https://www.businesstimes.com.sg/brunch/singapore-stocks-once-bitten-twice-shy

Why retail investors are shifting away from the local bourse, and how SGX plans to stay ahead

UPDATED Sat, Aug 21, 2021 - 9:42 AM

AS a seasoned stock market investor since the 1990s, Ken is no stranger to market fluctuations and paper losses. As of today, the 56-year-old has lost some S$300,000 in the Singapore stock market, while his investments in the United States and Hong Kong have given him sizeable profits. "Retail investors don't have much confidence here, they're getting toasted," he tells The Business Times. "I've lost so much money that I'm scared."

While Singapore continues to be lauded as a financial hub, drawing big business and billions in foreign investment, the local stock market appears to have lost some of its appeal to retail, or non-professional, investors like Ken. Concerns like regulatory lapses and lack of liquidity, he says, have diminished confidence.

"I would generally avoid the Singapore market unless there are sound stocks like the blue-chips," he says, "but I have allocated less for Singapore unless we see a marked improvement in the supervisory environment here".

Some of Ken's biggest losses in the local market to date include S$20,000 in embattled commodities trading company Noble Group, and about S$200,000 in entertainment production company Spackman Entertainment Group which has incurred the ire of regulator Singapore Exchange Regulation (SGX RegCo) for issues related to its management and certain acquisitions, and is currently trading at about 0.5 Singapore cent. The counter's high was 50.5 cents back in July 2014.

It is a similar situation for 65-year-old retiree CK Law. He has been investing since 2000, and has been more active in the stock market since his retirement last year.

The Covid-19 pandemic made things worse. Mr Law, who invests only in Singapore, is now staring at a "six-figure paper loss" while his friends are reaping gains from rallies in other markets around the world.

Since the end of March 2020 when the Covid-19 pandemic decimated most stock markets around the world, the benchmark Straits Times Index is up about 24.4 per cent. In comparison, the Shanghai and Hong Kong markets are up 26 per cent and 7.3 per cent respectively, while the Malaysia market is up 12.1 per cent. Key Wall Street indices are also up. The Dow Jones Industrial Average has risen 59.1 per cent, the Nasdaq has added 88.9 per cent, while the S&P 500 is up 70.5 per cent.

Declining investor confidence

Although the Singapore market is known for its stability, some have identified shortcomings that could threaten its ability to attract investor interest. Younger investors also appear to be shying away from the local bourse.

Investment analyst Jennifer Franslay says her current portfolio allocations are 60 per cent in the US, 30 per cent in the rest of Asia, and 5 per cent each in Singapore and cryptocurrencies. The 25-year-old says that her US holdings have recovered to pre-Covid levels, while most of her Singapore holdings are still in the red.

"When someone invests in the Singapore market, they're losing out on all the gains they can get from overseas markets, which is why I find it quite unattractive," she says.

Financial adviser Liu Minghao says the market movement of the Singapore market is "way too small" compared to that of the US. The types of counters listed in Singapore also have limited appeal, he suggests.

"In Singapore, we all know about Walmart and probably invest in it, but I doubt there is anyone in the US looking to buy Sheng Siong shares," says the 25-year-old.

In order to shore up retail activity, the Singapore stock market needs to urgently improve on two things - liquidity and attracting "good quality companies", says S Nallakaruppan, president of the Society of Remisiers.

Homegrown unicorns like Grab and SEA are venturing abroad for listings. MyRepublic plans a Hong Kong IPO, while Olam opted for London for the primary listing of its unit Olam Food Ingredients with a concurrent listing on SGX.

A rising number of companies have also come under investigation or have been voluntarily suspended from trading for long periods of time, which he says is the stock market equivalent of a "black hole". Investors are left in the lurch holding "zombie companies".

According to a report from SGX, 56 stocks have been suspended from trading for 12 months or longer as at May this year, while another 9 stocks are set to be delisted in due course. This translates to about 10 per cent of counters currently listed on the bourse. In 2016 when SGX first started giving half-yearly updates of such stocks, there were only 20 stocks on this list.

Mr Nallakaruppan recalls his own experience with railway parts maker Midas Holdings, which shocked shareholders with litigation suits and enforcement orders. The stock has been suspended from trading since February 2018, but remains listed on SGX.

