China’s $656 Billion Offshore Bond Market Put to Test

A Beijing court case may have far reaching implications for international creditors in the country

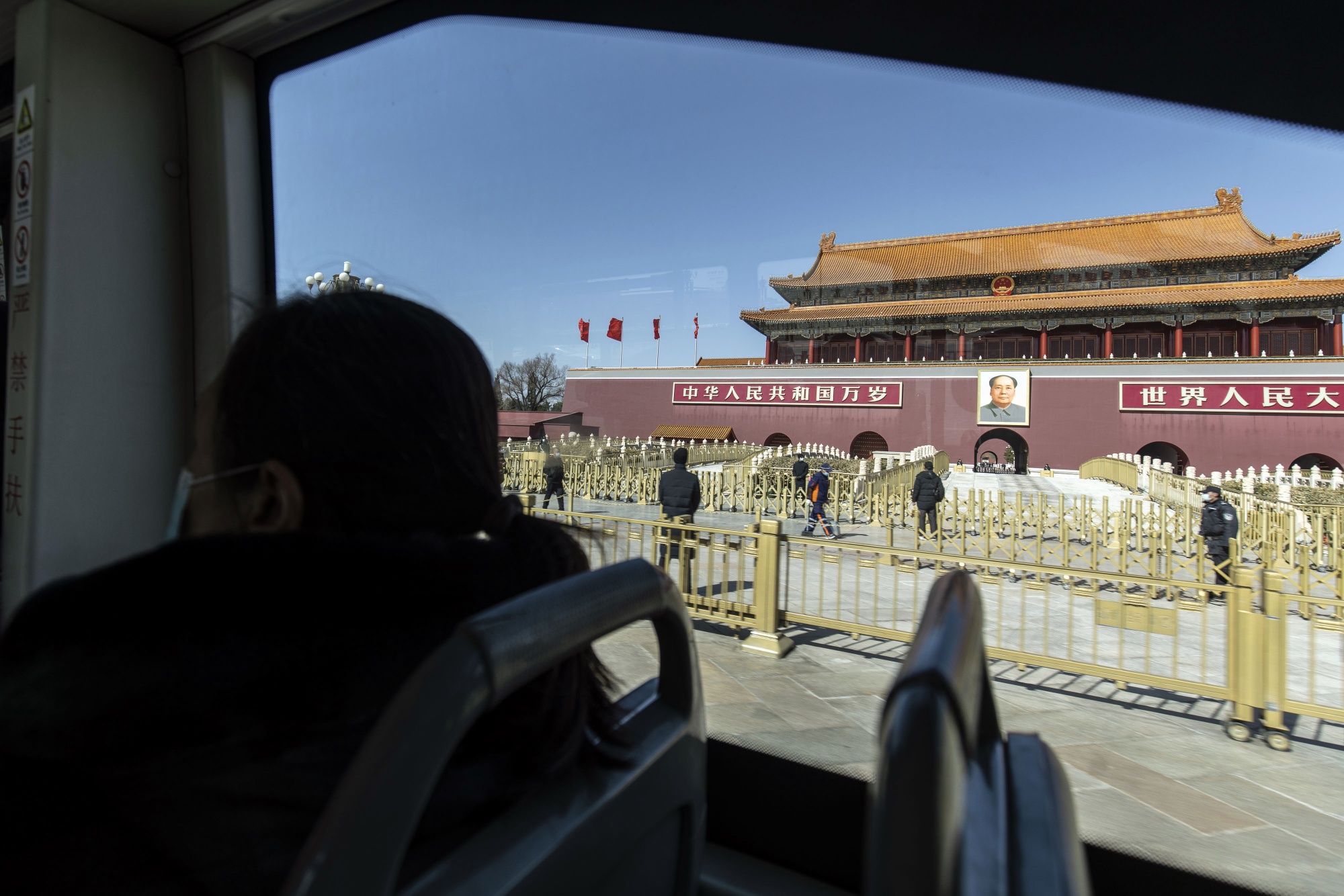

Tiananmen Square in Beijing.

Photographer: Qilai Shen/Bloomberg

By Kari Soo Lindberg

April 23, 2024 at 11:01 PM GMT+8

This article is for subscribers only.

Welcome to The Brink. I’m Kari Soo Lindberg, a reporter in Hong Kong, where I’m following Peking University Founder’s case in mainland China. We also have news on Ecuador, US retailer Express and packaging firm Ardagh. Follow this link to subscribe. Send us feedback and tips at [email protected] or DM on X to @KariSoo1.

A legal case slowly making its way through a Beijing court promises to have far reaching implications for foreign investors in China.

Have a confidential tip for our

Last edited: