Singapore Braces for Shockwaves as Trump-Harris Tussle Goes to the Wire

The US embassy in Singapore.

Photographer: ED WRAY/AP

By Bill Faries

2 November 2024 at 9:00 AM SGT

Save

Translate

Welcome to the Singapore Edition newsletter. Each week we’ll bring you insights into one of Asia’s most dynamic economies. If you haven’t yet, please sign up here.

This week, Bill Faries looks ahead at a potentially seismic US election finale, Patrick Winters digs into the world’s priciest car market and Yongchang Chin savors Ningbo flavors.

All Eyes on America

“When elephants fight, the grass suffers.” —Lee Kuan Yew, citing Tanzanian President Julius Nyerere.It may be happening on the other side of the world, but next week’s US election is sure to reverberate in Singapore. As we wrap up this newsletter, the polls show a race well within the margin of error. A final result could take days to emerge.

The election isn’t a sideshow for Singapore: China may be our top trading partner, but the US is the biggest source of foreign direct investment, and the American embassy estimates that more than 30,000 US citizens call the little red dot home.

Prime Minister Lawrence Wong has been warning the public for months that US-China tensions are the new normal. At his swearing-in ceremony in May, he said, “The great powers are competing to shape a new, yet undefined, global order. We must brace ourselves to these new realities and adapt to a messier, riskier, and more violent world.”

Neither Kamala Harris nor Donald Trump appear likely to change that trajectory.

2024 General Election: Trump vs. Harris

RealClearPolitics Poll AverageSource: RealClearPolitics

Harris has touted the Biden administration’s efforts to restrict China’s access to high technology, chafing some European and Asian allies. The US also recently approved $2 billion more in weapons for Taiwan, the biggest geopolitical hot spot in Asia.

Trump, meanwhile, has raised doubts about the US commitment to Taiwan and proposed a blanket 10% tariff on imports, a move that would spark retaliation around the globe and strike at Singapore’s sweet spot as a champion of open and free trade.

One Western envoy based in Singapore told Bloomberg that if the election results lead more countries to enact retaliatory tariffs, or raise doubts about the US willingness to defend allies in Asia, that would put Singapore in a complicated spot.

Rohit Sipahimalani, chief investment officer of Temasek, tells Haslinda Amin global growth would be negatively impacted by the US election.Bloomberg

Temasek International’s Chief Investment Officer Rohit Sipahimalani was more direct, telling Bloomberg’s Haslinda Amin this week that while a Harris win would be beneficial for emerging markets, the opposite is likely under a Trump victory.

“A Trump win is probably going to mean a stronger dollar and higher rates than you would otherwise have,” he said. “The tariffs are going to create uncertainty, which is never good for investment.” (See Temasek’s clarification.)

Singapore has navigated plenty of crises in its nearly 60 years of independence, from the Cold War to the Asian financial crisis to Covid. Whatever happens Tuesday, the island’s history of thriving in difficult times will be put to the test. —Bill Faries

Weekend Catch-Up

A selection of the best of Bloomberg storytelling, from podcasts and video to explainers and feature stories.Read:

- Trader’s $10,000 spoofing profit hauntsNomura, with clients dumping the Japanese firm from underwriting corporate bonds.

- Olympus CEO Stefan Kaufmann resigned after an investigation into allegations that he purchased illegal drugs.

- Taiwan’s control of the AI supply chain goes way beyond chips.

- You’ve heard of K-Pop, but what about K-Architecture? Haslinda Amin explores the Korean design wave for Bloomberg Originals’ Momentum series.

An increasingly unstable world has upended the post-Cold War dynamic, with the US-China rivalry helping remake the hubs and pathways of global trade. Some nations have chosen sides, but a few are taking advantage of the situation.

Listen:

- Our Big Take Asia podcast explores the struggle by the US to curb China’s tech rise.

- Find out why Wall Street is betting on a Trump win.

Market Place: Car Supplies Get a Rev

Bringing you up to speed on the most interesting moves in the markets.In Singapore, owning a car is a luxury for most people. Only a privileged slice of the population can afford the most expensive vehicles in the world.

Rising wealth in the city-state has intensified bidding for the scarce permits needed to take a vehicle onto roads, pushing the total cost of ownership well into six figures.

