http://finance.sina.com.cn/zt_d/qqzbsc/

聚焦5月6日全球资本市场震荡

专题摘要:

5月6日,A股大幅低开,沪指盘初即失守3000点,随后进一步下挫,盘中失守2900点,一度大跌超6%,创业板指盘中跌超8%,两市飘红个股仅100余只,两市超1000股跌停。

搜索

分享专题至:

头条新闻

收评:沪指跌5.58%日挫170余点 两市再现千股跌停

新浪财经|2019年05月06日 15:00

14,157

收评:北上资金净流出超50亿元 午后外资有30亿抄底

新浪港股|2019年05月06日 15:06

2,671

开盘:恐慌指数大涨 道指重挫450点

新浪财经|2019年05月06日 21:32

517

涨停板复盘:三大指数全线暴跌 千股跌停再现

新浪财经|2019年05月06日 14:53

0

3.4万亿市值灰飞烟灭:北向资金流出82亿 5月要清仓吗

中国证券报|2019年05月06日 13:21

1,144

收评:港股恒指大跌2.9%险守29000点 创科实业暴跌8%

新浪港股|2019年05月06日 16:12

0

美元指数宽幅震荡 在岸人民币收报6.7666贬值300点

新浪财经|2019年05月06日 16:30

17

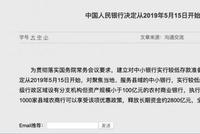

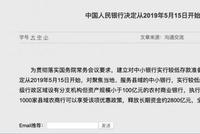

央行5月15日起实施定向降准 释放长期资金约2800亿元

央行|2019年05月06日 09:32

1,073

全球避险资产亚洲开盘大涨 美股期货大跌

新浪财经综合|2019年05月06日 06:13

342

对冲基金持仓逾10万手 5.1假期国际金价绝地反弹

新浪财经综合|2019年05月06日 11:04

0

富时中国A50指数期货跌逾4% 离岸人民币持续下挫

新浪财经综合|2019年05月06日 09:09

152

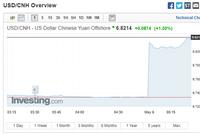

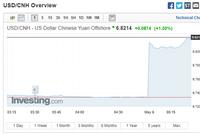

离岸人民币贬值失守6.82关口 日内贬值逾600点

新浪财经|2019年05月06日 08:34

30

美国股指期货下挫 道琼斯指数期货一度跌逾470点

新浪美股|2019年05月06日 06:16

403

机构观点

海通荀玉根:牛市大逻辑没变 阶段性调整尚未结束

新浪财经综合|2019年05月05日 19:43

766

十大基金评A股:市场整体回调 短期谨慎中长期可为

新浪财经|2019年05月06日 17:30

448

30亿资金抄底A股 机构:牛市逻辑没变 5月中或现买点

新浪财经综合|2019年05月06日 16:19

1,802

光大证券:二季度三大风险兑现一个半 下跌空间有限

新浪财经综合|2019年05月06日 08:29

441

平安:沪深300指数今年底合理值为4764点 22%上升空间

新浪财经综合|2019年05月06日 14:18

976

券商分析师:罕见5月降准 凸显政府逆周期调节决心

21世纪经济报道|2019年05月06日 12:42

53

上证指数

深证成指

创业板指

微博热议

更多>>

新浪意见反馈留言板 欢迎批评指正

新浪简介 | About Sina | 广告服务 | 联系我们 | 招聘信息 | 网站律师 | SINA English | 通行证注册 | 产品答疑

Copyrig

https://www.straitstimes.com/busine...-tumble-at-mondays-open-sti-down-21-to-332278

Singapore shares sink 3% amid Asia rout after Trump escalates on China tariffs

The Singapore Exchange Centre in Shenton Way.PHOTO: ST FILE

The Singapore Exchange Centre in Shenton Way.PHOTO: ST FILE

Published

May 6, 2019, 9:39 am SGT

Updated

3 hours ago

Facebook Twitter Email

SINGAPORE - Investors ran for the exits on Monday (May 6) as the threat of a full-blown trade war unexpectedly reared its head overnight.

