-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

A Singaporean's guide to living in Thailand

- Thread starter Leongsam

- Start date

- Joined

- Jul 15, 2008

- Messages

- 21,110

- Points

- 113

Moneyed slice of thai mango today. VAT up, no less than 8%?

VAT set to be increased

Up 1 percentage point at least, says minister

Bangkok Published: 2/12/2014 at 06:00 AM

Newspaper section: Business

Value-added tax (VAT) may be raised by at least one percentage point next year to finance the government's planned loosening of fiscal policy by increasing the fiscal-2015 budget by 12-13% from this year's.

Finance Minister Sommai Phasee said the raise would be the first step towards increasing the VAT rate, but no concrete decision on the hike had been made yet.

"It has to be increased by at least a percentage point, maybe even two points, but there'll be further discussion about this," he said.

The National Council for Peace and Order earlier approved an extension of the 7% rate for another fiscal year, to Sept 30, 2015, with the aim of smoothing domestic consumption, which has faltered since the second half of last year.

The proposed VAT hike will be next on the agenda after the inheritance and land and buildings taxes have won National Legislative Assembly approval.

Raising VAT appears to be a challenging move as seen from the fact that previous administrations opted to keep the 7% rate lest their popularity subside. The tax was introduced in 1992 at a rate of 10% but immediately slashed to 7% at the request of business operators who felt the rate was too high.

Mr Sommai said revenue collection was expected to meet the target of 2.325 trillion baht for this fiscal year started Oct 1, while revenue collection in 2016 was projected to be even higher due to tax reform measures, particularly the land and buildings tax as well as VAT.

"Tax revenue collection in 2016 is expected to increase reasonably, and this will contribute to an increase in government spending, which will be higher than this year's expenditure," he said.

Mr Sommai said there was also room for a greater fiscal deficit in 2016, in which the deficit could be at the same or higher levels compared with 2015.

Amid expectations of cabinet deliberation next month, land and buildings valued at more than 1 million baht would be subject to tax, with unused or vacant land to be charged at a progressive rate every three years but not exceeding a maximum level of 4% of the appraised value, according to the draft of the land and buildings tax bill.

The Finance Ministry will deliberate its fiscal-2016 budget in mid-January, and the size of state expenditure is expected to be 12-13% higher, Mr Sommai said, adding that the government would use this budget to develop the economy, social security programmes, education and healthcare services.

The fiscal-2016 budget is projected at 2.88 trillion baht, up by some 300 billion baht from the sum of 2.575 trillion baht for the fiscal-2015 budget, he said.

In the meantime, the economy is expected to grow by up to 4% next year, but the rate could be higher, given additional government investments, said Kobsak Pootrakul, an executive vice-president of Bangkok Bank.

However, the private sector's confidence could increase further if the government can initiate certain investment projects to become more tangible, he said.

Mr Kobsak said despite ostensible higher economic growth next year, the most crucial factor was laying the fundamentals for both economic development and reform in the long run.

Inflation is projected to remain subdued on the back of a decline in energy prices, he said. The Bank of Thailand's Monetary Policy Committee is not expected to lower its policy interest rate further since exports have recorded a recovery, domestic consumption in the high-earning segment has improved and government spending will resume, Mr Kobsak said.

He said the rate-setting council would assess economic data in next year's first quarter before deciding whether to hike the benchmark interest rate in the second quarter.

Pichit Akrathit, chairman and chief executive of Asia Wealth Securities Co, said the SET index was expected to reach 1,800 points next year as a result of excessive financial liquidity coming from the European Central Bank and the Bank of Japan coupled with an improved outlook for a global economic recovery.

State investment policies and domestic political stability also support the index reaching that threshold, he said.

VAT set to be increased

Up 1 percentage point at least, says minister

Bangkok Published: 2/12/2014 at 06:00 AM

Newspaper section: Business

Value-added tax (VAT) may be raised by at least one percentage point next year to finance the government's planned loosening of fiscal policy by increasing the fiscal-2015 budget by 12-13% from this year's.

