- Joined

- Oct 7, 2012

- Messages

- 5,228

- Points

- 113

A year after Malaysia’s historic election, public euphoria surrounding the new government has evaporated. And investors are losing patience too.

Global funds are bypassing the country in favor of other markets. Stocks recorded outflows in all but two of the past 12 months, the ringgit is trailing most of its peers and bonds may be on the cusp of another sell-off.

Hopes for reform from Prime Minister Mahathir Mohamad’s administration have given way to caution, after a government drive to cut public debt weighed on consumption and growth. On May 7 the central bank cut its benchmark interest rate for the first time since July 2016, seeking to support the economy as global risks mount.

Few portfolio managers expect a recovery anytime soon.

“I don’t think I need to rush into Malaysia at the moment,” said Tim Love, who manages about $1 billion of emerging-markets equities in London for a unit of GAM Holding AG. “Even with the valuation attraction which is now definitely coming up clearly, I don’t think that the outlook is clear enough.”

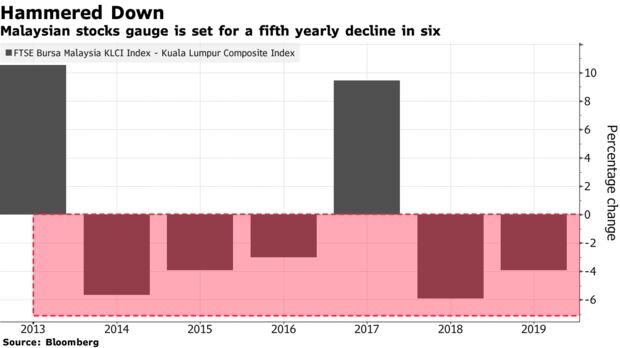

Malaysia’s benchmark stock index has fallen more than 4% this year and is the world’s worst-performing major equity market. Slowing economic growth and weak company earnings have taken a toll, though valuations have improved.

The one-year forward price-earnings ratio on the FTSE Bursa Malaysia KLCI Index is 15.7 times, in line with its five-year average, according to data compiled by Bloomberg.

Corporate profits were hurt after the government scrapped several large infrastructure projects to rein in a fiscal deficit which ballooned to a five-year high in 2018. Some developments, including a $10.7 billion railway line, have since been revived.

Macquarie Group Ltd. said the resumption of infrastructure spending may bolster local equities although FTSE Russell’s review of Malaysian debt for possible exclusion from its bond index remains a risk.

Looming Outflow

Ringgit bonds came under pressure last month, when FTSE Russell said it may drop Malaysia from its World Government Bond Index due to concerns about market accessibility. The move renewed the spotlight on a ban on offshore ringgit trading, and 10-year yields jumped to a two-month high. Morgan Stanley warned almost $8 billion may exit the local debt market.

While onshore bonds have since retraced their losses, investors are holding off on adding to holdings, pending FTSE Russell’s decision on its review in September.

“We’ve been neutral Malaysian government bonds for a while now,” said Delphine Arrighi, a London-based portfolio manager at Merian Global Investors which oversees $37 billion. “The decision by the central bank a couple of years ago to shut down the NDF market has essentially made it impossible to hedge bond exposure. I doubt offshore investors will now return en masse.”

Lagging Peers

MYR is among EM Asia's worst performers over the past year

Source: Bloomberg

<style>                        .chart-js { display: none; }                    </style>                    <img src="https://assets.bwbx.io/images/users/iqjWHBFdfxIU/ihgG3LtZyIzY/v0/-1x-1.png">

The ringgit has weakened more than 2% since reaching an eight-month high in March, hurt by equity outflows and a stronger dollar.

Buying Opportunity

Still, weakness in Malaysian securities presents a buying opportunity for some. SPI Asset Management says fears of an outflow are overdone, with any impact likely to be offset by the presence of a large pool of domestic investors, and easier monetary policy.

“Ultimately the currency markets will need to price in the bond outflow which could trigger some short term sell-off in equities,” said Stephen Innes, SPI Asset’s head of trading and market strategy. “But for the equity and bond markets, the rate cut will support both and come September we will be asking ourselves why didn’t we buy more when there was blood on the street.”

https://www.bloomberg.com/news/arti...un-malaysia-as-mahathir-reform-euphoria-fades

Global funds are bypassing the country in favor of other markets. Stocks recorded outflows in all but two of the past 12 months, the ringgit is trailing most of its peers and bonds may be on the cusp of another sell-off.