Hence the excitement among car lovers seeing news this week about a government plan for a one-off increase in the number of cars on the road, despite the policy enforced since 2018 to crimp the population.

According to the headlines, the Land Transport Authority will “progressively inject” as many as 20,000 new permits representing about 2% of the 1 million vehicles on the road right now. What isn’t clear from the press release is exactly how and when this would boost actual wheels on the road and ease prices.

The LTA said it can add more permits because people are using their cars less since the pandemic. And traffic management has improved thanks to a new satellite tracking system used to price road usage in congested areas.

The land-strapped city-state has for decades been a pioneer in limiting the vehicle population to avoid the congestion afflicting cities like Jakarta, Bangkok and Manila. So, before you can own a vehicle you have to join a biweekly auction to buy a so-called Certificate of Entitlement giving road access for as long as 10 years.

As this limited supply intersected with a flood of wealthy immigrants, frantic bidding has driven prices of permits for larger, more powerful autos above S$100,000 in most auctions since mid-2022. In late 2023, they peaked at more than S$150,000. In recent auctions, COEs for even the cheapest little hatchback have again nudged above S$100,000. That’s what you must pay before you even buy the car.

Singapore’s fourth-generation premier, Lawrence Wong, must pick a date to win his own personal mandate in an election before the end of next year. Car inflation coupled with property prices and other cost increases could fuel grumbling among middle-class voters. —Patrick Winters

House Swap: Singapore River Versus Miami

What you can get for your money in Singapore’s pricey property market.The property market is set for a key test in November, as multiple developers rush to release projects for sale. Lower interest rates and the first drop in private-home prices in five quarters are raising hopes that buyers will return to ease the pain of the worst year for home sales since the 2008 financial crisis.

An artist impression of the Union Square Residences in Singapore.Source: City Developments Ltd.

Among these projects is Union Square Residences in the city center. It’s begun previews: Its smallest one-bedroom apartments (463 square feet) are priced from S$1.38 million ($1.04 million). City Developments — among the country's largest developers — and some peers are placing high stakes on the appetite for luxury property.

“With the recent pricing and macro environment, the developer might want to err a bit more on the cautious side and not significantly overprice a project,” said Bloomberg Intelligence analyst Ken Foong.

A unit at Miami’s Biscayne Bay.Source: Lux Media Group and ONE Sotheby’s International Realty

Swap vistas of the Singapore River and Marina Bay for Miami’s Biscayne Bay, where a high-floor, two-bedroom unit in the financial district offers more than three times the space, complete with a tub. Priced at $1.1 million, 1,500-square-foot apartments like these are gaining traction among rich Mexicans seeking to park wealth overseas since President Claudia Sheinbaum’s landslide win. —Nurin Sofia

The Limelight: Centenarian Artist

Who’s in the news in Singapore’s global, multicultural population.Lim Tze Peng received a gift to celebrate his 103rd birthday: his first solo show in the National Gallery.

For more than half a century, Lim’s brush has recorded Singapore’s changes. Chinatown and the Singapore River feature in works blending Orientalist and Impressionist styles. Vibrant portraits of old Singapore are a glimpse of the past, a tour through crowded wet markets and kopitiams, festive celebrations and depictions of local landmarks like the Sultan Mosque, according to exhibition notes.

The show — Becoming Lim Tze Peng — also depicts landscapes from his art expeditions in Southeast Asia and the world beyond. Born in 1921, Lim was a primary school teacher at Xin Min School and then became principal in 1951. He remained principal until he retired in 1981. In an interview this month, Lim told the Straits Times that he is still painting or writing calligraphy. —Alfred Cang

Where: National Gallery Singapore, Level 4 City Hall Wing, 1 St Andrew’s Road

When: Oct. 25 to March 23, 2025, 10 a.m. to 7 p.m. daily

Admission: Free for Singaporeans and permanent residents, from $15 for non-residents

Info: https://www.nationalgallery.sg/BecomingLimTzePeng

The Review: Ningbo Flavors

From the best spots for a business lunch to drinks with the boss, we sample the city’s eateries, bars and new experiences.Among Singapore’s sea of Cantonese and Sichuanese restaurants, newly opened Yongfustands out with cuisine from Ningbo, a city south of Shanghai. It’s the eatery’s fifth branch, along with three in Shanghai and one in Hong Kong.

