- Joined

- Apr 25, 2009

- Messages

- 2,068

- Points

- 83

Soon to be a reality! The country thanks you 66%. You can improve your ranking by improving the benefits (i.e. raising the returns to a more reasonable level than the current 2-4%) instead of raising withdrawal age, you dumb ass thambi!

https://www.businesstimes.com.sg/go...f-withdrawal-age-amid-growing-lifespans-study

====================

SINGAPORE can improve its pension system by raising the Central Provident Fund withdrawal age amid growing lifespans, and also open the fund to non-permanent resident workers, said the Melbourne Mercer Global Pension Index (MMGPI).

Currently, Singapore's pension system remains the best in Asia - for the 10th consecutive year - and ranks 7th globally, said MMGPI on Monday in its 2018 review.

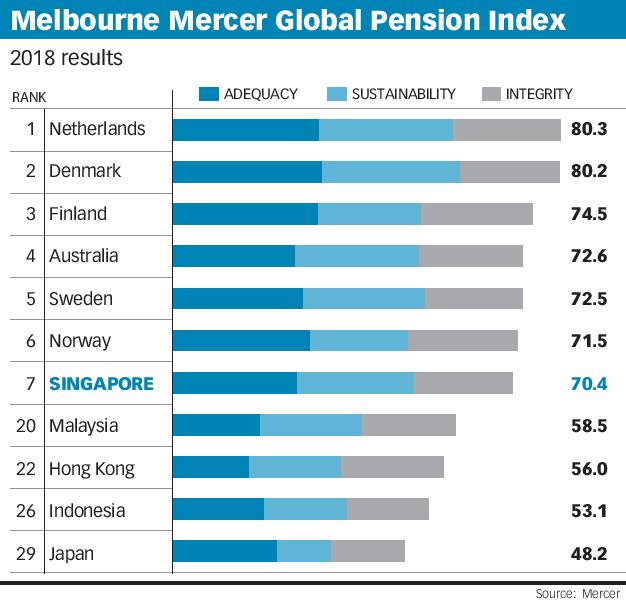

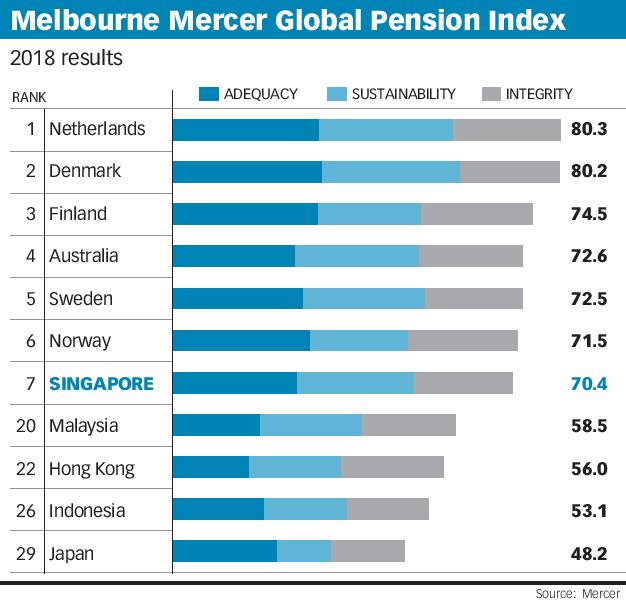

Measuring 34 pension systems, the Index shows that the Netherlands and Denmark (with scores of 80.3 and 80.2 respectively) both offer A-Grade world class retirement income systems with good benefits, clearly demonstrating their preparedness for tomorrow's ageing world, it said.

Singapore scored a B grade, climbing to 70.4 in 2018 from 69.4 in 2017 - which itself was an improvement from the 67.0 in 2016 - due to improvements in the sustainability sub-index. In the sub-indices, the Republic scored a C+ for adequacy, B for sustainability and A for integrity.

Singapore's overall B grade - shared with nations including Finland, Australia and Norway - is defined as "a system that has a sound structure, with many good features, but has some areas for improvement that differentiates it from an A-grade system".

"Having one of the most developed pension schemes in Asia, Singapore has continued to make improvements through the CPF by providing more flexibility to its members," said Mercer's director of strategic research, growth markets, Garry Hawker.

Singapore's retirement income system is based mainly on the Central Provident Fund which covers all employed Singaporean residents and permanent residents (PRs).

"The overall index value for the Singaporean system could be further increased by reducing the barriers to establishing tax-approved group corporate retirement plans; opening CPF to non-permanent residents; and increasing the age at which CPF members can access their savings that are set aside for retirement, as life expectancies rise," said Mr Hawker.

Ageing populations continue to pose a challenge to governments worldwide, with policymakers struggling to balance between sustainability of the pension system and adequacy for their retirees, said MMGPI.