"It's sad when you see all your money wiped out like this, and all these affect investors' confidence overtime," he says. "This isn't like Monopoly money, it's real money that people are losing."

Delistings have also been on the rise, notes Maybank Kim Eng's (MBKE) chief executive Aditya Laroia. "Since 2012, delistings on SGX have outpaced new listings by 40 per cent," he notes. "This is largely driven by the limited niche, specialised sectors offered on SGX compared to other regional exchanges. Notable valuation discounts have been the result, encouraging delistings."

A lack of liquidity has prompted listed companies to head for privatisation, including BreadTalk, Fragrance Group and SK Jewellery.

SGX's latest financial results released on Aug 5 reflect some of these sentiments. SGX posted net profit of S$205.6 million for the second half of FY2021 ended June, down from S$258.6 million in the year-ago period. The group's H2 operating revenue fell 6.8 per cent year-on-year to S$535.1 million, with the decline coming from its equities segment, amid a fall in treasury and other revenue as well as trading and clearing revenue.

For the full FY2021, SGX's largest business segment, equities, saw operating revenue decline 7.7 per cent to S$701.1 million.

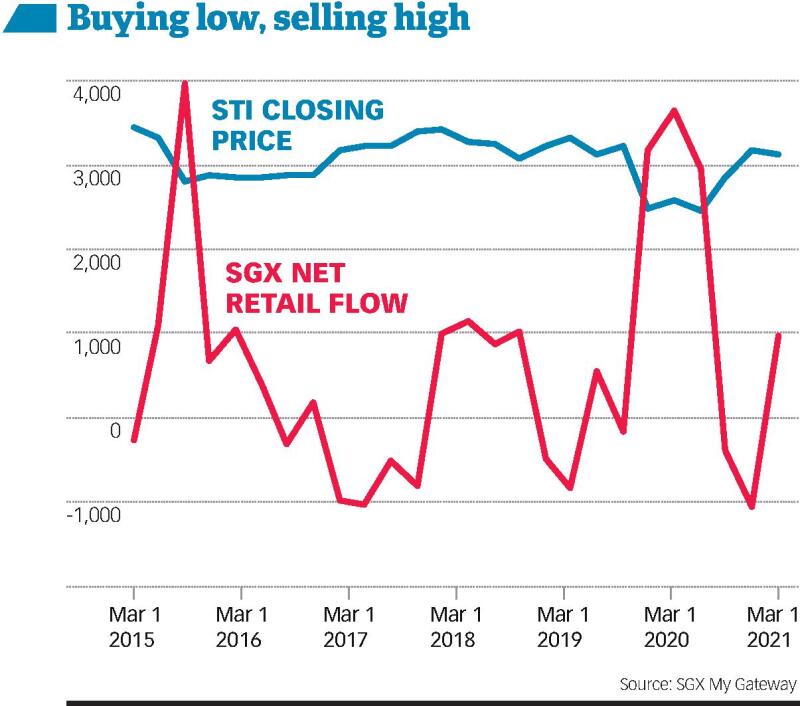

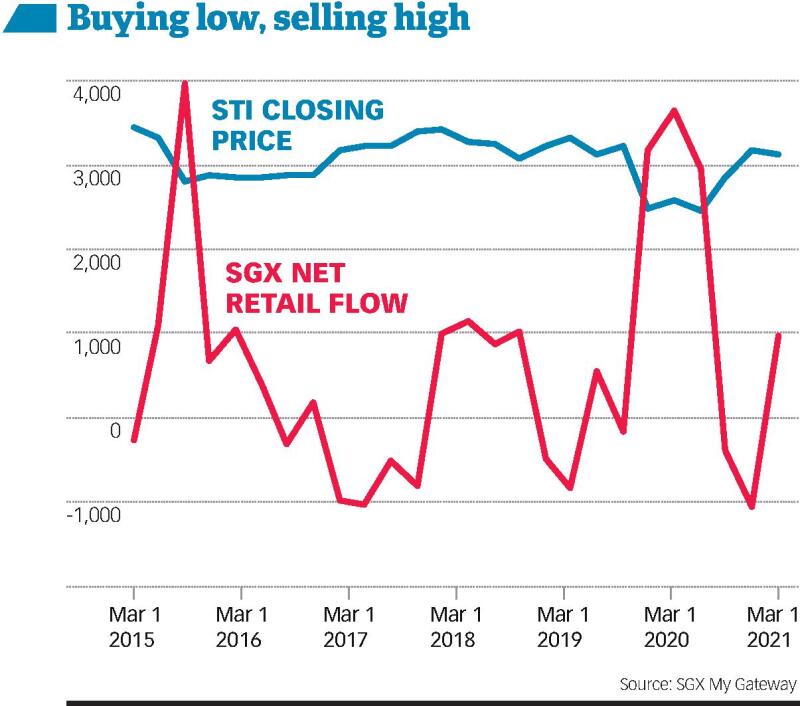

SGX market strategist Geoff Howie notes that STI constituent stocks typically "dominate" the inflows and outflows of the Singapore market in terms of market value. However, in July this year, only six out of the 30 stocks that saw the highest net institutional inflows were constituent stocks.

The health of the stock market is largely dependent on the authorities and regulators here, argues Mak Yuen Teen, a corporate governance advocate and associate professor at the National University of Singapore.

Prof Mak notes that 10 years ago, Singapore was home to more than 150 "S-chip" companies, or Chinese companies listed on SGX. This number is down to just 71 today, and could drop even further, he warns.

"Just over the first six months of this year, another six S-chips have disappeared. I am not saying they are all going to collapse, but I think we will continue to see more doing so," he says.

