| [h=1]THE TRUTH: GIC MANAGES ONLY SINGAPOREANS’ CPF AND YOU SHOULD EARN 6% ON YOUR CPF?[/h] Post date: 3 Sep 2014 - 5:36pm

Since the 1980s, PAP has taken our CPF to invest in GIC. However, for the past 15 years, they kept denying this. Lee Kuan Yew denied this in 2001 and 2006 and Ng Eng Hen denied this in 2007. Finally, on 30 May 2014 this year, PAP finally admitted for the first time that they take our CPF to give GIC to use. The Ministry of Finance admitted, “The Government’s assets (which our CPF is part of) are therefore mainly managed by GIC.“ But why did PAP want to hide this from Singaporeans? Why did PAP not want to admit to the truth? Today, we know that Singaporeans have paid $260 billion into the CPF. But how much is the GIC managing? PAP claims that “the size of the Government’s funds managed by GIC … are not published … (because) It is not in our national interest to publish the full size of our reserves.“ But “What has been revealed is that GIC manages well over US$100 billion.” So, why does PAP not want to let Singaporeans know how much GIC manages, and how much exactly does GIC manages? [h=3]GIC has S$236 billion in 2007[/h]In 2008, GIC lost S$59 billion. According to Lee Kuan Yew, this meant that GIC “lost about 25 per cent of its value from its peak last year“. Thus if you work backwards, what this means is that in the Financial Year 2007, GIC would have managed S$236 billion. So, it looks like we might have the closest estimate to how much GIC straight from the horse’s mouth – S$236 billion in 2007. [h=3]Singaporeans’ CPF Makes Up 65% of the Assets GIC Manages?[/h]In 2007, Singaporeans paid S$137 billion into the CPF. Does this mean that of the assets that GIC managed, our CPF accounted for 58% of the assets? Today, it is estimated that GIC has grown to S$400 billion. Today, Singaporeans have paid S$260 billion into the CPF. This would make up 65% of the GIC’s estimated value. Does this mean that GIC is managing even more of our CPF today? And note – 65% is a substantial amount. It means that two-thirds of the assets managed by the GIC are our CPF, or the declared official value of our CPF!

[h=3]100% of the Assets GIC Manages are Singaporeans’ CPF, When Including Interest Not Returned?[/h]Now, Singaporeans are paid 2.5% to 4% in interest on our CPF. This is an average of about 3%. GIC is estimated to earn an interest of 6% since its inception in 1981, or 3% more than what we get on our CPF. As I have written before, the 3% of interest that is not returned to Singaporeans would mean that Singaporeans are losing about half of our CPF to the PAP. As such, even though there is the official value of $260 billion inside the CPF today, our CPF could actually have grown to twice the size, or $520 billion, if all the interest earned on our CPF was returned to our CPF. This would mean that our CPF could actually be larger than the $400 billion value of the GIC! In other words, our CPF does not account for only 65% of the assets that GIC manages. For the rest of the 35%, this could possibly be interest earned on our CPF that is not returned to Singaporeans. Some economists have explained that the interest not returned to Singaporeans is an implicit tax that PAP is making Singaporeans pay to them. In short, this would mean that all the assets that GIC is managing could actually be only our CPF and nothing else.

Is this the reason why PAP does not want to let us know the value of GIC? So that we do not know the actual value that our CPF should have, and how much of the interest earned on our money (at least $140 billion) is not being returned to Singaporeans? [h=3]If GIC Only Manages Singaporeans’ CPF, Then Singaporeans Should Be Earning 6% on Our CPF[/h]In 1981, when GIC was set up, Goh Keng Swee said, “there should be two pools of reserves – one to be managed by the Monetary Authority of Singapore (MAS), the other to be managed by a new investment management organisation with a long-term orientation. The former needed to concentrate on holdings of liquid assets with short maturities to allow MAS to respond quickly to market conditions and switch large amounts between currencies, especially in an environment of increasingly volatile interest and exchange rates. The latter, however, could focus more on investments that would yield good long-term returns, such as equities.“ Now, it is known than our reserves are made up “Sustained balance of payments surpluses and accumulated national savings (which) are the fundamental sources of the Singapore’s Government’s funds.” This was before GIC deleted this information from their website.

