-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

If the PAP government don't kill you, the hospitals will

- Thread starter LITTLEREDDOT

- Start date

- Joined

- Mar 3, 2024

- Messages

- 4,697

- Points

- 113

To prevent yourself being a victim in such tyrannical circumstances, is to recover back as much sovereignty from the government during this period. For example, stop outsourcing your rights to any government agencies. Once you achieve that, you are not subjected to any conditions specified by the government.

Most sheeple only knows how to seek medical advices/treatment from hospital. Therefore, they ended up threatened by the authorities

Most sheeple only knows how to seek medical advices/treatment from hospital. Therefore, they ended up threatened by the authorities

- Joined

- May 16, 2023

- Messages

- 35,967

- Points

- 113

All ish 万福金安MOH investigating death of 103-year-old who was erroneously given 4th Covid-19 jab

MOH said it takes a serious view of the incident and is carrying out a thorough investigation. ST PHOTO: KEVIN LIM

Linette Lai

Health Correspondent

Feb 4, 2022

SINGAPORE - The Health Ministry (MOH) is investigating the death of a 103-year-old woman who was erroneously given a fourth dose of the Covid-19 vaccine by a mobile vaccination team.

The woman, a nursing home resident, was admitted to Changi General Hospital on Dec 16 - three days after receiving the extra dose.

She had pneumonia and low sodium levels, and was subsequently diagnosed as having had a stroke.

The woman died on Jan 10.

An autopsy found that the main cause of death was pneumonia, with other contributing factors including stroke and coronary artery disease. The coroner has not determined if these were linked to vaccination.

However, these are natural disease processes common in seniors, said MOH in a statement on Friday (Feb 4).

MOH said it takes a serious view of the incident and is carrying out a thorough investigation, which is likely to be completed this month.

"Our preliminary findings were that the vaccine was erroneously administered due to possible irregularities in vaccination procedures and poor communication between the nursing home and the medical service provider handling the vaccination," it said.

The woman was a resident at Econ Healthcare's Chai Chee nursing home, while the vaccination was administered by a team from PanCare Medical Clinic. Both have co-funded the woman's hospital bill as a gesture of goodwill, MOH said.

The ministry added that this is the first case of mistaken identity leading to erroneous vaccination by a mobile vaccination team.

Some 152,000 such mobile vaccinations have been carried out to date.

It added that it had originally planned to announce the incident in December.

However, the woman's family had requested to withhold details which could have led to her identification.

"We have since consulted the family further and are releasing the information to provide clarity on the incident."

Both the nursing home and the mobile vaccination provider have reviewed their processes to prevent such an incident from recurring.

The Agency for Integrated Care, which facilitates vaccinations in nursing homes, has also reminded the homes to ensure proper communication with mobile vaccination teams.

"MOH has also reminded all mobile vaccination teams to perform independent identity verification and authentication before administering any vaccination," the ministry said.

- Joined

- May 16, 2023

- Messages

- 35,967

- Points

- 113

Boss John, u agree?To prevent yourself being a victim in such tyrannical circumstances, is to recover back as much sovereignty from the government during this period. For example, stop outsourcing your rights to any government agencies. Once you achieve that, you are not subjected to any conditions specified by the government.

Most sheeple only knows how to seek medical advices/treatment from hospital. Therefore, they ended up threatened by the authorities

- Joined

- Mar 3, 2024

- Messages

- 4,697

- Points

- 113

- Joined

- Jul 25, 2008

- Messages

- 13,733

- Points

- 113

Forum: Difficulties in getting medication for my child

Jun 13, 2024

I would like to share an unpleasant healthcare experience involving my 3½-year-old child.

We visited a general practitioner (GP) who, after diagnosing my child with thrush, prescribed medication. But the clinic did not have it in stock.

We then discovered that the medication had been out of stock nearly everywhere for almost a year, according to various pharmacies.

Desperate, we went to a private hospital in the vicinity but were denied medication from the hospital pharmacy because the GP was not registered under the same hospital group.

We were instructed to give the GP a physical form to fill out to have the prescription filled at the hospital pharmacy, which we could not do as the clinic had closed for lunch.

We were offered the option of consulting the paediatrician at the hospital after lunch, and then getting the medication.

