CPF-OA should relax 10% limit for investment in gold ETF/bullion/ UOB etc

"The survey's composite five-year-expectation is 4.97 per cent - just below the 5.2 per cent predicted in the survey in September. "(see report: 'Singapore's inflation may remain elevated for years to come: survey')

S$100K in CPF OA @int.2.5%, inflation 5%(proj): value @ end of 5 years??...

S$100,000, net interest over 5 yrs (CPF OA 2.5%interest, 5% annual loss to inflation= nett -2.5% interest):

S$100K *0.975 *0.975 *0.975 *0.975 *0.975= $88,110 (i.e. loss of nett S$11,890) to inflation due to the SG govt printing extra SGD [see: Money printing (/borrowing) by Singapore government- how much is too much? ].

Suggestion: Perhaps SG govt will allow much more than the current measly 10% of CPF OA to be invested in gold; or as a last resort, pay inflation rate plus 1% on all CPF OA accounts?

Reference:

- [Forbes India (Inflation)]: 'Why It Makes Sense To Buy Gold']

- Gold as an investment - Wikipedia, the free encyclopedia

.JPG) [pict source: https://secure.mas.gov.sg/msb-xml/Re...=I&tableID=I.1 ]

[pict source: https://secure.mas.gov.sg/msb-xml/Re...=I&tableID=I.1 ]

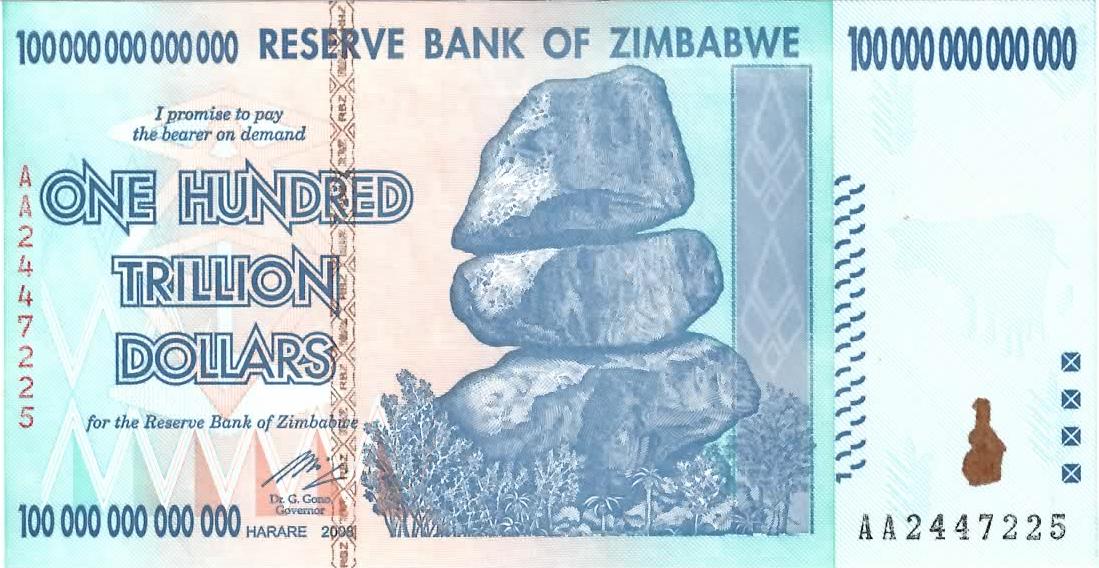

[pict source: Zimbabwe Z$100T dollar note (Issue date:2008)]

[pict source: Zimbabwe Z$100T dollar note (Issue date:2008)]

Caption: My currency to exchange for gold please- too many zeros for me to count, please, quick![Image source]

Caption: My currency to exchange for gold please- too many zeros for me to count, please, quick![Image source]

Tags: Inflation, Singapore, provident, CPF, savings, economics, quantitative easing, gold, investment,

"The survey's composite five-year-expectation is 4.97 per cent - just below the 5.2 per cent predicted in the survey in September. "(see report: 'Singapore's inflation may remain elevated for years to come: survey')

S$100K in CPF OA @int.2.5%, inflation 5%(proj): value @ end of 5 years??...

S$100,000, net interest over 5 yrs (CPF OA 2.5%interest, 5% annual loss to inflation= nett -2.5% interest):

S$100K *0.975 *0.975 *0.975 *0.975 *0.975= $88,110 (i.e. loss of nett S$11,890) to inflation due to the SG govt printing extra SGD [see: Money printing (/borrowing) by Singapore government- how much is too much? ].

Suggestion: Perhaps SG govt will allow much more than the current measly 10% of CPF OA to be invested in gold; or as a last resort, pay inflation rate plus 1% on all CPF OA accounts?

Reference:

- [Forbes India (Inflation)]: 'Why It Makes Sense To Buy Gold']

- Gold as an investment - Wikipedia, the free encyclopedia

Singapore's inflation may remain elevated for years to come: survey

24 January 2013 2230 hrs (SST)

SINGAPORE: Singapore's inflation may remain elevated for years to come, according to a survey by the Singapore Management University (SMU) where it forecasts an inflation rate of close to 5 per cent in 2017.

The survey also found Singaporeans expect inflation to hit 4.4 per cent this year.

The online survey was derived from around 400 randomly selected individuals from Singapore households. It was conducted jointly by SMU's Sim Kee Boon Institute for Financial Economics and MasterCard.

Inflation averaged 4.6 per cent last year - not as quite as hot as the 5.2 per cent in 2011.

Inflationary expectations have subsided because of the uncertain global climate but survey respondents predict 4.4 per cent in 2013 - near to the top of the Monetary Authority of Singapore's estimated 3.5 to 4.5 per cent range.

The survey's composite five-year-expectation is 4.97 per cent - just below the 5.2 per cent predicted in the survey in September.

SMU's programme director of Sim Kee Boon Institute Aurobindo Ghosh said: "People are always concerned and they don't always see very clearly what will happen five years later. They will have to rely on media for example, they have to rely on how things are looking, their confidence level. So, we are not going to put too much money into the fact that it is going to be 5 per cent five years later. It might really come down if the conditions actually improve. So, this are perceptions."

However, the recent cooling measures in the property sector are expected to put a check on headline inflation.

Economists said inflationary pressures in Singapore are not just asset prices boosted by liquidity, but homegrown prices as well, such as labour and rental costs.

And investors are always looking at hedging their wealth which is being eroded by inflation.

Centennial Group International's director Manu Bhaskaran said: "The natural place is to look at property. If one part of property market is closed, they will go into another. If more and more administrative measures are placed on property, then I am sure innovative financial institutions will come up with new kinds of products that will enable Singapore savers to invest in property but bypass regulations."

Some members of the survey panel suggested the issuance of inflation-linked bonds may help Singaporeans to hedge against price rise rather than a mis-allocation of assets, geared entirely toward real estate.

- CNA/ck

Singapore's inflation may remain elevated for years to come: survey - Channel NewsAsia

Tags: Inflation, Singapore, provident, CPF, savings, economics, quantitative easing, gold, investment,

Last edited: