-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Serious Medishield life premium to increase by 35% from Apr 2025

- Thread starter sbfuncle

- Start date

- Joined

- Jun 13, 2023

- Messages

- 6,480

- Points

- 113

Skip to main content

Best News Website or Mobile Service

Digital Media Awards Worldwide 2022

A health insurance claim form. (Photo: iStock/LIgorko)

Listen

8 min

New: You can now listen to articles.

Vanessa Lim

15 Oct 2024 03:00PM (Updated: 15 Oct 2024 08:21PM)

Bookmark Share

Read a summary of this article on FAST.

FAST

SINGAPORE: MediShield Life premiums will increase from April 2025 as the government expands the national health insurance scheme.

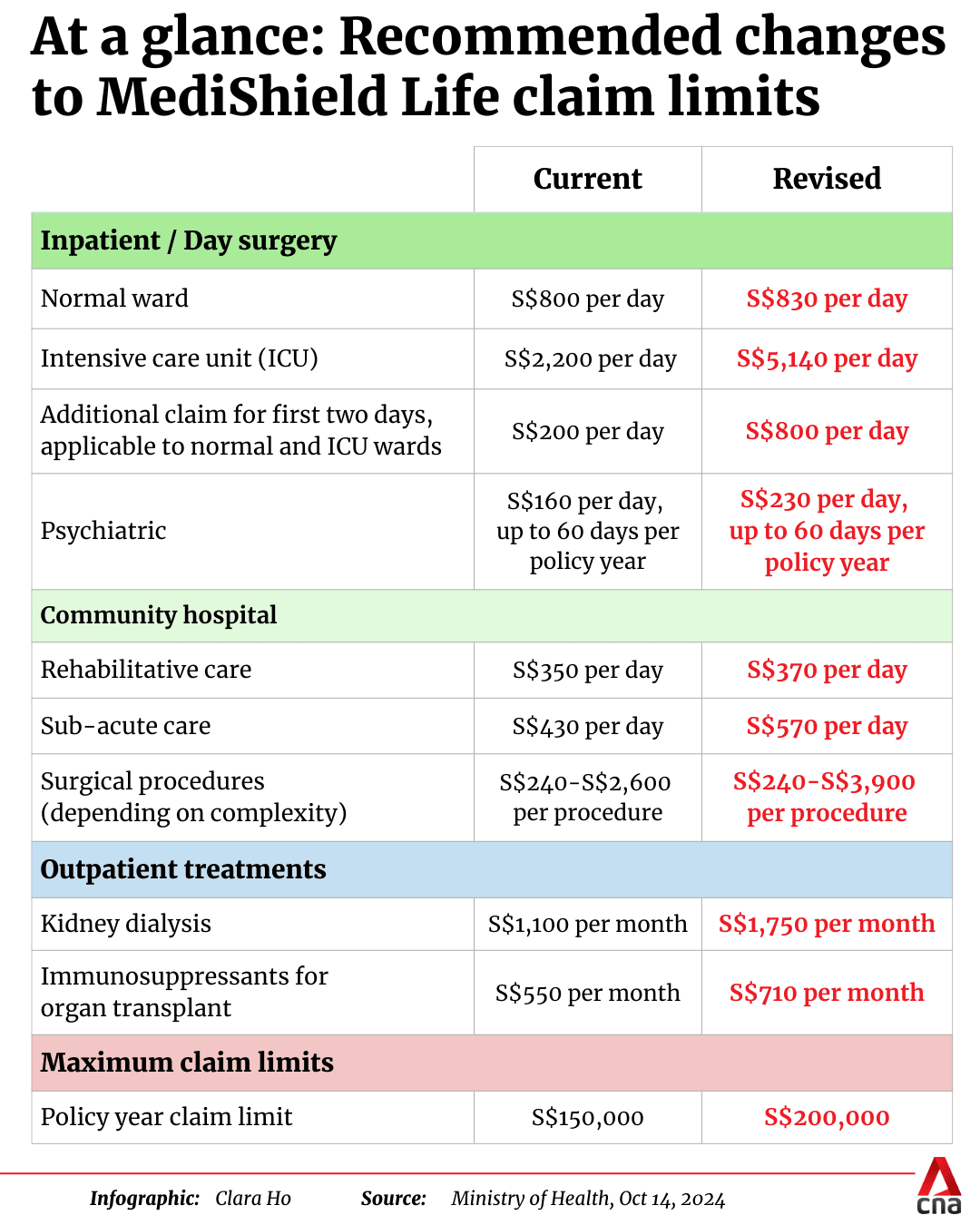

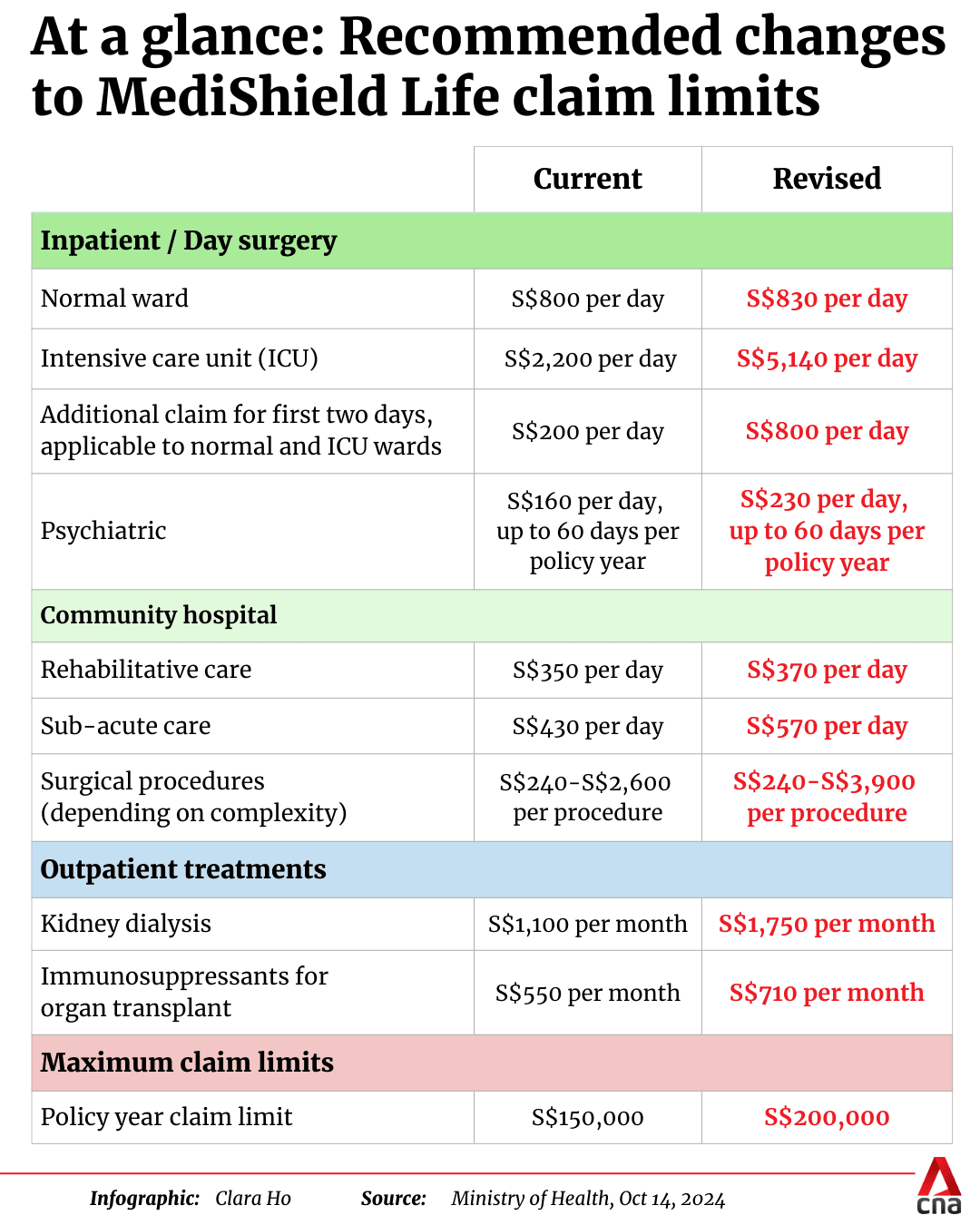

This comes after a review of the insurance scheme by the MediShield Life Council. It called for increased claim limits to better protect Singaporeans against large medical bills and expanded coverage to help patients afford new types of care and treatments.

With higher claims and expansion of coverage, premiums may increase by as much as 35 per cent. The increases will be phased evenly over three years from April next year to March 2028.

With this, premiums will increase by an average of 22 per cent per policyholder by the end of the third year, read the council’s report, which was published on Tuesday (Oct 15).

To fund this, the council recommended a one-off release of around S$600 million from the MediShield Life Fund so as to cap the total premium increase at 35 per cent and phase it evenly.

5. Expand coverage to include new outpatient treatments and home-based medical care.

6. Introduce a new outpatient deductible of S$500 per year.

Explaining the changes, the council said rising medical bills have eroded the coverage of existing claim limits, which now fully cover just under eight in 10 subsidised bills.

This is lower than the nine in 10 subsidised bills that the scheme was designed to fully cover.

As a result, more patients with large bills have to pay for parts of these in cash, the report said.

The new claim limits should bring the scheme back to its original mandate of fully covering nine in 10 bills.

In addition, with the centre of gravity for healthcare delivery shifting from hospitals to outpatient, community and home settings, the council said there is a need to improve patient access to safe and affordable outpatient and home care.

MOH said the government will adjust MediSave withdrawal limits so that patients can use MediSave to cover the co-insurance and the revised deductibles.

The revised MediShield Life benefits and MediSave limits will be implemented progressively from April next year, together with the first phase of the increase in inpatient deductible.

The outpatient deductible will be introduced on Jan 1, 2026, followed by the second phase of the increase in inpatient deductible on Apr 1, 2027. All other changes will be made progressively from Apr 1 next year.

To cushion the impact of higher premiums on Singaporeans, the government will provide an additional S$4.1 billion in support measures over the next three years.

This package comprises S$3.4 billion in MediSave top-ups and S$0.7 billion in premium subsidies.

As part of this, premium subsidies will be increased by five to 10 percentage points for lower-income and middle-income Singaporeans in older age groups. From Apr 1, 2025, they will be able to receive premium subsidies of up to 60 per cent, an increase from the current cap of 50 per cent.

Annual MediSave top-ups for the Pioneer Generation will also be increased by up to S$300, bringing the maximum annual top-up to S$1,200.

For Singaporeans born in 1973 or earlier, a one-time Majulah package MediSave bonus of up to S$1,500 - first announced in August last year - will be increased by S$500. This will be paid in December.

Meanwhile, an additional MediSave bonus of S$500 will be given in 2025 to some seniors born between 1950 and 1973 who may not have been able to accumulate enough savings in their MediSave account to help cover the rise in premiums.

For newborns, the MediSave grant will be increased from S$4,000 to S$5,000 from Apr 1, 2025.

Finally, for Singaporeans born between 1974 and 2003, a one-time MediSave bonus of up to S$300 – announced in this year’s Budget – will be increased by S$200. This will be paid in December.

According to MOH, for more than nine in 10 Singaporeans, the additional MediSave top-ups, subsidies and support will “more than offset” the cumulative S$1.8 billion in additional premiums over the next three years.

The conversion rate will be 150 Healthpoints to S$2, up from the regular rate of S$1. The programme will commence in the third quarter of next year and will run as a pilot for three years.

