https://www.eenewsanalog.com/news/apple-lose-share-shrinking-smartphone-market

Apple to lose share in shrinking smartphone market

0 Comments

January 15, 2019 //By Peter Clarke

print reddit

The global production of smartphones is going to be 1.41 billion units in 2019, a 3.3 percent fall compared with 2018, according to TrendForce.

A lack of innovation in smartphone features is limiting the desire to replace serviceable phones, the market research firm said. If the demand outlook deteriorates together with concerns over the US-China trade war, the decline in smartphone production may reach 5 percent in 2019.

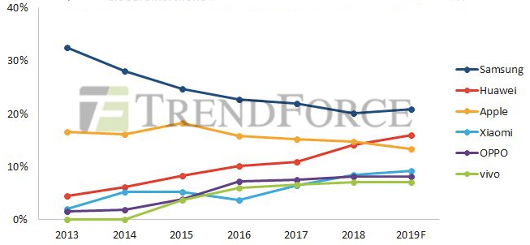

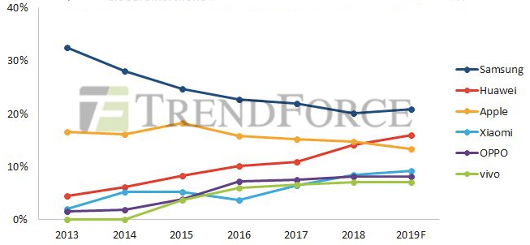

TrendForce predicts that Samsung will remain the market leader in 2019 while Huawei will take second place from Apple.

Top six global smartphone brands by market share 2013 to 2019. Source: TrendForce.

Samsung produced 293 million smartphones in 2018, a year-on-year decline of 8 percent but that it should creep back up in 2019 to maintain a 20 percent share, TrendForce predicts. Chinese brands are gradually gaining market share by pursuing the emerging overseas markets and the low-end of the market.

Huawei’s production volume increased by 30 percent YoY in 2018 to 205 million units in 2018 with success coming through a displacement of Apple in China and forays into overseas markets such as Europe and South America. As China's leading smartphone brand Huawei could be more affected by the US-China trade war.

Apple's 2018 was affected by lower than expected iPhone sales in the second half of the year with a result that Apple's production dropped by 3 percent compared with 2017. Apple was affected by a ban on sale of some iPhone models and high pricing of the new iPhones. Trendforce predicts that Apple's production will decline to 189 million units in 2019 and its market share drop 2 points to 13 percent. If the tension in US-China trade becomes worse this year, Apple’s production volume may decline further.

Xiaomi, Oppo, and Vivo will retain the fourth, fifth and sixth position respectively in the global smartphone brand ranking for 2019, the same as 2018, TrendForce said.

Related links and articles:

www.trendforce.com

https://www.theverge.com/2019/1/3/18166399/iphone-android-apple-samsung-smartphone-sales-peak

Apple and Samsung feel the sting of plateauing smartphones

166 comments

The two biggest phone makers are having to adapt to stalling sales and unstinting competition from China

By Vlad Savov@vladsavov Jan 3, 2019, 8:00am EST

Share

/cdn.vox-cdn.com/uploads/chorus_image/image/62774033/jbareham_180917_2948_0212_02.0.jpg) Photo by James Bareham / The Verge

Photo by James Bareham / The Verge

If there’s one thing we’ve learned from Samsung’s soft sales of the Galaxy S9 through 2018 and Apple’s dramatically reduced forecast of iPhone revenues for the end of that year, it’s that most people who want a great smartphone already have one. In his letter to investors yesterday, Apple CEO Tim Cook spelled out the reasons why his company sold (many) fewer iPhones than it had anticipated in the final quarter of 2018, and a large chunk of them can be summed up as “too many good phones already out there.” This statement from the boss of the iPhone company is merely the crowning punctuation to a market stagnation that’s been apparent to phone makers for well over a year.

Smartphones, the iPhone especially, have been on a constant growth trajectory for so long that we’ve come to expect them to keep perpetually expanding as a category. But, just as desktop PCs eventually reached a saturation point where almost every home that could afford a computer had a decent one, smartphone shipments had to eventually hit a level at which demand for them tapered off. That point was reached sometime over the past couple of years, driven by three major long-term factors: the shrinking benefit when upgrading from a recent phone to the latest model, the increasing average price of new devices, and the concordant reluctance to treat smartphones as things to be disposed of every year or two.

Phone innovation has hit a plateau — one of great quality and maturity in most aspects of performance and design — and until we get another groundbreaking, must-have upgrade, we’re set to watch a smartphone market without meaningful additional growth. Prior to 2018, there were successive waves of major upgrades worth having: from 4G and the annual increase in display size and battery efficiency to the additions of secondary zoom cameras, biometric ID systems, wireless charging, and waterproofing. But now that all the keenest upgraders have the full set of discrete features on their devices, research is showing that people are holding on to their phones longer simply because they’re mostly satisfied with what they already have.

The two premium brands, Apple and Samsung, have tried to offset the reduction in units sold each year by raising the price per device, but that’s only compounded their problem. Yes, Apple can sell a $1,000-plus iPhone. However, the owner of that iPhone will be far less likely to rush to replace it the way someone who’d previously spent a fraction of that price might have done. Cook said that cheap iPhone battery replacements in 2018 played into a tendency toward refurbishing existing phones rather than buying new ones.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13664770/bohnzone01.jpg) Photo by Vjeran Pavic / The Verge

Photo by Vjeran Pavic / The Verge

The phone business is still growing in complexity, if not in sales numbers

The greatest innovation in the mobile world during the past year was Google’s Night Sight camera mode. A piece of software. Google distributed Night Sight as an update to every Google Pixel model, effectively diluting the most compelling reason to buy a new phone. This is a trend that looks to be just getting started: the smartphone user experience growing better through software improvements in bigger steps than through hardware augmentations. Apple’s gesture-based interface on the iPhone X is another example where the new software design was more instrumental to the sense of an upgrade than the hardware updates.

After all, there’s a limit to how color-accurate a Samsung OLED display can get, or how many modules of RAM a chipmaker can stack inside of a phone. But, as Google has shown, those physical limitations don’t constrain the possibilities of what can be done with the smart application of machine learning and computation.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13316207/akrales_181022_3014_0003_02.jpg) Photo by Amelia Holowaty Krales / The Verge

Photo by Amelia Holowaty Krales / The Verge

As the world’s biggest smartphone market, China is singled out for special attention in Cook’s investor letter. He argues that China’s broader economic slowdown is to blame for Apple’s underperformance, and there’s certainly an element of truth to that. The original iPhone was released in 2007, and after the financial market maelstrom of 2008, Apple and its competitors have been selling their devices into a world economy that’s been getting progressively better. So their performance until now has been buoyed by macroeconomic growth, just as it’s now suffering from the effects of changing market conditions in China.