However, by the time my child woke up from her nap at 3pm, the paediatrician’s clinic said it was not accepting walk-ins any more, although its opening hours were till 4pm. I had to beg the clinic staff to make an exception while we rushed down to the hospital.

Finally, we consulted the paediatrician and obtained the medication. Including the consultation and prescription fee paid to the GP in the morning, it cost us more than $200.

There was a significant waste of time, resources and money, and the episode caused undue stress and discomfort to my child who needed timely medical treatment.

It is unacceptable that a valid clinical prescription is not immediately accepted at a hospital pharmacy merely because the doctor is not part of the same medical group. Such policies are detrimental to patient care and need urgent review.

I am also curious how the supply of medication is managed in Singapore.

Not having easy and timely access to medication in a First World country like Singapore adds an unnecessary burden to parenting and affects the well-being of our children.

Claudia Wong Siying

- Joined

- Aug 20, 2022

- Messages

- 17,573

- Points

- 113

Claudia also complain about toilets in 2016...

JAN 20, 2016, 07:09 PM

I was appalled at the state of the public toilet at City Hall MRT station when I used it recently.

The mirrors above the sinks were old and rusty, the toilet seat was not the right size for the toilet bowl, wall fans were used to circulate the air, and the toilet was in an overall poor sanitary condition.

City Hall is an iconic landmark of Singapore, with multiple attractions, such as the National Gallery, Padang, Chijmes, as well as shopping malls, in the vicinity.

For an area that experiences high human traffic, having just two cubicles in the toilet is definitely not adequate.

With the many activities going on all year round, a great Singapore experience should surely include a decent toilet environment at a prime location in a city that prides itself on its cleanliness.

I hope the authorities will rectify the situation to preserve Singapore's clean First World city image.

Claudia Wong Siying (Ms)

Poor state of City Hall MRT toilet

JAN 20, 2016, 07:09 PM

I was appalled at the state of the public toilet at City Hall MRT station when I used it recently.

The mirrors above the sinks were old and rusty, the toilet seat was not the right size for the toilet bowl, wall fans were used to circulate the air, and the toilet was in an overall poor sanitary condition.

City Hall is an iconic landmark of Singapore, with multiple attractions, such as the National Gallery, Padang, Chijmes, as well as shopping malls, in the vicinity.

For an area that experiences high human traffic, having just two cubicles in the toilet is definitely not adequate.

With the many activities going on all year round, a great Singapore experience should surely include a decent toilet environment at a prime location in a city that prides itself on its cleanliness.

I hope the authorities will rectify the situation to preserve Singapore's clean First World city image.

Claudia Wong Siying (Ms)

- Joined

- Jul 22, 2013

- Messages

- 11,506

- Points

- 113

Why are pap dogs complaining? They voted for this no?

- Joined

- Aug 10, 2008

- Messages

- 105,771

- Points

- 113

Not having easy and timely access to medication in a First World country like Singapore adds an unnecessary burden to parenting and affects the well-being of our children.

Read too much of Harry's memoirs, you begin to believe the bullshit too.

- Joined

- Sep 22, 2008

- Messages

- 80,645

- Points

- 113

Malaysian cancer patient cries upon finding out MRI scan is free after struggling to pay medical bills while in Singapore

Subashini Jeyaraman- 26-08- 2024 06:57 PM

Pix for representational purposes - BERNAMAPIX & FREEPIK

Pix for representational purposes - BERNAMAPIX & FREEPIKWITH many Malaysians seeking better opportunities abroad, the grass is not always greener on the other side, especially in regards to healthcare where it can cost a bomb in certain countries.

recommended by

https://clck.mgid.com/ghits/2043995...4MDSSeIsOVMe5QHUgP7lzNW3Cw7&muid=o82V4DTB3DVg

Artraid

If You Have Pain In Your Hips And Knees, Read This!

Learn more

Malaysia’s public healthcare has been touted in being one of the most affordable and providing better medical treatment to patients despite certain setbacks such as lack of staff and long waiting times.