As the MAS manages “liquid assets” which would need to “allow MAS to respond quickly to market conditions”, it can be assumed that MAS manages the surpluses. And GIC, because it “could focus more on investments … (for the) long-term”, it would be managing our CPF, since as Professor Mukul Asher had said, CPF “is essentially a 35-year or more (the duration of one’s work-life) savings plan“. Thus we can safely assume that MAS manages only the surpluses and GIC manages only our CPF. Now, the government also said the reserves include “Singapore Government Securities (SGS) … (and) Special Singapore Government Securities (SSGS), which are Government bonds issued to the CPF Board.“ Thus we can also assume that MAS manages the SGS and GIC manages the SSGS (since this is the CPF).

And now, if you look at the breakdown of the SGS (including the SSGS) when this information was still available in the past, our CPF makes up the bulk of the SGS, or about 70% to 85% of the SGS. This means that the government’s reserves are mostly made up of our CPF.

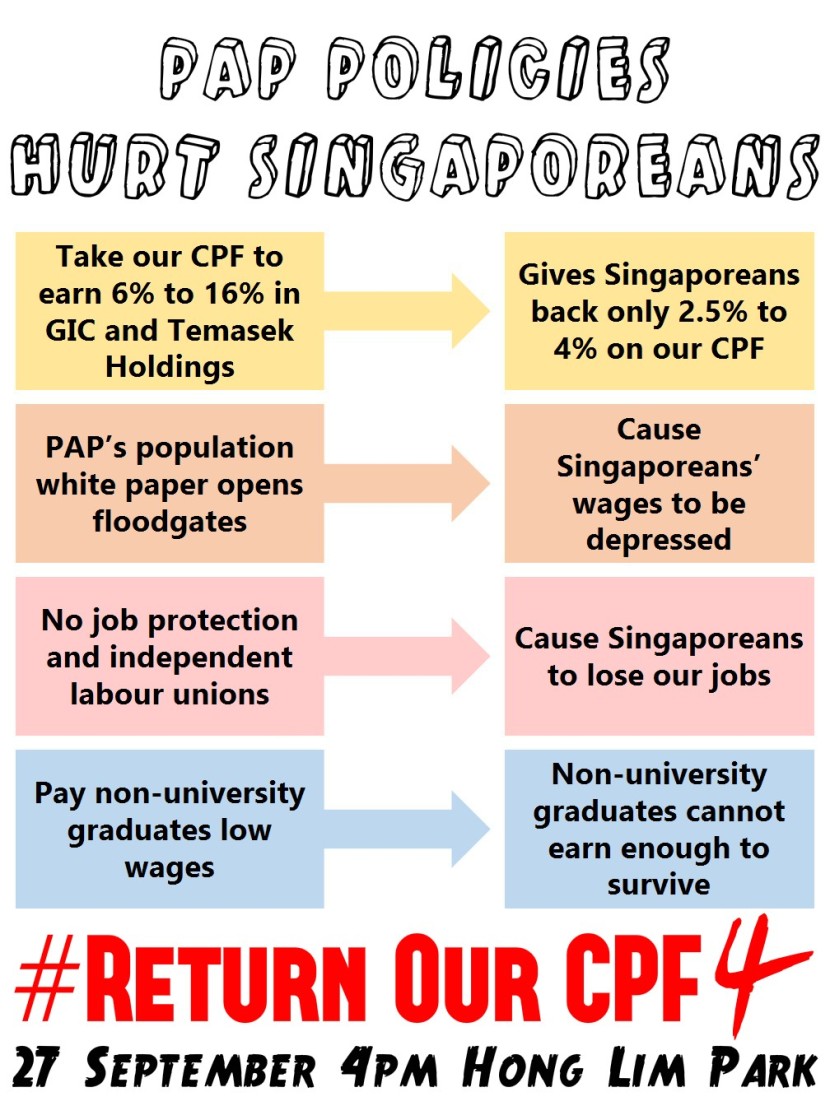

What does this all means? From this, we can clearly see that the whole of GIC would most probably be made up of only our CPF, of both the official size of the CPF and the undeclared returns. And if there are any additional undeclared returns that GIC is not managing, they most probably are being managed by MAS or siphoned off to Temasek Holdings. Now, GIC earns an estimated 6% in interest. Temasek Holdings earn 16%. Our CPF currently earns an average of only 3%. If GIC is managing our CPF, should’t our CPF be getting the 6% interest since the GIC would be managing nothing else but our CPF? Also, if some of our CPF would most probably be managed by Temasek Holdings, shouldn’t some of our CPF also earns the 16% that Temasek Holdings is earning now? This would mean that our CPF should be earning between 6% to 16% in interest, instead of the 2.5% to 4% that we are getting now. [h=3]PAP Says It is Taking On the Risk for Singaporeans, But It is Singaporeans Who are Taking On the Risk for PAP and GIC[/h]Now, PAP might claim that they pool Singaporeans’ CPF together to give it to GIC to manage, so that the government takes on the risk of GIC (Read here, here, here and here.) And PAP says that because they take on the risk, they get to keep the higher 6% interest while Singaporeans should only have a lower 3% interest. But from this article, you can see that GIC would most probably be made up fully of our CPF, when including for interest earned confiscated by PAP and not returned. If so, if GIC is only managing our CPF, doesn’t that mean that the fact of the matter is that our CPF would be the one taking on the full risk of the GIC? If so, doesn’t this mean that Singaporeans would actually be the ones taking on the risk of the GIC? Thus no matter what returns are made, shouldn’t all the returns earned by GIC be returned to Singaporeans? Thus is it disingenous for the PAP to claim that they take on the risk of GIC and our CPF, when it is our CPF and Singaporeans who are the ones actually taking on the risk of GIC? Why does PAP want to come in to pretend to be the middleman to “take on the risk”? [h=3]Singaporeans Lose Half of Our What We Could Have Earned on Our CPF to PAP[/h]You see, when PAP makes themselves the middleman, PAP can claim to be managing our CPF and because they then make it sound so dangerous, they can then say that they will then take on the risk, give us low interest and they will be our saviour by doing so, but then whatever additional returns earned, they will keep. Easy right? Here’s an example. Let’s say you invest $1,000 on your own at 6% every year. In 13 year’s time, you will be able to get back $2,000. Then let’s say I come in, I tell you why don’t you give me your $1,000, and by the way, it is a very dangerous world outside, if you handle your own money, you will lose it. Let me take your money, let me take on the “risk”, let me invest it for you. But because I take on the risk, I will give you only 3%. Whatever else I earn, I keep. Then after 13 years, I earn 6% and $1,000. But I only give you back $500. I take your money and earn another $500.