What was once an "S-chip problem" has spread to the rest of the market over the past few years. Big companies like Hyflux and Noble, Singapore-based companies like Best World and Trek 2000, and Eagle Hospitality Trust are some of the names that have collapsed, wiping out investors' money along with them.

Mom-and-pop investors also have limited protection in the market, notes Prof Mak, and may not have the resources to make up for losses. As such, the bourse regulator needs to do more to protect the interests of these investors in terms of holding relevant parties responsible for stock market scandals. These include the likes of company directors, issue managers, sponsors and auditors.

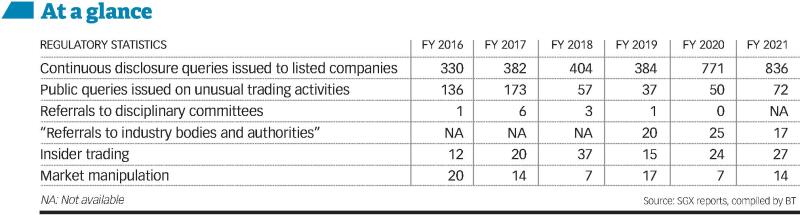

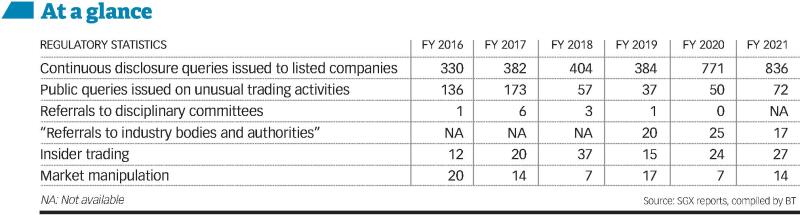

"While SGX Regco has strengthened certain rules and improved its surveillance, and there are signs of them and other regulators stepping up, we have yet to see results," says Prof Mak.

"We should aim for a market with good quality companies, not aim to increase the number of listings regardless of quality."

Changing investment landscape

Over the years, more people have piled into capital markets as they realise the importance of alternative sources of income. Financial literacy too has increased, and with it, awareness of the need to diversify portfolios.

"Singapore investors have become more aware - not just of opportunities but more importantly, risks," says Thomas Rupf, head of VP Bank Singapore.

Financial institutions and brokerages report similar trends. MBKE's Mr Laroia says that in the past, opportunities on the SGX could represent as much as 80 per cent of the bank's retail business.

"One would expect that to be reflective of many firms in Singapore," says Mr Laroia. But investors became "more informed holistically about opportunities globally".

Without commenting on exact proportions, Mr Laroia says the Singapore market is "still a significant portion" of MBKE's retail business, but interest in the US and Hong Kong markets have seen "significant increases" over recent years, and continue to grow.

Samuel Rhee, chairman and chief investment officer of Endowus, says that the firm offers several "ready-made investment portfolios" that are designed to serve different investment objectives. "Most portfolios are globally diversified and Singapore's representation in the global allocation is very small," he says.

