http://m.sohu.com/n/412346187/?wscrid=15084_1

王健林身家达381亿美元 超越李嘉诚居亚洲首富

05-04 16:36 中国新闻网

21644 放到桌面

王健林重夺大陆首富

00:00

00:00 / 00:27

相关推荐更多

下载

资料视频:王健林重夺大陆首富

中新网5月4日电*最近一个月以来,随着万达集团旗下位于大陆A股和香港H股的两家上市公司股价持续上涨,使得此前位居大陆首富的王健林身家超过了此前的亚洲首富李嘉诚。

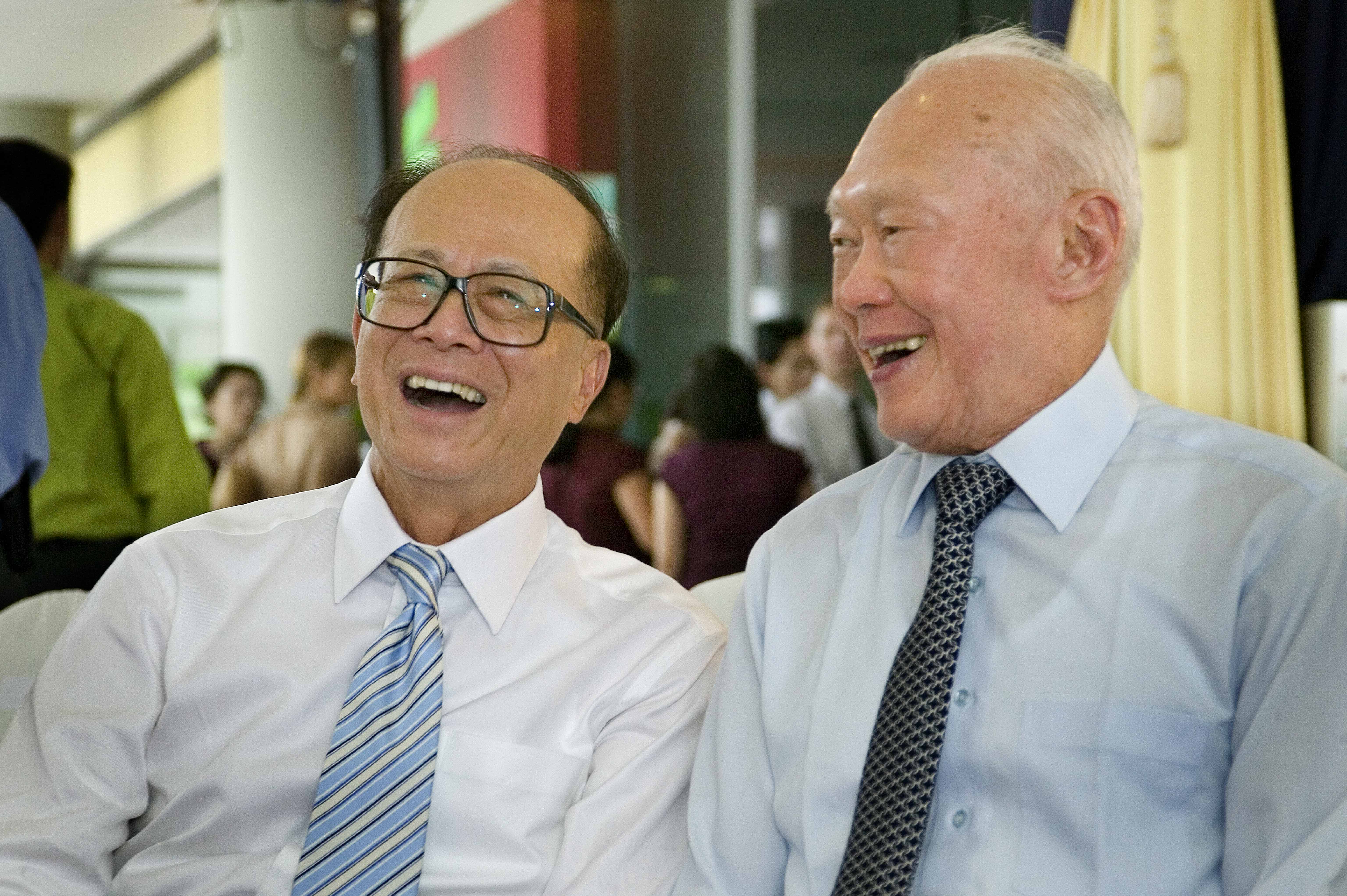

根据彭博华人富豪榜和亚洲富豪榜截至5月1日的数据,王健林以381亿美元的身家超过李嘉诚,成为新的华人首富兼亚洲首富。王健林在当日的排名是全球第11位,马云以351亿美元排名第17位,李嘉诚以347亿美元排名第19位。从4月下旬开始,王健林的排名就持续超过了李嘉诚和马云。