The Straits Times Index (STI) skidded 3 per cent or 101.67 points to close at 3,290.62, after US President Donald Trump tweeted that he plans to to ratchet up tariffs on Chinese imports on Friday, upending markets that had expected a resolution to trade talks within the month.

According to Singapore Exchange data, this is only the third time in the last five years that the index has plunged 3 per cent or more in a single session, with the previous times being in August 2015 and January 2016.

About 1.44 billion securities worth $1.49 billion changed hands, which worked out to an average unit price of $1.03. Losers outnumbered gainers 369 to 100, or about 11 securities down for every three up.

Penny stock International Cement was far and away the most actively traded counter, with 99.3 million shares changing hands before it closed flat at four cents.

It was followed by Genting Singapore, which lost two cents or 2.06 per cent to $0.95 on a volume of 40.58 million. Resorts World Sentosa, which is owned by the casino operator, has set aside $1 billion to intensify the use of its existing land and to buy about one hectare of new land, Senior Minister of State for Trade and Industry Chee Hong Tat said in Parliament on Monday.

Other active index counters included Yangzijiang Shipbuilding, which closed down 2.56 per cent to $1.52, and Ascendas Reit, up 0.99 per cent to $3.06.

In New York earlier, US stock index futures dived after Mr Trump said he would raise tariffs on U$200 billion worth of Chinese goods to 25 per cent from 10 per cent by this Friday, and would soon target hundreds of billions more.

"For 10 months, China has been paying Tariffs to the USA of 25% on 50 Billion Dollars of High Tech, and 10% on 200 Billion Dollars of other goods," Mr Trump tweeted on Sunday night. "The 10% will go up to 25% on Friday."

DBS analysts wrote in a research note on Monday morning that Mr Trump's tariff threat will likely create a "knee-jerk impact" on financial markets, and that the latest move could be his negotiation strategy to put pressure on China to agree to a deal very soon.

Regarding the impact on the Singapore market, the researchers noted that the risk-off effect should send cyclicals lower, with stocks likely to be down over the next 1.5 days, before attention turns to China's next move, as Chinese Vice-Premier Liu He is scheduled to return to the US for trade talks on Wednesday. The analysts added that a pullback of the STI to 3,300 is on the cards.

Related Story

Trump threatens to hike tariffs on $272 billion of China goods, escalating tension in trade talks

Related Story

China Vice-Premier Liu He still likely to travel to US for trade talks this week: Report

Related Story

Tit-for-tat: Timeline of US-China trade dispute

Elsewhere in Asia, equities tumbled and the safe-haven yen strengthened 0.3 per cent to 110.72 per US dollar, the strongest in more than five weeks.

The benchmark Shanghai Composite Index sank 5.58 per cent by the close, its steepest single-day drop since February 2016. The Shenzhen Composite Index, which tracks stocks on China's second exchange, plummeted 7.38 per cent.

Around 1,000 mainland firms sank the maximum allowed 10 per cent daily limit. But market sentiment was lifted somewhat after China said its trade delegation is still preparing to go to the United States, Reuters reported

Hong Kong's Hang Seng index ended down 2.9 per cent, regaining some lost ground in the late afternoon session.

Shares in Sydney closed 0.8 per cent weaker while markets in Seowl and Tokyo were closed for holidays.

The offshore yuan fell as much as 1.3 per cent to 6.8218 to the US dollar, its biggest fall in more than three years to its lowest since Jan 10, before trading at 6.7797 as of 4:30 pm. in Hong Kong. The onshore rate slid 0.46 per cent to 6.7659 per dollar.

