- Joined

- Oct 30, 2014

- Messages

- 36,768

- Points

- 113

Having a meaningful amount of CPF savings will give most of us peace of mind as we cannot reasonably expect every year to be a good year for our investments.

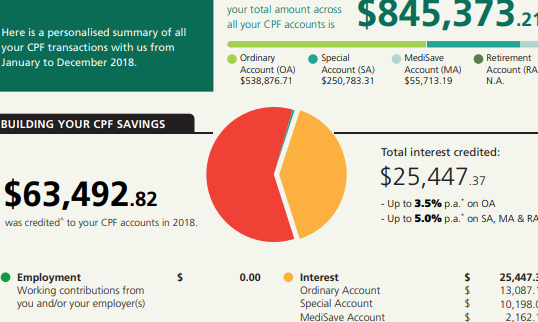

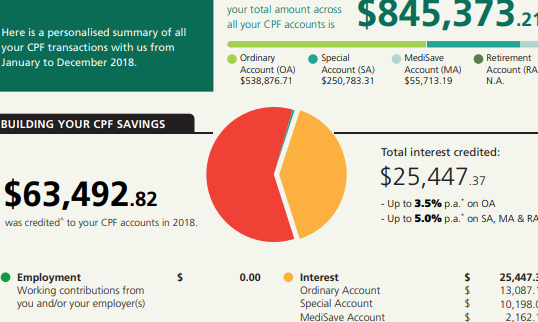

In my retirement, lacking mandatory contributions to my CPF account, I have been voluntarily contributing to my CPF account and here is what it looks like at the end of 2018:

$845,373 at the end of 2018 and that was at the ripe old age of 47 too.

By age 55, more likely than not, my CPF savings will be in excess of $1 million.

To the very rich, $1 million might not be a lot of money but to the vast majority of us, I am sure it will make a meaningful difference in funding our retirement.

This is why I share my CPF story.

Unless we are handicapped in some way, I believe that if we put in enough effort, we can become CPF millionaires.

http://singaporeanstocksinvestor.blogspot.com/

In my retirement, lacking mandatory contributions to my CPF account, I have been voluntarily contributing to my CPF account and here is what it looks like at the end of 2018:

$845,373 at the end of 2018 and that was at the ripe old age of 47 too.

By age 55, more likely than not, my CPF savings will be in excess of $1 million.

To the very rich, $1 million might not be a lot of money but to the vast majority of us, I am sure it will make a meaningful difference in funding our retirement.

This is why I share my CPF story.

Unless we are handicapped in some way, I believe that if we put in enough effort, we can become CPF millionaires.

http://singaporeanstocksinvestor.blogspot.com/