Finance Minister Sommai Phasee said the raise would be the first step towards increasing the VAT rate, but no concrete decision on the hike had been made yet.

"It has to be increased by at least a percentage point, maybe even two points, but there'll be further discussion about this," he said.

The National Council for Peace and Order earlier approved an extension of the 7% rate for another fiscal year, to Sept 30, 2015, with the aim of smoothing domestic consumption, which has faltered since the second half of last year.

The proposed VAT hike will be next on the agenda after the inheritance and land and buildings taxes have won National Legislative Assembly approval.

Raising VAT appears to be a challenging move as seen from the fact that previous administrations opted to keep the 7% rate lest their popularity subside. The tax was introduced in 1992 at a rate of 10% but immediately slashed to 7% at the request of business operators who felt the rate was too high.

Mr Sommai said revenue collection was expected to meet the target of 2.325 trillion baht for this fiscal year started Oct 1, while revenue collection in 2016 was projected to be even higher due to tax reform measures, particularly the land and buildings tax as well as VAT.

"Tax revenue collection in 2016 is expected to increase reasonably, and this will contribute to an increase in government spending, which will be higher than this year's expenditure," he said.

Mr Sommai said there was also room for a greater fiscal deficit in 2016, in which the deficit could be at the same or higher levels compared with 2015.

Amid expectations of cabinet deliberation next month, land and buildings valued at more than 1 million baht would be subject to tax, with unused or vacant land to be charged at a progressive rate every three years but not exceeding a maximum level of 4% of the appraised value, according to the draft of the land and buildings tax bill.

The Finance Ministry will deliberate its fiscal-2016 budget in mid-January, and the size of state expenditure is expected to be 12-13% higher, Mr Sommai said, adding that the government would use this budget to develop the economy, social security programmes, education and healthcare services.

The fiscal-2016 budget is projected at 2.88 trillion baht, up by some 300 billion baht from the sum of 2.575 trillion baht for the fiscal-2015 budget, he said.

In the meantime, the economy is expected to grow by up to 4% next year, but the rate could be higher, given additional government investments, said Kobsak Pootrakul, an executive vice-president of Bangkok Bank.

However, the private sector's confidence could increase further if the government can initiate certain investment projects to become more tangible, he said.

Mr Kobsak said despite ostensible higher economic growth next year, the most crucial factor was laying the fundamentals for both economic development and reform in the long run.

Inflation is projected to remain subdued on the back of a decline in energy prices, he said. The Bank of Thailand's Monetary Policy Committee is not expected to lower its policy interest rate further since exports have recorded a recovery, domestic consumption in the high-earning segment has improved and government spending will resume, Mr Kobsak said.

He said the rate-setting council would assess economic data in next year's first quarter before deciding whether to hike the benchmark interest rate in the second quarter.

Pichit Akrathit, chairman and chief executive of Asia Wealth Securities Co, said the SET index was expected to reach 1,800 points next year as a result of excessive financial liquidity coming from the European Central Bank and the Bank of Japan coupled with an improved outlook for a global economic recovery.

State investment policies and domestic political stability also support the index reaching that threshold, he said.