而在彭博、福布斯等机构在早前公布的富豪榜排名当中,当时王健林的身价还只有242亿美元,这期间,王健林旗下三家上市公司的市值上涨成为助推其身价暴涨的关键因素之一。

5月4日,万达集团旗下的港股上市公司万达商业(3699.HK)股价再度拉升,开盘后即冲高至每股68港元,万达商业地产的总市值也首次突破了3000亿港元,按照王健林家族通过万达集团持有万达商业地产24.3亿股计算,王健林家族仅持有万达商业地产的市值就已经超过了200亿美元。

而除了万达商业地产之外,王健林还通过万达投资有限公司持有A股上市公司万达院线(002739.SZ)60.71%的股权,按照5月4日万达院线的总市值计算,这部分股权的市值在572亿元人民币左右。

除了这两家上市公司之外,王健林还持有在美国上市的AMC78%的股份,截止5月4日的股价,这部分股权的市值在145亿元人民币左右。

王健林仅持有的这三家上市公司的股权价值就已经接近2000亿元人民币,折合320亿美元左右。

值得注意的是,从4月份以来王健林掌控下的万达商业和万达院线两家上市公司,都出现了股价大幅上涨,万达商业的区间涨幅为33%,而万达院线的区间涨幅为74%。

对于两家公司在资本市场上的表现,此间有行业分析师认为主要得益于投资者对其估值的重新定位,特别是最近一段时间以来,万达集团提出了旨在从“重资产”向“轻资产”的第四次转型战略之后,长期掣肘万达商业扩张速度的资金瓶颈将得以化解,投资者对于万达商业的资产扩张速度也将做重新评估。

此外,随着万达集团在文化、旅游、电商和金融四大业务上的逐步完善,万达集团未来基于线下消费基础上的客流、物流、资金流和信息流将完成闭合生态的搭建。

“万达商业在内地拥有庞大的商用物业组合,相信可受惠于中央提振国内消费的趋势,万达在国内的品牌强劲,相信零售物业颇受国内外零售商青睐,随着其商用物业组合成熟,相信万达上有空间调高租金。”对于万达商业的预测,瑞银分析师在报告中给出了每股77.95港元/股的目标价,重申“买入”评级。

王健林身家达381亿美元 超越李嘉诚居亚洲首富

05-04 16:36 中国新闻网

21644 放到桌面

王健林重夺大陆首富

00:00

00:00 / 00:27

相关推荐更多

下载

资料视频:王健林重夺大陆首富

中新网5月4日电*最近一个月以来,随着万达集团旗下位于大陆A股和香港H股的两家上市公司股价持续上涨,使得此前位居大陆首富的王健林身家超过了此前的亚洲首富李嘉诚。

根据彭博华人富豪榜和亚洲富豪榜截至5月1日的数据,王健林以381亿美元的身家超过李嘉诚,成为新的华人首富兼亚洲首富。王健林在当日的排名是全球第11位,马云以351亿美元排名第17位,李嘉诚以347亿美元排名第19位。从4月下旬开始,王健林的排名就持续超过了李嘉诚和马云。

而在彭博、福布斯等机构在早前公布的富豪榜排名当中,当时王健林的身价还只有242亿美元,这期间,王健林旗下三家上市公司的市值上涨成为助推其身价暴涨的关键因素之一。

5月4日,万达集团旗下的港股上市公司万达商业(3699.HK)股价再度拉升,开盘后即冲高至每股68港元,万达商业地产的总市值也首次突破了3000亿港元,按照王健林家族通过万达集团持有万达商业地产24.3亿股计算,王健林家族仅持有万达商业地产的市值就已经超过了200亿美元。

而除了万达商业地产之外,王健林还通过万达投资有限公司持有A股上市公司万达院线(002739.SZ)60.71%的股权,按照5月4日万达院线的总市值计算,这部分股权的市值在572亿元人民币左右。

除了这两家上市公司之外,王健林还持有在美国上市的AMC78%的股份,截止5月4日的股价,这部分股权的市值在145亿元人民币左右。

王健林仅持有的这三家上市公司的股权价值就已经接近2000亿元人民币,折合320亿美元左右。

值得注意的是,从4月份以来王健林掌控下的万达商业和万达院线两家上市公司,都出现了股价大幅上涨,万达商业的区间涨幅为33%,而万达院线的区间涨幅为74%。

对于两家公司在资本市场上的表现,此间有行业分析师认为主要得益于投资者对其估值的重新定位,特别是最近一段时间以来,万达集团提出了旨在从“重资产”向“轻资产”的第四次转型战略之后,长期掣肘万达商业扩张速度的资金瓶颈将得以化解,投资者对于万达商业的资产扩张速度也将做重新评估。

此外,随着万达集团在文化、旅游、电商和金融四大业务上的逐步完善,万达集团未来基于线下消费基础上的客流、物流、资金流和信息流将完成闭合生态的搭建。

“万达商业在内地拥有庞大的商用物业组合,相信可受惠于中央提振国内消费的趋势,万达在国内的品牌强劲,相信零售物业颇受国内外零售商青睐,随着其商用物业组合成熟,相信万达上有空间调高租金。”对于万达商业的预测,瑞银分析师在报告中给出了每股77.95港元/股的目标价,重申“买入”评级。