- Joined

- Jul 15, 2008

- Messages

- 21,130

- Points

- 113

ECONOMY

Holiday tax break redux considered

Shopping period may be longer than before

"The measure to stimulate consumption during the festive season may be similar to the tax breaks we used last year, but this time we may extend the period to longer than a week," Mr Visut said.

Last year, the Finance Ministry offered tax breaks worth up to 15,000 baht per person in the final seven days of 2015, adding 0.2 points to GDP growth.

The incentive prompted consumers to spend money at shopping centres all over the country, with combined spending estimated to have risen by 150 billion baht during the final week of the year.

While Mr Visut refused to give concrete details, a senior official suggested that the ministry is considering a period of holiday tax breaks from between two weeks to one month.

Mr Visut said that over the past year the government has lent support to small and medium-sized enterprises and the farm sector, but consumption has remained stagnant in line with the slow improvement in purchasing power. As a result, it is considering returning to its wheelhouse of holiday shopping tax breaks.

He said that last year's measure successfully compelled more than 2 million middle- and high-income earners to spend more in order to capitalise on the tax benefits, costing the government a total of 4 billion baht in tax rebates.

"Also, the measure's conditions forced operators that wanted to get benefits from increased sales to enter into the formal tax system," Mr Visut said.

Under last year's year-end tax incentive scheme, a person whose income tax rate was 20% was entitled to 3,000 baht in savings if he or she spent 15,000 during the last seven days of the year, while a person who paid 10% in income tax was entitled to a 1,500-baht tax write-off.

At present, the tax rates are zero for yearly earnings of 150,000 baht or less, and up to 35% for yearly earnings of more than 4 million baht.

To qualify for the tax deduction, all transactions must be verified with a value-added-tax invoice, as it is meant to attract service or product providers to pay VAT in order to be eligible for the scheme.

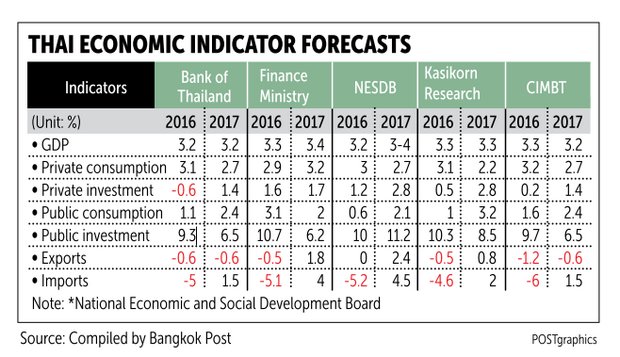

Somchai Sujjapongse, permanent secretary of the Finance Ministry, said that if the measure is implemented, it is expected to boost full-year GDP growth to 3.4% from 3.3% projected earlier.

"It is good to use the excess budget to temporarily boost spending," Mr Somchai said. "In the mid-to-long term, the government has already given support through public spending on both small projects and megaprojects."

Krisada Chinavicharana, director-general of the Fiscal Policy Office, said that apart from the holiday tax breaks, the Finance Ministry is also considering reducing import tariffs for cosmetics and perfumes, as requested by the Tourism and Sports Ministry.

The import tax cut for cosmetics and perfumes is intended to boost spending from locals and tourists alike.

After initial discussions between the two ministries, the Finance Ministry agreed that it would be possible to lower the tax on particular goods, but the measure must be temporary.

"So far, we have talked about a two-week period, but the timing of the measure depends on the Tourism and Sports Ministry's decision," Mr Krisada said, adding that it must have a purchase limit of 1-2 items per buyer in order to prevent bulk buying for the sake of commercial resale.

The Finance Ministry has asked the Tourism and Sports Ministry to discuss the details with operators before making a final decision.

Currently, excise and import duties for cosmetics and perfumes are 15% and 30%, respectively.

Annual revenue from the duties averages 200 million baht.

Amornthep Chawla, head of research at CIMB Thai Bank, said that the holiday tax breaks and lower tax for cosmetics would affect two groups of buyers: Thai middle- and high-income earners, who are normally able to afford these goods anyway, and tourists who travel to Thailand.

He said that as Thai middle- and high-income earners have not been affected much by the economic slowdown thus far, their purchasing power remains strong, though poor confidence in the economy may have limited their spending.

"These people don't just consider the prices of these goods, but also the future prospects of the economy and their incomes," Mr Amornthep said.

He said it's more likely that the policy will help increase the spending of tourists travelling to Thailand, since right now neither their spending per person nor length of stay is great.

"The government will have to also consider that other countries can also lower their tariffs for these goods to help attract tourists," Mr Amornthep said.

He said these goods are mostly imported, so only a small portion of sales will go to Thai companies or Thai people.

"I recommend not only lowering the tariffs, but also supporting or investing more in Thai brand names and luxury products to help generate income for Thai people," Mr Amornthep said.

Paiboon Kanokwattanawan, chief executive of The Mall Group, said the stimulus scheme is good for the retail sector, but the timing might be better if the government implemented such measures during the low season as opposed to the holiday season, when people are already in the mood for shopping.