Competition and efforts at radical differentiation are only going to increase

But Samsung and Apple have deeper issues in China than just the overall market. Both global companies are struggling to establish themselves as the dominant players that they are in other countries. WeChat is effectively the operating system in China, so Apple’s iOS and App Store lock-in isn’t a thing, whereas Samsung’s generally being outpaced at its own spec race by nimbler local rivals.

The Chinese consumer is well-served by companies like Huawei, Oppo, and Vivo, each of which delivers a great deal of spec-laden value for a shopper’s yuan. As China’s appetite for the very latest smartphone also diminishes, those same companies are transitioning into India, the last remaining bastion of rapid smartphone sales growth, and retreading their strategy of garnering market share through aggressive pricing.

It’s fascinating to observe how, even as the overall smartphone market has been in gentle decline for a couple of years, the share of it held by each company and the geographies dominated by various brands keep shifting and changing. Within the span of the past decade, we’ve witnessed Nokia and BlackBerry supplanted by Apple and Samsung, and now we’re watching the likes of Huawei and Xiaomi ascending to offer a fresh challenge. Competition is likely to only intensify in the coming years as every manufacturer competes for a slice of a finite pie.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/12058301/akrales_180814_2817_0380.jpg) Photo by Amelia Holowaty Krales / The Verge

Photo by Amelia Holowaty Krales / The Verge

As to what might bring smartphone sales back to growth, Qualcomm would tell you 5G will trigger a new wave of upgrades, IDC anticipates Latin America and Africa showing greater demand, and Samsung, Huawei, and others are working on zany foldable devices. Every avenue for hardware differentiation and leadership will be explored, which, from a consumer’s perspective, bodes well for a future of devices that are at the very least more interesting than the current crop we have today.

Smartphone markets are slowing down in large part because they’ve served their purpose. We wanted phones with great displays, fast connectivity, all-day battery life, and a few extra luxuries thrown in, and now we’ve got them in abundance. The system works. When the next truly compelling upgrade shows up on the horizon, consumers will once again throw money at the latest and greatest products. But until then, all this competition makes for a bumpy ride for any company venturous enough to be in the phone-selling business, including those at the very top.

https://www.theinquirer.net/inquire...artphone-sales-suffered-a-sharp-decline-in-q4

iPhone, Samsung smartphone sales suffered a sharp decline in Q4

To the benefit of Chinese upstarts, claims Gartner

iPhone sales fell 11 per cent in Q4

APPLE AND SAMSUNG both suffered a sharp decline in smartphone sales in the fourth quarter as they face growing competition from Chinese upstarts.

That's according to analyst outfit Gartner, at least. The firm's latest figures show that Samsung saw its global market share shrink from 20.9 per cent to 19 per cent globally as its sales dipped 9 per cent year-on-year. Apple suffered a similar setback; it saw its slice of the pie shrink from 14 per cent to 13.4 per cent, with iPhone sales seeing an 11 per cent year-over-year slump.

While bad news for the two market leaders, this decline appears to have benefited Chinse OEMs. Echoing a recent report out of Canalys, Gartner's stats show that Huawei and Oppo saw their market share climb; Huawei from 10.8 to 14. per cent and Oppo from 6.3 to 7.7 per cent. Xiaomi lost one percentage point but still managed to claim 6.8 per cent of global smartphone sales in the quarter.

This growth of Chinese upstarts has been credited for Apple and Samsung's respective declines, with Anshul Gupta, senior research director at Gartner, noting that both brands face growing competitions from reasonably-priced Chinese brands.

"Although Samsung is strengthening its smartphone offering at the mid-tier, it continues to face growing competition from Chinese brands that are expanding into more markets," Gupta said.

"Apple has to deal not only with buyers delaying upgrades as they wait for more innovative smartphones, but it also continues to face compelling high-price and midprice smartphone alternatives from Chinese vendors. Both these challenges limit Apple's unit sales growth prospects."

Looking at the global market as a whole, Gartner says that smartphone sales to end users stalled in the fourth quarter of 2018 with total sales 408.4 million units - growth of just 0.1 per cent year-on-year. µ

https://tech.sina.com.cn/i/2019-06-16/doc-ihvhiews9170332.shtml

三星手机逐渐暗淡 在华最后手机厂继续裁员

2019年06月16日 07:40 经济观察报

三星手机逐渐暗淡,在华最后手机厂继续裁员

于惠如

2019年6月,三星未迎来原本推迟上市的折叠屏手机GalaxyFold上市,却迎来了三星在华最后一家手机厂——惠州三星电子有限公司(以下简称“惠州三星”)裁员的消息。“由于中国市场形势严峻、竞争加剧,我们正在调整三星电子惠州工厂的产量。”三星在近期的一份声明中表示。该份声明并未提供任何细节。

不仅是裁员,此前更有消息称惠州工厂最快在今年9月份关闭。对此消息,三星公开对外表示,尚未决定是否关闭三星惠州工厂。

经济观察报记者从一名惠州三星内部人士处获知,此次裁员自愿报名,涉及岗位包括管理岗位等间接部门以及一线生产岗位,裁员规模大约数百人。

一位接近三星的人士提供给经济观察报记者的一份数据清单显示,在5月至7月的生产计划中,惠州三星工厂的量产、社内主要成品生产线、所需人力均在减少。其中,社内MAINLINE成品生产线计划为:5月21条,6月13条,7月11条。截至4月底,惠州三星工厂人力为4087人。5月至7月计划所需人力为:3708人、2717人、2461人,富余人力分别为:379人,1370人、1626人。

此外,惠州三星在该份材料中表示:“间接部门严重超编,生产性中偏下,公司竞争力几乎没有了。”

业内分析人士认为,过去中国人工工资低、智能手机市场大,三星在中国设立手机厂占有优势,但随着成本承压、竞争加剧、国产手机崛起,上述优势已经不复存在,三星手机工厂在中国存在的理由越来越小。

截至发稿前,三星并未就经济观察报惠州工厂裁员的原因、在华投资战略转变等问题给出明确的回复。

“这次赔偿还是很人性化的”

位于惠州市惠城区陈江镇的惠州三星工厂成立于1992年,1993年正式投产,是三星在中国的主要生产基地。自去年三星位于天津的工厂关闭之后,惠州三星工厂成为三星在中国的最后一个手机生产工厂。

与其它位于工业园区的手机制造厂不同,惠州三星工厂周边拥有成熟的生活配套区,生活气息更浓厚。6月12日中午时分,身穿浅色工衣的三星员工三五成群从侧门走出,到对面超市外面的休息凳上休息闲聊。