You see, you could have earned $1,000. But I make you scared and tell you all sorts of fearful stories, then I take your money and give you only $500, while I take $500 for myself. Not bad right, do nothing and get $500 for free? Now, if Singaporeans cannot retire today, can you see why? Whatever you could have earned, PAP have already taken half away from you. Now, this is not yet even including how much they had purposely increased the prices of flats, so that they make you lose even more of your CPF to pay for housing loans. Now, do you see why Singaporeans cannot save enough inside our CPF? The PAP has never meant for you to save because they already have a plan to take your money away – half of it from CPF and more from HDB. [h=3]PAP Makes Themselves the Middleman to Earn From Singaporeans’ CPF[/h]But not only that – then why create GIC? If you are going to just use all my CPF to earn my money, then why not just use the CPF Board to do it? Now, same example as above, let’s say you want to invest your $1,000, you put it in Bank ABC and earn $1,000. Then I say, why not I invest your money for you? But I won’t use Bank ABC. I will tell you, you put your $1,000 in Bank ABC, then I transfer it into Bank XYZ. Now, with Bank XYZ, even though the only money I am using is your money, I make it a private bank and tell you I cannot let you know what is happening inside. Then I tell you, by the way, at Bank XYZ, I also mixed up your $1,000 with other money. Actually there is no other money, or there might be just a little bit, maybe $10, $20 or $50, but your $1,000 is still the main source of money I have in Bank XYZ. But I tell you I mixed it up anyway. Then I tell you because your $1,000 is only one small component, I can give you back only $500 back. Meanwhile, I tell you I can earn another $500 because of all these other mixed-up money I have. Not because of your $1,000, ok? It’s all so dangerous and I took all the risk, so I could earn the $500 all because of the risk I took. But actually, truth is, it is all from your money. It is all your money.

You see what Bank XYZ was used for? So that you will not be able to know what is happening inside and I can take your money to do whatever I want with it, I make it such that I don’t have to tell you and you cannot do anything about it. But can I use Bank ABC to do the same? If I use Bank ABC, then I would have to let you know how much you are earning and have to give you back 6%. In Bank XYZ, I only need to give you back 3% and I can keep the other 3%. You see what they are doing here to your money? [h=3]Do You Think You Should Be Earning 6% on Your CPF and Should CPF Board Take Back Your CPF from GIC to Manage Transparently?[/h]If what GIC is managing is fully your CPF monies and GIC is earning 6%, would you do you think you should still earn the 3% on your CPF or should you be earning the full 6% on your CPF? And if your CPF is is being routed into GIC to be managed but it could be all your CPF anyway and done so secretly somemore, would you rather take it back to the CPF Board and get the CPF Board to manage it with full transparency and accountability?

