-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Serious Shanghai become ghost town, FTs and Tiongs run road!

- Thread starter Pinkieslut

- Start date

The Government Data Is Missing the Recession

https://247wallst.com/military/2024/09/06/the-government-data-is-missing-the-recession/

Austin Smith

Published: September 6, 2024 6:30 pm

https://feeds.feedburner.com/typepad/RyNm

https://www.facebook.com/sharer/sha...=The Government Data Is Missing the Recession

https://twitter.com/intent/tweet?ur...the-government-data-is-missing-the-recession/

https://apple.news/TScSq_6wWRYOv00RB2aVF2A

https://flipboard.com/@247WallSt

https://b.smartnews.be/sr/A4puk1w66vSs2rHUyfjcYZuMrAougXMEK

Key Points:

- Government economic reports, like unemployment and GDP, are being questioned for accuracy.

- Experts suggest real GDP growth might be closer to 0.9%, indicating a potential recession.

- Current economic metrics are seen as outdated and potentially misleading.

- One of the best ways to protect yourself in a downturn is high-quality dividend stocks. Smart money is scooping up these two dividend legends before word gets out.

US market selloff stokes recession fears, trounces rate cut cheer

By Naomi RovnickSeptember 4, 20248:47 PM GMT+8Updated 2 days ago

A trader works on the floor at the New York Stock Exchange (NYSE) in New York City, U.S., August 28, 2024. REUTERS/Brendan McDermid/File Photo Purchase Licensing Rights, opens new tab

- Summary

- Companies

- Renewed recession risks batter stocks

- Volatility gauges on the rise

- Aggressive Fed rate cut forecasts no longer seen as good news

Following a rapid recovery for risky assets such as stocks and high yield bonds from a chaotic early August selloff, traders have lost their short-lived optimism that U.S. interest rate cuts would support growth.

U.S. stocks fell on Friday, weighed down by a jobs report that left traders uncertain about how far the Federal Reserve will go in cutting interest rates.

Instead, they appear to be already getting ahead of U.S. jobs data on Friday that may repeat last month's weak report, with Tuesday's weak U.S. manufacturing data triggering fresh selling.

Wall Street's S&P 500 share index (.SPX), opens new tab fell over 2% on Tuesday, while Japan's broad Topix share gauge plunged 3.7% on Wednesday in its biggest daily drop since the Aug. 5 market rout and European stocks tumbled (.STOXX), opens new tab.

Meanwhile, the VIX (.VIX), opens new tab index of expected U.S. equity volatility has hit a one-month high, as choppy currency trading threatened the dollar and other haven currencies.

"Markets were dealing with uncertain inflation but growth was resilient," said Florian Ielpo, head of macro at Lombard Odier. "That situation seems to be changing, the new uncertainty is how deep will the slowdown be."

Indonesia’s middle class lament ‘worsening’ plight, as sharp drop in their population sets off economic alarm bell

channelnewsasia.com4 hours agoWorkers wait for a train home at a station in Jakarta, Indonesia. (Photo: CNA/Wisnu Agung Prasetyo)

JAKARTA: It has been four years since Mr Muhammad Yudhi last had a steady job. The 33-year-old motorcycle taxi driver used to work at a textile factory one hour east of Jakarta before he was laid off in 2020 due to an economic slowdown brought by the COVID-19 pandemic.

Indonesia’s middle class lament ‘worsening’ plight, as sharp drop in their population sets off economic alarm bell

channelnewsasia.com4 hours ago

Workers wait for a train home at a station in Jakarta, Indonesia. (Photo: CNA/Wisnu Agung Prasetyo)

JAKARTA: It has been four years since Mr Muhammad Yudhi last had a steady job. The 33-year-old motorcycle taxi driver used to work at a textile factory one hour east of Jakarta before he was laid off in 2020 due to an economic slowdown brought by the COVID-19 pandemic.

Oppies should be on their knees grateful to PAP for keeping recession away from sinkies. Our Din Tai Fung and Toast box restaurants are filled with middle class customers

Subscribe

Markets

Jerome PowellPhotographer: Al Drago/Bloomberg

By Katanga Johnson

September 7, 2024 at 8:20 AM GMT+8

Save

The Federal Reserve and other regulators are poised to unveil sweeping changes to a slate of proposed capital rules for banks as they seek to overcome tough resistance from the industry, according to people familiar to the matter.