The flight to safety also saw the US dollar surge against higher-yielding, higher-risk units, with South Africa's rand off 1 per cent, the Mexican peso 0.9 per cent lower, and the Australian dollar 0.6 per cent lower, AFP reported.

European shares fell sharply when trading opened on Monday. Germany's DAX and France's CAC indices led declines, down 1.7 per cent and 1.8 per cent respectively. Italy and Spain also fell more than 1 per cent while markets in Britain remained shut for a bank holiday.

On oil markets, both the US West Texas Intermediate and Brent crude were hammered more than 2 per cent by worries that a trade war between the world's top two economies could hit demand for the commodity.

Unlock more articles at just $0.99/month

Subscribe and get access to all Premium stories today. Cancel anytime.

Subscribe Now

聚焦5月6日全球资本市场震荡

专题摘要:

5月6日,A股大幅低开,沪指盘初即失守3000点,随后进一步下挫,盘中失守2900点,一度大跌超6%,创业板指盘中跌超8%,两市飘红个股仅100余只,两市超1000股跌停。

搜索

分享专题至:

头条新闻

收评:沪指跌5.58%日挫170余点 两市再现千股跌停

新浪财经|2019年05月06日 15:00

14,157

收评:北上资金净流出超50亿元 午后外资有30亿抄底

新浪港股|2019年05月06日 15:06

2,671

开盘:恐慌指数大涨 道指重挫450点

新浪财经|2019年05月06日 21:32

517

涨停板复盘:三大指数全线暴跌 千股跌停再现

新浪财经|2019年05月06日 14:53

0

3.4万亿市值灰飞烟灭:北向资金流出82亿 5月要清仓吗

中国证券报|2019年05月06日 13:21

1,144

收评:港股恒指大跌2.9%险守29000点 创科实业暴跌8%

新浪港股|2019年05月06日 16:12

0

美元指数宽幅震荡 在岸人民币收报6.7666贬值300点

新浪财经|2019年05月06日 16:30

17

央行5月15日起实施定向降准 释放长期资金约2800亿元

央行|2019年05月06日 09:32

1,073

全球避险资产亚洲开盘大涨 美股期货大跌

新浪财经综合|2019年05月06日 06:13

342

对冲基金持仓逾10万手 5.1假期国际金价绝地反弹

新浪财经综合|2019年05月06日 11:04

0

富时中国A50指数期货跌逾4% 离岸人民币持续下挫

新浪财经综合|2019年05月06日 09:09

152

离岸人民币贬值失守6.82关口 日内贬值逾600点

新浪财经|2019年05月06日 08:34

30

美国股指期货下挫 道琼斯指数期货一度跌逾470点

新浪美股|2019年05月06日 06:16

403

机构观点

海通荀玉根:牛市大逻辑没变 阶段性调整尚未结束

新浪财经综合|2019年05月05日 19:43

766

十大基金评A股:市场整体回调 短期谨慎中长期可为

新浪财经|2019年05月06日 17:30

448

30亿资金抄底A股 机构:牛市逻辑没变 5月中或现买点

新浪财经综合|2019年05月06日 16:19

1,802

光大证券:二季度三大风险兑现一个半 下跌空间有限

新浪财经综合|2019年05月06日 08:29

441

平安:沪深300指数今年底合理值为4764点 22%上升空间

新浪财经综合|2019年05月06日 14:18

976

券商分析师:罕见5月降准 凸显政府逆周期调节决心

21世纪经济报道|2019年05月06日 12:42

53

上证指数

深证成指

创业板指

微博热议

更多>>

-

六藏取经 :千言万语不如特不靠普一句话 落后就要被牵制 情绪化的A股已经不看技术面 空仓的继续休息,等跌停家数只有30家内再出手 有仓位的高位股尽早出局,低位的没到止损标准就做T等个反弹出局 调整时间还不够等待情绪再次崩溃后的反弹力度会大 大妖股也就在这个阶段产生 翻了2018年6.19前后几个交易日的复盘

