- Joined

- Jul 25, 2008

- Messages

- 13,800

- Points

- 113

Don't need to resign. Just to hire more CECA programmers.

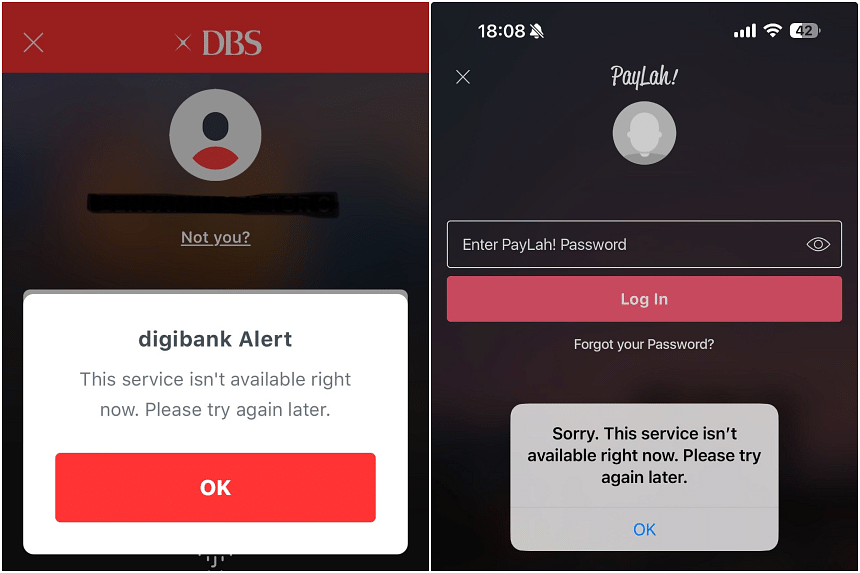

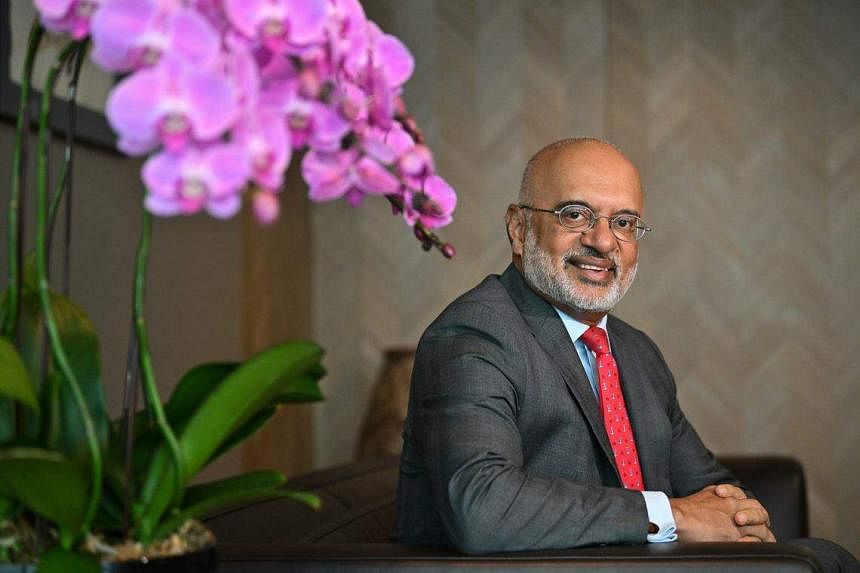

DBS will also set aside a special budget of $80 million to enhance system resiliency. ST PHOTO: GIN TAY

Prisca Ang

Nov 6, 2023

SINGAPORE – DBS Bank will hire more engineering talent in the coming months to troubleshoot issues that might lie deep within its technology systems, in response to a spate of disruptions that have plagued customers this year.

Chief executive officer Piyush Gupta said on Monday that four of the bank’s five major disruptions in 2023 were bug- or software-related.

“The big issue to me is, how do you make sure that you get good change control, because the reality is that as you use a lot of different systems and architecture, you will run into bugs,” he told reporters during the bank’s third-quarter results briefing on Monday.

