- Joined

- Apr 20, 2024

- Messages

- 856

- Points

- 63

https://www.google.com/amp/s/m.econ...at-history-says/amp_articleshow/117562866.cms

With deepseek and china chips coming....

With deepseek and china chips coming....

https://www.google.com/amp/s/m.econ...at-history-says/amp_articleshow/117562866.cms

With deepseek and china chips coming....

Bro, why u hate the chinks so much?China the entire country will crash and burn.

i had been researching on DeepSeek and playing with the DeepSeek app. This is a real deal and if its true they only use 5pc of what OpenAI use in Compute.. The Magnificent Stocks will crash…https://www.google.com/amp/s/m.econ...at-history-says/amp_articleshow/117562866.cms

With deepseek and china chips coming....

https://www.google.com/amp/s/m.econ...at-history-says/amp_articleshow/117562866.cms

With deepseek and china chips coming....

Already collapsed in 2011.China the entire country will crash and burn.

crash not crash is another thing it does not follow the normal 出牌游戏i had been researching on DeepSeek and playing with the DeepSeek app. This is a real deal and if its true they only use 5pc of what OpenAI use in Compute.. The Magnificent Stocks will crash…

Its actually a rebirth. A new China will emerge. A super power strong enough to stand up against serial regime change oppressor.China the entire country will crash and burn.

But why still so many chickens?Its actually a rebirth. A new China will emerge. A super power strong enough to stand up against serial regime change oppressor.

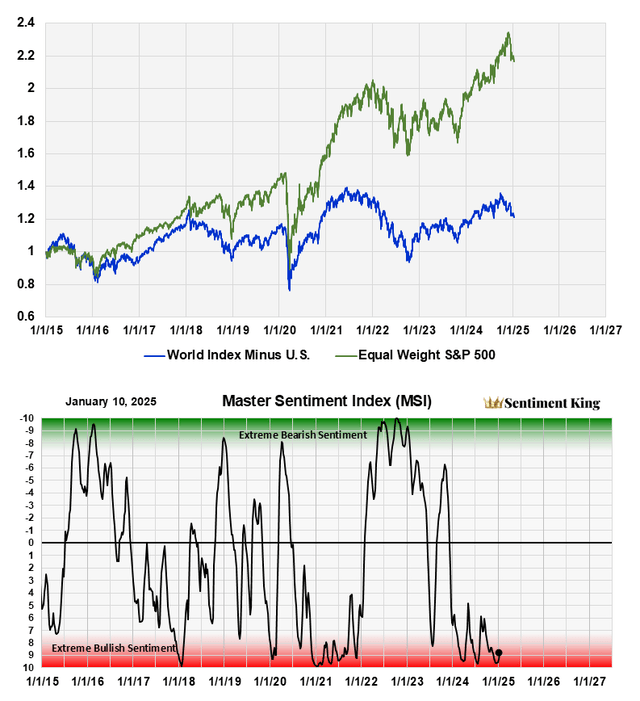

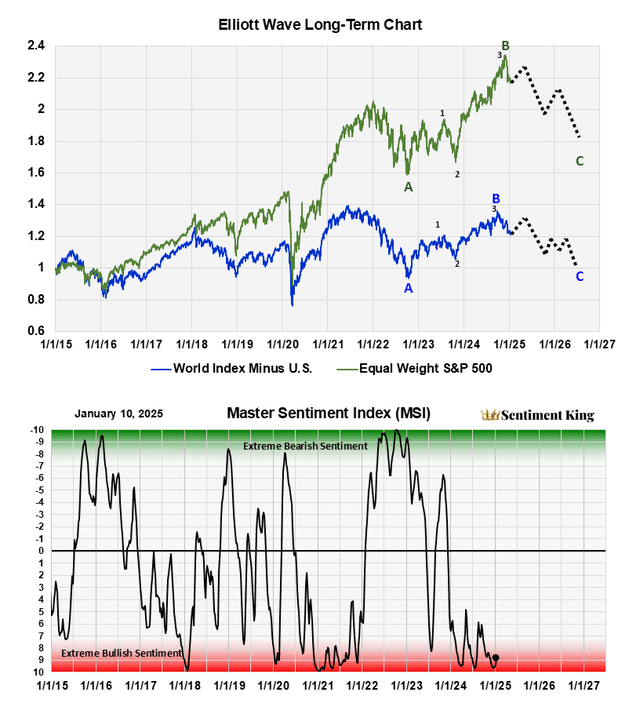

https://seekingalpha.com/article/4751578-a-major-market-correction-is-comingThe Nvidia stock has been tanking nev make new high. Once they crashed, micron also will crash. Retrenchment coming....

https://seekingalpha.com/article/4751578-a-major-market-correction-is-coming

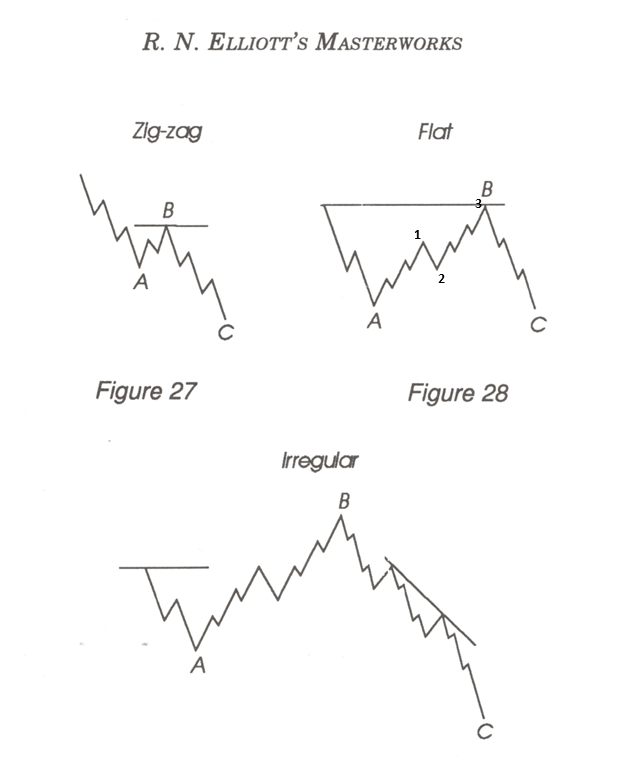

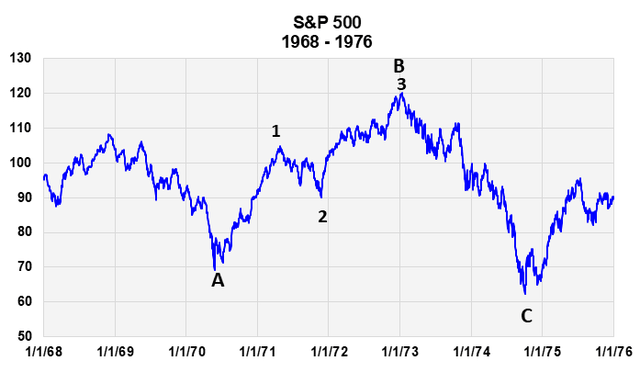

Seeking Alpha has an article that discuss a major correction in 2025 and a strong recovery 2026….so sit tight for a wild wild ride

Chicons land chips? Wat tat...?https://www.google.com/amp/s/m.econ...at-history-says/amp_articleshow/117562866.cms

With deepseek and china chips coming....

It's a culture thing. Most likely many were abused sexually since young and ran away and ended up in the business by pimps who treated them well initially.But why still so many chickens?