Chinese wagering strong in Saipan Island

Overseas casinos clean up despite China's cash curbs

By Farah Master By Farah Master December 11, 2016

By Farah Master

SAIPAN (Reuters) - For evidence of the odds stacked against China's battle to stop the flight of cash battering its currency and draining its reserves, look no further than the tiny Pacific island of Saipan, which has hit the jackpot with a flood of Chinese money at its new casino.

Thousands of miles from the Chinese mainland, the U.S.-administered island of 50,000 people is festooned with signs written in Chinese and stuffed with Chinese supermarkets, restaurants and karaoke parlours serving the 200,000 Chinese visitors that arrived this year.

Private jets bring big spenders so free with their cash - and $100 million (£79.5 million) credit lines - that the modest Best Sunshine casino, owned by Hong-Kong listed Imperial Pacific, wildly outperforms the top casinos in Macau, the world's biggest gambling hub.

Best Sunshine's 16 VIP tables can turn over $3.9 billion a month, while the world's biggest, the Venetian Macao, manages about $2.5 billion per month on 102 VIP tables, and the MGM around $2.9 billion on 161.

"Never have I dealt with so much money in 36 years in casinos,” said one executive working in the casino, who could not be named due to company policy.

Back in Beijing, policymakers are trying to keep that money on the mainland.

Capital outflows, both legal and illegal, have dragged the yuan to eight-year lows this year, prompting China to eat through more than a fifth of its foreign currency reserves since mid-2014 and impose a series of measures to stem the outflows.

Such measures, plus an anti-corruption crackdown that began in early 2014, has dealt a blow to Macau, the self-governing Chinese territory linked by a thread to the mainland province of Guangdong.

Macau’s gaming revenues have more than halved since then, as high rollers from the mainland gave it a wide berth.

But whacking the mole in Macau has made it pop up elsewhere, where China's writ doesn't run; in Saipan, the Philippines, Cambodia and Australia.

Manila's Solaire casino registered a 61 percent increase in VIP turnover in the third quarter, while the number of junket operators bringing in foreign high rollers has more than doubled. Half of its VIP gamblers come from China.

NagaCorp in Phnom Penh has seen a 13 percent increase in Chinese visitors in the first half of 2016, with VIP turnover up 11 percent for the first nine months.

HOUSE WINS

China has fought to suppress the demand, detaining marketing employees from Australia’s Crown Resorts in October for "gambling offences", and arresting South Korean casino managers last year for "enticing" Chinese to gamble overseas.

"We have always asked that Chinese citizens leaving the borders respect the laws and rules of relevant countries, and not get involved in gambling or gamble themselves,” Chinese foreign ministry spokesman Lu Kang told a daily news briefing in Beijing.

But the casinos are getting ready for more.

NagaCorp is building additional facilities and a luxury retail complex, while Solaire, where VIPs play in opulent ocean-front rooms, is also unrolling new amenities to lure VIPs.

Imperial is spending $3 billion to build a 14-storey resort in Saipan after winning a 40-year exclusive monopoly licence.

Its towering bamboo scaffolding already dwarfs the low-rise local buildings.

The man behind Imperial's push into Saipan, Ji Xiaobo, a one-time middleman whose company brought players to Macau, is also in discussions with nearby Pacific island Palau to set up a small resort, according to a source familiar with the deal.

Ji, who casino executives said brings VIP players to Saipan on his private jet and accommodates them on his yacht or in opulent villas, declined to comment.

Saipan’s government, desperate for revenues after the collapse of its garment industry and a decline in tourism, approved the casino in 2014, overturning longstanding opposition.

It makes it very attractive for the operator, with just 5 percent gaming tax compared with Macau's 39 percent, said Mark Brown, Imperial's chief executive, who formerly worked for U.S. casino tycoons including president-elect Donald Trump, Steve Wynn and Sheldon Adelson.

Not everyone on the island thinks Saipan gets much benefit.

Casino revenues have surged, but the government budget remains less than a sixth of what the casino produces annually, said local resident Glen Hunter, who has fought against the development.

“You have created an entity out here with so much resources and power that I think we will no longer even have a proper functioning democracy," Hunter said.

The influx of money is already changing the nature of the place.

Chinese investment in Saipan has skyrocketed since the casino opened last year, with almost every available property bought in the last six months, say local residents.

"I’ve also had Chinese investors just knock on my door and offer to buy my house, in cash,” said Harry Blalock, who runs dive company Axe Murderer Tours.