MOH said the government will review the outcomes of the pilot before deciding whether to make it a permanent feature of MediShield Life.

From October next year, the government will also extend MediShield Life and MediSave coverage to cell, tissue and gene therapy products (CTGTPs) that are on MOH’s list.

Given the high costs of CTGTPs, MOH said the Medishield Life and MediSave limits will be sized to fully cover two in three subsidised patients initially.

Source: CNA/vl(mi/ac)

Subscribe here

DBS collaborates with the Singapore Police Force and leverages innovative solutions to detect fraud and safeguard customers' savings

Protects against 37 critical illnesses starting from an affordable S$5.72/month. T&Cs apply. DBS

Learn More

CancerCare: Get covered for cancer by answering 1 question. DBS

Learn More

2 to 5-Bedroom Available Nava Grove

Learn More

Copyright© Mediacorp 2024. Mediacorp Pte Ltd. All rights reserved.

Official Domain | Terms & Conditions | Privacy Policy | Report Vulnerability

To continue, upgrade to a supported browser or, for the finest experience, download the mobile app.

Upgraded but still having issues? Contact us

Best News Website or Mobile Service

Digital Media Awards Worldwide 2022

- Search

Edition Menu

Hamburger MenuMain navigation

Advertisement

SingaporeMediShield Life premiums to increase as government expands national health insurance scheme

Premiums may increase by as much as 35 per cent from April 2025 over a three-year period but for most Singaporeans, this will be fully offset by government support measures.

A health insurance claim form. (Photo: iStock/LIgorko)

Listen

8 min

New: You can now listen to articles.

Vanessa Lim

15 Oct 2024 03:00PM (Updated: 15 Oct 2024 08:21PM)

Bookmark Share

Read a summary of this article on FAST.

FAST

SINGAPORE: MediShield Life premiums will increase from April 2025 as the government expands the national health insurance scheme.

This comes after a review of the insurance scheme by the MediShield Life Council. It called for increased claim limits to better protect Singaporeans against large medical bills and expanded coverage to help patients afford new types of care and treatments.

With higher claims and expansion of coverage, premiums may increase by as much as 35 per cent. The increases will be phased evenly over three years from April next year to March 2028.

With this, premiums will increase by an average of 22 per cent per policyholder by the end of the third year, read the council’s report, which was published on Tuesday (Oct 15).

To fund this, the council recommended a one-off release of around S$600 million from the MediShield Life Fund so as to cap the total premium increase at 35 per cent and phase it evenly.

WHAT ARE THE NEW BENEFITS?

The higher premiums will support the changes to the MediShield Life scheme. Here are some of the new benefits:- Higher claim limits for existing inpatient and day surgery.

- Raise the policy year claim limit from S$150,000 to S$200,000.

- The council said that very few patients – about 50 per year – currently exceed the policy year claim limit and that these cases are largely due to prolonged hospital stays. Increasing this will provide greater assurance for such patients with exceptionally large bills.

- This has not been adjusted since the scheme was introduced in 2015. With rising medical bills, the council said the deductible has become less effective in sieving out smaller, more affordable bills which can be paid for by MediSave. Increasing the deductible will allow MediShield Life to focus its coverage on larger medical bills and moderate the extent of premium growth.

5. Expand coverage to include new outpatient treatments and home-based medical care.

6. Introduce a new outpatient deductible of S$500 per year.

- The deductible paid for inpatient treatments would also count towards the outpatient deductible and vice versa. For example, if a patient has paid S$500 towards his deductible in the inpatient setting, he would have fulfilled the outpatient deductible for the policy year.

- This includes treatments on the Ministry of Health’s (MOH) cell, tissue and gene therapy products (CTGTPs) list, as well as high-cost drugs for blood conditions such as haemophilia and childhood onset conditions.

Explaining the changes, the council said rising medical bills have eroded the coverage of existing claim limits, which now fully cover just under eight in 10 subsidised bills.

This is lower than the nine in 10 subsidised bills that the scheme was designed to fully cover.