The revisions, which run up to 450 pages, may be unveiled as soon as Sept. 19 and would reshape key components of the US bank-capital regime known as Basel III Endgame, said the people, who asked not to be identified as the plans may change.

Have a confidential tip for our reporters?

Markets

US to Propose Bank Capital Rule Revisions as Soon as This Month

- Changes will center on operational-risk, capital allocation

- Regulators dialed back plan after fierce backlash from banks

Jerome PowellPhotographer: Al Drago/Bloomberg

By Katanga Johnson

September 7, 2024 at 8:20 AM GMT+8

Save

The Federal Reserve and other regulators are poised to unveil sweeping changes to a slate of proposed capital rules for banks as they seek to overcome tough resistance from the industry, according to people familiar to the matter.

The revisions, which run up to 450 pages, may be unveiled as soon as Sept. 19 and would reshape key components of the US bank-capital regime known as Basel III Endgame, said the people, who asked not to be identified as the plans may change.

Have a confidential tip for our reporters?

Because SG unique ecocomic advantage - middle class customer jiak roti can be from US, Uk, Indon or Africa...thanks to open door globalozation policyOppies should be on their knees grateful to PAP for keeping recession away from sinkies. Our Din Tai Fung and Toast box restaurants are filled with middle class customers

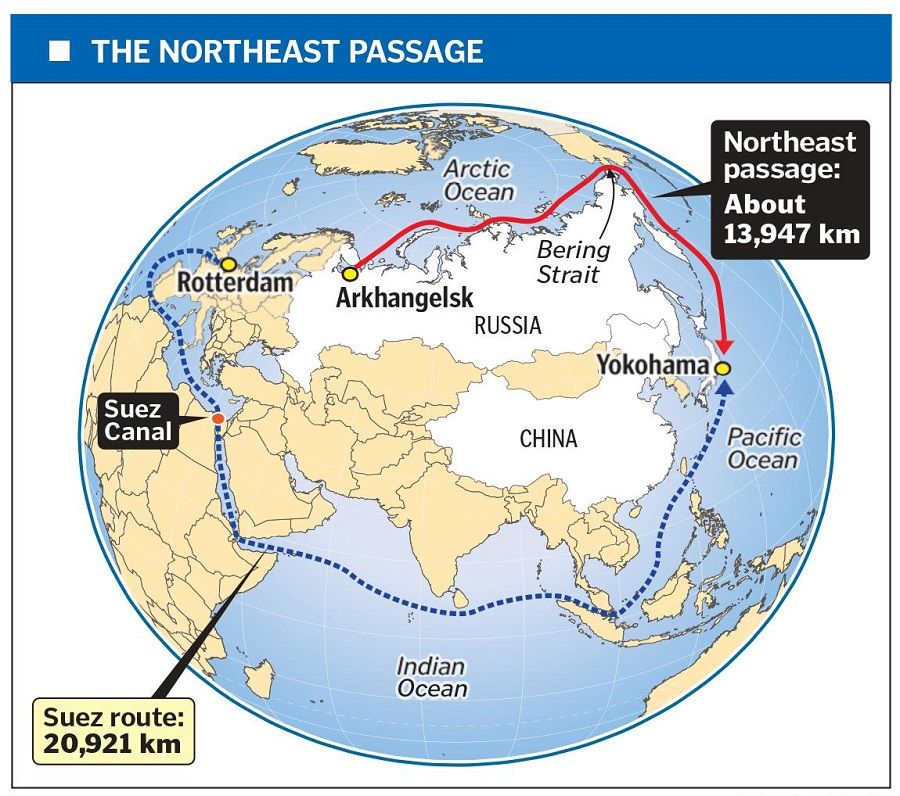

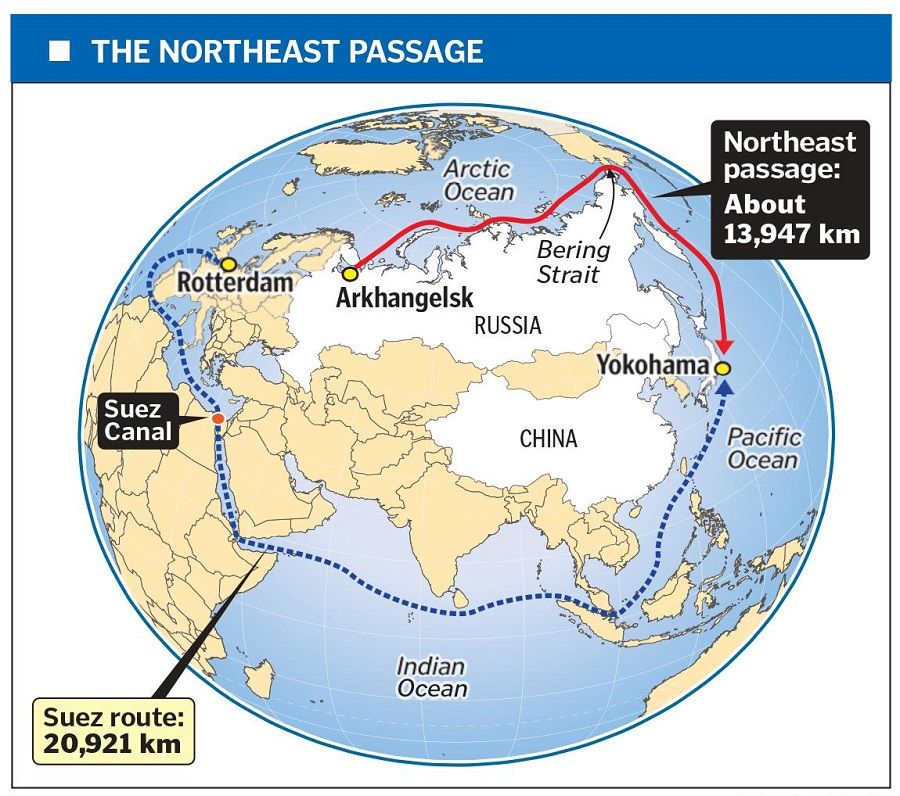

The Northern Sea Route (NSR), also known as the Northeast Passage (NEP), is a shipping route connecting the eastern and western parts of the Arctic Ocean. The 13,000-kilometre NSR is shorter than the 21,000-kilometre Suez Canal route, and can reduce sailing time between Europe and Asia from one month to less than a fortnight.