The vibe. It’s classy and quite a contrast from its relaxed mall location. The main dining room is small, with only four big round tables and two smaller ones. All were taken on a Sunday evening. The decor is understated yet refined.

Yongfu SingaporeSource: Yongfu Singapore

Can you conduct a meeting here? It’s certainly quiet enough for a business lunch. If privacy is needed, there are also bookable rooms available.

What about a romantic dinner? It would depend on the mood you’re going for. Yongfu has a polished feel that’s probably better for a big anniversary celebration than a first date.

What we’d order again. The standout dishes included yam soup, called Taro Pottage on the menu (it’s nicer than it sounds), Chinese mustard greens stewed in a clay pot, and a seaweed cake as a dessert (it’s more of a biscuit). The general flavor profile of Ningbo dishes, I’ve been told, tends to be fresh and leans toward saltiness.

Taro Pottage, Yongfu SingaporeSource: Yongchang China

Need to know. Located on the first floor of Suntec City mall, Yongfu opens daily from 10 a.m. to 10 p.m. Prices can vary depending on what you order. I went with family to celebrate a birthday, and we avoided the extravagant live seafood options. One soup, two appetizers and four mains for the four of us came to more than S$500. Call to reserve. —Yongchang Chin

Have a place you’d like us to review or feedback to share? Get in touch at [email protected].

Thanks for reading our newsletter! Subscribe hereif you haven’t already.

More from Bloomberg

- Markets Daily for what’s moving in stocks, bonds, FX and commodities

- Next China provides dispatches from within the world’s second-largest economy on where China stands now — and where it’s going next

- Hong Kong Edition for following the money and people shaking up the Asian finance hub

- India Edition for an insider’s guide to the emerging economic powerhouse

- Watch Club for exclusive news about timepieces, plus access to special events and meetups

- Explore all Bloomberg newsletters at Bloomberg.com.

— With assistance from Patrick Winters, Nurin Sofia, Yongchang Chin, and Low De Wei

