Markets

By Bloomberg News

April 21, 2024 at 9:00 AM GMT+8

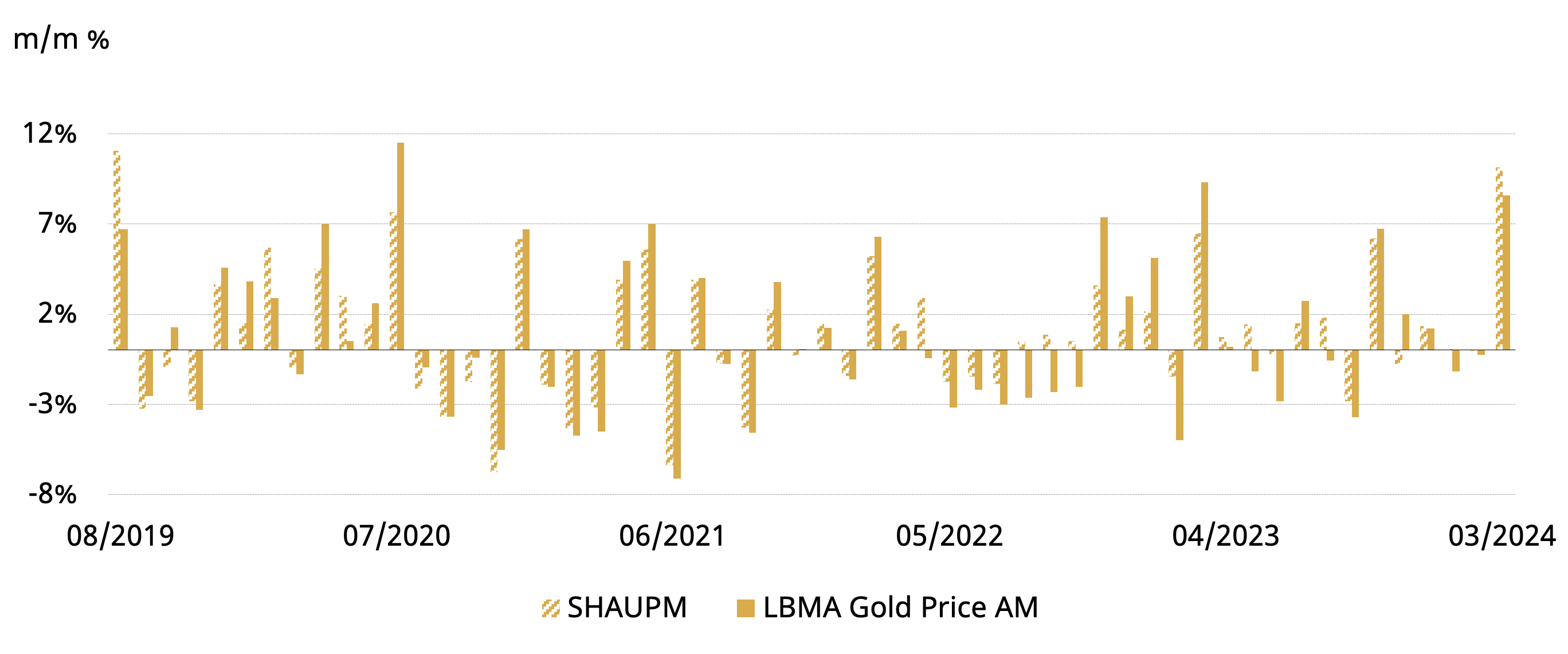

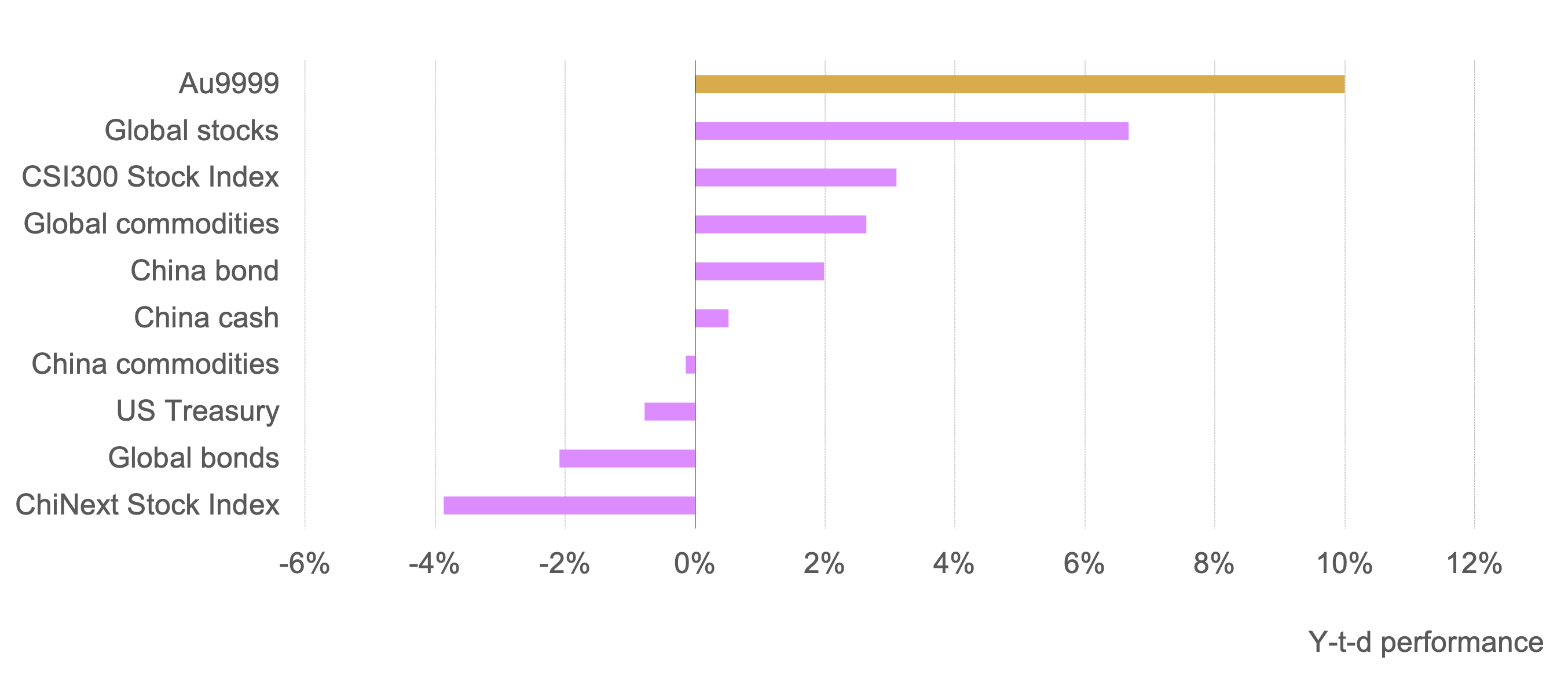

Gold’s rise to all-time highs above $2,400 an ounce this year has captivated global markets. China, the world’s biggest producer and consumer of the precious metal, is front and center of the extraordinary ascent.

Worsening geopolitical tensions, including war in the Middle East and Ukraine, and the prospect of lower US interest rates all burnish gold’s billing as an investment.

