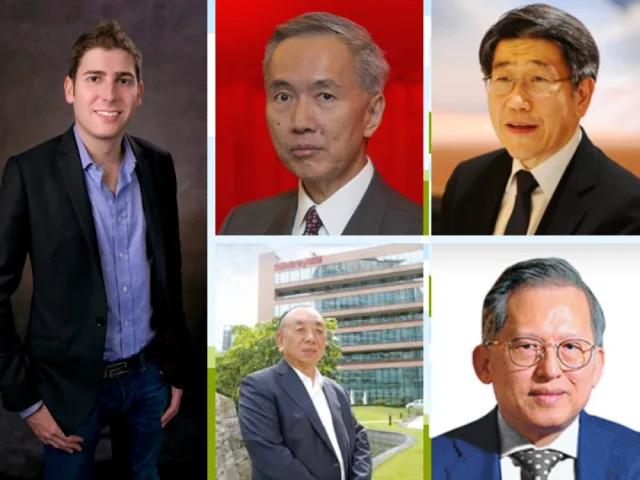

Singapore’s top 50 richest see 10pc wealth surge to US$195b; Meta’s Eduardo Saverin retains prime spot on Forbes’ list with US$29b

Malay Mail

Fri, 6 September 2024 at 4:37 pm GMT+83-min read

Malay Mail

SINGAPORE, Sept 6 — The combined fortune of Singapore’s 50 wealthiest individuals has surged by over 10 per cent to US$195 billion (RM844 billion) in 2024, up from US$177 billion the previous year.

Despite this significant rise, their collective wealth still falls short of the US$208 billion recorded in 2021, Forbes Asia said in a statement yesterday.

The latest Forbes list reveals that nearly two-thirds of the individuals featured saw their fortunes increase, buoyed by Singapore’s robust economic growth and a buoyant stock market.

ADVERTISEMENT

This positive shift is attributed to a series of factors according to Forbes, including the swearing-in of Prime Minister Lawrence Wong in May and a boost from the influx of visitors for sold-out concerts by pop star Taylor Swift and rock band Coldplay.

Eduardo Saverin, co-founder of Meta Platforms (formerly Facebook), retains his position as Singapore’s richest individual for the second consecutive year.

His net worth has soared to US$29 billion, marking a remarkable US$13 billion increase from 2023, thanks to Meta’s rising stock prices driven by substantial investments in artificial intelligence.

Holding on to second place are the Ng siblings, Robert and Philip, of Far East Organization, with a combined wealth of US$14.4 billion, despite a slight decrease from US$14.8 billion last year.