[h=3]PAP is Using Singaporeans’ CPF as Very Cheap Money for Themselves[/h]Now, do you know why PAP keeps being so resistant to let Singaporeans put our CPF in private pension fund plans? If they let you do so, where will they get your money to put in GIC? How will they be able to earn? In fact, there is already a “private pension fund” – it is the GIC, just that your money is not being returned. Thus our CPF is very cheap money for the PAP. In his analysis of Singapore’s CPF system, Dr. Richard Wong, Director of the Hong Kong Centre for Economic Research, had said that, “It was clear from the very outset that the CPF would make available to government a cheap source of credit for social and economic development.“ The Straits Times also admitted to this in 1983 that, “The CPF … provided a cheap source of finance for the government. The CPF purchases government stocks, and the government loans the money cheaply to the HDB.”

Yet, Ng Eng Hen would deny this in 2007 and said that, “if it was that cheap, we would have a line of suitors waiting for that money. There is none.” Even Lee Hsien Loong also said in 2007, “Some people say…Government wants cheap money to go and make a profit. We do not have to make cheap money. This is not that kind of government.“ [h=3]PAP Does Not Want Singaporeans to Know the Truth About the GIC Because GIC Manages 100% Our CPF?[/h]You see, what is the truth? Why did PAP not want to let Singaporeans know how much assets GIC is managing. Why did PAP not want to let Singaporeans know it is our CPF they are giving GIC to use? If Singaporeans knew that GIC would in all likelihood be managing only our CPF, and if we knew how much GIC is managing, then we will know that of the $260 billion we have inside our CPF, not all is being returned. And we would know how much GIC is swallowing up from Singaporeans – at least another $140 billion? Then, we will know the real reason why Singaporeans cannot retire today and why we cannot save enough inside our CPF. There might be another $140 billion that is not returned~! Then, we will know the complete truth to what PAP is really taking our money to do, what they do not want to return to us, how they took half of our money away and earn for themselves. You know, it is really easy to be the PAP. How else can you take the people’s money, make it your own, make it private and tell them you didn’t take it? And when they find out, tell them that it’s for their own good and you are trying to take on the risk for them. It’s very easy, you know? Just scare the people a bit, make them scared, then make that a valid reason to take their money from them. I don’t know any other get rich quick scheme other than this one that the PAP has devised. It’s devious, scheming, disingenuous and despicable. This is the people’s hard-earned money you are playing around with, for goodness sake! And if Singaporeans cannot retire today, you do not tell them that they did not work hard enough when it was you who took their hard-earned money to take for yourselves and not returned! When people cannot save enough, your first duty and responsibility as a government is to give back to them the money and earnings you took from them, and not to tell them to work longer, so that you can take their money from them! What kind of government is this to take your money and earn for themselves, then blame you for not doing more, then make you work even more, so that they can earn more from you? What kind of crooked-minded government is this that would perverse such hardship onto the people, for their own selfish greed and wants? I have no kind words for the PAP. They have been doing this since the 1980s for 30 years now, and not telling Singaporeans for at least the past 15 years. These past 30 years of manipulating Singaporeans and subjecting Singaporeans to the PAP’s victimisation is disgusting, dishonourable and downright despicable. The PAP has hijacked the Singapore government for their own purposes and hijacked Singaporeans’ CPF for their own wanton and selfish greed. They have also hijacked our labour in exchange for the money that they can earned from us. This is outrageous and disgusting. The PAP is no longer my government. The PAP is no longer our government. #IDoNotTrustPAP Come down to the #ReturnOurCPF 4 protest on 27 September 2014 at 4pm at Hong Lim Park. You can join the Facebook event page here. On 27 September 2014, join us at the Hong Lim Park at 4pm at the #ReturnOurCPF 4 protest. The PAP cannot take our CPF and money to use and come out with a cock-and-bull story about how they do not know how they are using our money. When Singaporeans are not able to retire today, when our wages are depressed and more and more Singaporeans are becoming unemployed and are unable to save, then the PAP has failed Singaporeans and has become a liability to our country. Join us at the next protest as we speak up against the low retirement funds and wages, and the high cost of living in Singapore. You can join the Facebook event page here. Also, my first court case will be held on 18 September 2014, at 10.00am. It will be a full-day hearing.

Roy Ngerng *The writer blogs at http://thehearttruths.com/ <button type="button" data-url="http://forums.delphiforums.com/3in1kopitiam/api/v1/discussions/id/79375/messages/id/8/read.json">View Full Message</button> |

<tbody>

</tbody>