:千言万语不如特不靠普一句话 落后就要被牵制 情绪化的A股已经不看技术面 空仓的继续休息,等跌停家数只有30家内再出手 有仓位的高位股尽早出局,低位的没到止损标准就做T等个反弹出局 调整时间还不够等待情绪再次崩溃后的反弹力度会大 大妖股也就在这个阶段产生 翻了2018年6.19前后几个交易日的复盘

2019-05-06 22:00

转发 评论

-

刘宛岚 :今天A股跌出了纪录:沪指跌5.58%,创2016年2月25日以来最大单日跌幅;深成指跌7.56%,创业板指跌破7.94%,均创下2016年1月7日以来最大单日跌幅。 股市是人性的炼狱,这是我喜欢它的地方。在现实中你可能把缺点隐藏的很好,甚至都不知道自己有某个缺点。一进入股市,每个人性格、心理、观念和心胸上的

:今天A股跌出了纪录:沪指跌5.58%,创2016年2月25日以来最大单日跌幅;深成指跌7.56%,创业板指跌破7.94%,均创下2016年1月7日以来最大单日跌幅。 股市是人性的炼狱,这是我喜欢它的地方。在现实中你可能把缺点隐藏的很好,甚至都不知道自己有某个缺点。一进入股市,每个人性格、心理、观念和心胸上的

2019-05-06 22:00

转发 评论

-

快兰斯24小时财经直播 :实时播报:【今天的A股有点小情绪 明天心情能不能平复?】今天是五一假期后的第一个交易日,估计很多人都还没有从休假的状态中走出来。四月以来市场上上下下,到如今千股跌停。对久经考验的老股民来说,可能已不算新奇。但是确实是给新股民结结实实地上了一课。分析师认为,历来暴跌的持续性都不会太强

:实时播报:【今天的A股有点小情绪 明天心情能不能平复?】今天是五一假期后的第一个交易日,估计很多人都还没有从休假的状态中走出来。四月以来市场上上下下,到如今千股跌停。对久经考验的老股民来说,可能已不算新奇。但是确实是给新股民结结实实地上了一课。分析师认为,历来暴跌的持续性都不会太强

2019-05-06 21:59

转发(1) 评论

-

天津侠哥谈市 :今天大跌的心情很不舒服,倒不是亏了多少钱,按比例总账户缩水只有1个多点,远远低于指数跌幅。不愉快的是,中国作为世界第二大经济体,A股近50万亿的股票市场,早上被人家一则推特就干翻了,哪没到哪,就弄出个千股跌停!这样的市场,你让我们怎么去投资?上个猪年12年前大盘3000点,12年后还不到3000

:今天大跌的心情很不舒服,倒不是亏了多少钱,按比例总账户缩水只有1个多点,远远低于指数跌幅。不愉快的是,中国作为世界第二大经济体,A股近50万亿的股票市场,早上被人家一则推特就干翻了,哪没到哪,就弄出个千股跌停!这样的市场,你让我们怎么去投资?上个猪年12年前大盘3000点,12年后还不到3000

2019-05-06 21:59

转发(1) 评论

-

天津侠哥谈市 :富时中国A50指数期货全天近20个小时的交易时间,欧美股市与我们有8小时和12小时的时差,我们国内股指期货是T+0双向交易,A股现货是T+1单向交易,每天交易4小时,有无数个节假日在休市,可全球资本市场和各类信息是每时每刻的都不停歇,机构完全是在利用这些股指期货和时间差玩弄我们小散于掌心。

:富时中国A50指数期货全天近20个小时的交易时间,欧美股市与我们有8小时和12小时的时差,我们国内股指期货是T+0双向交易,A股现货是T+1单向交易,每天交易4小时,有无数个节假日在休市,可全球资本市场和各类信息是每时每刻的都不停歇,机构完全是在利用这些股指期货和时间差玩弄我们小散于掌心。

2019-05-06 21:59

转发 评论

-

蓝鲸财经记者工作平台 :【鲸视频:今天的A股有点小情绪,明天心情能不能平复?