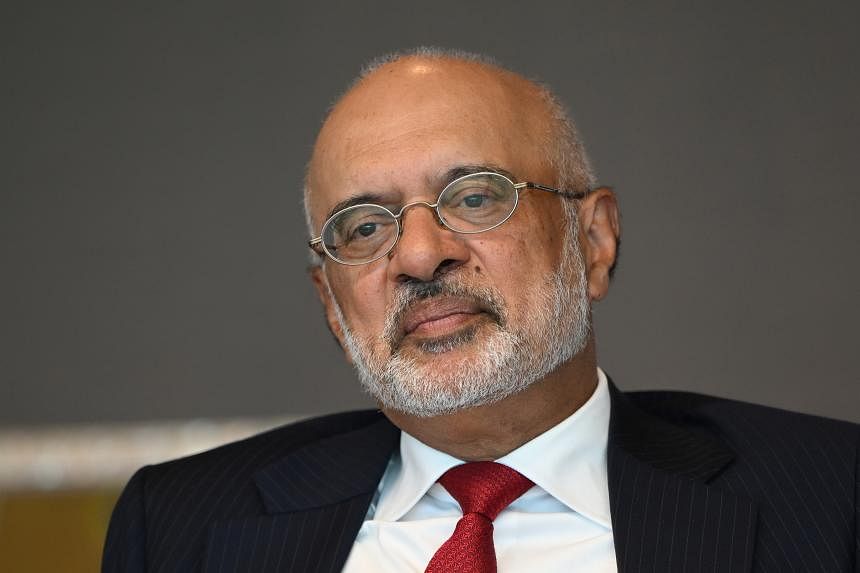

Monetary Authority of Singapore (MAS) managing director Ravi Menon said last week in an interview that there are some deeper-seated issues that need to be resolved at the bank.

Responding to a question on Monday about what these issues are, Mr Gupta said: “One issue is to have the deep engineering talent, because in at least two or three of these incidents, the bug was so deep that we wouldn’t be able to pick it up.”

Several of the recent disruptions have boiled down to human error or software bugs in systems of the bank’s vendors, he noted.

Working with a vendor to resolve these problems takes time, he said. Instead, improving the depth of DBS’ engineering team will help it troubleshoot bugs better.

Mr Gupta said the bank is working on a comprehensive set of measures to deliver improved service availability and hopes to have a more robust recovery process by the end of the first quarter of 2024.

One measure is to put in place more rigorous and comprehensive processes to ensure that systems that are being developed work correctly. The bank will also set aside a special budget of $80 million to enhance system resiliency.

