- Joined

- Jul 25, 2008

- Messages

- 13,503

- Points

- 113

#65

Ah neh lawyer

Quote: "Ms Mala, who attended the hearing via video, later asked that the case be stood down so she could attend to another client. The judge again chided her for this.

"Ms Mala, I don't know what planet you come from, but you do not ask the court to stand down just so you can attend to your other client," said the judge. "You'll be excused when I'm ready.""

Quote: "Ms Mala had asked that he be allowed to pay the fine in instalments. But when the judge asked her to provide the basic information needed for the application, she asked what the basic information required was. Judge Tan told her that this was something she as a lawyer should know."

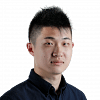

Samuel Chen (left) and Raymond Wong were fined after each pleading guilty to two charges of fraud under the CPF Act.

David Sun

June 30, 2021

SINGAPORE - Two men exploited an option to make investments using Central Provident Fund (CPF) monies, withdrawing more than $32,000 in an illegal scheme over a period of more than two years.

Samuel Chen Zhihao, 37, and Raymond Wong Tuck Wai, 38, were fined on Wednesday (June 30) after they each pleaded guilty to two charges of fraud under the CPF Act.

They each also had two similar charges taken into consideration for sentencing.

Chen, who masterminded the scheme, was fined $7,000, while Wong, who aided him in the scheme, was fined $5,000.

Chen had been the one to approach Wong, who had been his close friend since primary school.

Their plan involved Chen using his monies in his CPF Ordinary Account to cross-trade investments with Wong.

Chen would buy shares that had low trading volumes and sell them to Wong at an artificially low price.

Wong would then sell the shares back to Chen, who bought them back using his CPF monies at an artificially high price.

This way, Chen would consistently make losses in his trades and his CPF account, while Wong would make a profit in cash.

They were able to do this as the CPF Investment Scheme allows members to buy investment products using monies in their CPF Ordinary Account, with the goal of enhancing their financial security.

The proceeds from the sales of such products are required to be returned to the account.

However, Chen had actively sought out shares with low trading volumes, allowing the pair to manipulate the buying and selling of the shares exclusively to each other.

Wong kept a portion of the profits from the scheme and transferred the rest to Chen in cash.

Using this method, Chen managed to essentially withdraw more than $32,000 from his CPF from September 2017 to January 2019.

The proceedings of the case on Wednesday were marked by strong words from the judge to Chen's lawyer Mala Ravindran.

At one point, Ms Mala had tried asking that the court be cleared for the case to be heard.

But District Judge Tan Jen Tse chided her, saying that if there was no legal basis for her request, she should not bother making the application.

Ms Mala, who attended the hearing via video, later asked that the case be stood down so she could attend to another client.

The judge again chided her for this.

"Ms Mala, I don't know what planet you come from, but you do not ask the court to stand down just so you can attend to your other client," said the judge.

"You'll be excused when I'm ready."

During mitigation, Ms Mala said her client was "robbed of a clean record" because of the offence, and asked for a low fine to be given.

Chen has been ordered to pay back more than $46,000 to his CPF, on top of the fine that was handed to him on Wednesday.

Ms Mala had asked that he be allowed to pay the fine in instalments.

But when the judge asked her to provide the basic information needed for the application, she asked what the basic information required was.

Judge Tan told her that this was something she as a lawyer should know, before saying he was going to deal with Chen directly instead.

He ordered that Chen pay $1,000 first, with subsequent instalments of $500 to be paid monthly.

For each charge of defrauding the CPF with their scheme, the men could have been jailed for up to six months, or fined up to $5,000, or both.

Ah neh lawyer

Quote: "Ms Mala, who attended the hearing via video, later asked that the case be stood down so she could attend to another client. The judge again chided her for this.

"Ms Mala, I don't know what planet you come from, but you do not ask the court to stand down just so you can attend to your other client," said the judge. "You'll be excused when I'm ready.""

Quote: "Ms Mala had asked that he be allowed to pay the fine in instalments. But when the judge asked her to provide the basic information needed for the application, she asked what the basic information required was. Judge Tan told her that this was something she as a lawyer should know."

2 men fined over illegal scheme leading to withdrawal of $32,000 from CPF account

Samuel Chen (left) and Raymond Wong were fined after each pleading guilty to two charges of fraud under the CPF Act.

David Sun

June 30, 2021

SINGAPORE - Two men exploited an option to make investments using Central Provident Fund (CPF) monies, withdrawing more than $32,000 in an illegal scheme over a period of more than two years.

Samuel Chen Zhihao, 37, and Raymond Wong Tuck Wai, 38, were fined on Wednesday (June 30) after they each pleaded guilty to two charges of fraud under the CPF Act.

They each also had two similar charges taken into consideration for sentencing.

Chen, who masterminded the scheme, was fined $7,000, while Wong, who aided him in the scheme, was fined $5,000.

Chen had been the one to approach Wong, who had been his close friend since primary school.

Their plan involved Chen using his monies in his CPF Ordinary Account to cross-trade investments with Wong.

Chen would buy shares that had low trading volumes and sell them to Wong at an artificially low price.

Wong would then sell the shares back to Chen, who bought them back using his CPF monies at an artificially high price.

This way, Chen would consistently make losses in his trades and his CPF account, while Wong would make a profit in cash.

They were able to do this as the CPF Investment Scheme allows members to buy investment products using monies in their CPF Ordinary Account, with the goal of enhancing their financial security.

The proceeds from the sales of such products are required to be returned to the account.

However, Chen had actively sought out shares with low trading volumes, allowing the pair to manipulate the buying and selling of the shares exclusively to each other.

Wong kept a portion of the profits from the scheme and transferred the rest to Chen in cash.

Using this method, Chen managed to essentially withdraw more than $32,000 from his CPF from September 2017 to January 2019.

The proceedings of the case on Wednesday were marked by strong words from the judge to Chen's lawyer Mala Ravindran.

At one point, Ms Mala had tried asking that the court be cleared for the case to be heard.

But District Judge Tan Jen Tse chided her, saying that if there was no legal basis for her request, she should not bother making the application.

Ms Mala, who attended the hearing via video, later asked that the case be stood down so she could attend to another client.

The judge again chided her for this.

"Ms Mala, I don't know what planet you come from, but you do not ask the court to stand down just so you can attend to your other client," said the judge.

"You'll be excused when I'm ready."

During mitigation, Ms Mala said her client was "robbed of a clean record" because of the offence, and asked for a low fine to be given.

Chen has been ordered to pay back more than $46,000 to his CPF, on top of the fine that was handed to him on Wednesday.

Ms Mala had asked that he be allowed to pay the fine in instalments.

But when the judge asked her to provide the basic information needed for the application, she asked what the basic information required was.

Judge Tan told her that this was something she as a lawyer should know, before saying he was going to deal with Chen directly instead.

He ordered that Chen pay $1,000 first, with subsequent instalments of $500 to be paid monthly.

For each charge of defrauding the CPF with their scheme, the men could have been jailed for up to six months, or fined up to $5,000, or both.