- Joined

- Oct 5, 2018

- Messages

- 17,604

- Points

- 113

The articles said that he had 2.2% of shares but 66.11% of voting rights.You reported he only got 2.2% share.

He can continue to pay himself $12K a day.

The articles said that he had 2.2% of shares but 66.11% of voting rights.You reported he only got 2.2% share.

The articles said that he had 2.2% of shares but 66.11% of voting rights.

He can continue to pay himself $12K a day.

Softbank is in trouble. Banks reducing their exposure to them.at this point can say Grab is essentially owned by Japanese Billionaire Masayoshi Son' s SoftBank and his Vision Fund.

unlike eg Elon Musk who owns about 17% of Tesla which he founded.

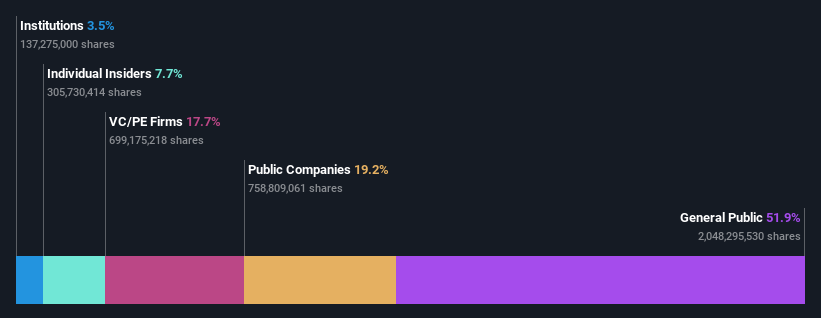

NasdaqGS:GRAB Ownership Breakdown December 9th 2021

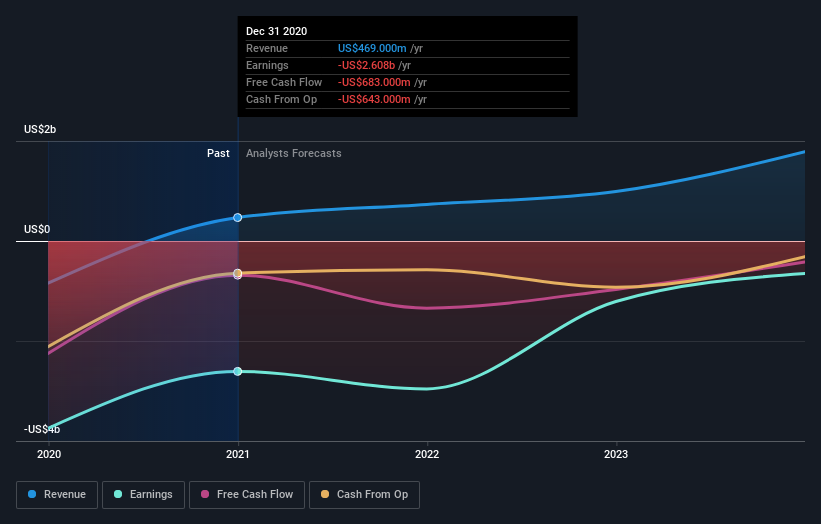

NasdaqGS:GRAB Ownership Breakdown December 9th 2021 NasdaqGS:GRAB Earnings and Revenue Growth December 9th 2021

NasdaqGS:GRAB Earnings and Revenue Growth December 9th 2021Softbank sweating.

Tan saw roughly about us$500m wiped out from his networth since 2nd Dec.

best he cash out by selling his 2% plus to Softbank and retires.

After the Digital Bank is launched, Tan can do an Elon Musk.

Elon Musk sold US$11bn of TESLA in the past six weeks and claimed that Space X was broke.

https://www.zerohedge.com/markets/elon-musk-just-sold-another-963-million-stock

https://fortune.com/2021/11/30/elon-musk-spacex-bankruptcy-warning-raptor-engine/

heard those Short Sellers are determined to sell it down all the way to us$3 ...