"The spending ceiling of 15,000 baht seems a little too low to make a big impact," he said. "As for lowering the taxes on select products, the government should do more homework and learn which products are popular among tourists. They should also learn for which products Thailand won't be able to compete with rival countries.

"That way, they'll know which goods to throw their support behind, benefiting the country," Mr Paiboon added.

Holiday tax break redux considered

Shopping period may be longer than before

- Bangkok Post Published: 25/11/2016 at 06:00 AM

"The measure to stimulate consumption during the festive season may be similar to the tax breaks we used last year, but this time we may extend the period to longer than a week," Mr Visut said.

Last year, the Finance Ministry offered tax breaks worth up to 15,000 baht per person in the final seven days of 2015, adding 0.2 points to GDP growth.

The incentive prompted consumers to spend money at shopping centres all over the country, with combined spending estimated to have risen by 150 billion baht during the final week of the year.

While Mr Visut refused to give concrete details, a senior official suggested that the ministry is considering a period of holiday tax breaks from between two weeks to one month.

Mr Visut said that over the past year the government has lent support to small and medium-sized enterprises and the farm sector, but consumption has remained stagnant in line with the slow improvement in purchasing power. As a result, it is considering returning to its wheelhouse of holiday shopping tax breaks.

He said that last year's measure successfully compelled more than 2 million middle- and high-income earners to spend more in order to capitalise on the tax benefits, costing the government a total of 4 billion baht in tax rebates.

"Also, the measure's conditions forced operators that wanted to get benefits from increased sales to enter into the formal tax system," Mr Visut said.

Under last year's year-end tax incentive scheme, a person whose income tax rate was 20% was entitled to 3,000 baht in savings if he or she spent 15,000 during the last seven days of the year, while a person who paid 10% in income tax was entitled to a 1,500-baht tax write-off.

At present, the tax rates are zero for yearly earnings of 150,000 baht or less, and up to 35% for yearly earnings of more than 4 million baht.

To qualify for the tax deduction, all transactions must be verified with a value-added-tax invoice, as it is meant to attract service or product providers to pay VAT in order to be eligible for the scheme.

Somchai Sujjapongse, permanent secretary of the Finance Ministry, said that if the measure is implemented, it is expected to boost full-year GDP growth to 3.4% from 3.3% projected earlier.

"It is good to use the excess budget to temporarily boost spending," Mr Somchai said. "In the mid-to-long term, the government has already given support through public spending on both small projects and megaprojects."

Krisada Chinavicharana, director-general of the Fiscal Policy Office, said that apart from the holiday tax breaks, the Finance Ministry is also considering reducing import tariffs for cosmetics and perfumes, as requested by the Tourism and Sports Ministry.

The import tax cut for cosmetics and perfumes is intended to boost spending from locals and tourists alike.

After initial discussions between the two ministries, the Finance Ministry agreed that it would be possible to lower the tax on particular goods, but the measure must be temporary.

"So far, we have talked about a two-week period, but the timing of the measure depends on the Tourism and Sports Ministry's decision," Mr Krisada said, adding that it must have a purchase limit of 1-2 items per buyer in order to prevent bulk buying for the sake of commercial resale.

The Finance Ministry has asked the Tourism and Sports Ministry to discuss the details with operators before making a final decision.

Currently, excise and import duties for cosmetics and perfumes are 15% and 30%, respectively.

Annual revenue from the duties averages 200 million baht.

Amornthep Chawla, head of research at CIMB Thai Bank, said that the holiday tax breaks and lower tax for cosmetics would affect two groups of buyers: Thai middle- and high-income earners, who are normally able to afford these goods anyway, and tourists who travel to Thailand.

He said that as Thai middle- and high-income earners have not been affected much by the economic slowdown thus far, their purchasing power remains strong, though poor confidence in the economy may have limited their spending.

"These people don't just consider the prices of these goods, but also the future prospects of the economy and their incomes," Mr Amornthep said.

He said it's more likely that the policy will help increase the spending of tourists travelling to Thailand, since right now neither their spending per person nor length of stay is great.

"The government will have to also consider that other countries can also lower their tariffs for these goods to help attract tourists," Mr Amornthep said.

He said these goods are mostly imported, so only a small portion of sales will go to Thai companies or Thai people.

"I recommend not only lowering the tariffs, but also supporting or investing more in Thai brand names and luxury products to help generate income for Thai people," Mr Amornthep said.

Paiboon Kanokwattanawan, chief executive of The Mall Group, said the stimulus scheme is good for the retail sector, but the timing might be better if the government implemented such measures during the low season as opposed to the holiday season, when people are already in the mood for shopping.

"The spending ceiling of 15,000 baht seems a little too low to make a big impact," he said. "As for lowering the taxes on select products, the government should do more homework and learn which products are popular among tourists. They should also learn for which products Thailand won't be able to compete with rival countries.

"That way, they'll know which goods to throw their support behind, benefiting the country," Mr Paiboon added.