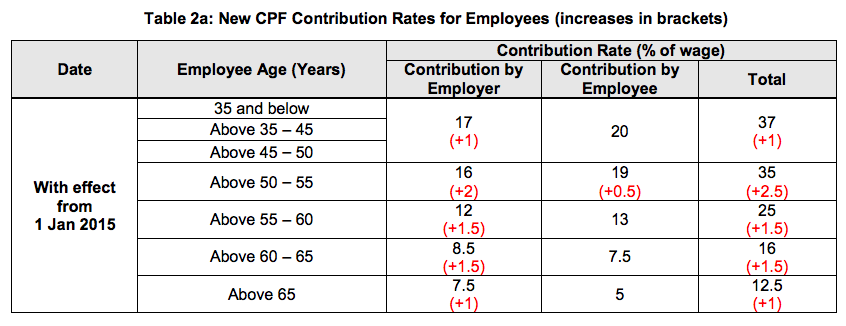

Gahmen (not employer) should pay 17% employer CPF contribution, so that Singaporeans can be hired on EQUAL footing as foreigner PMET in terms of company's affordability to hire...

See letter by a reformed Sinkie ex-HR-manager who now regrets the mistake in his past Evil ways... What previously made economic sense on behalf of his employer (MNC) (more affordable foreigner PMETs) were bought at the high attendant cost of diminished opportunities for Singaporeans and PR, and possibly a disenfranchised and demoralised Singaporean PMET labour force since foreigners are EXCUSED from the employer 17% CPF contribution and Singaporeans are now also discouraged by the ever elusive CPF drawdown age.

(Alternatively, Gahmen can impose a 17% employer levy for employing foreigner PMETs, to equate the 17% employer CPF payable when Singaporean/PR are hired.

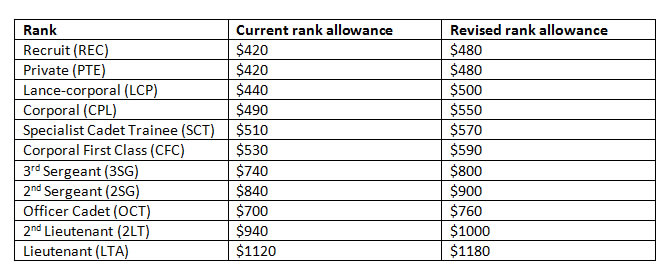

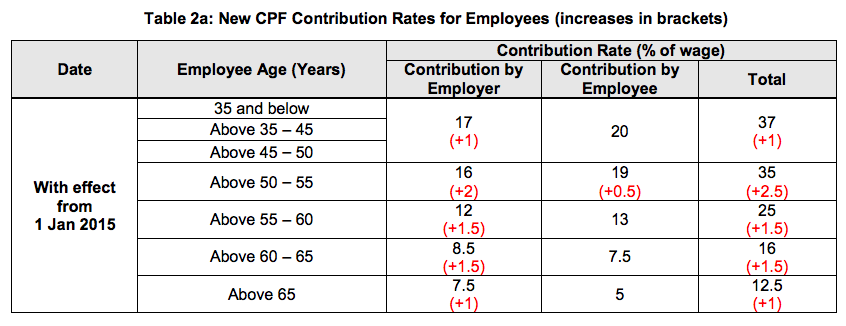

(Pict source(CPF rates, current and after 1.1.2015))

(Pict source(CPF rates, current and after 1.1.2015))

Not happy with Gahmen paying/ absorbing the 17% employer CPF? Then please convince me that the current practise of unemployed Singaporean PMETs becoming taxi drivers/ phantom workers to satisfy MOM work permit holder's 'dependency ratio' is any better since phantom work is all about Potemkin work: in as much our economy seems to be built on......

See letter by a reformed Sinkie ex-HR-manager who now regrets the mistake in his past Evil ways... What previously made economic sense on behalf of his employer (MNC) (more affordable foreigner PMETs) were bought at the high attendant cost of diminished opportunities for Singaporeans and PR, and possibly a disenfranchised and demoralised Singaporean PMET labour force since foreigners are EXCUSED from the employer 17% CPF contribution and Singaporeans are now also discouraged by the ever elusive CPF drawdown age.