"Endowus' clients are generally more interested in global markets which have provided consistently better returns over time than being just exposed to a single market, but most will maintain some small exposure to Singapore."

Exposure to Singapore securities in Endowus's Cash Smart portfolios - which have shorter-term goals - currently range from 16.4 per cent to 30.2 per cent. The Selected General Investing portfolios for cash and Supplementary Retirement Scheme (SRS) funds have allocations of 0.11 per cent to 0.63 per cent.

Digital wealth manager Syfe's chief executive Dhruv Arora notes that Singaporeans "already have a lot of exposure to the Singaporean market by working and owning property in Singapore".

"The most attractive and popular overseas markets for our clients are definitely the US and China."

While Syfe's core portfolio, which offers "global diversification", has a "negligible" allocation to Singapore, its real-estate, income-focused portfolio is fully made up of Singapore-listed real estate investment trusts and Singapore government bonds. Its cash management solution, Cash+, has about 50 per cent of its holdings in Singapore through government bonds and investment grade corporate bonds.

Stashaway says: "In general, we try to build portfolios that give our clients as much global exposure as possible for diversification."

A majority of clients at Tiger Brokers have holdings in equities directly, says chief executive Eng Thiam Choon. US holdings are the most popular, with a notional value of about 68 per cent. Hong Kong's stands at 24 per cent, while Singapore has just 5 per cent.

"Today, there is a huge interest in technology and digitalisation due to the pandemic, and the US stock markets are getting more interesting with theirs reputation for attracting big technology companies," says Mr Eng.

Staying ahead of the curve

SGX is ramping up its efforts to provide a diversified experience for investors, and has been increasing its focus on derivatives. The result? An ability to offer investors "two forms of economic participation", says Michael Syn, head of equities at SGX. Mr Syn used to look after SGX's currency and commodity derivatives before he assumed his current position.

"One is ownership, which you do through shares. But the other one is really through the economic ripple effects through the economy," he says, which makes the market "both horizontally and vertically integrated".

SGX had long ago noticed that most customers wanted things that exist both in the stock market and in the futures market, and the exchange has had to adapt accordingly in order to secure a "bigger share of (customers') wallets.

"If I don't do it, someone else will do it, and then they will be number one in Asia," says Mr Syn. He recalls how, a decade ago, investors were interested in China commodities and currency. Three to five years ago, SGX offered access to different countries and themes through launching more currencies and commodities.

Today, the exchange has broadened its range of ESG derivatives even further. In January this year, SGX launched four new derivatives which have been certified by the Commodity Futures Trading Commission, enabling market participants to trade them directly from the US. These include the SGX FTSE Blossom Japan Index Futures and the SGX FTSE Emerging ESG Index Futures.

SGX has also increased its focus on foreign exchange. In June 2020, the exchange fully acquired BidFX - a cloud-based foreign exchange (FX) trading platform for institutional investors. In July 2021, it also acquired global multi-asset execution and order management systems provider MaxxTrader.

But competition is on the rise. SGX is looking to grow its non-equities business, which constitutes commodities, derivatives and FX. This segment has also seen the largest increase in liquidity, says Mr Syn.

"The largest increase in liquidity that we've seen reflects very much Singapore's increasing role in commodities, derivatives, and FX... that's why we derive so much of our revenue and growth from derivatives."

SGX is also actively looking into allowing special purpose acquisition companies (SPACs) to list in Singapore, and is said to be considering lowering the minimum value for SPAC listings, DealStreetAsia reported on Thursday.

Robson Lee, a Singapore-based partner of US law firm Gibson Dunn, says that while there could be some initial interest by promoters and cornerstone investors to set up SPACs in Singapore when this is allowed, sustained demand will depend on the market's ability to attract potential unicorns or serious businesses to list here.

He says: "While finalising the regulatory requirements for SPAC listings, SGX should concurrently address the fundamentals to promote Singapore as a holistic market for high liquidity and sustainably high valuation securities listings in Asia."

For equities, meanwhile, the historical challenge for Singapore is that its market "matures and grows very early", says SGX's Mr Syn. For instance, domestic names such as Singtel and DBS were listed in the 1990s. Today, the exchange is a 50:50 between domestic and international companies, but newer platforms and companies are emerging. And SGX will have to continue to take heavy bets to keep its attractiveness to investors.