On 6 June 2023, Russian Prime Minister Mikhail Mishustin spoke at a strategic session on the NSR. The session evaluated the progress of the "Northern Sea Route development plan" which was approved by the Russian government in August 2022 that "includes [the] construction of more than 50 icebreakers and ice-class vessels, ports and terminals, emergency and rescue centres, [and] building an orbital group of satellites". Russia has pledged 2 trillion rubles (US$21.4 billion) over the next 13 years to the development of the NSR.

The Northern Sea Route (NSR), also known as the Northeast Passage. (SPH Media)

The Northern Sea Route (NSR), also known as the Northeast Passage. (SPH Media)

India was recorded as the largest buyer of Russian crude petroleum oil and the second-largest buyer of Russian oil after China in 2022. Russian exports of crude petroleum oil to India increased significantly from US$1,221 million in 2018 to US$24,988 million in 2022, and overall Russian exports to India increased from US$8,695 million in 2021 to US$46,342 million in 2022. The NSR will provide India and Russia with the ability to increase bilateral trade further through its reliable and secure transportation of goods.

On 6 June 2023, Russian Prime Minister Mikhail Mishustin spoke at a strategic session on the NSR. The session evaluated the progress of the "Northern Sea Route development plan" which was approved by the Russian government in August 2022 that "includes [the] construction of more than 50 icebreakers and ice-class vessels, ports and terminals, emergency and rescue centres, [and] building an orbital group of satellites". Russia has pledged 2 trillion rubles (US$21.4 billion) over the next 13 years to the development of the NSR.