- Joined

- Jul 25, 2008

- Messages

- 13,733

- Points

- 113

MOH suspends 2 doctors from making insurance, MediSave claims for 6 months

The two doctors are from Melissa Teo Surgery at Mount Elizabeth Novena Specialist Centre and Dr Natasha Lim Eye Centre at Royal Square@Novena. ST PHOTOS: GAVIN FOO

Salma Khalik and Judith Tan

Aug 05, 2024

SINGAPORE - The Ministry of Health (MOH) has taken action against six private specialists for overtreating, overclaiming or claiming for procedures that were not done, as “part of MOH’s broader efforts to ensure that healthcare costs and premiums remain affordable for all Singaporeans”.

This is the first time it has done so since the Escalation and Enforcement Framework (EEF), which gives the ministry more teeth to act against errant doctors, was put in place on April 1, 2023.

For their “egregious non-compliances”, two of the doctors and their clinics have been suspended from making claims against MediSave or MediShield Life, including Integrated Shield Plans (IPs), for six months, starting from Aug 5.

The most severe penalty would be to have MOH revoke a doctor’s ability to make claims.

The other four have to undergo in-person training on prevailing MOH guidelines for non-compliance.

Whistle-blowing and analytics brought these cases to MOH’s notice.

The two doctors who were suspended are general surgeon Melissa Teo Ching Ching from Melissa Teo Surgery at Mount Elizabeth Novena Specialist Centre and The Surgical Oncology Clinic at Connexion in Farrer Park, and ophthalmologist Natasha Lim from Dr Natasha Lim Eye Centre at Royal Square@Novena.

Both of them can continue to practise, as well as submit claims to non-IP insurers, including companies that pay for their employees’ treatments.

The MOH spokesman pointed out that for both doctors, IP claims made up a significant portion of their incomes.

The ministry is still reviewing whether to refer them to the Singapore Medical Council (SMC), or even the police, for further action.

It did not name the other four doctors, who have to undergo training.

All the claims from these six doctors were reviewed by expert panels of four or five senior doctors from the public and private sectors.

Dr Teo was found to have “severe non-compliance” when she submitted claims under six codes when they were fully covered under just two codes. The inappropriate claim amount she made was $90,000 for the bill of $170,000 – or more than half the bill.

She had been warned previously for a similar offence, but the incident took place before the EEF was set up.

Dr Lim was found guilty of severe non-compliance for six claims, including for procedures for conditions her patients did not have, and also for providing treatments that were not medically necessary.

Two patients underwent refractive lens exchanges where their natural lenses were replaced with artificial ones to provide for better sight. These are not claimable against insurance or MediSave.

However, the claims made were for cataract surgery – which is claimable – when the patients, both in their 40s, either had no cataract or had mild cataract that did not require surgery.

Claims were made for two patients for corneal ectasia, a condition the patients did not have.

When questioned, Dr Lim said the procedure was to prevent corneal ectasia, a condition where the shape of the cornea changes.

The panel of experts said this is not standard care.

The bills for Dr Lim’s four patients amounted to $52,000 – all of which were not claimable.

Dr Lim tried to recover the money from one patient after the MOH review, against the ministry’s instructions. The patient complained to MOH and that was stopped.

All wrongful claims from the six doctors are in the process of being returned to the insurer, MediSave or the patient.

The MOH spokesman said these six cases are “part of a larger and separate review to uncover potential professional misconduct by doctors in their financial practices”. He added that this will not be the last batch of doctors taken to task.

Professor Kenneth Mak, director-general of health at MOH, said: “When doctors make inappropriate claims, we take these very seriously as it causes potential financial and physical harm to the patient.

“Such acts are also not consistent with the core pillars of medical ethics – beneficence, non-maleficence and justice. While these errant doctors constitute a very small proportion of the medical profession, their actions can have negative implications on the reputation of the medical profession.”

He added: “Hence, we need to send a strong signal to the medical profession that we expect all our doctors to abide by high standards, not only in clinical care, but also in their character.”

Since October 2023, MOH’s expert panels have looked at 34 outlier claims.

Of these, 25 claims from 12 doctors were non-compliant. Some of the claims occurred prior to the setting up of the EEF, and those doctors were given a warning.

MOH has expressed concern over the rising cost of premiums for IPs covering treatments at private hospitals.