Staying ahead of the curve has been the focus of SGX, says Mr Syn.

"I often tell my guys this, it's not because we're smarter. It's because we have to be. Otherwise, there's nothing left for us... Because if we don't anticipate and build in advance of demand, by the time the demand comes, it's very hard for us to compete for attention and for credibility."

Why retail investors are shifting away from the local bourse, and how SGX plans to stay ahead

UPDATED Sat, Aug 21, 2021 - 9:42 AM

AS a seasoned stock market investor since the 1990s, Ken is no stranger to market fluctuations and paper losses. As of today, the 56-year-old has lost some S$300,000 in the Singapore stock market, while his investments in the United States and Hong Kong have given him sizeable profits. "Retail investors don't have much confidence here, they're getting toasted," he tells The Business Times. "I've lost so much money that I'm scared."

While Singapore continues to be lauded as a financial hub, drawing big business and billions in foreign investment, the local stock market appears to have lost some of its appeal to retail, or non-professional, investors like Ken. Concerns like regulatory lapses and lack of liquidity, he says, have diminished confidence.

"I would generally avoid the Singapore market unless there are sound stocks like the blue-chips," he says, "but I have allocated less for Singapore unless we see a marked improvement in the supervisory environment here".

Some of Ken's biggest losses in the local market to date include S$20,000 in embattled commodities trading company Noble Group, and about S$200,000 in entertainment production company Spackman Entertainment Group which has incurred the ire of regulator Singapore Exchange Regulation (SGX RegCo) for issues related to its management and certain acquisitions, and is currently trading at about 0.5 Singapore cent. The counter's high was 50.5 cents back in July 2014.

It is a similar situation for 65-year-old retiree CK Law. He has been investing since 2000, and has been more active in the stock market since his retirement last year.

The Covid-19 pandemic made things worse. Mr Law, who invests only in Singapore, is now staring at a "six-figure paper loss" while his friends are reaping gains from rallies in other markets around the world.

Since the end of March 2020 when the Covid-19 pandemic decimated most stock markets around the world, the benchmark Straits Times Index is up about 24.4 per cent. In comparison, the Shanghai and Hong Kong markets are up 26 per cent and 7.3 per cent respectively, while the Malaysia market is up 12.1 per cent. Key Wall Street indices are also up. The Dow Jones Industrial Average has risen 59.1 per cent, the Nasdaq has added 88.9 per cent, while the S&P 500 is up 70.5 per cent.

Declining investor confidence

Although the Singapore market is known for its stability, some have identified shortcomings that could threaten its ability to attract investor interest. Younger investors also appear to be shying away from the local bourse.

Investment analyst Jennifer Franslay says her current portfolio allocations are 60 per cent in the US, 30 per cent in the rest of Asia, and 5 per cent each in Singapore and cryptocurrencies. The 25-year-old says that her US holdings have recovered to pre-Covid levels, while most of her Singapore holdings are still in the red.

"When someone invests in the Singapore market, they're losing out on all the gains they can get from overseas markets, which is why I find it quite unattractive," she says.

Financial adviser Liu Minghao says the market movement of the Singapore market is "way too small" compared to that of the US. The types of counters listed in Singapore also have limited appeal, he suggests.

"In Singapore, we all know about Walmart and probably invest in it, but I doubt there is anyone in the US looking to buy Sheng Siong shares," says the 25-year-old.

In order to shore up retail activity, the Singapore stock market needs to urgently improve on two things - liquidity and attracting "good quality companies", says S Nallakaruppan, president of the Society of Remisiers.

Homegrown unicorns like Grab and SEA are venturing abroad for listings. MyRepublic plans a Hong Kong IPO, while Olam opted for London for the primary listing of its unit Olam Food Ingredients with a concurrent listing on SGX.

A rising number of companies have also come under investigation or have been voluntarily suspended from trading for long periods of time, which he says is the stock market equivalent of a "black hole". Investors are left in the lurch holding "zombie companies".

According to a report from SGX, 56 stocks have been suspended from trading for 12 months or longer as at May this year, while another 9 stocks are set to be delisted in due course. This translates to about 10 per cent of counters currently listed on the bourse. In 2016 when SGX first started giving half-yearly updates of such stocks, there were only 20 stocks on this list.