】今天是五一假期后的第一个交易日,千股跌停。金融界网首席评论员王伦分析,突发利空催生了A股市场的恐慌情绪,走出2016年初以来单日最惨烈行情,预计明天A股还有继续下探的空间,大盘很可能要回补2800的跳空缺口。西南证券首席分析师

:【鲸视频:今天的A股有点小情绪,明天心情能不能平复?

】今天是五一假期后的第一个交易日,千股跌停。金融界网首席评论员王伦分析,突发利空催生了A股市场的恐慌情绪,走出2016年初以来单日最惨烈行情,预计明天A股还有继续下探的空间,大盘很可能要回补2800的跳空缺口。西南证券首席分析师

2019-05-06 21:59

转发(1) 评论(11)

-

王宇佳_phoenix:今天早上五点半左右莫名其妙的就醒了,然后手贱的就拿起了手机刷了下微博,就看到了去年总见到的大哥又发推特了,然后就没再睡着了…… 想到了今天的行情可能会惨,但没想到今天的行情这么惨,人家一条推特就把我们大A股干沉了近200点,千股跌停,我这天天发微博也没见怎么着啊。今天的盘面基本毫

2019-05-06 21:57

转发 评论

-

睿羿:#股市#来 看看欧美 看看亚洲 看看全世界 谁要是有中国涨的多那是全部 谁要是跌最多 还是中国 于情于理 中国股民如何投资 这特么是卷人 和ptwop跑路没有区别 这绝不是股市 这是被黑了!股民毫无还手之力八天跌出几个月的 这就没法在论中国股市了 就是欺负散户 霸市 世界第一恶霸就是中国股市 没有之一!

2019-05-06 21:57

转发 评论

-

金融界网 :【惨烈!A股史上第20次千股跌停 千股年内已回撤逾30%】 从历史数据来看,千股跌停后,大盘走向不容乐观。从千股跌停后一周内的市场表现看,沪指上涨的有7次,占比不足四成,反弹力度最大的一次出现在2015年8月25日后的一周内,沪指当时反弹幅度为6.8%。值得注意的是,在千股跌停后的一周内,沪指有2次

:【惨烈!A股史上第20次千股跌停 千股年内已回撤逾30%】 从历史数据来看,千股跌停后,大盘走向不容乐观。从千股跌停后一周内的市场表现看,沪指上涨的有7次,占比不足四成,反弹力度最大的一次出现在2015年8月25日后的一周内,沪指当时反弹幅度为6.8%。值得注意的是,在千股跌停后的一周内,沪指有2次

2019-05-06 21:56

转发(3) 评论(2)

新浪意见反馈留言板 欢迎批评指正

新浪简介 | About Sina | 广告服务 | 联系我们 | 招聘信息 | 网站律师 | SINA English | 通行证注册 | 产品答疑

Copyrig

https://www.straitstimes.com/busine...-tumble-at-mondays-open-sti-down-21-to-332278

Singapore shares sink 3% amid Asia rout after Trump escalates on China tariffs

Published

May 6, 2019, 9:39 am SGT

Updated

3 hours ago

Facebook Twitter Email

SINGAPORE - Investors ran for the exits on Monday (May 6) as the threat of a full-blown trade war unexpectedly reared its head overnight.

The Straits Times Index (STI) skidded 3 per cent or 101.67 points to close at 3,290.62, after US President Donald Trump tweeted that he plans to to ratchet up tariffs on Chinese imports on Friday, upending markets that had expected a resolution to trade talks within the month.

According to Singapore Exchange data, this is only the third time in the last five years that the index has plunged 3 per cent or more in a single session, with the previous times being in August 2015 and January 2016.