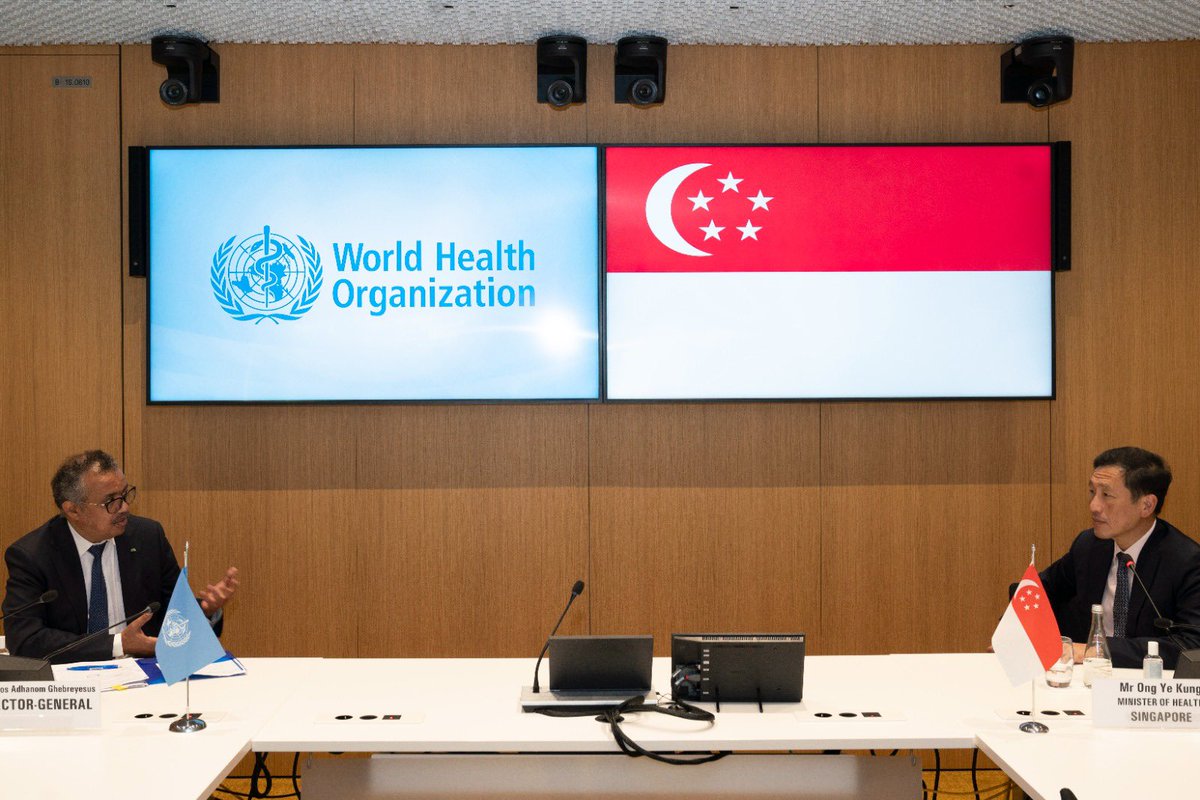

Health Minister Ong Ye Kung said in July that there is a need to break the health insurance vicious circle, including taking action against the minority of doctors making the most egregious and inappropriate insurance claims.

Currently, surveillance of the various MOH schemes to ensure they are carried out appropriately is done by different offices, with different enforcement frameworks.

There is the Claims Management Office’s Claims Adjudication for surgical and medical claims.

The MOH Holdings’ Group Internal Audit (GIA) covers MediShield Life, MediSave, the Community Health Assist Scheme (Chas) and Healthier SG subsidies.

To align the penalties and enforcement approach across all schemes, MOH said it will progressively implement the same EEF for all cases of non-compliance.

It will start with selected MediSave and MediShield surgical claims audited by GIA from Oct 1, and move on to claims made under the Chronic Disease Management Programme, Chas and other schemes from 2025.

MOH said that in addition to EEF sanctions, it may also refer relevant cases to the Commercial Affairs Department under the Singapore Police Force for investigation of potential fraud/cheating offences, or the Singapore Dental Council and the SMC for disciplinary proceedings in respect of potential breaches of their respective ethical codes and ethical guidelines.

Why action was taken by MOH against 6 doctors over claims

1. Dr Melissa Teo Ching Ching

The Surgical Oncology Clinic at Connexion in Farrer Park and Melissa Teo Surgery at Mount Elizabeth Novena Specialist CentreShe has been suspended from making claims against MediSave, MediShield Life or IPs for six months, starting from Aug 5.