Mr Nallakaruppan recalls his own experience with railway parts maker Midas Holdings, which shocked shareholders with litigation suits and enforcement orders. The stock has been suspended from trading since February 2018, but remains listed on SGX.

"It's sad when you see all your money wiped out like this, and all these affect investors' confidence overtime," he says. "This isn't like Monopoly money, it's real money that people are losing."

Delistings have also been on the rise, notes Maybank Kim Eng's (MBKE) chief executive Aditya Laroia. "Since 2012, delistings on SGX have outpaced new listings by 40 per cent," he notes. "This is largely driven by the limited niche, specialised sectors offered on SGX compared to other regional exchanges. Notable valuation discounts have been the result, encouraging delistings."

A lack of liquidity has prompted listed companies to head for privatisation, including BreadTalk, Fragrance Group and SK Jewellery.

SGX's latest financial results released on Aug 5 reflect some of these sentiments. SGX posted net profit of S$205.6 million for the second half of FY2021 ended June, down from S$258.6 million in the year-ago period. The group's H2 operating revenue fell 6.8 per cent year-on-year to S$535.1 million, with the decline coming from its equities segment, amid a fall in treasury and other revenue as well as trading and clearing revenue.

For the full FY2021, SGX's largest business segment, equities, saw operating revenue decline 7.7 per cent to S$701.1 million.

SGX market strategist Geoff Howie notes that STI constituent stocks typically "dominate" the inflows and outflows of the Singapore market in terms of market value. However, in July this year, only six out of the 30 stocks that saw the highest net institutional inflows were constituent stocks.

The health of the stock market is largely dependent on the authorities and regulators here, argues Mak Yuen Teen, a corporate governance advocate and associate professor at the National University of Singapore.

Prof Mak notes that 10 years ago, Singapore was home to more than 150 "S-chip" companies, or Chinese companies listed on SGX. This number is down to just 71 today, and could drop even further, he warns.

"Just over the first six months of this year, another six S-chips have disappeared. I am not saying they are all going to collapse, but I think we will continue to see more doing so," he says.

What was once an "S-chip problem" has spread to the rest of the market over the past few years. Big companies like Hyflux and Noble, Singapore-based companies like Best World and Trek 2000, and Eagle Hospitality Trust are some of the names that have collapsed, wiping out investors' money along with them.

Mom-and-pop investors also have limited protection in the market, notes Prof Mak, and may not have the resources to make up for losses. As such, the bourse regulator needs to do more to protect the interests of these investors in terms of holding relevant parties responsible for stock market scandals. These include the likes of company directors, issue managers, sponsors and auditors.

"While SGX Regco has strengthened certain rules and improved its surveillance, and there are signs of them and other regulators stepping up, we have yet to see results," says Prof Mak.

"We should aim for a market with good quality companies, not aim to increase the number of listings regardless of quality."

Changing investment landscape

Over the years, more people have piled into capital markets as they realise the importance of alternative sources of income. Financial literacy too has increased, and with it, awareness of the need to diversify portfolios.

"Singapore investors have become more aware - not just of opportunities but more importantly, risks," says Thomas Rupf, head of VP Bank Singapore.

Financial institutions and brokerages report similar trends. MBKE's Mr Laroia says that in the past, opportunities on the SGX could represent as much as 80 per cent of the bank's retail business.

"One would expect that to be reflective of many firms in Singapore," says Mr Laroia. But investors became "more informed holistically about opportunities globally".

Without commenting on exact proportions, Mr Laroia says the Singapore market is "still a significant portion" of MBKE's retail business, but interest in the US and Hong Kong markets have seen "significant increases" over recent years, and continue to grow.

Samuel Rhee, chairman and chief investment officer of Endowus, says that the firm offers several "ready-made investment portfolios" that are designed to serve different investment objectives. "Most portfolios are globally diversified and Singapore's representation in the global allocation is very small," he says.

"Endowus' clients are generally more interested in global markets which have provided consistently better returns over time than being just exposed to a single market, but most will maintain some small exposure to Singapore."

Exposure to Singapore securities in Endowus's Cash Smart portfolios - which have shorter-term goals - currently range from 16.4 per cent to 30.2 per cent. The Selected General Investing portfolios for cash and Supplementary Retirement Scheme (SRS) funds have allocations of 0.11 per cent to 0.63 per cent.