(Reporting by Farah Master; Additional reporting by Ben Blanchard in Beijing and Prak Chan Thul in Phnom Penh; Editing by Will Waterman)

//

Chinese wagering strong in Saipan Island

Rollers seeking for new places

Chinese wagering strong in Saipan Island

UNITED STATES

| 02/08/2016

Casino gambling may be in a slump in Macau and doing little better in Singapore or South Korea, but it’s boom time on the Pacific island of Saipan where Chinese high rollers are wagering more than $1.5 billion a month at a temporary casino operating out of a duty-free mall.

It’s all in the timing, according to Mark Brown, chief executive of Best Sunshine International, the casino’s operator, who says the high rollers were looking for somewhere new to go.

“We are dealing with the ‘VVIP’ guys that we personally know,” Brown told the Nikkei Asian Review during an interview at Best Sunshine’s small Hong Kong headquarters. “They are coming and they are loving it. There’s a lot of repeat business. The views alone are incredible, [plus] the boat rides, the dinners on the beach.”

Brown knows a lot of big gamblers. For three years, he ran the Macau operations of Las Vegas Sands, the biggest US casino operator in the former Portuguese colony, and has had senior roles at casinos in Phnom Penh, Las Vegas and Atlantic City, New Jersey. Marketing executives on his team also have experience from casinos in Australia and the Philippines plus Best Sunshine is linked through its controlling shareholder to Macau junket agency Heng Sheng Group.

Best Sunshine, a subsidiary of Hong Kong-listed Imperial Pacific International Holdings, fought a rival group of Hong Kong-based investors for the exclusive right to open casinos on Saipan two years ago and is betting it can draw more Chinese gamblers even if the slump ends in Macau.

That would be followed up by a sprawling resort complex with multiple hotels.

Despite its hard-won exclusive, Best Sunshine faces competition. Several gambling machine halls have opened within Saipan hotels since these were authorized in December 2013. Meanwhile on the neighboring island of Tinian, the investors Best Sunshine beat out in Saipan are working to revive a defunct casino hotel and two other Asian investor groups are seeking to develop new casino hotels. South Korean and Japanese investors have also held talks with local officials about making new casino investments on the island of Rota.

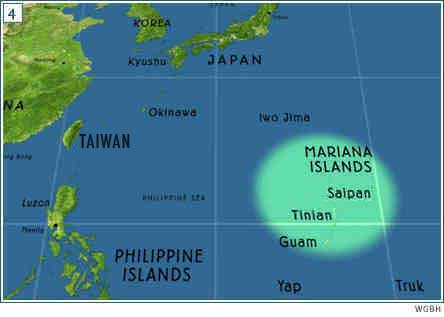

Saipan, Rota and Tinian are all part of a U.S. territory known as the Commonwealth of the Northern Mariana Islands in the western Pacific just northeast of Guam, a separate U.S. territory.

Measures taken by the Chinese government in its fight against corruption and capital flight to identify and restrict those taking cash out of the country have been frequently identified as a key driver in Asia’s gaming slump.

Regulatory moves by local officials in Macau, Singapore and South Korea have further dampened industry sentiment.

“Macau numbers, they are not going down because the guys are broke. They are going down because of things that are going on in Macau, issues and restrictions,” said Brown, who left Las Vegas Sands in 2009.

Yet at Best Sunshine Live, he said: “No one can play in our VIP rooms unless we know who they are. The game is real. [The players] like the fact that we’re highly regulated. They like the fact that it’s the U.S. It’s safe outside, it’s safe inside, it’s safe everywhere.”

To reinforce this message, Imperial Pacific has recruited an array of former senior U.S. officials as directors and advisors.

Former Central Intelligence Agency director James Woolsey in May joined the board, which already included former U.S. judge Eugene Sullivan; the board’s advisory committee formed in April includes a former director of the U.S. Federal Bureau of Investigation and former governors of New York and Pennsylvania.

Brown, who spent a year as the chief operating officer of the Cambodian casino run by Hong Kong-listed NagaCorp, contrasted Saipan with other new Asian casino markets like Vietnam and the Philippines. “Does a guy feel comfortable betting $500,000 a hand in Phnom Penh or on the beach in Danang? ‘Is it a real game? Am I going to get robbed outside?’” he said. “These same guys are not going to Solaire [in Manila] and going to bet $600,000 a hand in the baccarat room.”