She submitted claims using six Table of Surgical Procedures codes, when two codes were enough to cover the procedure she had done.

The table is a list of about 2,400 procedures for which claims can be made.

The total bill for the patient was $170,000, of which 52 per cent, or about $90,000, was for “inappropriate items”.

This was not her first offence.

She was warned in June 2023 for another non-compliant claim.

MOH said aggravating factors in her case were “repeated non-compliance and recalcitrant behaviour”.

2. Dr Natasha Lim Pei Yee

Natasha Lim Eye Centre at Royal Square@NovenaShe has been suspended from making claims against MediSave, MediShield Life or IPs for six months, starting from Aug 5.

She submitted claims for four cases – two patients treated for both eyes – for cataract surgery.

Reviewing the cases, a panel of experts from the public and private sectors found that the claims were inappropriate as these patients either had no cataract or mild cataract that did not require surgery.

She also claimed for two surgical treatments for corneal ectasia for two patients who did not suffer from that condition.

She told the panel that the treatment was to prevent the condition. The panel said that is not standard care.

An aggravating factor in her case was acting against MOH instructions in trying to recover money from a patient for a claim she was asked to rectify.

3. Doctor C

GastroenterologistHe submitted claims for gastroscopy and colonoscopy when only gastroscopy was appropriate, given the patient’s symptoms.

MOH said that in doing both procedures, he “exposed the patient to unnecessary risk of physical harm”.

4. Doctor D

CardiologistThe doctor hospitalised two patients for one night, when it was not necessary to do so. They were put through a barrage of tests.

The expert panel assessed the two patients, who were in their 30s, to be at low risk of cardiac conditions.

All the investigations could also be done in an outpatient setting.

MOH said: “The unnecessary admission caused inappropriate claims from MediShield Life and the patients’ MediSave monies.”

5. Doctor E

Orthopaedic surgeonThe surgeon submitted claims for treating bunions for two patients.

The claims included two under a higher code (which would involve a more complex procedure), and two with multiple codes when a single code was enough. This resulted in inappropriate claims.

6. Doctor F

OphthalmologistThe doctor submitted a claim for cataract surgery with a capsular tension ring.

The patient did not need the capsular tension ring, which is for patients who also have other eye problems.

MOH said the doctor exposed the patient “to unnecessary additional risk of physical harm” as well as made inappropriate claims.

- Joined

- Jul 25, 2008

- Messages

- 13,733

- Points

- 113

Inflated insurance claims: MOH sends strong signal with action against doctors

Salma Khalik

Senior Health Correspondent

Two specialists were suspended from making claims against MediSave, MediShield Life and Integrated Shield Plans for six months. PHOTOS: ST FILE

Aug 08, 2024

SINGAPORE - Six doctors have been taken to task for making wrongful insurance claims against unnecessary treatments, excessive claims and procedures that were never carried out, but the crackdown by the Ministry of Health (MOH) is still ongoing and more doctors are likely to feel the heavy hand of the regulators.

Two specialists, for their severe non-compliance, were suspended from making claims against MediSave, MediShield Life and Integrated Shield Plans (IPs) for six months.

The other four private sector specialists have to attend in-person training to refresh their knowledge of what can be claimed from insurance and how claims should be made.

Reactions to the MOH action have been mixed, with some people shocked at such conduct while others sympathised with the doctors, saying that it is easy to make mistakes and what they did was to help patients avoid paying big bills.

Nonetheless, whether or not these were unintentional mistakes, the ministry has indicated it will have little tolerance for wrongful claims that will ultimately lead to higher medical costs for everyone.

Yes, mistakes can happen. But MOH has made clear these erroneous claims are not first offences that draw simply a warning, and may in fact take legal action if such is warranted.

Furthermore, it is incumbent on doctors and clinics to know how to submit claims properly.

Even “honest” mistakes due to lack of knowledge are inexcusable, since the result is to make the patient or insurer pay more than they should. Too many “accidental” excessive claims would result in huge amounts of money wrongfully paid out. The losers are the insurance policyholders, whose premiums will go up.

To give doctors the time to work out the process for making claims, MOH allowed a six-month transition period, where they were not penalised for wrongful claims.

