- Joined

- Jul 25, 2008

- Messages

- 13,542

- Points

- 113

Woman admits duping trader into thinking over $900k worth of her firm’s cryptocurrency was hers

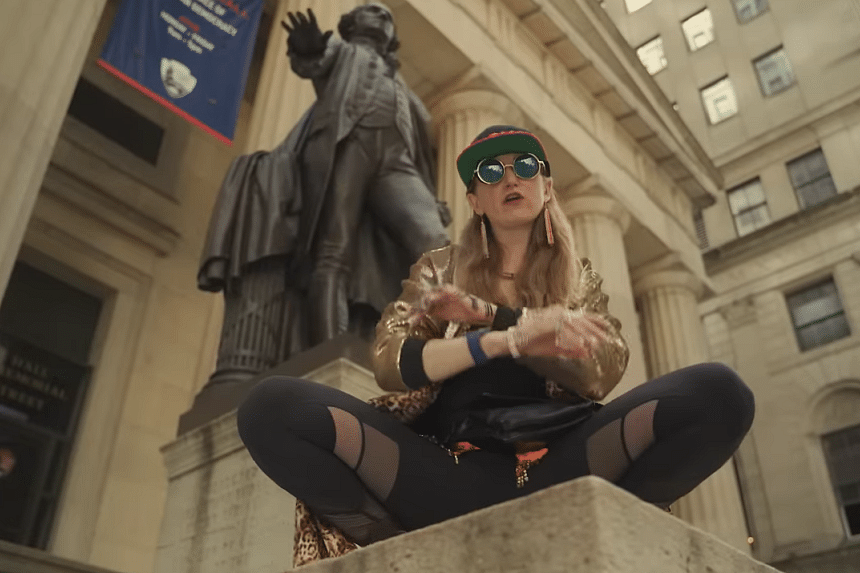

Isabella Yer Enci pleaded guilty to two cheating charges in court on Oct 1. ST PHOTO: KELVIN CHNG

Samuel Devaraj

Oct 01, 2024

SINGAPORE – A local tech company which accepts cryptocurrency as payment from its clients would convert the tokens into cash by selling them to a trader.

Isabella Yer Enci, who was then Voltron’s accounts executive tasked with contacting the trader, had asked the latter to exchange more than $900,000 worth of cryptocurrency which she claimed was hers or her parents’. In fact, it belonged to her company.

On Oct 1, the 32-year-old Singaporean pleaded guilty to two cheating charges in court.

Another four charges will be taken into consideration during her sentencing on Oct 14.

Deputy Public Prosecutor Ng Jun Chong said that in 2021, the victim, a Malaysian woman, engaged in cryptocurrency arbitrage trading in her spare time.

She would buy cryptocurrencies from various sources, including Voltron, and sell them for a profit.

When Voltron’s finance manager resigned in September 2021, Yer took over the liaising with the trader.

But on Oct 6, 2021, Yer told one of Voltron’s investors that she had found a better job opportunity and wanted to resign. He told her to discuss the matter with the human resources department.

Four days later, Yer asked the trader if she entertained personal transactions, and when the victim said yes, they agreed on a conversion rate.

Over the next few days, Yer transferred her own cryptocurrency to the trader in exchange for cash.

Said DPP Ng: “The accused knew that it was not appropriate for her to be engaging in personal cryptocurrency conversion transactions with the victim while she was in charge of Voltron’s cryptocurrency conversion transactions with the victim.”

On Oct 18, 2021, Voltron needed to convert 300,000 USDT, the stablecoin issued by Tether Holdings, into cash to pay for certain expenses incurred by its Singapore and Malaysia operations.

She told the trader that the tokens belonged to her and arranged to exchange them for cash.

As required by Voltron, Yer sent to two of her colleagues screenshots of messages with the trader, which included the agreed-upon conversion rate and the specific recipient wallet address.

When the company approved the transaction, Yer transferred 300,000 USDT from Voltron’s crypto wallet to the one belonging to the trader.

The trader handed to Yer about $399,900 in cash at her office later that day.

Said DPP Ng: “When the victim asked the accused how she obtained such a large amount of cryptocurrency, the accused lied that it came from her personal funds as she and/or her parents had bought Bitcoin when it was much lower in value.”

After other similar transactions, Yer resigned from Voltron on Oct 26, 2021.

While closing the accounts for October 2021 some time after Oct 25, 2021, Voltron’s finance department discovered that 300,000 USDT, 265,552 USDT, and 130,538.46 USDT, which were supposed to have been converted to Singapore dollars and used to pay the company’s expenses, were unaccounted for.

On Nov 3, 2021, a Voltron staff member spoke to the trader.

“The victim informed him that the transactions were done by the accused, and that the accused had informed her that the cryptocurrency came from ‘personal fund’ and ‘parent cash-out’,” said DPP Ng.

Suspecting Yer of misappropriating Voltron’s money, the employee told the company’s management.

On Nov 5, 2021, when Yer went to Voltron’s office at Paya Lebar Square to return her work laptop and settle some administrative matters, she was asked about the transactions.

She denied knowing about them initially, but eventually admitted that she took the money, claiming that it was to pay her grandmother’s medical bills.

She signed a letter of undertaking to repay the sums that she had misappropriated within six months and paid back to the company about $201,000 over the next few days. She still owed the company about $723,000.

On Dec 2, 2021, Yer filed a police report alleging that Voltron’s employees locked her up in a meeting room for more than 12 hours and falsely accused her of stealing money. She claimed that she had transferred money to them under duress.

But DPP Ng said no one threatened her when she was in Voltron’s office on Nov 5, 2021, and that its employees knew that she was pregnant at that time.

On Sept 1, 2022, a Voltron director lodged a police report against Yer as she still owed the company money.

For each cheating charge, Yer can be jailed for up to 10 years and fined.