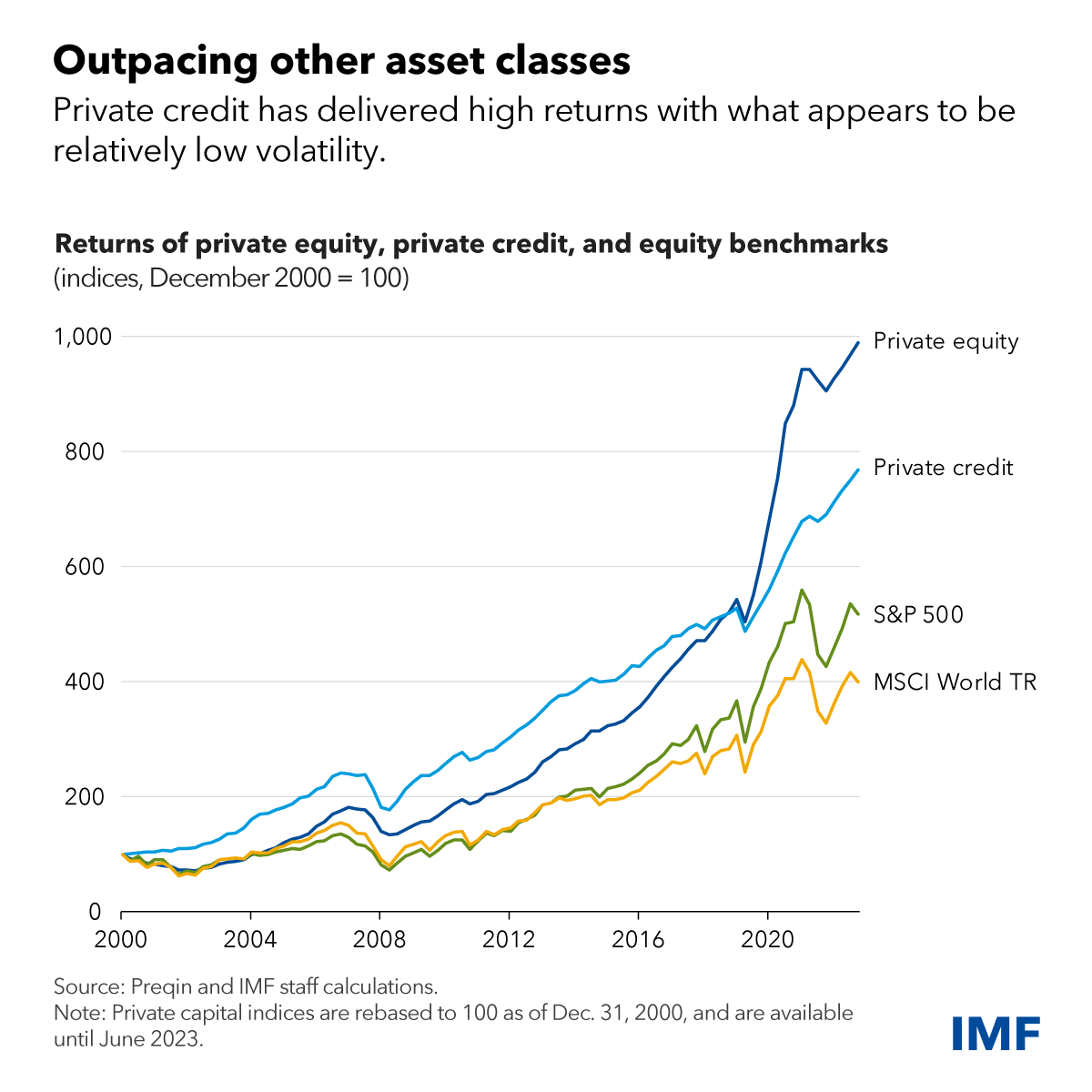

Private corporate credit has created significant economic benefits by providing long-term financing to corporate borrowers. However, the migration of this lending from regulated banks and more transparent public markets to the more opaque world of private credit creates potential risks.