- Joined

- Jul 19, 2008

- Messages

- 30,580

- Points

- 0

impact car show

bikes

racing car

models

bikes

racing car

models

- Joined

- Jul 19, 2008

- Messages

- 30,580

- Points

- 0

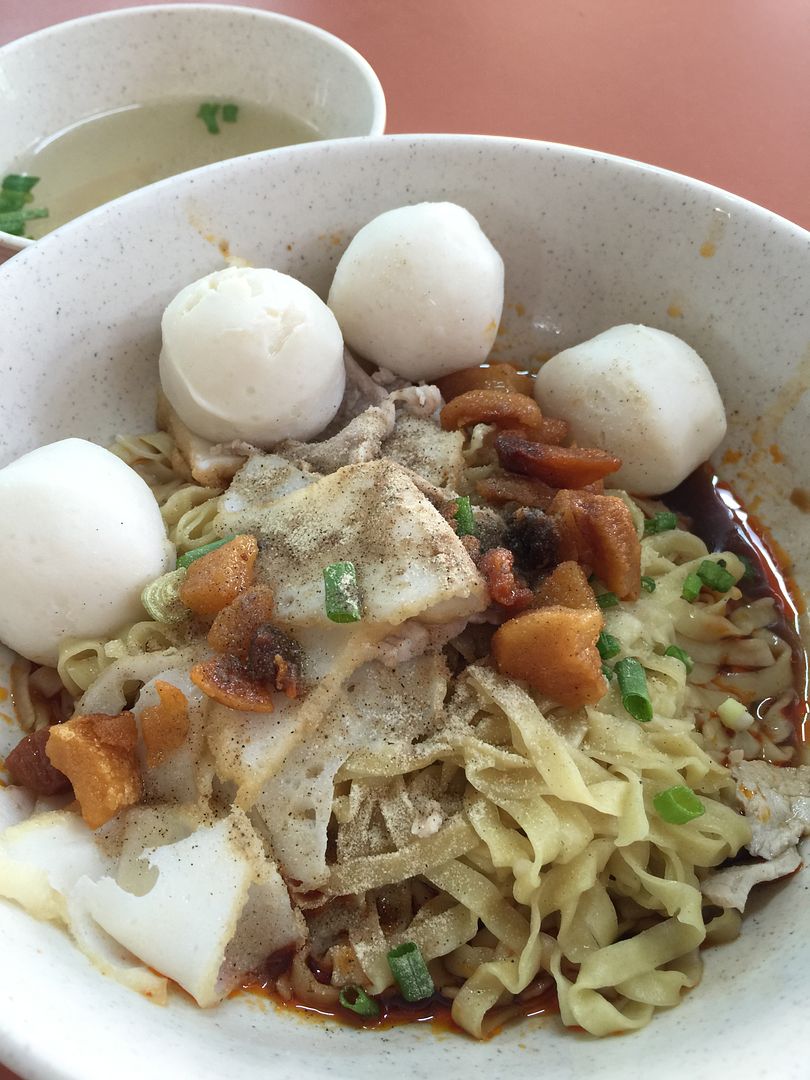

Lunch at a HK restaurant

- Joined

- Jul 19, 2008

- Messages

- 30,580

- Points

- 0

Jah, nice pics, any luck with any of them pretty?

Thanks joe those are professional models and they give priority to guys holding dslr with huge lens cos they might be working for the press or car magazines.