Since that grace period elapsed, MOH has decided that two doctors deserved harsher punishment for their actions – citing “aggravating factors” of repeated non-compliance and recalcitrant behaviour for surgeon Melissa Teo, and ophthalmologist Natasha Lim’s attempt to recover the monies from her patient against the ministry’s instructions.

Dr Teo submitted a claim for one operation under six different codes instead of two as prescribed by the Table of Surgical Procedures (TOSP) codes.

This effectively meant she was making more claims for the same operation than justified.

This was not an unintended mistake. She told The Straits Times that the surgery was complex, involving several organs, and can sometimes take up to 18 hours to complete.

However, the complexity of a procedure is already taken into consideration by the TOSP. The TOSP lists about 2,400 procedures, including those involving multiple organs. The codes also indicate the maximum payout from the basic MediShield Life and MediSave accounts.

MOH said Dr Teo’s claim of $170,000 for the one procedure included $90,000 in “inappropriate claims”.

An orthopaedic surgeon ordered to undergo training had also coded claims wrongly for two patients. He treated them for bunions, submitting claims under four codes each. Two of the codes were for a higher category than the procedures warranted and came with a higher payout than merited. The other two were inappropriately multi-coded when a single code was enough.

In some of the cases, it could be argued that the doctor was helping the patient. Helping a patient game the system could land them both in hot water.

MOH found that Dr Lim had made claims for four cataract operations in patients who either did not have any cataract, or had mild cataract that did not require surgery, among other issues.

The four procedures she actually carried out were to insert refractive lenses into both eyes of both patients to correct their vision. But vision correction, except in very severe cases, is not considered a medically necessary procedure and cannot be claimed against insurance. Cataract surgery, however, can be claimed.

Making a claim for unnecessary procedures is also a no-no. One gastroenterologist performed both gastroscopy and colonoscopy on a patient with gastric symptoms, who needed only the former, which is an examination of the stomach.

It is not unusual for doctors to suggest that patients do both procedures at the same time. Colonoscopy to check for colon cancer is a recommended screening tool. But neither MediShield Life nor IPs pay for screening – only for treatment that is medically indicated.

The doctor’s mistake was to submit claims for both procedures. The correct thing to do would be to submit a claim for the gastroscopy, and bill the patient for the colonoscopy.

Similarly, was the cardiologist who admitted two young patients for a “barrage of tests” instead of carrying out just the appropriate tests in an outpatient setting trying to save his patients’ money?

A panel of senior doctors who reviewed these cases said that not only did the two not need to be admitted given their low level of risk, they also did not need all the tests they were put through.

Then there was the eye doctor whose patient needed only cataract surgery. Instead, on top of that, the ophthalmologist also inserted a capsular tension ring that should have been used only if the patient had other eye problems. In this case, MOH said not only were the claims higher than they should have been, but the patient was also exposed to additional risk.

The vast majority of doctors are conscientious and honest. The six doctors represent less than half a per cent of the more than 2,000 specialists working in the private sector, but their actions do reflect badly on everyone.

Hopefully, by showing it is willing to flex its muscles, MOH has sent a strong warning to doctors to be rigorous with their claims and no more such cases will emerge. It will be a sad day if patients’ trust in the private sector, an integral part of the healthcare system, is eroded by a small minority.

How about the forever increasing premium of Medishield Life, will it kill all old age with insufficient medisave money?Inflated insurance claims: MOH sends strong signal with action against doctors

Salma Khalik

Senior Health Correspondent

Two specialists were suspended from making claims against MediSave, MediShield Life and Integrated Shield Plans for six months. PHOTOS: ST FILE

Aug 08, 2024

SINGAPORE - Six doctors have been taken to task for making wrongful insurance claims against unnecessary treatments, excessive claims and procedures that were never carried out, but the crackdown by the Ministry of Health (MOH) is still ongoing and more doctors are likely to feel the heavy hand of the regulators.

Two specialists, for their severe non-compliance, were suspended from making claims against MediSave, MediShield Life and Integrated Shield Plans (IPs) for six months.

The other four private sector specialists have to attend in-person training to refresh their knowledge of what can be claimed from insurance and how claims should be made.

Reactions to the MOH action have been mixed, with some people shocked at such conduct while others sympathised with the doctors, saying that it is easy to make mistakes and what they did was to help patients avoid paying big bills.

