-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Why can’t the size of our reserves be revealed?

- Thread starter Cs101

- Start date

- Joined

- Jul 18, 2014

- Messages

- 4,841

- Points

- 113

Don't bark up the wrong tree lah. Call a spade a spade. Not everything PAP-Gov do is wrong and don't oppose the sake of opposing.

------------------------

The People’s Action Party (PAP) of Singapore has stated that the size of the nation’s reserves must remain undisclosed as a strategic defense against speculative attacks. This approach is rooted in the belief that revealing the exact amount of reserves could make Singapore vulnerable to currency speculators who might target the Singapore Dollar if they perceive the reserves as insufficient to defend the currency. Let’s explore whether other countries follow a similar principle, drawing on global practices and economic strategies.

----------------

Source: Grok AI

------------------------

The People’s Action Party (PAP) of Singapore has stated that the size of the nation’s reserves must remain undisclosed as a strategic defense against speculative attacks. This approach is rooted in the belief that revealing the exact amount of reserves could make Singapore vulnerable to currency speculators who might target the Singapore Dollar if they perceive the reserves as insufficient to defend the currency. Let’s explore whether other countries follow a similar principle, drawing on global practices and economic strategies.

Singapore’s Rationale and Context

Singapore’s reserves, managed by the Monetary Authority of Singapore (MAS), GIC, and Temasek Holdings, are a critical buffer against economic shocks, including speculative attacks on the Singapore Dollar. A speculative attack occurs when investors rapidly sell a country’s currency, often targeting nations with fixed or managed exchange rates, to force a devaluation or depletion of foreign reserves [Ref web ID: 0]. By keeping the size of its reserves secret, Singapore aims to deter such attacks by creating uncertainty for speculators about the MAS’s capacity to defend the currency. This opacity is part of a broader strategy to maintain economic stability, especially given Singapore’s open economy and reliance on trade.Do Other Countries Follow the Same Principle?

Countries That Conceal Reserve Sizes

Some countries adopt a similar approach to Singapore, either by not fully disclosing their reserves or by being selective about the details they share, often citing strategic defense against speculative attacks or geopolitical risks:- China: While China regularly reports its foreign exchange reserves—currently the world’s largest at around $3.3 trillion as of early 2025—it does not disclose the full composition or strategic deployment of these reserves [Ref web ID: 24]. For instance, China’s State Administration of Foreign Exchange (SAFE) provides monthly totals, but details about gold reserves, specific currency allocations, or other assets are often opaque. This partial transparency allows China to signal strength while retaining some ambiguity to deter speculative attacks, especially amid U.S.-China trade tensions that could trigger currency fluctuations [Ref web ID: 20].

- Russia: Russia has historically been cautious about revealing detailed reserve data, particularly following Western sanctions after the 2014 Crimea annexation and the 2022 Ukraine invasion. The Central Bank of Russia reports total reserves (approximately $600 billion as of 2024), but the breakdown of assets, including gold and foreign currency holdings, is not fully transparent. This opacity is a strategic move to protect against speculative attacks and sanctions, as reserve managers have noted the risk of “tight liquidity” from geopolitical conflicts [Ref web ID: 20].

- Saudi Arabia: Saudi Arabia, with reserves of about $450 billion as of 2024, also maintains a level of secrecy around its total sovereign wealth and reserve assets. The Saudi Arabian Monetary Authority (SAMA) publishes some data, but the full extent of its financial buffers, including assets in its Public Investment Fund (PIF), is not fully disclosed. This approach helps shield the Saudi Riyal, which is pegged to the U.S. Dollar, from speculative attacks, especially during periods of oil price volatility [Ref web ID: 23].

Countries That Disclose Reserve Sizes

In contrast, many countries adopt a policy of transparency, regularly publishing detailed reserve data, often as a confidence-building measure rather than a deterrent:- United States: The U.S. does not maintain large foreign exchange reserves in the traditional sense (around $250 billion as of 2024), as the U.S. Dollar is the world’s reserve currency, reducing the need to defend its exchange rate [Ref web ID: 23]. However, the U.S. Strategic Petroleum Reserve (SPR), which holds 395.3 million barrels as of March 2025, is publicly reported with detailed updates on inventory levels [Ref web ID: 14]. The U.S. uses transparency to signal preparedness for energy supply disruptions, not currency defense, as the Dollar’s global status makes speculative attacks less likely.

- Japan: Japan, with the second-largest forex reserves at about $1.3 trillion, provides detailed monthly reports through the Bank of Japan (BOJ) [Ref web ID: 24]. Japan’s transparency is intended to foster market confidence in the Yen, which floats freely. Despite this openness, Japan has faced speculative pressures in the past (e.g., the 1998 Asian Financial Crisis), but its massive reserves act as a deterrent, aligning with the idea that a large “war chest” can discourage attacks [Ref web ID: 0].