- Joined

- Jul 19, 2008

- Messages

- 30,580

- Points

- 0

audrey at central embassy

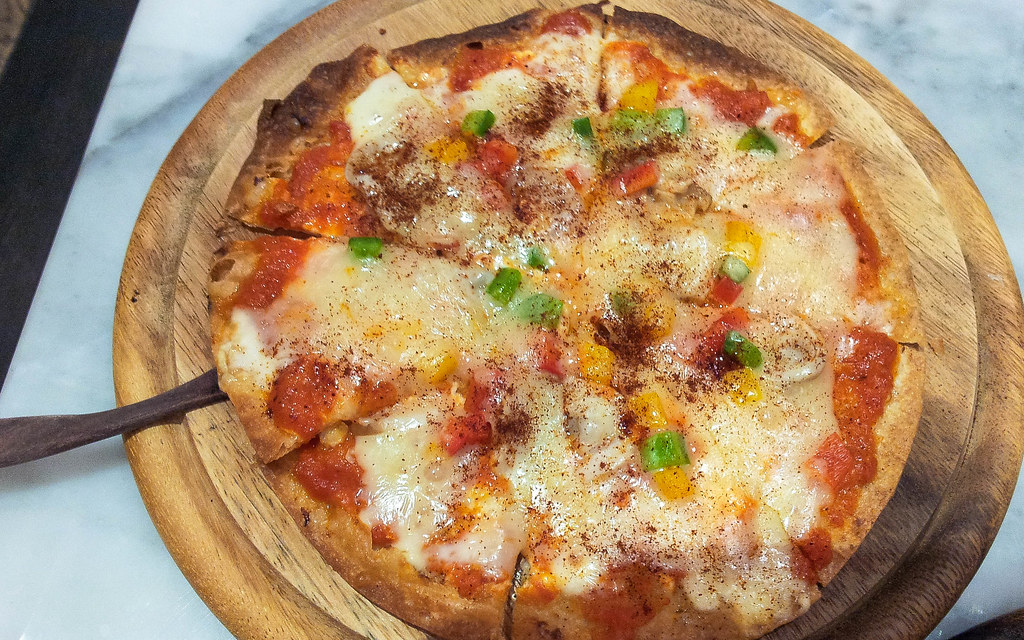

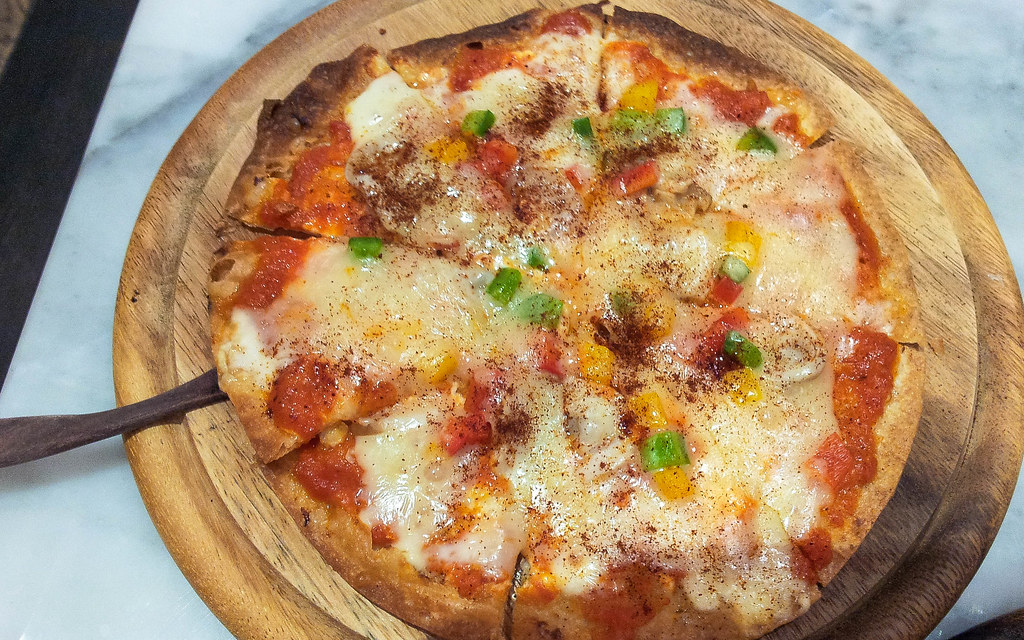

tom yung goong pizza this is really good.

pepperoni

nachos with sauce

tom yung goong pizza this is really good.

pepperoni

nachos with sauce

- Joined

- Jul 19, 2008

- Messages

- 30,580

- Points

- 0

forgot to include this cute chick at the car show at impact and these 2 cool rides