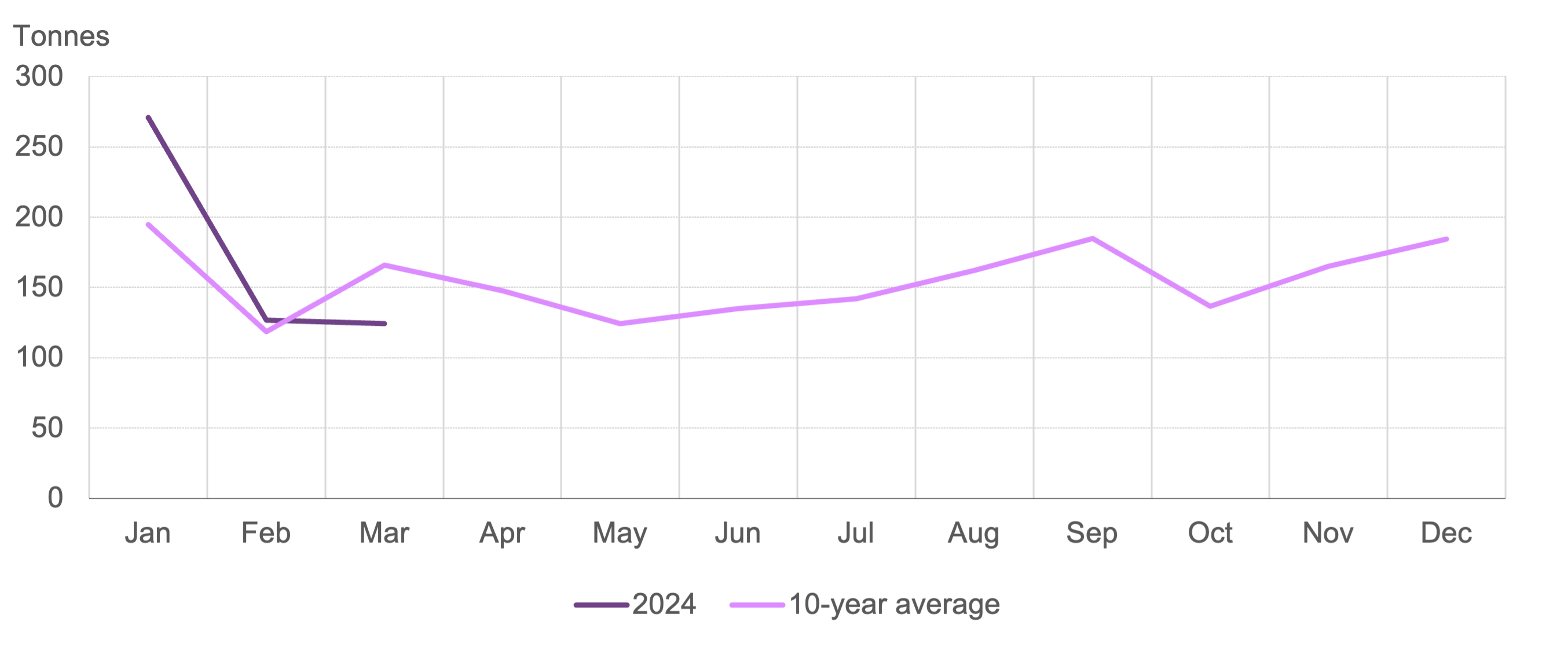

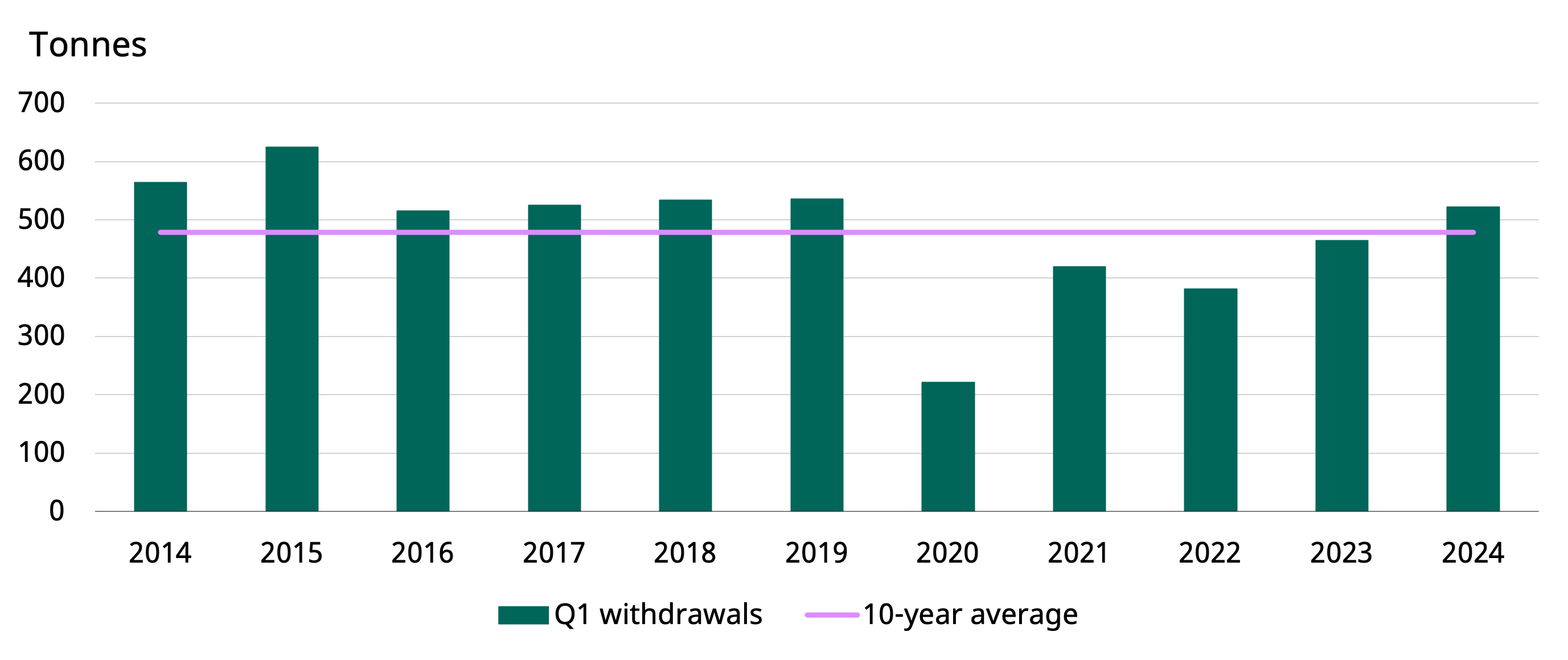

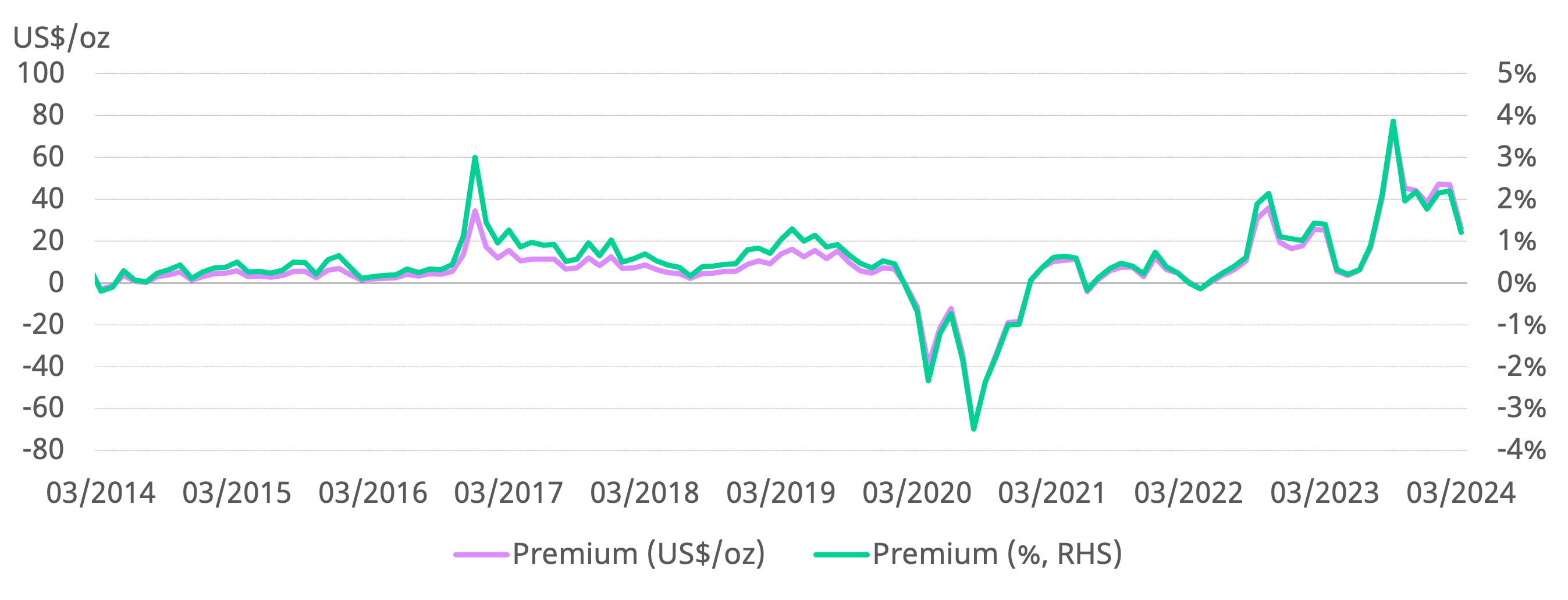

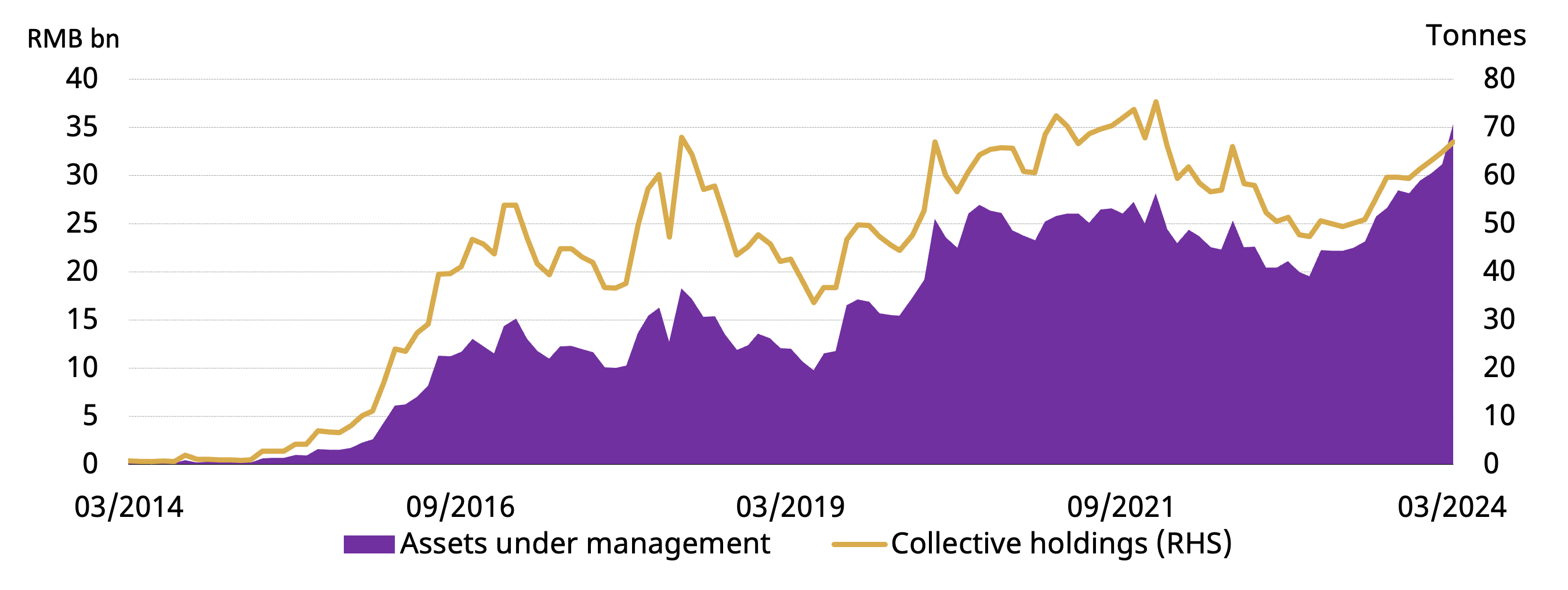

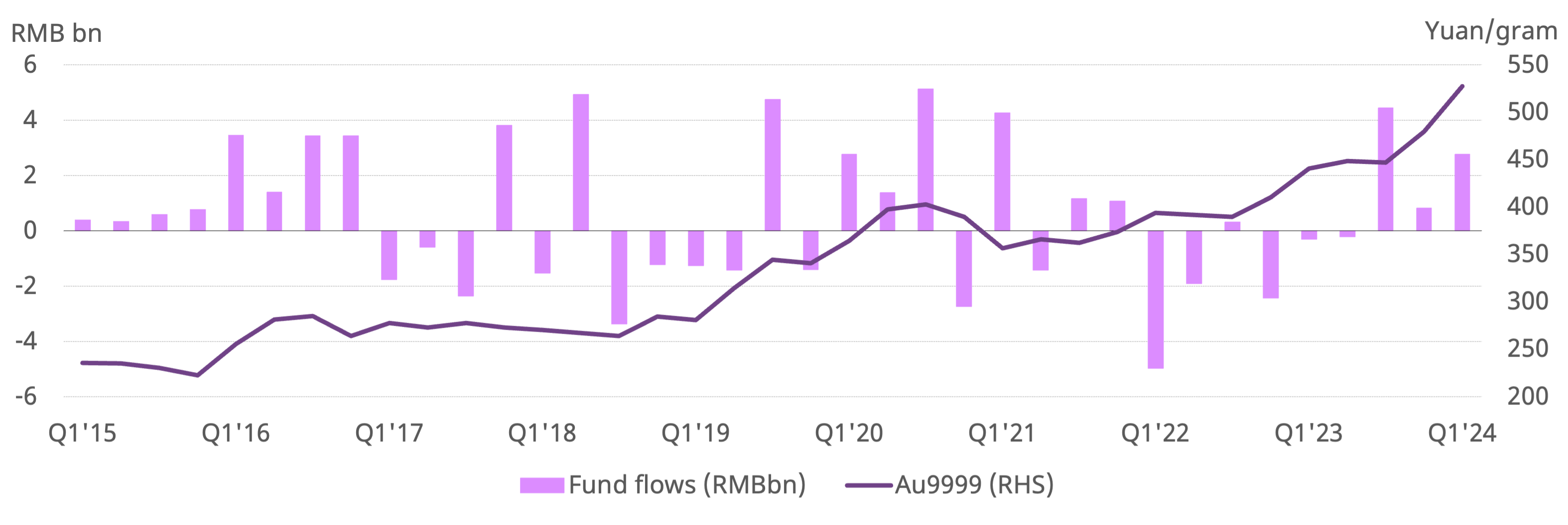

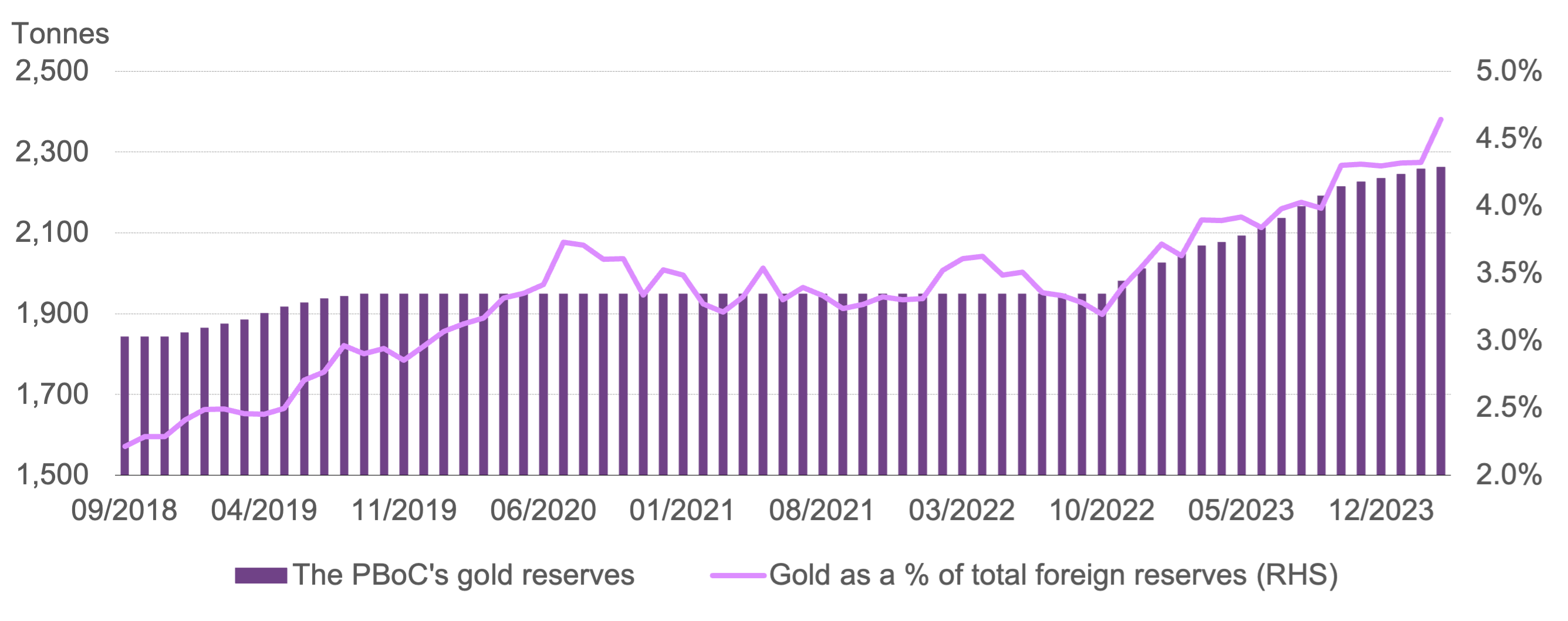