About 1.44 billion securities worth $1.49 billion changed hands, which worked out to an average unit price of $1.03. Losers outnumbered gainers 369 to 100, or about 11 securities down for every three up.

Penny stock International Cement was far and away the most actively traded counter, with 99.3 million shares changing hands before it closed flat at four cents.

It was followed by Genting Singapore, which lost two cents or 2.06 per cent to $0.95 on a volume of 40.58 million. Resorts World Sentosa, which is owned by the casino operator, has set aside $1 billion to intensify the use of its existing land and to buy about one hectare of new land, Senior Minister of State for Trade and Industry Chee Hong Tat said in Parliament on Monday.

Other active index counters included Yangzijiang Shipbuilding, which closed down 2.56 per cent to $1.52, and Ascendas Reit, up 0.99 per cent to $3.06.

In New York earlier, US stock index futures dived after Mr Trump said he would raise tariffs on U$200 billion worth of Chinese goods to 25 per cent from 10 per cent by this Friday, and would soon target hundreds of billions more.

"For 10 months, China has been paying Tariffs to the USA of 25% on 50 Billion Dollars of High Tech, and 10% on 200 Billion Dollars of other goods," Mr Trump tweeted on Sunday night. "The 10% will go up to 25% on Friday."

DBS analysts wrote in a research note on Monday morning that Mr Trump's tariff threat will likely create a "knee-jerk impact" on financial markets, and that the latest move could be his negotiation strategy to put pressure on China to agree to a deal very soon.

Regarding the impact on the Singapore market, the researchers noted that the risk-off effect should send cyclicals lower, with stocks likely to be down over the next 1.5 days, before attention turns to China's next move, as Chinese Vice-Premier Liu He is scheduled to return to the US for trade talks on Wednesday. The analysts added that a pullback of the STI to 3,300 is on the cards.

Related Story

Trump threatens to hike tariffs on $272 billion of China goods, escalating tension in trade talks

Related Story

China Vice-Premier Liu He still likely to travel to US for trade talks this week: Report

Related Story

Tit-for-tat: Timeline of US-China trade dispute

Elsewhere in Asia, equities tumbled and the safe-haven yen strengthened 0.3 per cent to 110.72 per US dollar, the strongest in more than five weeks.

The benchmark Shanghai Composite Index sank 5.58 per cent by the close, its steepest single-day drop since February 2016. The Shenzhen Composite Index, which tracks stocks on China's second exchange, plummeted 7.38 per cent.

Around 1,000 mainland firms sank the maximum allowed 10 per cent daily limit. But market sentiment was lifted somewhat after China said its trade delegation is still preparing to go to the United States, Reuters reported

Hong Kong's Hang Seng index ended down 2.9 per cent, regaining some lost ground in the late afternoon session.

Shares in Sydney closed 0.8 per cent weaker while markets in Seowl and Tokyo were closed for holidays.

The offshore yuan fell as much as 1.3 per cent to 6.8218 to the US dollar, its biggest fall in more than three years to its lowest since Jan 10, before trading at 6.7797 as of 4:30 pm. in Hong Kong. The onshore rate slid 0.46 per cent to 6.7659 per dollar.

The flight to safety also saw the US dollar surge against higher-yielding, higher-risk units, with South Africa's rand off 1 per cent, the Mexican peso 0.9 per cent lower, and the Australian dollar 0.6 per cent lower, AFP reported.

European shares fell sharply when trading opened on Monday. Germany's DAX and France's CAC indices led declines, down 1.7 per cent and 1.8 per cent respectively. Italy and Spain also fell more than 1 per cent while markets in Britain remained shut for a bank holiday.

On oil markets, both the US West Texas Intermediate and Brent crude were hammered more than 2 per cent by worries that a trade war between the world's top two economies could hit demand for the commodity.

Unlock more articles at just $0.99/month

Subscribe and get access to all Premium stories today. Cancel anytime.

Subscribe Now