从厂区外围看,惠州三星工厂与过去往常别无二致。货运物流车时不时进出,员工进出都要经过层层严格的安检通道,厂区周围停靠着十余辆标有“SAMSUNG”的大巴车,内部员工告诉经济观察报记者,这是三星接送员工上下班回惠州市区的班车。

唯一与该工厂正在经历较大规模裁员的相关信息或许是公告栏上一则2月28日人事部贴出的的公告:2019年3月1日起本公司招聘暂停运营,向后请留意本公司招聘公告信息,不便之处,敬请谅解。

惠州三星内部中层员工沈文彦告诉经济观察报记者,在正式公布裁员之前,员工就已经知道了工厂要裁员的消息。只不过,在今年5月底召开的第二季度经营说明会上,总经理才正式告知员工该消息。“这不是惠州三星工厂的第一次裁员,从去年开始就有N+1裁员方案,只不过前两次都是管理岗位等间接部门的裁员,涉及的人员少,大约都在20人左右。”沈文彦介绍说,与过往补偿方案不同,此次裁员,惠州三星的补偿方案为:“N+3+工龄奖+择业期工资(择业期工资为最多两个月工资)”。“这次赔偿还是很人性化的,在签了离职协议找工作的期间还能拿到工资。”沈文彦说,由于此次赔偿金较高,已经有员工选择自愿离职。

在上述接近三星的人士提供给经济观察报记者的数据清单中,三星提到,为了应对5月至7月的生产计划以及间接部门严重超编、公司竞争力低等问题,人事部门采取的对策包括:各部门严格控制加班,N+1人力效率化常态化进行等。

原因还是市场占有率缩水

三星在中国曾拥有两家手机制造工厂,位于天津的手机工厂已于2018年最后一天正式关闭。

对于三星接连对南北两大手机工厂“动刀”,分析人士认为主要是因为三星手机在中国的市场占有率大幅缩水,在中国手机生产成本优势下降等原因。

2013年是三星手机在中国发展的鼎盛时期,自然也是惠州三星工厂最忙的时期。“当时本就是智能手机热销的时候,也是三星在中国市场上最受欢迎的时候。但惠州三星是外企,对于工作时长有严格的规定,面对巨量订单只有扩招,当时扩招了很多人。”沈文彦说。

公开数据显示,2013年三星手机在中国市场占有率为20%。短短5年时间,该数据已经下降到0.8%。市场调研机构IDC数据显示,2018年,三星手机在中国市场的销量为334万部,市场占有率为0.8%。“三星手机在中国的市场占有率从最辉煌时期的20%降到现在不到1%。随着国产手机的崛起,人工成本越来越高,三星手机生产工厂在中国存在的理由已经越来越小了。”第一手机界研究院院长孙燕彪认为,三星手机需要中国这个市场,但没必要需要中国的生产厂,因而将手机生产厂搬迁生产厂至成本更低的地方,保留更具高科技的部门或许是大势所趋。

2014年以后,三星的中低端手机受到国产手机品牌冲击,市场份额大幅下滑。2016年的GalaxyNote7电池爆炸事件又让三星承受一重创。“电池爆炸事件以后,我们厂的订单量明显少了。”沈文彦说。

三星电子最新财报数据显示,2019年第一季,三星电子实现营收52.39万亿韩元,手机仅为三星贡献了25.92万亿韩元的营收,同比下降6%。一季度三星智能手机出货量为7800万部。

三星高管在财报会上称,整体智能手机市场正在萎缩,中低端市场的竞争加剧,导致三星手机整体销量承压。为了适应市场需求,三星中低端手机产品的生产线正在经历重组,相关的营销调整也增加支出,因此该季度业务的盈利能力下降。

国内ODM工厂承接

与国内工厂相继关停、裁员相比,为应对中国劳动力成本的上升,三星在过去十年逐渐将智能手机的生产从中国迁至越南、印度。业内分析师预测,贸易摩擦将加速这一转移。

公开信息显示,自2009年起,三星就在越南建造生产基地,生产基地于2015年正式投产。目前,三星在越南各地亦设立了8个生产基地,主要生产手机与电子零件等。

此外,去年三星在印度扩建了全球最大的智能手机工厂,扩建完成后,三星新工厂等产量预计将增加一倍,达到近1.2亿部。今年5月,三星集团电子部门计划在印度投资250亿卢比(约合3.6035亿美元)用于智能手机生产线,这笔投资预计将落地于印度的诺伊达邦。

沈文彦告诉经济观察报记者,目前三星40%的智能手机已交由国内ODM厂商代工,这其中就包括惠州海格科技股份有限公司。

根据2018年手机产业ODM白皮书数据统计,由于中国手机厂商的冲击导致出货下滑,三星、Nokia和LG等手机厂商均大幅增加委外ODM项目,籍以优化成本及研发资源、提升其产品的竞争力,开放项目与ODM公司进行合作。预计三星、LG和Nokia2019年委外ODM项目整体出货将达到4000万部。

在孙燕彪看来,三星继续保留中国工厂的必要性不大,ODM模式的优点是能通过降低生产成本来确保价格竞争力,委外ODM项目在一定程度上可以降低成本压力。

Samsung mobile phone gradually dimmed

June 16, 2019 07:40 Economic Observer

Samsung mobile phone is gradually dimmed, and the final mobile phone factory in China continues to lay off employees

Yu Huiru

In June 2019, Samsung did not welcome the Galaxy Fold, a folding screen mobile phone that was delayed in listing, but ushered in the layoffs of Samsung’s last mobile phone factory in China, Huizhou Samsung Electronics Co., Ltd. (hereinafter referred to as “Huizhou Samsung”). “As the Chinese market is in a tough situation and competition is intensifying, we are adjusting the output of the Samsung Electronics Huizhou plant,” Samsung said in a recent statement. The statement did not provide any details.

Not only layoffs, but there have been more reports that the Huizhou factory was closed in September this year. In response to this news, Samsung publicly stated that it has not yet decided whether to close the Samsung Huizhou factory.

The Economic Observer reporter learned from a Huizhou Samsung insider that the layoffs were voluntarily registered, involving indirect departments such as management positions and first-line production positions, and the number of layoffs was about several hundred.

A data list provided by a person close to Samsung to the Economic Observer reporter showed that in the production plan from May to July, the mass production of the Huizhou Samsung plant, the production line of the main finished products in the company, and the manpower required were all reduced. Among them, the MAINLINE finished product line plan is: May 21, June 13 and July 11. As of the end of April, the Huizhou Samsung factory had a manpower of 4,087. The manpower required for the plan from May to July is 3,708, 2,716 and 2,461, with a surplus of 379, 1,370 and 1,626.