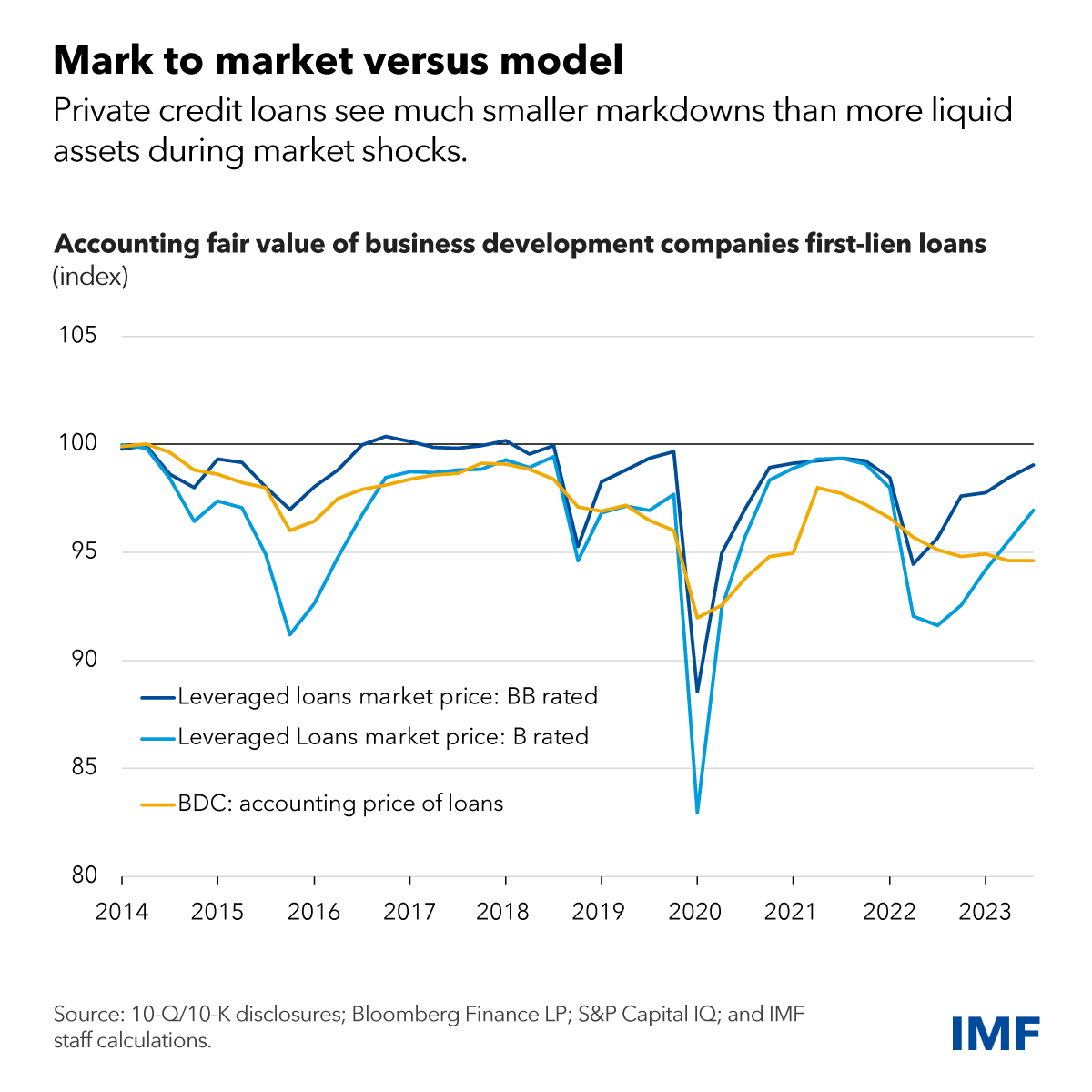

Valuation is infrequent, credit quality isn’t always clear or easy to assess, and it’s hard to understand how systemic risks may be building given the less than clear interconnections between private credit funds, private equity firms, commercial banks, and investors.

Today, immediate financial stability risks from private credit appear to be limited. However, given that this ecosystem is opaque and highly interconnected, and if fast growth continues with limited oversight, existing vulnerabilities could become a systemic risk for the broader financial system.