- European Union (Eurozone): Eurozone countries, managed by the European Central Bank (ECB), collectively hold around $900 billion in reserves as of 2024 [Ref web ID: 24]. The ECB publishes detailed reserve data, including gold and foreign currency holdings, to maintain transparency and stability in the Euro’s value. The Euro’s floating exchange rate and the ECB’s monetary policy tools reduce the risk of speculative attacks, making transparency less of a strategic concern.

Hybrid Approaches

Some countries adopt a hybrid approach, balancing transparency with strategic ambiguity:- India: India’s Reserve Bank of India (RBI) reports total forex reserves—around $700 billion as of 2024—but does not always disclose the full composition, such as the exact proportion of gold or specific currencies [Ref web ID: 23]. This partial disclosure allows India to signal economic strength while retaining some flexibility to manage speculative pressures on the Rupee, which has a managed float regime.

- South Korea: South Korea, with reserves of about $420 billion, provides regular updates but has been known to intervene in forex markets discreetly to stabilize the Won [Ref web ID: 23]. During the 2014 Crimea annexation, South Korean defense companies’ stocks reacted to geopolitical risks, indicating market sensitivity to reserve management [Ref web ID: 11]. South Korea balances transparency with strategic interventions to deter speculation.

Analysis: Why Practices Differ

The decision to reveal or conceal reserve sizes depends on a country’s economic structure, exchange rate regime, and geopolitical context:- Exchange Rate Regime: Countries with fixed or managed exchange rates (e.g., Singapore, Saudi Arabia) are more vulnerable to speculative attacks, as speculators can target the peg if reserves seem insufficient [Ref web ID: 0]. These nations often favor secrecy to create uncertainty for speculators. Conversely, countries with floating exchange rates (e.g., Japan, Eurozone) face less pressure to defend a peg, so transparency can enhance market confidence without inviting attacks.

- Geopolitical Risks: Nations facing geopolitical tensions, like Russia or China, may withhold details to protect against economic warfare, including sanctions or speculative attacks tied to conflicts (e.g., Ukraine war, U.S.-China trade tensions) [Ref web ID: 20]. Singapore, while not in direct conflict, is a small, trade-dependent economy, making it a potential target for currency speculation, thus justifying its secretive stance.

- Economic Size and Reserve Levels: Smaller nations or those with limited reserves (e.g., Thailand during the 1997 Asian Financial Crisis) are more vulnerable to speculative attacks, as their “war chests” can be depleted quickly [Ref web ID: 0]. Singapore, despite its substantial reserves (estimated at over $1 trillion including GIC and Temasek assets), adopts a cautious approach due to its small size and open economy. Larger economies like the U.S. or Japan can afford transparency because their reserves or global economic influence act as a natural deterrent.

Critical Examination

While Singapore’s rationale aligns with economic theory on speculative attacks, the effectiveness of secrecy is debated. Transparency can also deter speculators by signaling strength, as seen with Japan and the Eurozone, where large, publicly known reserves discourage attacks. Singapore’s approach may reflect a conservative strategy, but it could also limit public accountability, as citizens and analysts cannot fully assess the adequacy of reserves for other purposes, like economic stimulus during crises. Moreover, in today’s data-driven world, speculators might estimate Singapore’s reserves through indirect indicators (e.g., trade balances, sovereign wealth fund activities), potentially undermining the secrecy strategy.Conclusion

Singapore is not alone in concealing the size of its reserves as a defense against speculative attacks—countries like China, Russia, and Saudi Arabia adopt similar strategies, particularly those with fixed or managed exchange rates or significant geopolitical risks. However, many countries, including the U.S., Japan, and Eurozone nations, opt for transparency to build market confidence, relying on their large reserves or floating exchange rates to deter speculation. The choice reflects a trade-off between strategic ambiguity and economic openness, shaped by each country’s unique circumstances. Singapore’s secretive approach is a valid strategy for a small, trade-reliant nation, but it’s not a universal principle, as global practices vary widely.----------------