In addition, Huizhou Samsung said in the material: "The indirect department is seriously over-compiled, and the productivity is low, and the company's competitiveness is almost gone."

Industry analysts believe that in the past, China's low labor wages and smart phone market, Samsung has an advantage in setting up a mobile phone factory in China, but with the pressure of cost, increased competition, and the rise of domestic mobile phones, these advantages no longer exist, Samsung mobile phone factory The reasons for the existence of China are getting smaller and smaller.

As of press time, Samsung did not give a clear response to the reasons for the layoffs of the Huizhou factory in the economic observation report and the strategic shift in investment in China.

"This compensation is still very human."

The Huizhou Samsung Factory, located in Chenjiang Town, Huicheng District, Huizhou City, was established in 1992 and officially put into production in 1993. It is Samsung's main production base in China. Since the closure of Samsung's factory in Tianjin last year, the Huizhou Samsung plant has become Samsung's last mobile phone production plant in China.

Unlike other mobile phone manufacturers located in industrial parks, Huizhou Samsung Factory has a mature living area around it, and its life is more intense. At noon on June 12, Samsung employees wearing light-colored work clothes came out from the side door in groups of three and five, and went to rest on the rest bench outside the supermarket.

From the outside of the factory, the Huizhou Samsung factory is no different from the past. Freight logistics vehicles come in and out from time to time. Employees must go through a series of strict security inspection channels. There are more than ten buses marked "SAMSUNG" around the factory. The internal staff told the Economic Observer that this is Samsung's pick-up and return to work. Shuttle bus from Huizhou City.

The only information related to the large-scale layoffs of the factory may be a notice posted on the bulletin board by the Personnel Department on February 28th: the company's recruitment is suspended from March 1, 2019. Please pay attention to this later. Company recruitment notice information, please understand that the inconvenience.

Shen Wenyan, a middle-level employee of Huizhou Samsung, told the Economic Observer that before the official announcement of layoffs, employees already knew the news of the factory's layoffs. However, at the second quarter business briefing held at the end of May this year, the general manager officially informed the staff of the news. "This is not the first layoff of the Huizhou Samsung factory. Since last year, there have been N+1 layoffs, but the first two are layoffs in indirect departments such as management positions. The number of people involved is small, about 20 people. Shen Wenyan said that unlike the previous compensation scheme, Huizhou Samsung’s compensation plan for this layoff is: “N+3+ working age award+employment period salary (career period salary is up to two months salary)”. "This compensation is still very humane. I can get the salary during the period of signing the separation agreement to find a job." Shen Wenyan said that due to the higher compensation, some employees have chosen to voluntarily leave.

In the list of data provided by the people close to Samsung to the Economic Observer, Samsung mentioned that in response to the production plan from May to July and the serious over-compilation of the indirect department and the low competitiveness of the company, the personnel department’s countermeasures include : All departments strictly control overtime, and N+1 humanization efficiency is normalized.

The reason is that the market share has shrunk

Samsung has two mobile phone manufacturing plants in China, and the mobile phone factory in Tianjin was officially closed on the last day of 2018.

For Samsung to successively attack the two major mobile phone factories in North and South, analysts believe that the main reason is that Samsung's mobile phone market share in China has shrunk dramatically, and the cost advantage of mobile phone production in China has declined.

2013 is the heyday of Samsung mobile phone development in China, and naturally it is also the busiest period of Huizhou Samsung factory. "At the time, this was the time when smartphones were selling well, and it was also the most popular time for Samsung in the Chinese market. But Huizhou Samsung is a foreign company, and it has strict regulations on the length of work. In the face of huge orders, there are only expansion plans. At that time, many people were enrolled. "Shen Wenyan said.

According to public data, in 2013, Samsung's mobile phone market share in China was 20%. In just 5 years, the data has dropped to 0.8%. Market research firm IDC data shows that in 2018, Samsung mobile phone sales in the Chinese market was 3.34 million, with a market share of 0.8%. “The market share of Samsung mobile phones in China has dropped from 20% in the most brilliant period to less than 1% now. With the rise of domestic mobile phones, the labor costs are getting higher and higher, and the reasons for the existence of Samsung mobile phone production plants in China have come. The smaller the size.” Sun Yanxi, the president of the First Mobile Phone Research Institute, believes that Samsung mobile phones need China’s market, but there is no need for a Chinese production plant. Therefore, the mobile phone production plant will be relocated to a lower cost place, and more The high-tech sector may be the general trend.

After 2014, Samsung's low-end and mid-range mobile phones were hit by domestic mobile phone brands, and its market share dropped sharply. The 2016 Galaxy Note7 battery explosion caused Samsung to suffer a heavy blow. "After the battery explosion, the order quantity of our factory was significantly less." Shen Wenyan said.

Samsung Electronics' latest financial report data shows that in the first quarter of 2019, Samsung Electronics achieved revenue of 52.39 trillion won, and mobile phones contributed only 25.92 trillion won to Samsung, down 6% year-on-year. Samsung smartphone shipments in the first quarter were 78 million units.

Samsung executives said at the earnings conference that the overall smartphone market is shrinking and competition in the low-end market is intensifying, leading to pressure on Samsung's overall sales. In order to meet the market demand, the production line of Samsung's low-end mobile phone products is undergoing restructuring, and related marketing adjustments also increase spending, so the profitability of the business in the quarter declined.

Domestic ODM factory undertakes

In response to the rise in labor costs in China, Samsung has gradually moved its smartphone production from China to Vietnam and India over the past decade. Industry analysts predict that trade frictions will accelerate this shift.

Public information shows that since 2009, Samsung has built a production base in Vietnam, and the production base was officially put into operation in 2015. At present, Samsung has set up 8 production bases throughout Vietnam, mainly producing mobile phones and electronic components.

In addition, Samsung expanded its largest smartphone factory in the world last year. After the expansion, production at Samsung's new plant is expected to double to nearly 120 million units. In May of this year, Samsung Electronics Group plans to invest 25 billion rupees (about 366.35 million US dollars) in India for smartphone production lines. The investment is expected to land in Noida, India.

Shen Wenyan told the Economic Observer that 40% of Samsung's smartphones have been handed over to domestic ODMs, including Huizhou Hager Technology Co., Ltd.

According to the statistics of the mobile phone industry ODM white paper in 2018, due to the impact of the impact of Chinese mobile phone manufacturers, shipments of Samsung, Nokia and LG have significantly increased the number of outsourcing ODM projects, in order to optimize costs and R&D resources and enhance competition for their products. Force, open projects and ODM companies to cooperate. It is expected that Samsung, LG and Nokia will have 40 million outsourcing of ODM projects in 2019.

