Don’t Bet On A Return To Zero Rates

“Fine,” you’re thinking. “Show off your fancy terminal skills. But what does it actually mean for me?”

I’m glad you asked. First, I want to emphasise what I’m not saying: I’m not saying that Bank rate rising to this level is no big deal.

As residential property analyst Neal Hudson of BuiltPlace has pointed out many times, mortgage rates of 6% today are equivalent to the burden relative to income that homeowners saw when interest rates hit double-digits in the early 1990s.

The pain is real, and the good news — such as it is — is that the labour market is still strong. And the fact that so many homeowners are still on fixed rates means they have more time to prepare (in the 1990s, most people were on variable rates so got hammered right away).

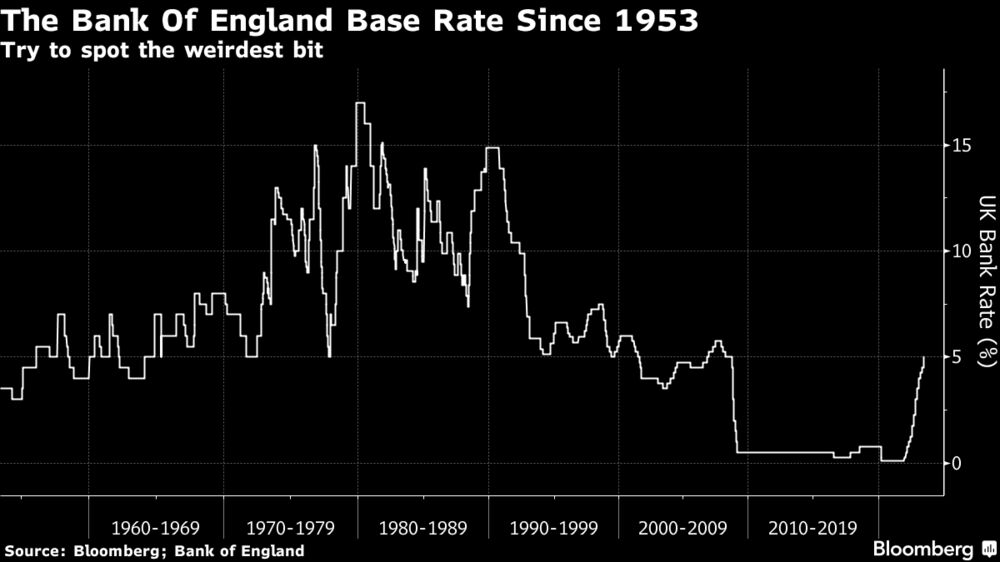

So I’m not dismissing the pain of rates at these levels. What I am saying, however, is that we should try to get used to rates being around these levels for the foreseeable future — as in decades, not years.

That’s because, even before the pandemic, we were edging back to normality, following the 2008 financial crisis. That recession ravaged the global banking system, which then spent about a decade in convalescence. This is — believe it or not — not unusual for such crises. The big difference in 2008 is that it was global rather than local.

In any case, if you can recall, central banks, led by the Federal Reserve, tentatively started raising interest rates in 2017 and 2018. That was the beginning of the post-crisis “normalisation” process.

We then got the pandemic, which saw the authorities going into overdrive both to protect a financial system (that likely did need some shielding) and to keep people inside their homes.

As a result, we got rampant inflation, rather than more “normal” price pressure. And a lot of this is still feeding through. You can’t just flick a switch to turn the global economy on and off again without getting a lot of bottlenecks in the restart process.

The big risk now — in my eyes — is that the Bank of England over-reacts in its haste to redeem itself, and causes more pain and volatility than is necessary in order to pull inflation back, at a time when we are already likely past the worst of it.

But even if we do get a recession, we’re not going back to the deflationary 2010s. You’ll note that although we saw several recessions in the UK between 1953 and 2007, there’s not been a single one in which interest rates were slashed to near 0%.

In short, don’t fall for recency bias. Accept and get used to higher interest rates being here to stay. For want of a better phrase, this is the “new normal.”