- Joined

- Jul 19, 2008

- Messages

- 30,580

- Points

- 0

free breakfast at suwan park view over 2 days

dining area

food selection

pool area outside dining area

sausage, bacon meal

rice and soup

fruits

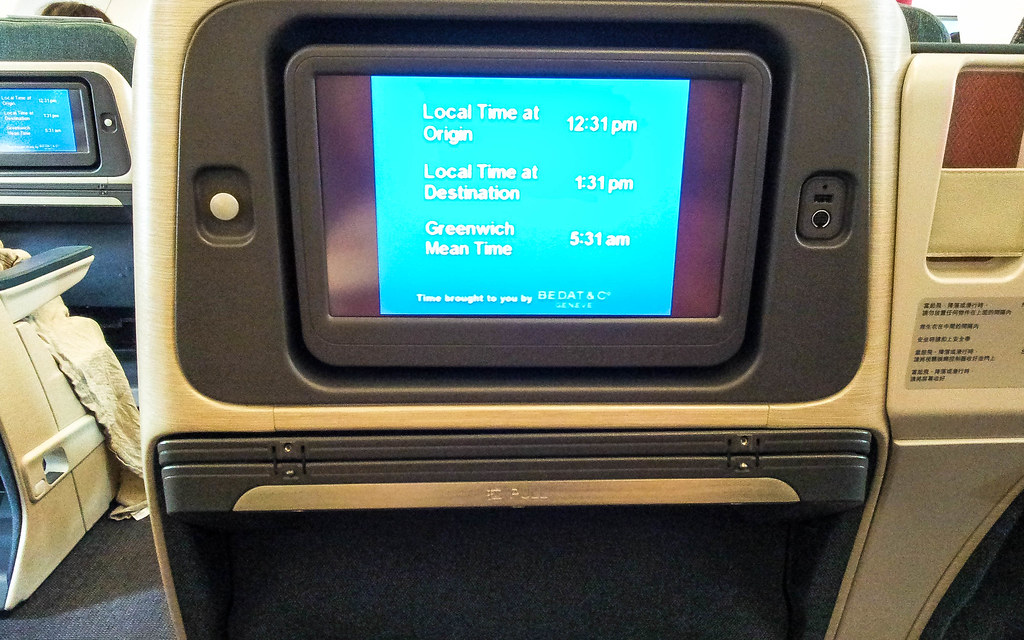

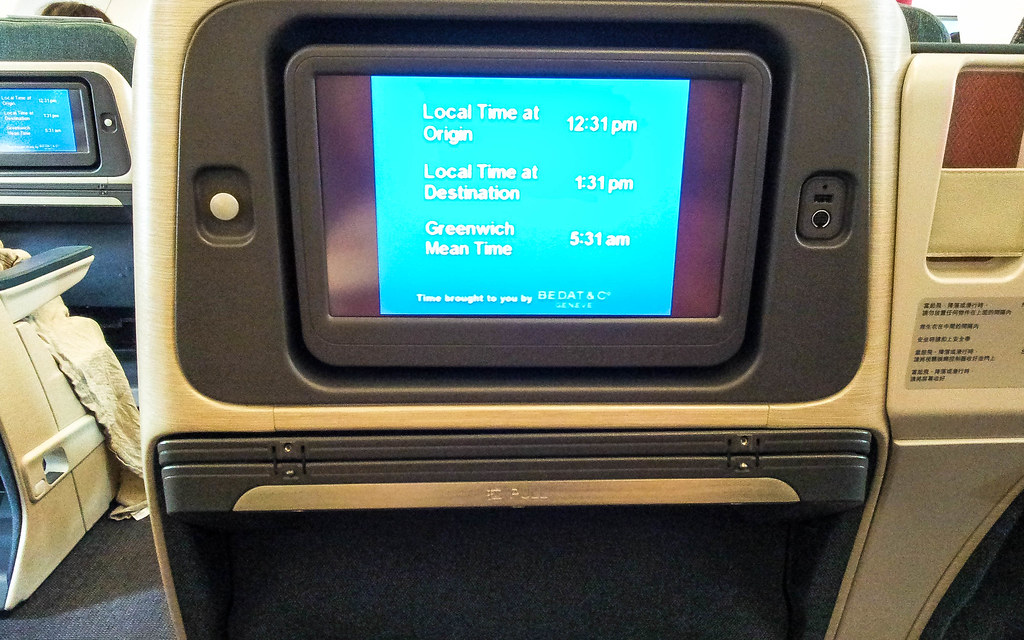

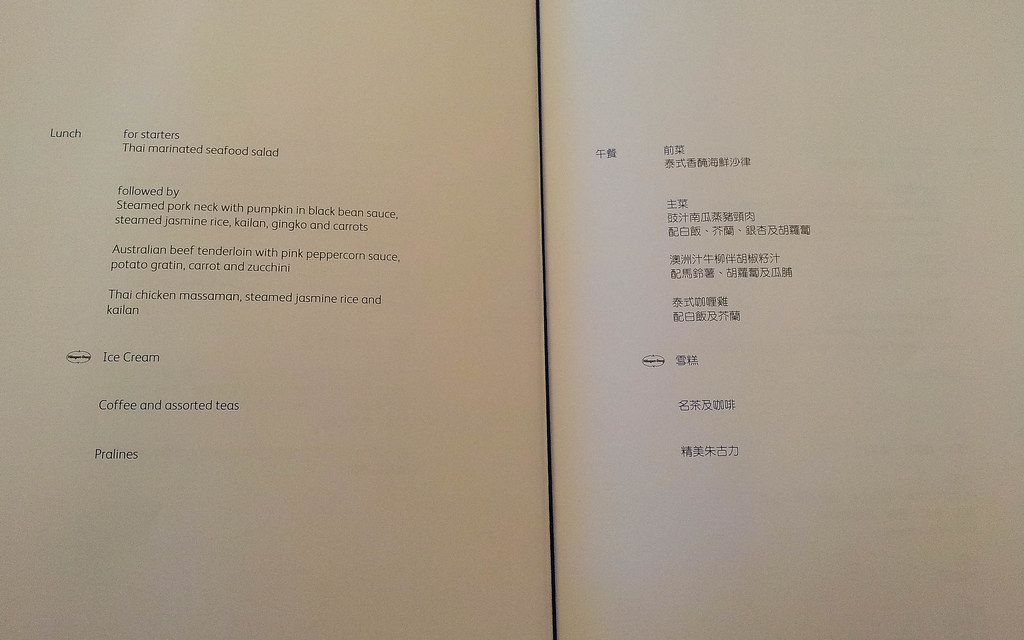

Flew back via business class on cathay pacific

touch screen tv

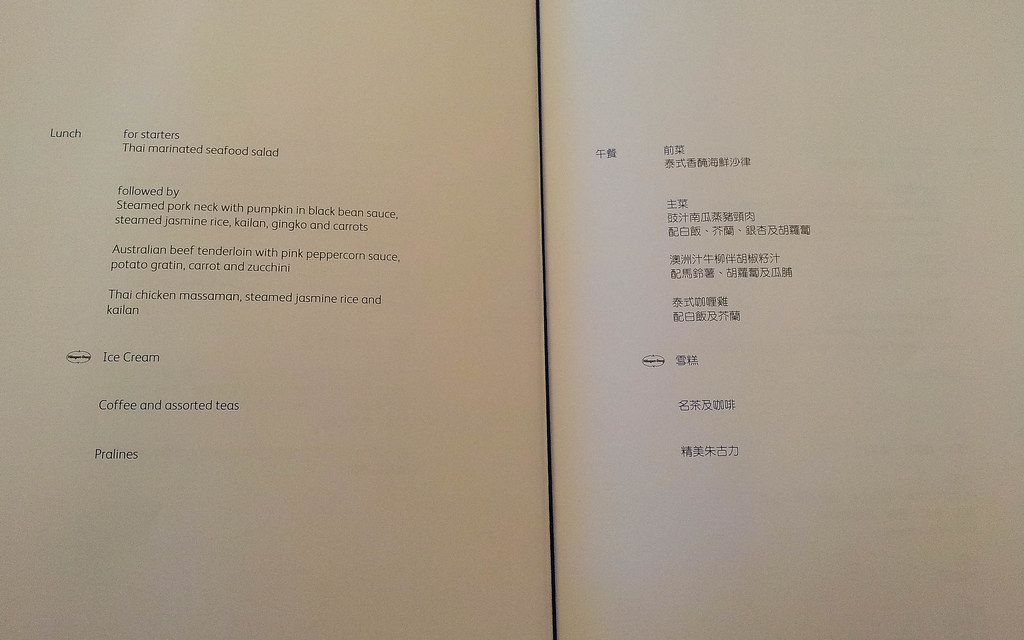

menu

3 course meal, appetizers, main course and dessert

Here's the wine, spirits selection

Here's the starter meal

order a johnny walker gold on the rocks to go with it.

Here's the main course. A beef meal

A nice champagne after the main course

Chocolate ice cream for dessert and no your eyes aren't playing tricks on you but there's 3 glasses and a coffee with some water to help wash down the johnny walker whiskey

dining area

food selection

pool area outside dining area

sausage, bacon meal

rice and soup