The temporary casino first opened in July 2015 then relaunched with a focus on VIP traffic last November.

It now has 16 gaming tables reserved for its own high rollers and those brought in by junket agents, as well as 32 tables and 106 gaming machines for regular players. The monthly VIP roll hit a high of $3.19 billion in April after which the company cautioned shareholders that “VIP gaming operations will cease to grow and have become saturated” due to capacity constraints.

In a July 22 report, Nomura estimated that Best Sunshine Live’s VIP roll per table was $6.8 million in the April-June quarter as compared to a Macau high of $1.1 million at Galaxy Entertainment Group’s flagship casino, which the bank estimated generated total VIP volume of $20 billion during the period. Best Sunshine plans to offer more than 200 tables and 400 slot machines at Grand Mariana.

Sunshine and security aren’t the only cards up Brown’s sleeve. Thanks to a favorable tax deal, Best Sunshine also pays commissions to high rollers and junket agents at a rate slightly higher than Macau casinos do.

In addition, Chinese nationals can visit Saipan visa-free unlike Las Vegas and other U.S. gaming markets. Rapid growth in arrivals from China and South Korea since 2011 has helped Saipan to rebound from a long decline in Japanese tourism. In the first nine months of the current fiscal year, the Northern Marianas attracted more visitors than in all of fiscal 2011.

But capacity, especially in terms of hotel space, is a serious issue in Saipan. Hotel occupancy rates have been running around 86 percent since last year, leaving little room for additional visitors. Ahead of the opening of Grand Mariana, Best Sunshine has bought blocks of rooms in two nearby hotels as well as a number of private homes. The company is also using five yachts for lodging, cruises and barbecues.

Best Sunshine is aiming to open 2,000 rooms — close to Saipan’s total current room count — by the end of 2018 in the first phase of its planned resort complex.

Three companies have agreed to invest in hotels in the complex, Brown said, though Best Sunshine is still waiting to hear if it will be able to take over a resort site the government has put to tender. He forecasts total investment by the company and the hotel investors in the first phase will exceed $2 billion.

Labor is another issue. Best Sunshine is gearing up to have 3,000 staff by the time Grand Mariana opens. Due to the tight labor supply on the island, only half its staff are locals, with much of the rest coming from the Philippines but because of an island-wide cap on foreign labor that was recently exceeded, more than 200 company staff have had to leave Saipan.

The influx of cash via Best Sunshine has been welcome in Saipan, which was previously a center for apparel manufacturing for companies from Hong Kong and other Asian markets who used it to avoid U.S. tariffs. The government legalized casinos in 2014, despite previous referendum votes against such a move, to help meet a public pension shortfall; Best Sunshine was required to put up $30 million when it received its license.

“[Business] hasn’t been this good in a long time,” said a server at Elegance Restaurant. Fast-food chains, rental car agencies and retailers are opening new shops. Manuel Sablan, executive director of the Commonwealth Development Authority, added: “There is high demand now for apartments and housing rentals because of the influx of workers. We’re seeing some marked increased in local [tax] revenue.”

It remains in question whether Saipan’s good fortune can benefit Tinian or Rota, which have both been open to casino gambling much longer but which lack international flight connections. Previous casinos have failed on both islands. Most recently, Tinian Dynasty Casino, opened by Hong Kong investors in 1998, closed last September and the connected hotel in March under the impact of heavy storm damage, a $75 million U.S. government fine for violations of anti-money laundering laws and years of losses that were further aggravated by Best Sunshine’s opening. The casino’s creditors are working through a restructuring plan that would bring the casino partly under the control of Hong Kong-listed Chinese Strategic Holdings.

Two groups have been licensed to open new casino hotels on Tinian, Macau’s Alter City Group and Bridge Investment Group, which is controlled by two Beijing-based businesspeople, but it’s unclear when either project will open. Bridge has kept a low profile this year but executives last year valued its project at $150 million. Alter City’s more ambitious project is valued at $1.2 billion. Managing Director Ken Lin told the Nikkei Asian Review that “it’s moving forward,” forecasting construction on a 1,000-room resort would start by year end.

Islanders have their fingers crossed. “The situation on Tinian is sincerely dire,” said Don Farrell, former chief of staff to the island’s mayor. The island’s government has been heavily dependent on gaming-related taxes revenue. “It appears that there will be a long drought ahead before Tinian’s economic recovery,” he said.

Yogonet.com/Mvariety.com

:p all the best!

:p all the best!:p all the best!