In Sun Yanxi's view, Samsung's necessity to keep the Chinese factory is small. The advantage of the ODM model is that it can ensure price competitiveness by reducing production costs. The outsourcing ODM project can reduce the cost pressure to a certain extent.

Apple to lose share in shrinking smartphone market

0 Comments

January 15, 2019 //By Peter Clarke

print reddit

The global production of smartphones is going to be 1.41 billion units in 2019, a 3.3 percent fall compared with 2018, according to TrendForce.

A lack of innovation in smartphone features is limiting the desire to replace serviceable phones, the market research firm said. If the demand outlook deteriorates together with concerns over the US-China trade war, the decline in smartphone production may reach 5 percent in 2019.

TrendForce predicts that Samsung will remain the market leader in 2019 while Huawei will take second place from Apple.

Top six global smartphone brands by market share 2013 to 2019. Source: TrendForce.

Samsung produced 293 million smartphones in 2018, a year-on-year decline of 8 percent but that it should creep back up in 2019 to maintain a 20 percent share, TrendForce predicts. Chinese brands are gradually gaining market share by pursuing the emerging overseas markets and the low-end of the market.

Huawei’s production volume increased by 30 percent YoY in 2018 to 205 million units in 2018 with success coming through a displacement of Apple in China and forays into overseas markets such as Europe and South America. As China's leading smartphone brand Huawei could be more affected by the US-China trade war.

Apple's 2018 was affected by lower than expected iPhone sales in the second half of the year with a result that Apple's production dropped by 3 percent compared with 2017. Apple was affected by a ban on sale of some iPhone models and high pricing of the new iPhones. Trendforce predicts that Apple's production will decline to 189 million units in 2019 and its market share drop 2 points to 13 percent. If the tension in US-China trade becomes worse this year, Apple’s production volume may decline further.

Xiaomi, Oppo, and Vivo will retain the fourth, fifth and sixth position respectively in the global smartphone brand ranking for 2019, the same as 2018, TrendForce said.

Related links and articles:

www.trendforce.com

https://www.theverge.com/2019/1/3/18166399/iphone-android-apple-samsung-smartphone-sales-peak

Apple and Samsung feel the sting of plateauing smartphones

166 comments

The two biggest phone makers are having to adapt to stalling sales and unstinting competition from China

By Vlad Savov@vladsavov Jan 3, 2019, 8:00am EST

Share

/cdn.vox-cdn.com/uploads/chorus_image/image/62774033/jbareham_180917_2948_0212_02.0.jpg)

If there’s one thing we’ve learned from Samsung’s soft sales of the Galaxy S9 through 2018 and Apple’s dramatically reduced forecast of iPhone revenues for the end of that year, it’s that most people who want a great smartphone already have one. In his letter to investors yesterday, Apple CEO Tim Cook spelled out the reasons why his company sold (many) fewer iPhones than it had anticipated in the final quarter of 2018, and a large chunk of them can be summed up as “too many good phones already out there.” This statement from the boss of the iPhone company is merely the crowning punctuation to a market stagnation that’s been apparent to phone makers for well over a year.

Smartphones, the iPhone especially, have been on a constant growth trajectory for so long that we’ve come to expect them to keep perpetually expanding as a category. But, just as desktop PCs eventually reached a saturation point where almost every home that could afford a computer had a decent one, smartphone shipments had to eventually hit a level at which demand for them tapered off. That point was reached sometime over the past couple of years, driven by three major long-term factors: the shrinking benefit when upgrading from a recent phone to the latest model, the increasing average price of new devices, and the concordant reluctance to treat smartphones as things to be disposed of every year or two.

This was the first year in five that I didn’t upgrade my iPhone. Two reasons:

- iPhone X was really, really good, and battery life is still great

- The 2018 models were functionally identical to the iPhone X

So: not just China

https://t.co/e2dB1PfLTu

— Casey Newton (@CaseyNewton) January 2, 2019

In July, the market analysts at IDC said “the combination of market saturation, increased smartphone penetration rates, and climbing [average selling prices] continue to dampen the growth of the overall market. Consumers remain willing to pay more for premium offerings in numerous markets and they now expect their device to outlast and outperform previous generations of that device which cost considerably less a few years ago.”- iPhone X was really, really good, and battery life is still great

- The 2018 models were functionally identical to the iPhone X

So: not just China

https://t.co/e2dB1PfLTu

— Casey Newton (@CaseyNewton) January 2, 2019

Phone innovation has hit a plateau — one of great quality and maturity in most aspects of performance and design — and until we get another groundbreaking, must-have upgrade, we’re set to watch a smartphone market without meaningful additional growth. Prior to 2018, there were successive waves of major upgrades worth having: from 4G and the annual increase in display size and battery efficiency to the additions of secondary zoom cameras, biometric ID systems, wireless charging, and waterproofing. But now that all the keenest upgraders have the full set of discrete features on their devices, research is showing that people are holding on to their phones longer simply because they’re mostly satisfied with what they already have.

The two premium brands, Apple and Samsung, have tried to offset the reduction in units sold each year by raising the price per device, but that’s only compounded their problem. Yes, Apple can sell a $1,000-plus iPhone. However, the owner of that iPhone will be far less likely to rush to replace it the way someone who’d previously spent a fraction of that price might have done. Cook said that cheap iPhone battery replacements in 2018 played into a tendency toward refurbishing existing phones rather than buying new ones.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13664770/bohnzone01.jpg)

The phone business is still growing in complexity, if not in sales numbers

The greatest innovation in the mobile world during the past year was Google’s Night Sight camera mode. A piece of software. Google distributed Night Sight as an update to every Google Pixel model, effectively diluting the most compelling reason to buy a new phone. This is a trend that looks to be just getting started: the smartphone user experience growing better through software improvements in bigger steps than through hardware augmentations. Apple’s gesture-based interface on the iPhone X is another example where the new software design was more instrumental to the sense of an upgrade than the hardware updates.

After all, there’s a limit to how color-accurate a Samsung OLED display can get, or how many modules of RAM a chipmaker can stack inside of a phone. But, as Google has shown, those physical limitations don’t constrain the possibilities of what can be done with the smart application of machine learning and computation.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/13316207/akrales_181022_3014_0003_02.jpg)

As the world’s biggest smartphone market, China is singled out for special attention in Cook’s investor letter. He argues that China’s broader economic slowdown is to blame for Apple’s underperformance, and there’s certainly an element of truth to that. The original iPhone was released in 2007, and after the financial market maelstrom of 2008, Apple and its competitors have been selling their devices into a world economy that’s been getting progressively better. So their performance until now has been buoyed by macroeconomic growth, just as it’s now suffering from the effects of changing market conditions in China.