fruits

Flew back via business class on cathay pacific

touch screen tv

menu

3 course meal, appetizers, main course and dessert

Here's the wine, spirits selection

Here's the starter meal

order a johnny walker gold on the rocks to go with it.

Here's the main course. A beef meal

A nice champagne after the main course

Chocolate ice cream for dessert and no your eyes aren't playing tricks on you but there's 3 glasses and a coffee with some water to help wash down the johnny walker whiskey

- Joined

- Jul 15, 2008

- Messages

- 21,110

- Points

- 113

Power brekkie ...for champions :p. Personally, brekkie with a reasonable selection and ambience can help start (or break) your day.free breakfast at suwan park view over 2 days

Flew back via business class on cathay pacific

Bumped up to business on CX both onward and return before, thanks to over-booking in cattle class

Rare chance away from hordes

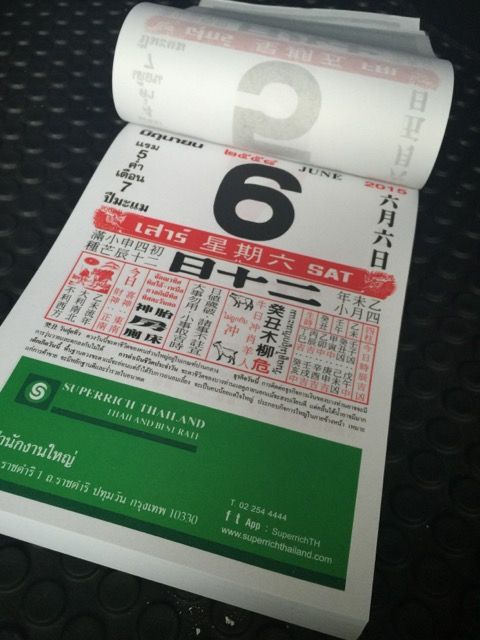

Rare chance away from hordesCashing in on your famly's heirloom? Your wallet must be bursting with thb1000 notes :p Old style calendars here had racing days marked.joetys said:change money in SuperRich, they gave me a Chinese calender

- Joined

- Aug 8, 2008

- Messages

- 28,849

- Points

- 113

Looks yummy...sweet ones rite?

As in nonya sweet meat bachang?

No la I inly like the trditional hokkien chang, my maid likes nonya so got her a few of nonyas

- Joined

- Jul 15, 2008

- Messages

- 21,110

- Points

- 113

A juvenile slice of thai mango :p

Girl, 9, drives car to school

Bangkok Post Published: 3/12/2014 at 05:38 PM

A video clip showing a nine-year old girl driving a car to school posted on a Facebook page has drawn widespread criticism of the parents.

The clip, “Real story, dad allows kid to drive to school (1/12/57)” was posted on a popular You Like Clip Ded page on Tuesday as a follow up from another clip which shows a girl driving in a red car.

