Sometimes I really find you 牛皮灯笼加黑漆 - 永运点不明。

You see, the Chinese developers come all the way here, literally 漂洋过海, 劳师动众 for what, obviously to make big money!

If coming here can only make a little money or worse just break even, why bother!

So, can they make big money just selling 20,000 units when their initial intention and calculation were many times higher?

The example you used to compare prices is totally flawed.

First, you use some development on the mainland to compare with some already near completed or near completion.

Secondly, you don't know the current construction prices.

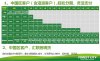

According to most current study, high rise luxurious condos cost RM3,000 to 4,400/sq m to construct, note, just to construct only!

And based on this prices, the profit margin is only 12.5%!

View attachment 30106

See the footnote on all the items exclusive in the cost.

You also forgot that those development you mentioned are all build with the existing infrastructure in place - roads system with street lightings, sewerage system, drainage system, power grids, etc. and all the developer needs to do is to connect to the existing system.

For FC, which is an inclusive development, the developer is responsible to construct and maybe provide complete maintenance too, for most of the infrastructure works instead of just a connection like the others.

So, it is not just the construction cost per unit that you should be looking at, you need to add in other costs too and they are not cheap.

Also, if FC depends on the JKR to construct the roads leading to the island, they may have to wait at least 4 or 5 years later, if lucky enough.

Again, I emphasis on the "leverage and economy of scale" factor.

The developer really need to sell much more than that 20,000 units in order to off set the initial reclamation and infrastructure cost.

Haha finally! You are giving out single piece of evidence to support my point, and prove that you have very poor grasp on conversion rate and fail your basic calculation.

Ok, very simple, previous post ady explained, now explain deeper again.. Cost got variable cost and fix cost, agree? Fix cost can be those road, reclaimed islands, basic infra, advertising fees etc. The more condo you build, those cost rather fixed, unmove or increased marginally.

Variable cost will be those construction price. The more you build each unit, the higher the cost will be. So we can work out our margin accordingly based on construction price and the price we sold for each unit.

*1.Since you are arguing 20K units is not enough. So we use 20K units, and assume all sold out, with certain degree of certainty to get the money after finish construction.

*2. What is the average size to represent those 20K units, so as to simplify our calculation. 1000sqf, fair?

Meanwhile, the condominium units and high-rise coastal residences on Island 1 have already been launched for sale in Singapore, China and Malaysia. Unit sizes range from 753 sq ft to 1,862 sq ft, with prices averaging around RM1,200 psf (S$400 psf). from the article

http://www.propertyguru.com.sg/prop...016/johors-forest-city-given-duty-free-status

Got studio, 1,2,3 bedder room, diff size, average up abit, btw 700-1800 sqf, i choose 1000sqf (more likely to be a 2 bedder), agree?

*3. Price? RM1200 is the latest phase price....we discount a bit for you, so that you wont lose face too badly and blame us using too high selling price.

http://www.freemalaysiatoday.com/ca...1/some-china-forest-city-purchasers-in-limbo/

She paid RM63,500 with her bank card as a 10 per cent down payment on a 59 square metre apartment. from article

-->RM635000 for 100% payment for her 59 sqm apartment. She paid RM 10762 sqm

10.7sqf=1sqm

Has to highlight this, so that can slap your face again when calculating the cost based on the evidence you gave.

Work out, she bought a small apartment at 631 sqf for RM635000----->RM1005 psf (RM 10762 per sqm)...still too high lehh...give you even more discount, I give you selling price RM 800 psf for all 20K units la, fair?

*4 Cost? high rise luxurious condos cost RM3,000 to 4,400/sq m to construct, note, just to construct only!

This is what you gave. Ok la, fair to you, i use RM4400/sqm, cost at the higher end. Convert= RM411 psf.

Now can work out the margin for each sqf/sqm liao? You gave 12.5%

Selling price RM 800 psf, cost RM 411 psf= Each sqm or sqf they sold, their margin is at 48.6%....and please remember, I already lower down my selling price, higher up the cost based on the evidence you gave.

Ok now 20K units, total 1000sqf on average @ RM 411psf on average. =That will be total net earning of RM 8.22B that can be used to pay for the fix cost.... remember last post you said 1.9B for land reclaimation? RM 8B net earning not enough to cover? need to sell until 30K - 40K baru can cover? 20K units sold, doesnt have sufficient economic of scale?

I know, the reason why your 牛皮灯笼加黑漆 - 永运点不明, is because you are not even willing to work out your calculation to prove your point....wait, you did work out 12.5%, bravo!

Ok please try to argue back with calculation, if you agree with me, please thanks me for pointing out that you are wrong, thanks for me to teach you simple calculation. I spend my time to type out the whole thing just simply because you are unwilling to even to use your brain. You actually already giving out evidence that prove my point, yet still giving out a wrong answer, tell me, you got use brain to think ma?