Source: Grok AI

lol d real probrem ish y dey ish pumping sooooooooooo much into leeeeeeeeeeserves

eg sale of land in uder kuntries is payed into g cash fund in sinkie.land ish hoarded into leeeeeeeeeeeeeeeserves

dey tell u for future gen butch d sad truth is tt sinkies ish a dying breeeeeeeeed

n dey kan raaaaaaiiiiiiiiiiiiiiiiiiiiid d leeeeeesrves any time eg during d previous ah net time dey raided it 28x

n wat dey do ish toooooooooooooooooooooooooop secreeeeeeeeeeeet

tooooooo much leeeeserves is detrimental to shiatizens bcos dey ish deprived eg health care, infra, etc tt improves d lives of shaitizens

while dey raaaaaaaaaaaiiiiiiiiiiiiiiiiiiid it clandestinely cloak n daggga style for hidden n unknown use

for all u noe it cud juz be a biiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiggggggggggggg black hole

vto

eg sale of land in uder kuntries is payed into g cash fund in sinkie.land ish hoarded into leeeeeeeeeeeeeeeserves

dey tell u for future gen butch d sad truth is tt sinkies ish a dying breeeeeeeeed

n dey kan raaaaaaiiiiiiiiiiiiiiiiiiiiid d leeeeeesrves any time eg during d previous ah net time dey raided it 28x

n wat dey do ish toooooooooooooooooooooooooop secreeeeeeeeeeeet

tooooooo much leeeeserves is detrimental to shiatizens bcos dey ish deprived eg health care, infra, etc tt improves d lives of shaitizens

while dey raaaaaaaaaaaiiiiiiiiiiiiiiiiiiid it clandestinely cloak n daggga style for hidden n unknown use

for all u noe it cud juz be a biiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiiggggggggggggg black hole

vto

- Joined

- Mar 10, 2024

- Messages

- 1,823

- Points

- 83

Aiyah If I disclose the leeserves of Sinkapore to you simnkie gangsters then sure kena rob one

so must be seecleeet

lol

so must be seecleeet

lol

- Joined

- Oct 15, 2023

- Messages

- 8,765

- Points

- 113

If S'poreans know how much $$$ is in the reserves, we will be asking the PAP why they raised the GST and are taxing us to death.The SG reserves is so secretive that even the president who jaga the reserves donch know how much it is

- Joined

- Oct 15, 2023

- Messages

- 8,765

- Points

- 113

The gangsters and robbers are are all dressed in white.Aiyah If I disclose the leeserves of Sinkapore to you simnkie gangsters then sure kena rob one

so must be seecleeet lol

- Joined

- Mar 10, 2024

- Messages

- 1,823

- Points

- 83

Ehhhhhh tomollow you angly with me again arrrhhhhhhhhhhhThe gangsters and robbers are are all dressed in white.

lol

- Joined

- Oct 15, 2023

- Messages

- 8,765

- Points

- 113

The President is a man of hidden talents. It is so deeply hidden that nobody is able to see any of his talent. LOL!The SG reserves is so secretive that even the president who jaga the reserves donch know how much it is

- Joined

- Oct 15, 2023

- Messages

- 8,765

- Points

- 113

Please lah! Getting genuinely angry at others on a forum like this is as foolish as getting angry at the jokes of a stand-up comedian. We come here to be entertained and hopefully, learn along the way - not be get upset by what other Samsters say. It is all banter to me.Ehhhhhh tomollow you angly with me again arrrhhhhhhhhhhh lol

- Joined

- Oct 15, 2023

- Messages

- 8,765

- Points

- 113

If the gangsters did not rob S'poreans, the reserves would not be in such a healthy state.Aiyah If I disclose the leeserves of Sinkapore to you simnkie gangsters then sure kena rob one so must be seecleeet lol

The robbers are wolves dressed in sheep's white clothing.

- Joined

- May 16, 2023

- Messages

- 36,008

- Points

- 113

The President is a man of hidden talents. It is so deeply hidden that nobody is able to see any of his talent. LOL!

Attachments

- Joined

- Apr 26, 2011

- Messages

- 12,275

- Points

- 113

you don't wanna know the size........or the lack of it.................

when you don't know how many chickens there are in the farm.............you won't know how many the fox had eaten..............