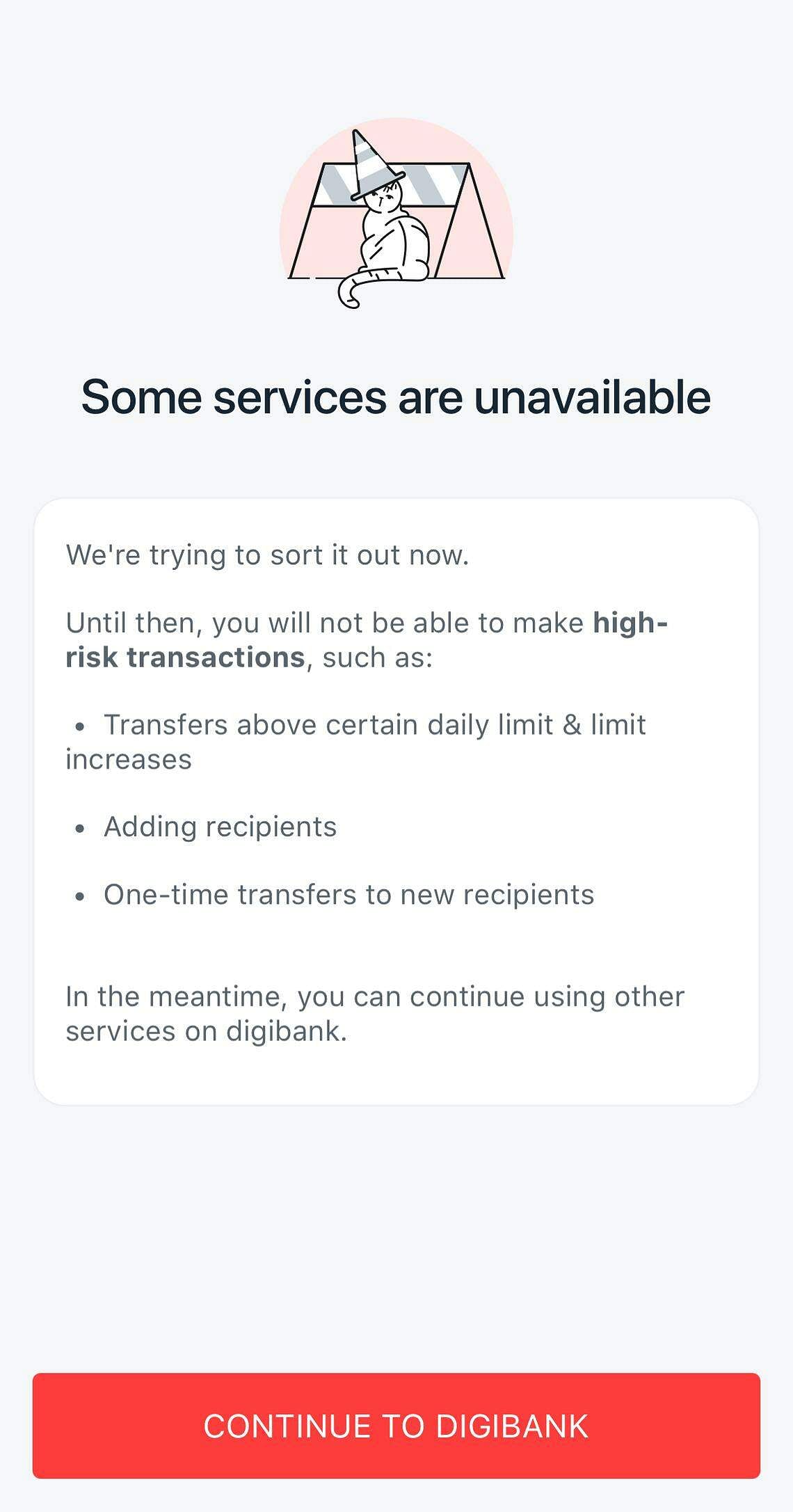

Another priority is to decouple the bank’s systems such that important services can still be accessed.

Its payment service, for example, operates on multiple tech systems. Decoupling its underlying infrastructure will allow customers to pay via the bank’s other digital banking platforms even if one of these channels fails.

“It’s hard to figure out why we are getting more bugs now than we have in the past,” said Mr Gupta. “It’s purely my speculation that post-Covid, people are working from home and I think there’s been more pressure on software quality in general around the world.”

DBS was barred last week by the country’s central bank from acquiring new businesses or making non-essential IT changes for six months to ensure it focuses on shoring up its digital banking services. It is also not allowed to reduce the number of its branches and automated teller machines (ATMs) during this time.

Asked whether the measures will affect business, Mr Gupta said the bank did not have new deals or business ventures planned, and has not reduced its branch or ATM network in recent years.

“We will have to defer some new product features, new products and services which we would normally have done.

“But in reality, we have to focus on building resiliency so we would not have been able to put resources (in those areas) anyway. The MAS measures give us a six-month window to consolidate (our processes).

“When you have good brakes, then you can run faster later.”

4 of the 5 major DBS disruptions in 2023 were bug or software-related: CEO Piyush Gupta

DBS will also set aside a special budget of $80 million to enhance system resiliency. ST PHOTO: GIN TAY

Prisca Ang

Nov 6, 2023

SINGAPORE – DBS Bank will hire more engineering talent in the coming months to troubleshoot issues that might lie deep within its technology systems, in response to a spate of disruptions that have plagued customers this year.

Chief executive officer Piyush Gupta said on Monday that four of the bank’s five major disruptions in 2023 were bug- or software-related.

“The big issue to me is, how do you make sure that you get good change control, because the reality is that as you use a lot of different systems and architecture, you will run into bugs,” he told reporters during the bank’s third-quarter results briefing on Monday.

Monetary Authority of Singapore (MAS) managing director Ravi Menon said last week in an interview that there are some deeper-seated issues that need to be resolved at the bank.

Responding to a question on Monday about what these issues are, Mr Gupta said: “One issue is to have the deep engineering talent, because in at least two or three of these incidents, the bug was so deep that we wouldn’t be able to pick it up.”

Several of the recent disruptions have boiled down to human error or software bugs in systems of the bank’s vendors, he noted.

Working with a vendor to resolve these problems takes time, he said. Instead, improving the depth of DBS’ engineering team will help it troubleshoot bugs better.

Mr Gupta said the bank is working on a comprehensive set of measures to deliver improved service availability and hopes to have a more robust recovery process by the end of the first quarter of 2024.

One measure is to put in place more rigorous and comprehensive processes to ensure that systems that are being developed work correctly. The bank will also set aside a special budget of $80 million to enhance system resiliency.

Another priority is to decouple the bank’s systems such that important services can still be accessed.

Its payment service, for example, operates on multiple tech systems. Decoupling its underlying infrastructure will allow customers to pay via the bank’s other digital banking platforms even if one of these channels fails.

“It’s hard to figure out why we are getting more bugs now than we have in the past,” said Mr Gupta. “It’s purely my speculation that post-Covid, people are working from home and I think there’s been more pressure on software quality in general around the world.”

DBS was barred last week by the country’s central bank from acquiring new businesses or making non-essential IT changes for six months to ensure it focuses on shoring up its digital banking services. It is also not allowed to reduce the number of its branches and automated teller machines (ATMs) during this time.

Asked whether the measures will affect business, Mr Gupta said the bank did not have new deals or business ventures planned, and has not reduced its branch or ATM network in recent years.

“We will have to defer some new product features, new products and services which we would normally have done.

“But in reality, we have to focus on building resiliency so we would not have been able to put resources (in those areas) anyway. The MAS measures give us a six-month window to consolidate (our processes).

“When you have good brakes, then you can run faster later.”