Stronger Russia-India ties

On 27-28 March 2023, Alexei Chekunkov, the Russian minister for the development of the Far East and the Arctic, visited India to meet with Indian business circles and officials to discuss the transportation of goods through the NSR via Russian and Indian ports. The meeting confirmed the development of transport and logistics links via the NSR, the Arctic and Far Eastern Railway, and port infrastructure between India and Russia.

India was recorded as the largest buyer of Russian crude petroleum oil and the second-largest buyer of Russian oil after China in 2022. Russian exports of crude petroleum oil to India increased significantly from US$1,221 million in 2018 to US$24,988 million in 2022, and overall Russian exports to India increased from US$8,695 million in 2021 to US$46,342 million in 2022. The NSR will provide India and Russia with the ability to increase bilateral trade further through its reliable and secure transportation of goods.

China CCP is trying hard to channel the social poverty fustration towards other "useful" channel eg TW or Nippon...it continue to double down on old path keep bragging on all its superiorities..that is not useful in a globalise world economic eco system...in fact CCP has dig itself into a corner that Beekok has tailored for themDon't forget Suzhou, hyped up by Sinkies' beloved Floundering Father Lee.

Many Jap expats there have left. They don't want to get stabbed by some crazy brainwashed Tiong.

Well the glass is half fill or half full lohOpen door policy , it's more like prostitute.

Ish a successful formula since Day 1Open door policy , it's more like prostitute.

Look around us, many VVIPs and Big Bosses are Jiuhu lai de

President Xi is making everyone poor,except himself and his party members.

Under Deng,Hu and Jiang, China is prosperous beyond words. It the envy of the world. It lifted hundreds of millions of people out of poverty by the Western media. It hailed as the new wonder. PRCs are buying and buying everything under their nose.

The only way to save China now is to get rid of Xi and his team who still believed in him.

The only way to save the world from China is to break the China up. And President Xi Is providing all the catalyst needed.

Under Deng,Hu and Jiang, China is prosperous beyond words. It the envy of the world. It lifted hundreds of millions of people out of poverty by the Western media. It hailed as the new wonder. PRCs are buying and buying everything under their nose.

The only way to save China now is to get rid of Xi and his team who still believed in him.

The only way to save the world from China is to break the China up. And President Xi Is providing all the catalyst needed.

You are making Jihu Kia rich by making the access so easy to them.Ish a successful formula since Day 1

Look around us, many VVIPs and Big Bosses are Jiuhu lai de

So at the end of the day, they still bring their money back to Jihu and not intending of spending their money here.

Only solution....Hilter show us in 1940-45President Xi is making everyone poor,except himself and his party members.

Under Deng,Hu and Jiang, China is prosperous beyond words. It the envy of the world. It lifted hundreds of millions of people out of poverty by the Western media. It hailed as the new wonder. PRCs are buying and buying everything under their nose.

The only way to save China now is to get rid of Xi and his team who still believed in him.

The only way to save the world from China is to break the China up. And President Xi Is providing all the catalyst needed.

But who want to be at Receiving End?

Non non non....Jiuhu Kia Rich Families dun cum thru Causeway to steal lunch, bro. Poor Jiuhu Kia that cum here steal job mist be controlledYou are making Jihu Kia rich by making the access so easy to them.

So at the end of the day, they still bring their money back to Jihu and not intending of spending their money here.

They usually live in Big Mansions and GCBs tucking in peaceful tranquil corner at atas Orchard Rd or Bt Timah. They are really the Rainmakers

How they access the wealth ? By Singkie government opening up for them.Non non non....Jiuhu Kia Rich Families dun cum thru Causeway to steal lunch, bro. Poor Jiuhu Kia that cum here steal job mist be controlled

They usually live in Big Mansions and GCBs tucking in peaceful tranquil corner at atas Orchard Rd or Bt Timah. They are really the Rainmakers

U need more history class de woh

They are here long before independence

They are here long before independence

How they access the wealth ? By Singkie government opening up for them.

Similar threads

- Replies

- 0

- Views

- 199

- Replies

- 1

- Views

- 258

- Replies

- 1

- Views

- 227

- Replies

- 5

- Views

- 415

- Replies

- 3

- Views

- 334