Competition and efforts at radical differentiation are only going to increase

But Samsung and Apple have deeper issues in China than just the overall market. Both global companies are struggling to establish themselves as the dominant players that they are in other countries. WeChat is effectively the operating system in China, so Apple’s iOS and App Store lock-in isn’t a thing, whereas Samsung’s generally being outpaced at its own spec race by nimbler local rivals.

The Chinese consumer is well-served by companies like Huawei, Oppo, and Vivo, each of which delivers a great deal of spec-laden value for a shopper’s yuan. As China’s appetite for the very latest smartphone also diminishes, those same companies are transitioning into India, the last remaining bastion of rapid smartphone sales growth, and retreading their strategy of garnering market share through aggressive pricing.

It’s fascinating to observe how, even as the overall smartphone market has been in gentle decline for a couple of years, the share of it held by each company and the geographies dominated by various brands keep shifting and changing. Within the span of the past decade, we’ve witnessed Nokia and BlackBerry supplanted by Apple and Samsung, and now we’re watching the likes of Huawei and Xiaomi ascending to offer a fresh challenge. Competition is likely to only intensify in the coming years as every manufacturer competes for a slice of a finite pie.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/12058301/akrales_180814_2817_0380.jpg)

As to what might bring smartphone sales back to growth, Qualcomm would tell you 5G will trigger a new wave of upgrades, IDC anticipates Latin America and Africa showing greater demand, and Samsung, Huawei, and others are working on zany foldable devices. Every avenue for hardware differentiation and leadership will be explored, which, from a consumer’s perspective, bodes well for a future of devices that are at the very least more interesting than the current crop we have today.

Smartphone markets are slowing down in large part because they’ve served their purpose. We wanted phones with great displays, fast connectivity, all-day battery life, and a few extra luxuries thrown in, and now we’ve got them in abundance. The system works. When the next truly compelling upgrade shows up on the horizon, consumers will once again throw money at the latest and greatest products. But until then, all this competition makes for a bumpy ride for any company venturous enough to be in the phone-selling business, including those at the very top.

https://www.theinquirer.net/inquire...artphone-sales-suffered-a-sharp-decline-in-q4

iPhone, Samsung smartphone sales suffered a sharp decline in Q4

To the benefit of Chinese upstarts, claims Gartner

iPhone sales fell 11 per cent in Q4

- @CarlyPage_

- 21 February 2019

APPLE AND SAMSUNG both suffered a sharp decline in smartphone sales in the fourth quarter as they face growing competition from Chinese upstarts.

That's according to analyst outfit Gartner, at least. The firm's latest figures show that Samsung saw its global market share shrink from 20.9 per cent to 19 per cent globally as its sales dipped 9 per cent year-on-year. Apple suffered a similar setback; it saw its slice of the pie shrink from 14 per cent to 13.4 per cent, with iPhone sales seeing an 11 per cent year-over-year slump.

While bad news for the two market leaders, this decline appears to have benefited Chinse OEMs. Echoing a recent report out of Canalys, Gartner's stats show that Huawei and Oppo saw their market share climb; Huawei from 10.8 to 14. per cent and Oppo from 6.3 to 7.7 per cent. Xiaomi lost one percentage point but still managed to claim 6.8 per cent of global smartphone sales in the quarter.

This growth of Chinese upstarts has been credited for Apple and Samsung's respective declines, with Anshul Gupta, senior research director at Gartner, noting that both brands face growing competitions from reasonably-priced Chinese brands.

"Although Samsung is strengthening its smartphone offering at the mid-tier, it continues to face growing competition from Chinese brands that are expanding into more markets," Gupta said.

"Apple has to deal not only with buyers delaying upgrades as they wait for more innovative smartphones, but it also continues to face compelling high-price and midprice smartphone alternatives from Chinese vendors. Both these challenges limit Apple's unit sales growth prospects."

Looking at the global market as a whole, Gartner says that smartphone sales to end users stalled in the fourth quarter of 2018 with total sales 408.4 million units - growth of just 0.1 per cent year-on-year. µ

https://tech.sina.com.cn/i/2019-06-16/doc-ihvhiews9170332.shtml

三星手机逐渐暗淡 在华最后手机厂继续裁员

2019年06月16日 07:40 经济观察报

三星手机逐渐暗淡,在华最后手机厂继续裁员

于惠如

2019年6月,三星未迎来原本推迟上市的折叠屏手机GalaxyFold上市,却迎来了三星在华最后一家手机厂——惠州三星电子有限公司(以下简称“惠州三星”)裁员的消息。“由于中国市场形势严峻、竞争加剧,我们正在调整三星电子惠州工厂的产量。”三星在近期的一份声明中表示。该份声明并未提供任何细节。

不仅是裁员,此前更有消息称惠州工厂最快在今年9月份关闭。对此消息,三星公开对外表示,尚未决定是否关闭三星惠州工厂。

经济观察报记者从一名惠州三星内部人士处获知,此次裁员自愿报名,涉及岗位包括管理岗位等间接部门以及一线生产岗位,裁员规模大约数百人。

一位接近三星的人士提供给经济观察报记者的一份数据清单显示,在5月至7月的生产计划中,惠州三星工厂的量产、社内主要成品生产线、所需人力均在减少。其中,社内MAINLINE成品生产线计划为:5月21条,6月13条,7月11条。截至4月底,惠州三星工厂人力为4087人。5月至7月计划所需人力为:3708人、2717人、2461人,富余人力分别为:379人,1370人、1626人。

此外,惠州三星在该份材料中表示:“间接部门严重超编,生产性中偏下,公司竞争力几乎没有了。”

业内分析人士认为,过去中国人工工资低、智能手机市场大,三星在中国设立手机厂占有优势,但随着成本承压、竞争加剧、国产手机崛起,上述优势已经不复存在,三星手机工厂在中国存在的理由越来越小。

截至发稿前,三星并未就经济观察报惠州工厂裁员的原因、在华投资战略转变等问题给出明确的回复。

“这次赔偿还是很人性化的”

位于惠州市惠城区陈江镇的惠州三星工厂成立于1992年,1993年正式投产,是三星在中国的主要生产基地。自去年三星位于天津的工厂关闭之后,惠州三星工厂成为三星在中国的最后一个手机生产工厂。

与其它位于工业园区的手机制造厂不同,惠州三星工厂周边拥有成熟的生活配套区,生活气息更浓厚。6月12日中午时分,身穿浅色工衣的三星员工三五成群从侧门走出,到对面超市外面的休息凳上休息闲聊。

从厂区外围看,惠州三星工厂与过去往常别无二致。货运物流车时不时进出,员工进出都要经过层层严格的安检通道,厂区周围停靠着十余辆标有“SAMSUNG”的大巴车,内部员工告诉经济观察报记者,这是三星接送员工上下班回惠州市区的班车。