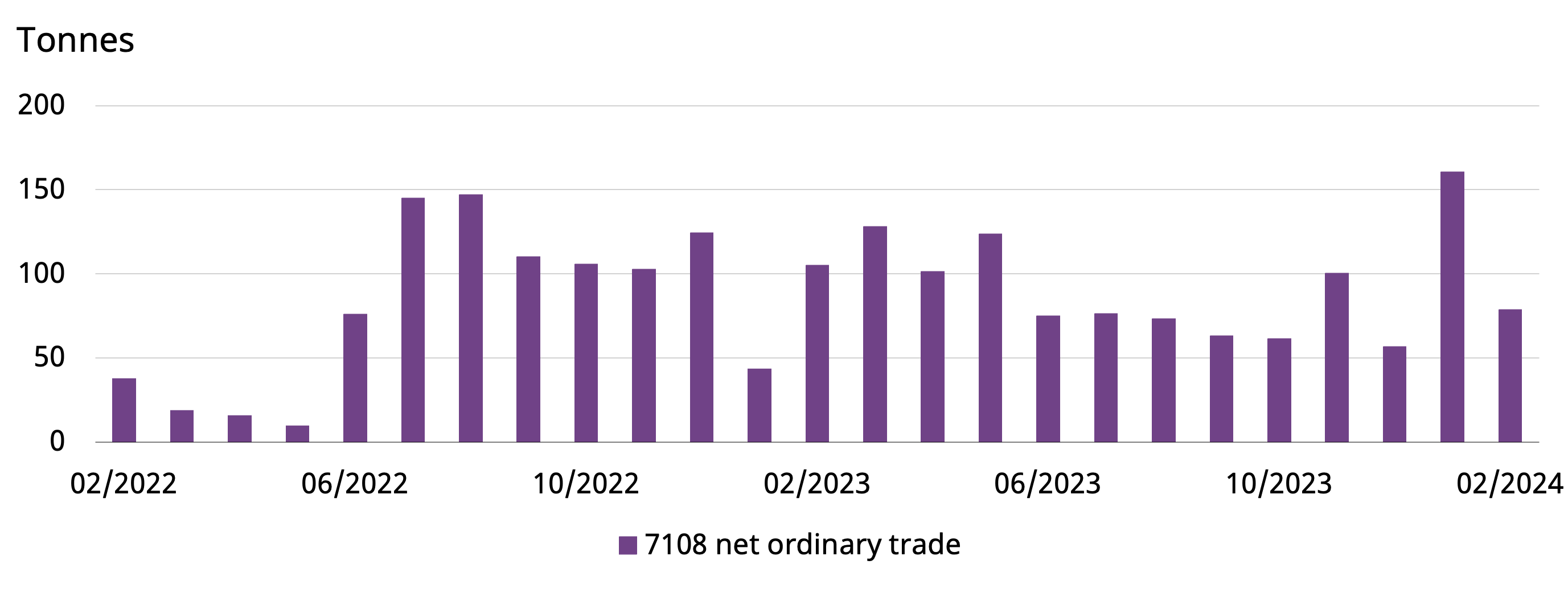

But juicing the rally is unrelenting Chinese demand, as retail shoppers, fund investors, futures traders and even the central bank look to bullion as a store of value in uncertain times.

China Is Front and Center of Gold’s Record-Breaking Rally

- Central bank has been on a buying spree for 17 straight months

- Demand remains buoyant despite record prices and weaker yuan

By Bloomberg News

April 21, 2024 at 9:00 AM GMT+8

Gold’s rise to all-time highs above $2,400 an ounce this year has captivated global markets. China, the world’s biggest producer and consumer of the precious metal, is front and center of the extraordinary ascent.

Worsening geopolitical tensions, including war in the Middle East and Ukraine, and the prospect of lower US interest rates all burnish gold’s billing as an investment.

But juicing the rally is unrelenting Chinese demand, as retail shoppers, fund investors, futures traders and even the central bank look to bullion as a store of value in uncertain times.