Hopes for reform from Prime Minister Mahathir Mohamad’s administration have given way to caution, after a government drive to cut public debt weighed on consumption and growth. On May 7 the central bank cut its benchmark interest rate for the first time since July 2016, seeking to support the economy as global risks mount.

Few portfolio managers expect a recovery anytime soon.

“I don’t think I need to rush into Malaysia at the moment,” said Tim Love, who manages about $1 billion of emerging-markets equities in London for a unit of GAM Holding AG. “Even with the valuation attraction which is now definitely coming up clearly, I don’t think that the outlook is clear enough.”

Malaysia’s benchmark stock index has fallen more than 4% this year and is the world’s worst-performing major equity market. Slowing economic growth and weak company earnings have taken a toll, though valuations have improved.

The one-year forward price-earnings ratio on the FTSE Bursa Malaysia KLCI Index is 15.7 times, in line with its five-year average, according to data compiled by Bloomberg.

Corporate profits were hurt after the government scrapped several large infrastructure projects to rein in a fiscal deficit which ballooned to a five-year high in 2018. Some developments, including a $10.7 billion railway line, have since been revived.

Macquarie Group Ltd. said the resumption of infrastructure spending may bolster local equities although FTSE Russell’s review of Malaysian debt for possible exclusion from its bond index remains a risk.

Looming Outflow

Ringgit bonds came under pressure last month, when FTSE Russell said it may drop Malaysia from its World Government Bond Index due to concerns about market accessibility. The move renewed the spotlight on a ban on offshore ringgit trading, and 10-year yields jumped to a two-month high. Morgan Stanley warned almost $8 billion may exit the local debt market.

While onshore bonds have since retraced their losses, investors are holding off on adding to holdings, pending FTSE Russell’s decision on its review in September.

“We’ve been neutral Malaysian government bonds for a while now,” said Delphine Arrighi, a London-based portfolio manager at Merian Global Investors which oversees $37 billion. “The decision by the central bank a couple of years ago to shut down the NDF market has essentially made it impossible to hedge bond exposure. I doubt offshore investors will now return en masse.”

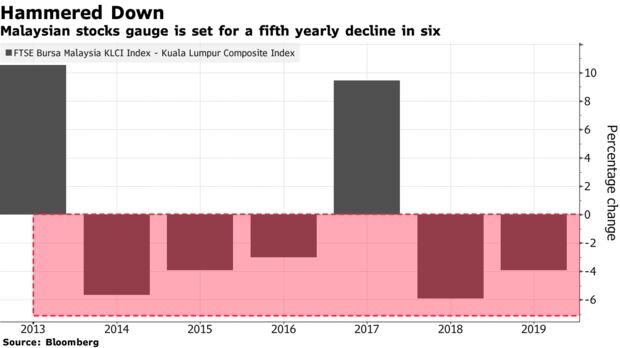

Lagging Peers

MYR is among EM Asia's worst performers over the past year

Source: Bloomberg

<style>                        .chart-js { display: none; }                    </style>                    <img src="https://assets.bwbx.io/images/users/iqjWHBFdfxIU/ihgG3LtZyIzY/v0/-1x-1.png">

The ringgit has weakened more than 2% since reaching an eight-month high in March, hurt by equity outflows and a stronger dollar.

Buying Opportunity

Still, weakness in Malaysian securities presents a buying opportunity for some. SPI Asset Management says fears of an outflow are overdone, with any impact likely to be offset by the presence of a large pool of domestic investors, and easier monetary policy.

“Ultimately the currency markets will need to price in the bond outflow which could trigger some short term sell-off in equities,” said Stephen Innes, SPI Asset’s head of trading and market strategy. “But for the equity and bond markets, the rate cut will support both and come September we will be asking ourselves why didn’t we buy more when there was blood on the street.”

https://www.bloomberg.com/news/arti...un-malaysia-as-mahathir-reform-euphoria-fades