Copy Link

Follow all new stories by Bill Faries

Save

Share feedback

Have a confidential tip for our reporters? Get in Touch

Before it’s here, it’s on the Bloomberg Terminal

More From Bloomberg

Nomura Woes Deepen on Spoofing Case, Attempted Murder Arrest

Stocks Rise as Dip Buyers Fuel Wall Street Rebound: Markets Wrap

Saudi Arabia Nears Deal to Take Over $4 Billion Olam Unit

Apple Sparks Concerns With Tepid Forecast, China Weakness

Top Reads

The US Is Squandering Its Hidden Advantage Over Xi Jinping

by Bloomberg News

Oil Was Written Off. Now It’s the Most Productive US Industry

by Catarina Saraiva, David Wethe, Mitchell Ferman and Kevin Crowley

Asia's Baby Shortage Cries Out for a Gender Equality Solution

by Katia Dmitrieva and Mia Glass

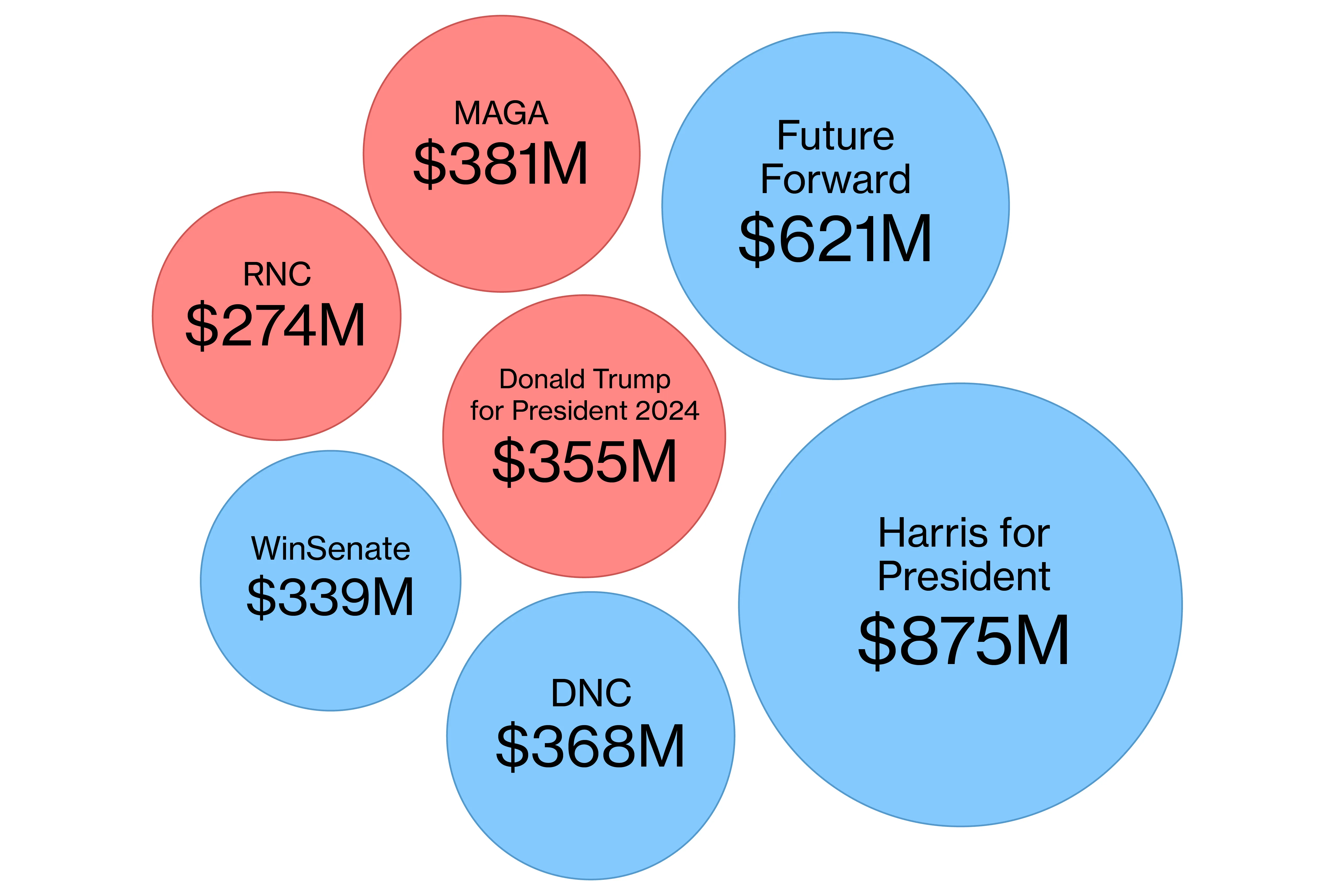

11,000 Political Groups Spent $14 Billion to Influence the 2024 Election

by Raeedah Wahid, Bill Allison, Cedric Sam and Tanaz Meghjani

For you

Based on your reading history and topics you followNomura Woes Deepen on Spoofing Case, Attempted Murder Arrest

Stocks Rise as Dip Buyers Fuel Wall Street Rebound: Markets Wrap

Stocks Rise as Dip Buyers Fuel Wall Street Rebound: Markets Wrap

Saudi Arabia Nears Deal to Take Over $4 Billion Olam Unit

Saudi Arabia Nears Deal to Take Over $4 Billion Olam Unit

Apple Sparks Concerns With Tepid Forecast, China Weakness

Apple Sparks Concerns With Tepid Forecast, China Weakness

Add more topics to your feed

Markets

Government

Emerging Markets

Infrastructure

Fixed Income

BRICS

Policy

Monetary Policy

HomeBTV+Market DataOpinionAudioOriginalsMagazineEvents

News

MarketsEconomicsTechnologyPoliticsGreenCryptoAI

Work & Life

WealthPursuitsBusinessweekCityLabEqualityPursuitsWork Shift

Market Data

StocksCommoditiesRates & BondsCurrenciesFuturesSectorsEconomic Calendar

Explore

NewslettersExplainersThe Big TakeGraphicsSubmit a TipAbout Us

Terms of ServiceDo Not Sell or Share My Personal InformationTrademarksPrivacy Policy

CareersMade in NYCAdvertise

Ad Choices

Help©2024 Bloomberg L.P. All Rights Reserved.