Singapore ranked third in the world for average life expectancy last year, behind Japan and Switzerland, by the World Health Organisation. Singapore's life expectancy came in at 83.1 years, after Japan at 83.7 years, and Switzerland 83.4.

According to the Department of Statistics, there were 1,200 Singaporeans aged 100 and above as of last June, from 50 in 1990, so the number of centenarians among Singaporeans has surged by 24 times over that period.

Singapore's foreign workforce is substantial, noted MMGPI. The foreign workforce stood at 1.37 million in 2017; excluding foreign domestic workers and construction workers who are the lowest paid, the total foreign workforce numbered 788,500.

The resident workforce comprising Singaporeans and permanent residents is 2.27 million.

Pension reform is a lively topic in Singapore, and the government is keen to improve the sustainability and adequacy of the CPF, said Taimur Baig, DBS Bank group research chief economist.

"Raising the age of first withdrawal from CPF is not a particularly radical concept, and can certainly be considered," he said.

In many countries around the world, as life expectancy has risen, so has the age of pension, he said. The US, for example, has a lower life expectancy than Singapore, but a higher full benefit age (65) for social security.

"In our view, key would be to communicate the desirability of such reforms to the public transparently and incorporate Singapore-specific considerations first," said Mr Baig.

On the issue of including non-PRs into the CPF system, note that Singapore already provides substantial tax-benefit to non-PRs for retirement savings through the Supplementary Retirement Scheme, said Mr Baig.

https://www.businesstimes.com.sg/go...f-withdrawal-age-amid-growing-lifespans-study

====================

SINGAPORE can improve its pension system by raising the Central Provident Fund withdrawal age amid growing lifespans, and also open the fund to non-permanent resident workers, said the Melbourne Mercer Global Pension Index (MMGPI).

Currently, Singapore's pension system remains the best in Asia - for the 10th consecutive year - and ranks 7th globally, said MMGPI on Monday in its 2018 review.

Measuring 34 pension systems, the Index shows that the Netherlands and Denmark (with scores of 80.3 and 80.2 respectively) both offer A-Grade world class retirement income systems with good benefits, clearly demonstrating their preparedness for tomorrow's ageing world, it said.

Singapore scored a B grade, climbing to 70.4 in 2018 from 69.4 in 2017 - which itself was an improvement from the 67.0 in 2016 - due to improvements in the sustainability sub-index. In the sub-indices, the Republic scored a C+ for adequacy, B for sustainability and A for integrity.

Singapore's overall B grade - shared with nations including Finland, Australia and Norway - is defined as "a system that has a sound structure, with many good features, but has some areas for improvement that differentiates it from an A-grade system".

"Having one of the most developed pension schemes in Asia, Singapore has continued to make improvements through the CPF by providing more flexibility to its members," said Mercer's director of strategic research, growth markets, Garry Hawker.

Singapore's retirement income system is based mainly on the Central Provident Fund which covers all employed Singaporean residents and permanent residents (PRs).

"The overall index value for the Singaporean system could be further increased by reducing the barriers to establishing tax-approved group corporate retirement plans; opening CPF to non-permanent residents; and increasing the age at which CPF members can access their savings that are set aside for retirement, as life expectancies rise," said Mr Hawker.

Ageing populations continue to pose a challenge to governments worldwide, with policymakers struggling to balance between sustainability of the pension system and adequacy for their retirees, said MMGPI.

Singapore ranked third in the world for average life expectancy last year, behind Japan and Switzerland, by the World Health Organisation. Singapore's life expectancy came in at 83.1 years, after Japan at 83.7 years, and Switzerland 83.4.

According to the Department of Statistics, there were 1,200 Singaporeans aged 100 and above as of last June, from 50 in 1990, so the number of centenarians among Singaporeans has surged by 24 times over that period.

Singapore's foreign workforce is substantial, noted MMGPI. The foreign workforce stood at 1.37 million in 2017; excluding foreign domestic workers and construction workers who are the lowest paid, the total foreign workforce numbered 788,500.

The resident workforce comprising Singaporeans and permanent residents is 2.27 million.

Pension reform is a lively topic in Singapore, and the government is keen to improve the sustainability and adequacy of the CPF, said Taimur Baig, DBS Bank group research chief economist.

"Raising the age of first withdrawal from CPF is not a particularly radical concept, and can certainly be considered," he said.

In many countries around the world, as life expectancy has risen, so has the age of pension, he said. The US, for example, has a lower life expectancy than Singapore, but a higher full benefit age (65) for social security.

"In our view, key would be to communicate the desirability of such reforms to the public transparently and incorporate Singapore-specific considerations first," said Mr Baig.

On the issue of including non-PRs into the CPF system, note that Singapore already provides substantial tax-benefit to non-PRs for retirement savings through the Supplementary Retirement Scheme, said Mr Baig.