- Joined

- Oct 15, 2023

- Messages

- 8,765

- Points

- 113

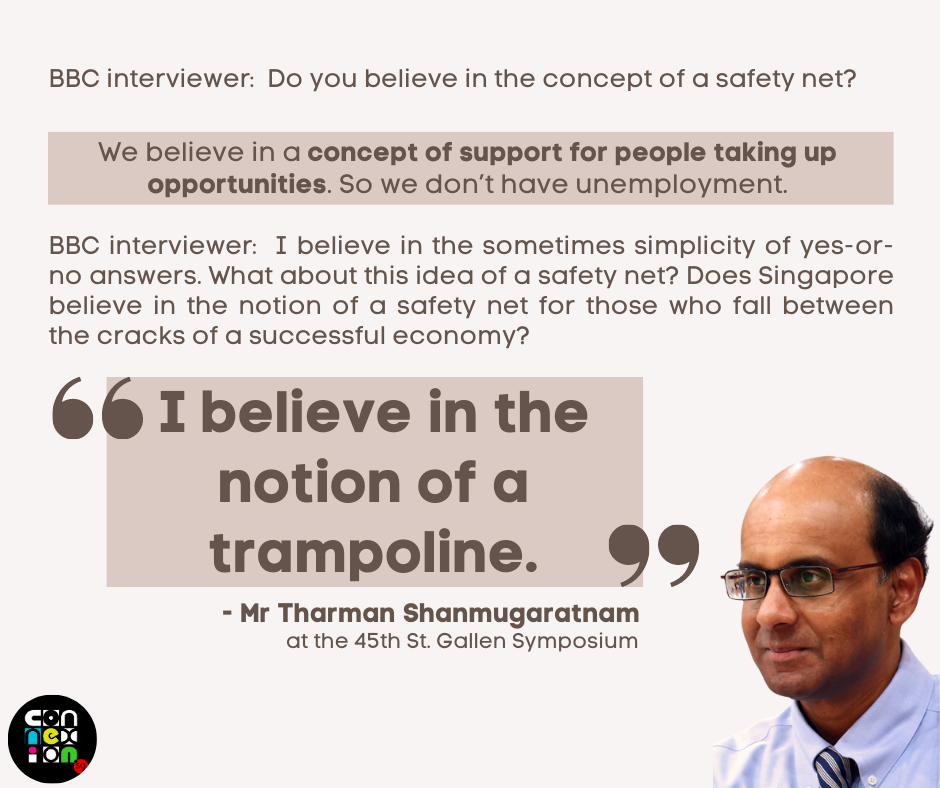

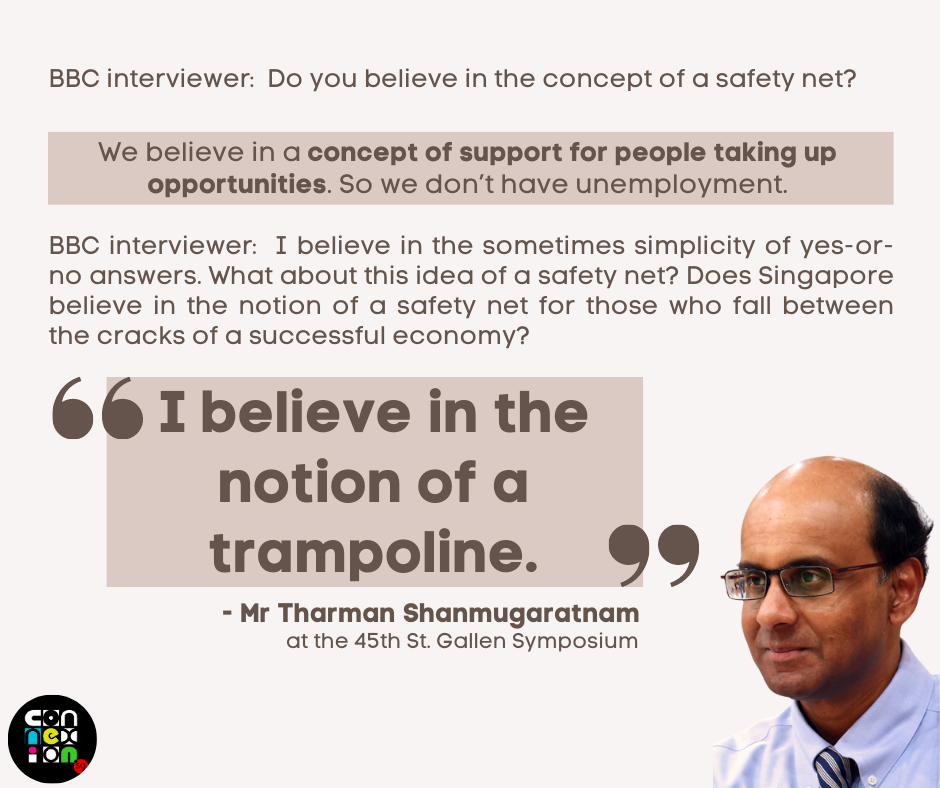

Tharman wants to give less fortunate S'poreans a trampoline so they may jump to their deaths from their high rise HDB pigeon holes.

- Joined

- Oct 15, 2023

- Messages

- 8,765

- Points

- 113

Was Tharman misquoted? Did he really say "trampoline" or the PAP trampling the people of S'pore?

- Joined

- Oct 15, 2023

- Messages

- 8,765

- Points

- 113

The same applies to the President. His JD is to do the complete

opposite of Ong Teng Chong: Just look the other way.

opposite of Ong Teng Chong: Just look the other way.

- Joined

- Jan 16, 2014

- Messages

- 6,694

- Points

- 113

you mean the money is still there?

Similar threads

- Replies

- 9

- Views

- 498

- Replies

- 23

- Views

- 1K

- Replies

- 3

- Views

- 320

- Replies

- 5

- Views

- 313