Nonetheless, whether or not these were unintentional mistakes, the ministry has indicated it will have little tolerance for wrongful claims that will ultimately lead to higher medical costs for everyone.

Yes, mistakes can happen. But MOH has made clear these erroneous claims are not first offences that draw simply a warning, and may in fact take legal action if such is warranted.

Furthermore, it is incumbent on doctors and clinics to know how to submit claims properly.

Even “honest” mistakes due to lack of knowledge are inexcusable, since the result is to make the patient or insurer pay more than they should. Too many “accidental” excessive claims would result in huge amounts of money wrongfully paid out. The losers are the insurance policyholders, whose premiums will go up.

To give doctors the time to work out the process for making claims, MOH allowed a six-month transition period, where they were not penalised for wrongful claims.

Since that grace period elapsed, MOH has decided that two doctors deserved harsher punishment for their actions – citing “aggravating factors” of repeated non-compliance and recalcitrant behaviour for surgeon Melissa Teo, and ophthalmologist Natasha Lim’s attempt to recover the monies from her patient against the ministry’s instructions.

Dr Teo submitted a claim for one operation under six different codes instead of two as prescribed by the Table of Surgical Procedures (TOSP) codes.

This effectively meant she was making more claims for the same operation than justified.

This was not an unintended mistake. She told The Straits Times that the surgery was complex, involving several organs, and can sometimes take up to 18 hours to complete.

However, the complexity of a procedure is already taken into consideration by the TOSP. The TOSP lists about 2,400 procedures, including those involving multiple organs. The codes also indicate the maximum payout from the basic MediShield Life and MediSave accounts.

MOH said Dr Teo’s claim of $170,000 for the one procedure included $90,000 in “inappropriate claims”.

An orthopaedic surgeon ordered to undergo training had also coded claims wrongly for two patients. He treated them for bunions, submitting claims under four codes each. Two of the codes were for a higher category than the procedures warranted and came with a higher payout than merited. The other two were inappropriately multi-coded when a single code was enough.

In some of the cases, it could be argued that the doctor was helping the patient. Helping a patient game the system could land them both in hot water.

MOH found that Dr Lim had made claims for four cataract operations in patients who either did not have any cataract, or had mild cataract that did not require surgery, among other issues.

The four procedures she actually carried out were to insert refractive lenses into both eyes of both patients to correct their vision. But vision correction, except in very severe cases, is not considered a medically necessary procedure and cannot be claimed against insurance. Cataract surgery, however, can be claimed.

Making a claim for unnecessary procedures is also a no-no. One gastroenterologist performed both gastroscopy and colonoscopy on a patient with gastric symptoms, who needed only the former, which is an examination of the stomach.

It is not unusual for doctors to suggest that patients do both procedures at the same time. Colonoscopy to check for colon cancer is a recommended screening tool. But neither MediShield Life nor IPs pay for screening – only for treatment that is medically indicated.

The doctor’s mistake was to submit claims for both procedures. The correct thing to do would be to submit a claim for the gastroscopy, and bill the patient for the colonoscopy.

Similarly, was the cardiologist who admitted two young patients for a “barrage of tests” instead of carrying out just the appropriate tests in an outpatient setting trying to save his patients’ money?

A panel of senior doctors who reviewed these cases said that not only did the two not need to be admitted given their low level of risk, they also did not need all the tests they were put through.

Then there was the eye doctor whose patient needed only cataract surgery. Instead, on top of that, the ophthalmologist also inserted a capsular tension ring that should have been used only if the patient had other eye problems. In this case, MOH said not only were the claims higher than they should have been, but the patient was also exposed to additional risk.

The vast majority of doctors are conscientious and honest. The six doctors represent less than half a per cent of the more than 2,000 specialists working in the private sector, but their actions do reflect badly on everyone.

Hopefully, by showing it is willing to flex its muscles, MOH has sent a strong warning to doctors to be rigorous with their claims and no more such cases will emerge. It will be a sad day if patients’ trust in the private sector, an integral part of the healthcare system, is eroded by a small minority.

- Joined

- Apr 14, 2011

- Messages

- 17,932

- Points

- 113

What’s wrong with making more $$$$?

- Joined

- Jul 22, 2013

- Messages

- 11,506

- Points

- 113

Are they mp relatives. How come can be anonymous even when guikty? Ceca?