(Alternatively, Gahmen can impose a 17% employer levy for employing foreigner PMETs, to equate the 17% employer CPF payable when Singaporean/PR are hired.

Not happy with Gahmen paying/ absorbing the 17% employer CPF? Then please convince me that the current practise of unemployed Singaporean PMETs becoming taxi drivers/ phantom workers to satisfy MOM work permit holder's 'dependency ratio' is any better since phantom work is all about Potemkin work: in as much our economy seems to be built on......

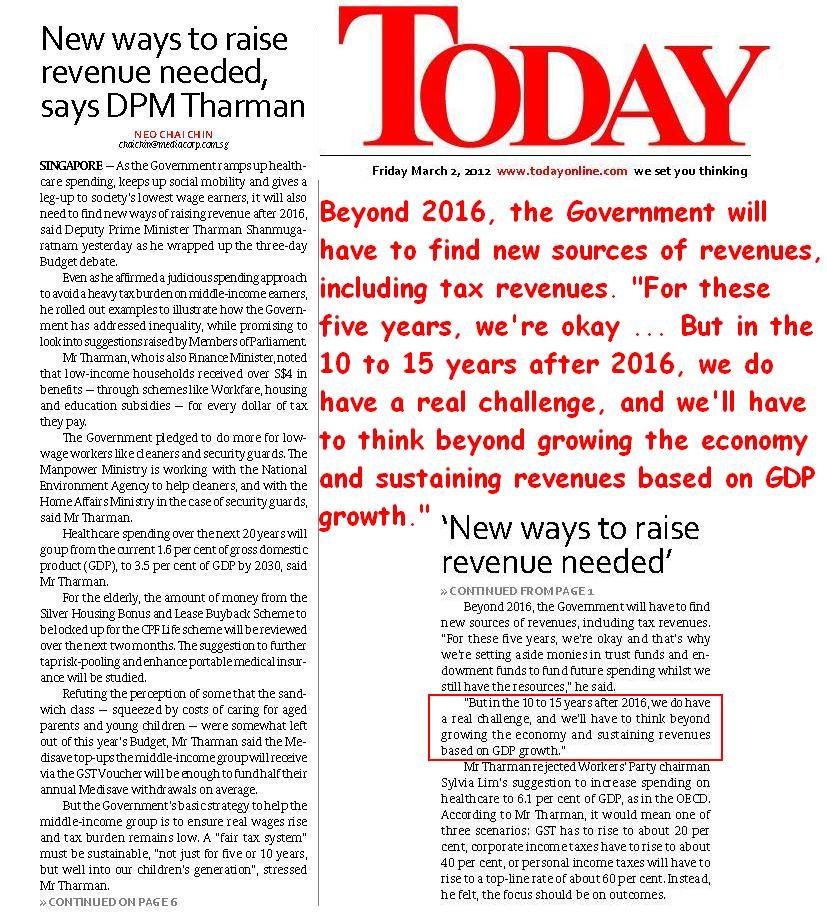

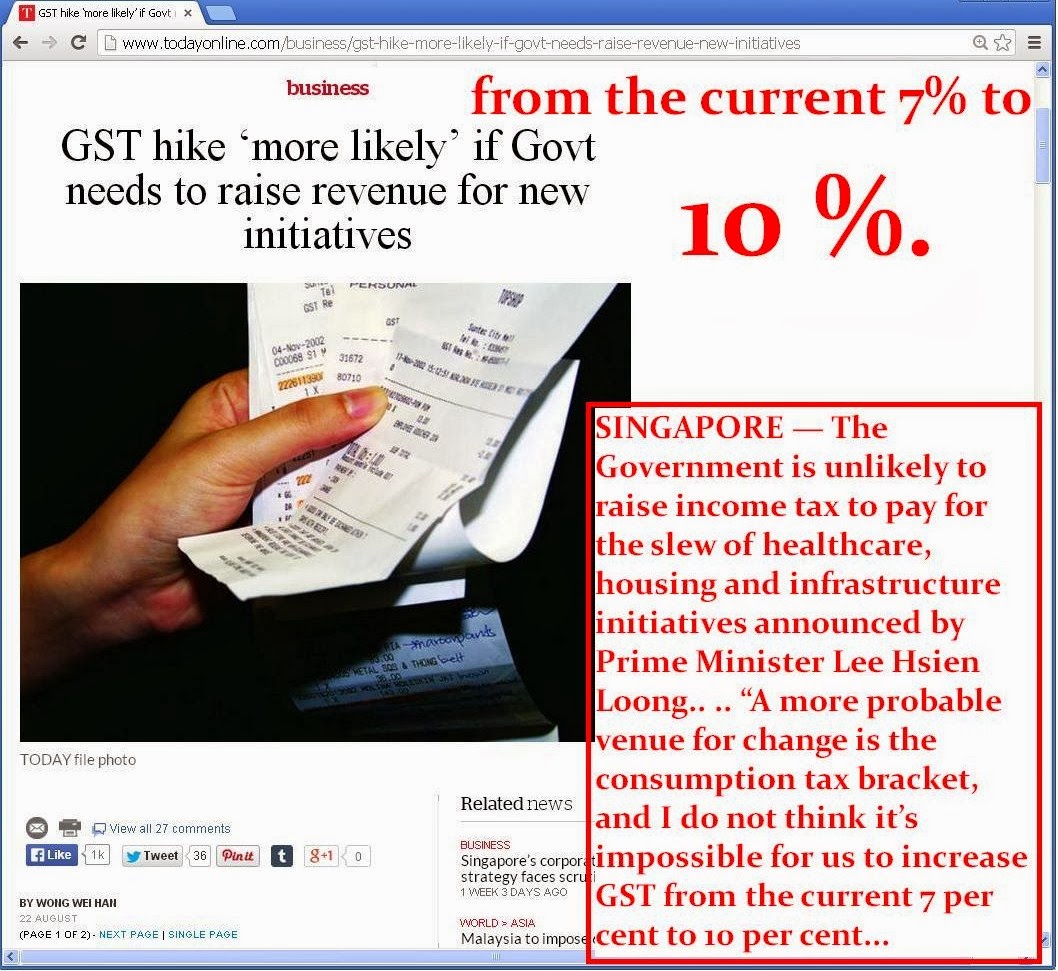

All this HAS TO BE DONE before/if GST is raised to 10%:Local PMEs don't have it easy

Published on May 31, 2014 1:22 AM

I REFER to the report ("MPs want more protection, support for local PMEs"; Tuesday)

When I was the general manager of a local IT company and, subsequently, a financial controller for a Dutch multinational corporation, I preferred hiring foreign mid-level staff for the following reasons:

- The company did not need to pay CPF contributions for them;

- Their salary expectations were lower than Singaporeans'; and

- Their skill sets and experiences were on a par with those of Singaporeans.

The total cost differential between local and foreign professionals, managers and executives (PMEs) was 20 to 40 per cent.

An Asian foreign employee with a degree and work experience can easily afford a city apartment and family sedan in his home country if he makes $200,000 during his stint here.

In Singapore, $200,000 would allow a Singaporean with the same qualifications to buy only a three-room HDB flat in outlying regions like Woodlands or Jurong. A family car would set him back by $120,000.

An Asian foreigner's cost of living back home is so much lower than ours. Hence, he is more willing to work for $3,000 to $5,000 a month. But a Singaporean graduate earning $4,000 a month will be trying to keep up with inflation.

It does not make sense that a foreign PME working here has a bright future, while his Singaporean counterparts are struggling with their living expenses, unless they are in strong sectors like banking and health care, where pay is high.

A levy is imposed when one hires a maid, but there is no such tax for hiring foreign PMEs. No wonder foreign PMEs were replacing local ones at an increasing rate until tighter restrictions were imposed last year.

At the moment, the local PME retrenchment rate is still high as employers are hiring foreigners for the cost savings.

Over the medium to long term, this will weaken Singapore's economy as local PMEs will become structurally unemployed as they lose their skills and employability.

Lim Kay Soon

Local PMEs don't have it easy