唯一与该工厂正在经历较大规模裁员的相关信息或许是公告栏上一则2月28日人事部贴出的的公告:2019年3月1日起本公司招聘暂停运营,向后请留意本公司招聘公告信息,不便之处,敬请谅解。

惠州三星内部中层员工沈文彦告诉经济观察报记者,在正式公布裁员之前,员工就已经知道了工厂要裁员的消息。只不过,在今年5月底召开的第二季度经营说明会上,总经理才正式告知员工该消息。“这不是惠州三星工厂的第一次裁员,从去年开始就有N+1裁员方案,只不过前两次都是管理岗位等间接部门的裁员,涉及的人员少,大约都在20人左右。”沈文彦介绍说,与过往补偿方案不同,此次裁员,惠州三星的补偿方案为:“N+3+工龄奖+择业期工资(择业期工资为最多两个月工资)”。“这次赔偿还是很人性化的,在签了离职协议找工作的期间还能拿到工资。”沈文彦说,由于此次赔偿金较高,已经有员工选择自愿离职。

在上述接近三星的人士提供给经济观察报记者的数据清单中,三星提到,为了应对5月至7月的生产计划以及间接部门严重超编、公司竞争力低等问题,人事部门采取的对策包括:各部门严格控制加班,N+1人力效率化常态化进行等。

原因还是市场占有率缩水

三星在中国曾拥有两家手机制造工厂,位于天津的手机工厂已于2018年最后一天正式关闭。

对于三星接连对南北两大手机工厂“动刀”,分析人士认为主要是因为三星手机在中国的市场占有率大幅缩水,在中国手机生产成本优势下降等原因。

2013年是三星手机在中国发展的鼎盛时期,自然也是惠州三星工厂最忙的时期。“当时本就是智能手机热销的时候,也是三星在中国市场上最受欢迎的时候。但惠州三星是外企,对于工作时长有严格的规定,面对巨量订单只有扩招,当时扩招了很多人。”沈文彦说。

公开数据显示,2013年三星手机在中国市场占有率为20%。短短5年时间,该数据已经下降到0.8%。市场调研机构IDC数据显示,2018年,三星手机在中国市场的销量为334万部,市场占有率为0.8%。“三星手机在中国的市场占有率从最辉煌时期的20%降到现在不到1%。随着国产手机的崛起,人工成本越来越高,三星手机生产工厂在中国存在的理由已经越来越小了。”第一手机界研究院院长孙燕彪认为,三星手机需要中国这个市场,但没必要需要中国的生产厂,因而将手机生产厂搬迁生产厂至成本更低的地方,保留更具高科技的部门或许是大势所趋。

2014年以后,三星的中低端手机受到国产手机品牌冲击,市场份额大幅下滑。2016年的GalaxyNote7电池爆炸事件又让三星承受一重创。“电池爆炸事件以后,我们厂的订单量明显少了。”沈文彦说。

三星电子最新财报数据显示,2019年第一季,三星电子实现营收52.39万亿韩元,手机仅为三星贡献了25.92万亿韩元的营收,同比下降6%。一季度三星智能手机出货量为7800万部。

三星高管在财报会上称,整体智能手机市场正在萎缩,中低端市场的竞争加剧,导致三星手机整体销量承压。为了适应市场需求,三星中低端手机产品的生产线正在经历重组,相关的营销调整也增加支出,因此该季度业务的盈利能力下降。

国内ODM工厂承接

与国内工厂相继关停、裁员相比,为应对中国劳动力成本的上升,三星在过去十年逐渐将智能手机的生产从中国迁至越南、印度。业内分析师预测,贸易摩擦将加速这一转移。

公开信息显示,自2009年起,三星就在越南建造生产基地,生产基地于2015年正式投产。目前,三星在越南各地亦设立了8个生产基地,主要生产手机与电子零件等。

此外,去年三星在印度扩建了全球最大的智能手机工厂,扩建完成后,三星新工厂等产量预计将增加一倍,达到近1.2亿部。今年5月,三星集团电子部门计划在印度投资250亿卢比(约合3.6035亿美元)用于智能手机生产线,这笔投资预计将落地于印度的诺伊达邦。

沈文彦告诉经济观察报记者,目前三星40%的智能手机已交由国内ODM厂商代工,这其中就包括惠州海格科技股份有限公司。

根据2018年手机产业ODM白皮书数据统计,由于中国手机厂商的冲击导致出货下滑,三星、Nokia和LG等手机厂商均大幅增加委外ODM项目,籍以优化成本及研发资源、提升其产品的竞争力,开放项目与ODM公司进行合作。预计三星、LG和Nokia2019年委外ODM项目整体出货将达到4000万部。

在孙燕彪看来,三星继续保留中国工厂的必要性不大,ODM模式的优点是能通过降低生产成本来确保价格竞争力,委外ODM项目在一定程度上可以降低成本压力。

Samsung mobile phone gradually dimmed

June 16, 2019 07:40 Economic Observer

Samsung mobile phone is gradually dimmed, and the final mobile phone factory in China continues to lay off employees

Yu Huiru

In June 2019, Samsung did not welcome the Galaxy Fold, a folding screen mobile phone that was delayed in listing, but ushered in the layoffs of Samsung’s last mobile phone factory in China, Huizhou Samsung Electronics Co., Ltd. (hereinafter referred to as “Huizhou Samsung”). “As the Chinese market is in a tough situation and competition is intensifying, we are adjusting the output of the Samsung Electronics Huizhou plant,” Samsung said in a recent statement. The statement did not provide any details.

Not only layoffs, but there have been more reports that the Huizhou factory was closed in September this year. In response to this news, Samsung publicly stated that it has not yet decided whether to close the Samsung Huizhou factory.

The Economic Observer reporter learned from a Huizhou Samsung insider that the layoffs were voluntarily registered, involving indirect departments such as management positions and first-line production positions, and the number of layoffs was about several hundred.

A data list provided by a person close to Samsung to the Economic Observer reporter showed that in the production plan from May to July, the mass production of the Huizhou Samsung plant, the production line of the main finished products in the company, and the manpower required were all reduced. Among them, the MAINLINE finished product line plan is: May 21, June 13 and July 11. As of the end of April, the Huizhou Samsung factory had a manpower of 4,087. The manpower required for the plan from May to July is 3,708, 2,716 and 2,461, with a surplus of 379, 1,370 and 1,626.

In addition, Huizhou Samsung said in the material: "The indirect department is seriously over-compiled, and the productivity is low, and the company's competitiveness is almost gone."