- Joined

- Jul 25, 2008

- Messages

- 13,733

- Points

- 113

Letter of the week: Avoid unnecessary tests that can stress out seniors and caregivers

Sep 13, 2024

I agree with the points in the Opinion piece discussing the challenges faced by seniors who are caregivers to other seniors (As seniors become caregivers to seniors, can doctors lighten their load? Sept 5). This is a reality many of us are grappling with, and it’s heartening to see this issue being highlighted.

Caring for a loved one, especially an elderly person, can be incredibly stressful. The emotional connection and sense of responsibility can make it hard for caregivers to step back and take care of themselves.

As our population ages, more and more seniors find themselves in the position of caring for their loved ones. While this is a noble responsibility, it can also be physically and emotionally exhausting. The burden of caregiving, particularly for those who may already be dealing with their own health issues, is significant.

Doctors do play a crucial role in lightening this load.

Beyond just providing medical care, they can offer guidance on managing caregiving stress, refer patients to relevant support services and even advocate for policies that provide more comprehensive assistance to caregivers.

If patients do not present themselves with clinical pathologies that warrant further investigation, there may be no need to search for medical solutions that may not offer relief or improve their quality of life.

Pursuing extensive tests or treatments when there is no clear clinical indication can lead to unnecessary stress for both the patient and caregiver. It can also result in treatments that might be invasive or have side effects, without providing real benefits.

Both time and financial resources are often limited, especially for seniors. By avoiding unnecessary medical investigations, these resources can be conserved and directed towards interventions that truly matter, such as improving the patient’s daily experiences or supporting the caregiver.

This approach can also ease the caregivers’ burden, as it lets them concentrate on the aspects of care that truly make a difference.

By working together with doctors, we can ensure that senior caregivers are supported, and their burdens eased.

Gabriel Chia Sit Loke

- Joined

- Jul 25, 2008

- Messages

- 13,733

- Points

- 113

Forum: Make more effort to take care of the elderly’s healthcare needs

Sep 13, 2024I refer to the Opinion piece by Dr Tan Kok Yang on the difficulties of taking care of senior patients (As seniors become caregivers to seniors, can doctors lighten their load?, Sept 5).

Indeed, there are several challenges faced by elderly patients who consult specialists at hospitals.

Many elderly patients have mobility issues. It is often difficult for them to visit a clinic via public transport independently.

Family members may have to book costly transport like a wheelchair-compatible van to ferry them to and from the hospital. At least one family member needs to take leave from work to accompany the elderly patient. Many elderly patients have several medical problems and often need to consult several specialists.

My patient, 80, fell and fractured her leg. She was also found to have poorly controlled hypertension, chronic renal impairment and severe hearing impairment due to old age.

She underwent surgery for the fracture. Upon discharge, she was given specialist outpatient appointments to see an orthopaedic surgeon, an endocrinologist, an ear, nose and throat (ENT) specialist, an audiologist and a dietitian.

But all five specialist appointments were on different dates, meaning her children needed to take five days of leave and pay for five transport trips.

After much pleading from the family, the hospital managed to schedule the appointments to see the orthopaedic surgeon and the endocrinologist on the same day.

Due to the difficulties in organising different trips to the hospital, the family decided not to see the ENT specialist, the audiologist and the dietitian. This will lead to suboptimal care.

To overcome the challenges, I suggest that hospitals schedule patients’ many specialist appointments on the same day. This is feasible as most specialists run clinics every day at hospitals.

Hospitals could also use technology to minimise unnecessary in-person clinic visits. Consultations like those by dietitians can be made via WhatsApp video.

Specialists could also run specialist clinics at polyclinics, which are probably nearer to the patients’ homes.

It is easier to send one specialist from a hospital to a polyclinic, than for many elderly patients to go to the hospital.

General practitioners and family physicians could be trained to take care of more medical problems. They could, for instance, then handle my patient’s post-operative care and blood pressure control, give dietary advice and arrange for hearing aids for her.

More effort can be made to better take care of our ageing population.

Desmond Wai (Dr)

Similar threads

- Replies

- 4

- Views

- 341

- Replies

- 0

- Views

- 139

- Replies

- 58

- Views

- 2K

- Replies

- 0

- Views

- 183