Nvidia CEO Cashes in on Rally With $169 Million Share Sale

- It’s the most he’s netted in a month thanks to stock surge

- The sales were part of a trading plan adopted in March

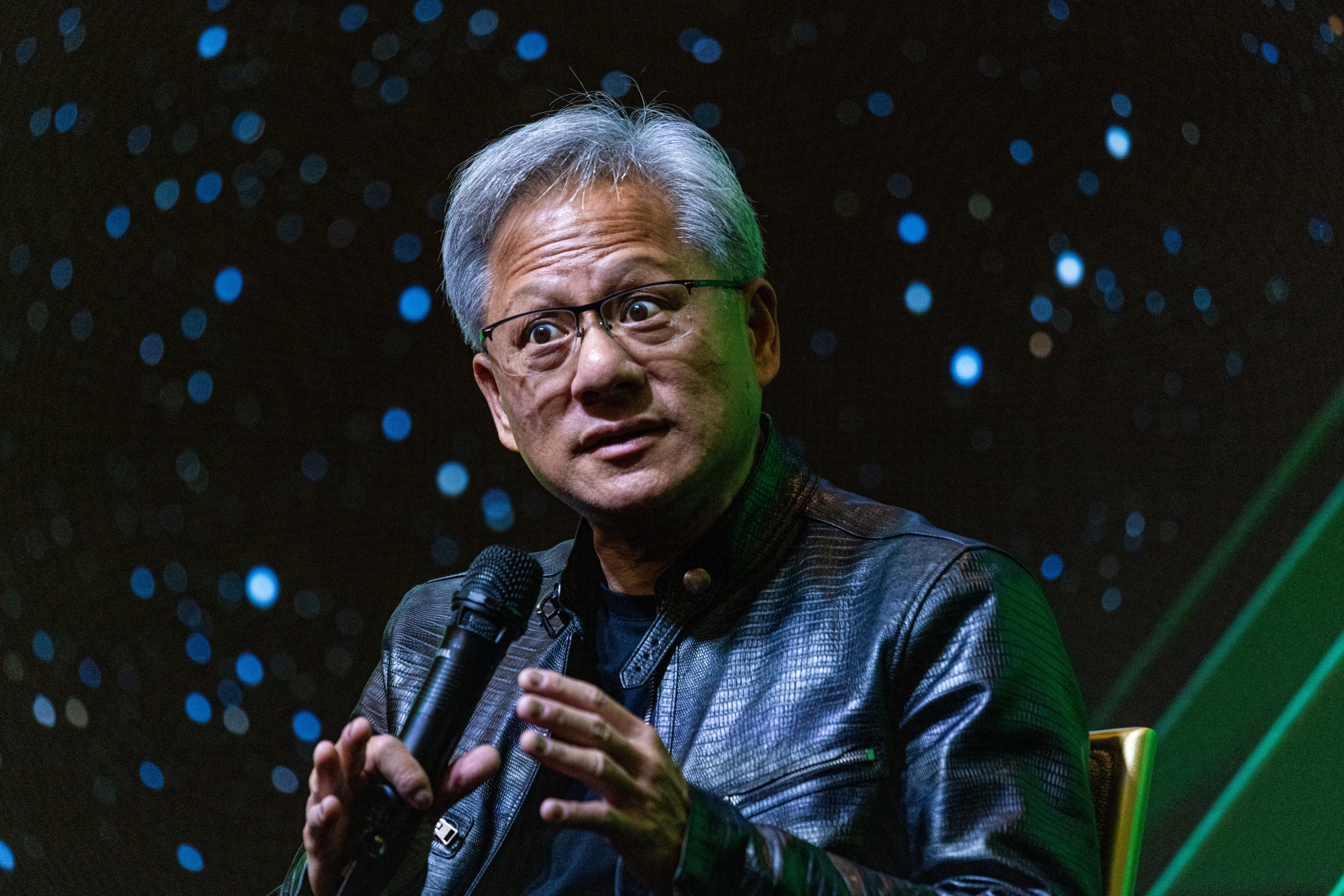

Jensen HuangPhotographer: Annabelle Chih/Bloomberg

By Biz Carson

July 4, 2024 at 12:23 AM GMT+8

Save

Nvidia Corp. Chief Executive Officer Jensen Huang unloaded shares worth nearly $169 million in June, the most he’s netted in a single month, as insatiable demand for the chips used to power artificial intelligence drove the stock to fresh peaks.

The sale of 1.3 million shares, his first of the year, came during a month when Nvidia’s market value rose above $3 trillion for the first time. That briefly made it the world’s most valuable company and pushed Huang, 61, into the rarefied group of ultra-rich with fortunes above $100 billion.

Have a confidential tip for our reporters