Industry analysts believe that in the past, China's low labor wages and smart phone market, Samsung has an advantage in setting up a mobile phone factory in China, but with the pressure of cost, increased competition, and the rise of domestic mobile phones, these advantages no longer exist, Samsung mobile phone factory The reasons for the existence of China are getting smaller and smaller.

As of press time, Samsung did not give a clear response to the reasons for the layoffs of the Huizhou factory in the economic observation report and the strategic shift in investment in China.

"This compensation is still very human."

The Huizhou Samsung Factory, located in Chenjiang Town, Huicheng District, Huizhou City, was established in 1992 and officially put into production in 1993. It is Samsung's main production base in China. Since the closure of Samsung's factory in Tianjin last year, the Huizhou Samsung plant has become Samsung's last mobile phone production plant in China.

Unlike other mobile phone manufacturers located in industrial parks, Huizhou Samsung Factory has a mature living area around it, and its life is more intense. At noon on June 12, Samsung employees wearing light-colored work clothes came out from the side door in groups of three and five, and went to rest on the rest bench outside the supermarket.

From the outside of the factory, the Huizhou Samsung factory is no different from the past. Freight logistics vehicles come in and out from time to time. Employees must go through a series of strict security inspection channels. There are more than ten buses marked "SAMSUNG" around the factory. The internal staff told the Economic Observer that this is Samsung's pick-up and return to work. Shuttle bus from Huizhou City.

The only information related to the large-scale layoffs of the factory may be a notice posted on the bulletin board by the Personnel Department on February 28th: the company's recruitment is suspended from March 1, 2019. Please pay attention to this later. Company recruitment notice information, please understand that the inconvenience.

Shen Wenyan, a middle-level employee of Huizhou Samsung, told the Economic Observer that before the official announcement of layoffs, employees already knew the news of the factory's layoffs. However, at the second quarter business briefing held at the end of May this year, the general manager officially informed the staff of the news. "This is not the first layoff of the Huizhou Samsung factory. Since last year, there have been N+1 layoffs, but the first two are layoffs in indirect departments such as management positions. The number of people involved is small, about 20 people. Shen Wenyan said that unlike the previous compensation scheme, Huizhou Samsung’s compensation plan for this layoff is: “N+3+ working age award+employment period salary (career period salary is up to two months salary)”. "This compensation is still very humane. I can get the salary during the period of signing the separation agreement to find a job." Shen Wenyan said that due to the higher compensation, some employees have chosen to voluntarily leave.

In the list of data provided by the people close to Samsung to the Economic Observer, Samsung mentioned that in response to the production plan from May to July and the serious over-compilation of the indirect department and the low competitiveness of the company, the personnel department’s countermeasures include : All departments strictly control overtime, and N+1 humanization efficiency is normalized.

The reason is that the market share has shrunk

Samsung has two mobile phone manufacturing plants in China, and the mobile phone factory in Tianjin was officially closed on the last day of 2018.

For Samsung to successively attack the two major mobile phone factories in North and South, analysts believe that the main reason is that Samsung's mobile phone market share in China has shrunk dramatically, and the cost advantage of mobile phone production in China has declined.

2013 is the heyday of Samsung mobile phone development in China, and naturally it is also the busiest period of Huizhou Samsung factory. "At the time, this was the time when smartphones were selling well, and it was also the most popular time for Samsung in the Chinese market. But Huizhou Samsung is a foreign company, and it has strict regulations on the length of work. In the face of huge orders, there are only expansion plans. At that time, many people were enrolled. "Shen Wenyan said.

According to public data, in 2013, Samsung's mobile phone market share in China was 20%. In just 5 years, the data has dropped to 0.8%. Market research firm IDC data shows that in 2018, Samsung mobile phone sales in the Chinese market was 3.34 million, with a market share of 0.8%. “The market share of Samsung mobile phones in China has dropped from 20% in the most brilliant period to less than 1% now. With the rise of domestic mobile phones, the labor costs are getting higher and higher, and the reasons for the existence of Samsung mobile phone production plants in China have come. The smaller the size.” Sun Yanxi, the president of the First Mobile Phone Research Institute, believes that Samsung mobile phones need China’s market, but there is no need for a Chinese production plant. Therefore, the mobile phone production plant will be relocated to a lower cost place, and more The high-tech sector may be the general trend.

After 2014, Samsung's low-end and mid-range mobile phones were hit by domestic mobile phone brands, and its market share dropped sharply. The 2016 Galaxy Note7 battery explosion caused Samsung to suffer a heavy blow. "After the battery explosion, the order quantity of our factory was significantly less." Shen Wenyan said.

Samsung Electronics' latest financial report data shows that in the first quarter of 2019, Samsung Electronics achieved revenue of 52.39 trillion won, and mobile phones contributed only 25.92 trillion won to Samsung, down 6% year-on-year. Samsung smartphone shipments in the first quarter were 78 million units.

Samsung executives said at the earnings conference that the overall smartphone market is shrinking and competition in the low-end market is intensifying, leading to pressure on Samsung's overall sales. In order to meet the market demand, the production line of Samsung's low-end mobile phone products is undergoing restructuring, and related marketing adjustments also increase spending, so the profitability of the business in the quarter declined.

Domestic ODM factory undertakes

In response to the rise in labor costs in China, Samsung has gradually moved its smartphone production from China to Vietnam and India over the past decade. Industry analysts predict that trade frictions will accelerate this shift.

Public information shows that since 2009, Samsung has built a production base in Vietnam, and the production base was officially put into operation in 2015. At present, Samsung has set up 8 production bases throughout Vietnam, mainly producing mobile phones and electronic components.

In addition, Samsung expanded its largest smartphone factory in the world last year. After the expansion, production at Samsung's new plant is expected to double to nearly 120 million units. In May of this year, Samsung Electronics Group plans to invest 25 billion rupees (about 366.35 million US dollars) in India for smartphone production lines. The investment is expected to land in Noida, India.

Shen Wenyan told the Economic Observer that 40% of Samsung's smartphones have been handed over to domestic ODMs, including Huizhou Hager Technology Co., Ltd.

According to the statistics of the mobile phone industry ODM white paper in 2018, due to the impact of the impact of Chinese mobile phone manufacturers, shipments of Samsung, Nokia and LG have significantly increased the number of outsourcing ODM projects, in order to optimize costs and R&D resources and enhance competition for their products. Force, open projects and ODM companies to cooperate. It is expected that Samsung, LG and Nokia will have 40 million outsourcing of ODM projects in 2019.

In Sun Yanxi's view, Samsung's necessity to keep the Chinese factory is small. The advantage of the ODM model is that it can ensure price competitiveness by reducing production costs. The outsourcing ODM project can reduce the cost pressure to a certain extent.