Digital wealth manager Syfe's chief executive Dhruv Arora notes that Singaporeans "already have a lot of exposure to the Singaporean market by working and owning property in Singapore".

"The most attractive and popular overseas markets for our clients are definitely the US and China."

While Syfe's core portfolio, which offers "global diversification", has a "negligible" allocation to Singapore, its real-estate, income-focused portfolio is fully made up of Singapore-listed real estate investment trusts and Singapore government bonds. Its cash management solution, Cash+, has about 50 per cent of its holdings in Singapore through government bonds and investment grade corporate bonds.

Stashaway says: "In general, we try to build portfolios that give our clients as much global exposure as possible for diversification."

A majority of clients at Tiger Brokers have holdings in equities directly, says chief executive Eng Thiam Choon. US holdings are the most popular, with a notional value of about 68 per cent. Hong Kong's stands at 24 per cent, while Singapore has just 5 per cent.

"Today, there is a huge interest in technology and digitalisation due to the pandemic, and the US stock markets are getting more interesting with theirs reputation for attracting big technology companies," says Mr Eng.

Staying ahead of the curve

SGX is ramping up its efforts to provide a diversified experience for investors, and has been increasing its focus on derivatives. The result? An ability to offer investors "two forms of economic participation", says Michael Syn, head of equities at SGX. Mr Syn used to look after SGX's currency and commodity derivatives before he assumed his current position.

"One is ownership, which you do through shares. But the other one is really through the economic ripple effects through the economy," he says, which makes the market "both horizontally and vertically integrated".

SGX had long ago noticed that most customers wanted things that exist both in the stock market and in the futures market, and the exchange has had to adapt accordingly in order to secure a "bigger share of (customers') wallets.

"If I don't do it, someone else will do it, and then they will be number one in Asia," says Mr Syn. He recalls how, a decade ago, investors were interested in China commodities and currency. Three to five years ago, SGX offered access to different countries and themes through launching more currencies and commodities.

Today, the exchange has broadened its range of ESG derivatives even further. In January this year, SGX launched four new derivatives which have been certified by the Commodity Futures Trading Commission, enabling market participants to trade them directly from the US. These include the SGX FTSE Blossom Japan Index Futures and the SGX FTSE Emerging ESG Index Futures.

SGX has also increased its focus on foreign exchange. In June 2020, the exchange fully acquired BidFX - a cloud-based foreign exchange (FX) trading platform for institutional investors. In July 2021, it also acquired global multi-asset execution and order management systems provider MaxxTrader.

But competition is on the rise. SGX is looking to grow its non-equities business, which constitutes commodities, derivatives and FX. This segment has also seen the largest increase in liquidity, says Mr Syn.

"The largest increase in liquidity that we've seen reflects very much Singapore's increasing role in commodities, derivatives, and FX... that's why we derive so much of our revenue and growth from derivatives."

SGX is also actively looking into allowing special purpose acquisition companies (SPACs) to list in Singapore, and is said to be considering lowering the minimum value for SPAC listings, DealStreetAsia reported on Thursday.

Robson Lee, a Singapore-based partner of US law firm Gibson Dunn, says that while there could be some initial interest by promoters and cornerstone investors to set up SPACs in Singapore when this is allowed, sustained demand will depend on the market's ability to attract potential unicorns or serious businesses to list here.

He says: "While finalising the regulatory requirements for SPAC listings, SGX should concurrently address the fundamentals to promote Singapore as a holistic market for high liquidity and sustainably high valuation securities listings in Asia."

For equities, meanwhile, the historical challenge for Singapore is that its market "matures and grows very early", says SGX's Mr Syn. For instance, domestic names such as Singtel and DBS were listed in the 1990s. Today, the exchange is a 50:50 between domestic and international companies, but newer platforms and companies are emerging. And SGX will have to continue to take heavy bets to keep its attractiveness to investors.

Staying ahead of the curve has been the focus of SGX, says Mr Syn.

"I often tell my guys this, it's not because we're smarter. It's because we have to be. Otherwise, there's nothing left for us... Because if we don't anticipate and build in advance of demand, by the time the demand comes, it's very hard for us to compete for attention and for credibility."