As of 4pm Wednesday, the clip had received 962,000 views with 83,295 likes and 12,301 shares. It drew loads of comment, most of which denounce the illegality of allowing the underage girl to drive. Some people, however, commented that the girl was doing well.

Most of the comments concerned safety, not for the girl herself but for other drivers.

Chanji VinzDayz wrote: "This is certainly illegal as she does not have a driving licence, or the maturity, and unlikely to make a proper decision in an emergency. If there is an accident, what will the other person do? It is like suicide."

A nine-year-old girl drives a car to school in Surat Thani. Louis Lunthom wrote that he respects children who can do better than others of the same age, but not in this case because it may be dangerous to others, and even to the girl who has not been in dangerous situations like being cut off or overtaken. He asked whether this little girl would have the reactions or decision-making abillity to avoid danger.

According to Thairath online, the girl’s father Yongyuth Mankaprathum asked the public not to condemn his family.

He said the girl started driving when she was seven years old. Normally, she drives the eight kilometres to her school in Surat Thani’s Muang district.

The longest trip was from Surat Thani to Phuket when she drove a Land Rover without an accident, her father said.

In the clip, which seems to be taken from the back passenger seat, the father said he also allowed his daughter to drive alone while he followed in another car behind her.

He admitted that it is illegal and said he will not allow her to drive again.

Mr Yongyuth said the girl was upset and asked why she could not continue to drive as she had never caused an accident, so he had to explain that it is the law.

Pol Col Suwat Suksri, superintendent of Surat Thani police station, has instructed officers to order Mr Yongyuth to report in and pay a 2,000 baht fine. There is no punishment clause for underage drivers, but her parents will be warned, he said

Girl, 9, drives car to school

Bangkok Post Published: 3/12/2014 at 05:38 PM

A video clip showing a nine-year old girl driving a car to school posted on a Facebook page has drawn widespread criticism of the parents.

The clip, “Real story, dad allows kid to drive to school (1/12/57)” was posted on a popular You Like Clip Ded page on Tuesday as a follow up from another clip which shows a girl driving in a red car.

As of 4pm Wednesday, the clip had received 962,000 views with 83,295 likes and 12,301 shares. It drew loads of comment, most of which denounce the illegality of allowing the underage girl to drive. Some people, however, commented that the girl was doing well.

Most of the comments concerned safety, not for the girl herself but for other drivers.

Chanji VinzDayz wrote: "This is certainly illegal as she does not have a driving licence, or the maturity, and unlikely to make a proper decision in an emergency. If there is an accident, what will the other person do? It is like suicide."

A nine-year-old girl drives a car to school in Surat Thani. Louis Lunthom wrote that he respects children who can do better than others of the same age, but not in this case because it may be dangerous to others, and even to the girl who has not been in dangerous situations like being cut off or overtaken. He asked whether this little girl would have the reactions or decision-making abillity to avoid danger.

According to Thairath online, the girl’s father Yongyuth Mankaprathum asked the public not to condemn his family.

He said the girl started driving when she was seven years old. Normally, she drives the eight kilometres to her school in Surat Thani’s Muang district.

The longest trip was from Surat Thani to Phuket when she drove a Land Rover without an accident, her father said.

In the clip, which seems to be taken from the back passenger seat, the father said he also allowed his daughter to drive alone while he followed in another car behind her.

He admitted that it is illegal and said he will not allow her to drive again.

Mr Yongyuth said the girl was upset and asked why she could not continue to drive as she had never caused an accident, so he had to explain that it is the law.

Pol Col Suwat Suksri, superintendent of Surat Thani police station, has instructed officers to order Mr Yongyuth to report in and pay a 2,000 baht fine. There is no punishment clause for underage drivers, but her parents will be warned, he said

- Joined

- Aug 8, 2008

- Messages

- 28,849

- Points

- 113

Similar threads

- Replies

- 0

- Views

- 191

- Replies

- 2

- Views

- 157

- Replies

- 2

- Views

- 198