As a result, more patients with large bills have to pay for parts of these in cash, the report said.

The new claim limits should bring the scheme back to its original mandate of fully covering nine in 10 bills.

In addition, with the centre of gravity for healthcare delivery shifting from hospitals to outpatient, community and home settings, the council said there is a need to improve patient access to safe and affordable outpatient and home care.

Related:

Commentary: What to do about rising medical costs in Singapore

MediShield Life set to cover precision medicine; MOH planning new laws for use of genetic test data

GOVERNMENT PACKAGE TO OFFSET PREMIUM INCREASES

In a press release on Tuesday, MOH said the government has accepted the council's recommendations, adding that it will enhance the scheme to better protect Singaporeans against major health episodes that result in large medical bills.MOH said the government will adjust MediSave withdrawal limits so that patients can use MediSave to cover the co-insurance and the revised deductibles.

The revised MediShield Life benefits and MediSave limits will be implemented progressively from April next year, together with the first phase of the increase in inpatient deductible.

The outpatient deductible will be introduced on Jan 1, 2026, followed by the second phase of the increase in inpatient deductible on Apr 1, 2027. All other changes will be made progressively from Apr 1 next year.

To cushion the impact of higher premiums on Singaporeans, the government will provide an additional S$4.1 billion in support measures over the next three years.

This package comprises S$3.4 billion in MediSave top-ups and S$0.7 billion in premium subsidies.

As part of this, premium subsidies will be increased by five to 10 percentage points for lower-income and middle-income Singaporeans in older age groups. From Apr 1, 2025, they will be able to receive premium subsidies of up to 60 per cent, an increase from the current cap of 50 per cent.

Annual MediSave top-ups for the Pioneer Generation will also be increased by up to S$300, bringing the maximum annual top-up to S$1,200.

For Singaporeans born in 1973 or earlier, a one-time Majulah package MediSave bonus of up to S$1,500 - first announced in August last year - will be increased by S$500. This will be paid in December.

Meanwhile, an additional MediSave bonus of S$500 will be given in 2025 to some seniors born between 1950 and 1973 who may not have been able to accumulate enough savings in their MediSave account to help cover the rise in premiums.

For newborns, the MediSave grant will be increased from S$4,000 to S$5,000 from Apr 1, 2025.

Finally, for Singaporeans born between 1974 and 2003, a one-time MediSave bonus of up to S$300 – announced in this year’s Budget – will be increased by S$200. This will be paid in December.

According to MOH, for more than nine in 10 Singaporeans, the additional MediSave top-ups, subsidies and support will “more than offset” the cumulative S$1.8 billion in additional premiums over the next three years.

REDEEMING PREMIUM DISCOUNTS USING HEALTHPOINTS

In support of Healthier SG, policyholders aged 40 and above may redeem MediShield Life premium discounts via the Health Promotion Board’s (HPB) Healthy 365 app.The conversion rate will be 150 Healthpoints to S$2, up from the regular rate of S$1. The programme will commence in the third quarter of next year and will run as a pilot for three years.

MOH said the government will review the outcomes of the pilot before deciding whether to make it a permanent feature of MediShield Life.

From October next year, the government will also extend MediShield Life and MediSave coverage to cell, tissue and gene therapy products (CTGTPs) that are on MOH’s list.

Given the high costs of CTGTPs, MOH said the Medishield Life and MediSave limits will be sized to fully cover two in three subsidised patients initially.

Source: CNA/vl(mi/ac)

Sign up for our newsletters

Get our pick of top stories and thought-provoking articles in your inboxSubscribe here

Related Topics

MediShield Life healthcare MOH healthAdvertisement

Also worth reading

Taiwanese TV host Mickey Huang sentenced to 8 months in jail for possessing obscene materials involving minors

Japanese actress Miho Nakayama died due to 'unfortunate accident', agency announces

Former Mediacorp star Phyllis Quek shares that she quit showbiz in 2012 to focus on her health and she has no regrets

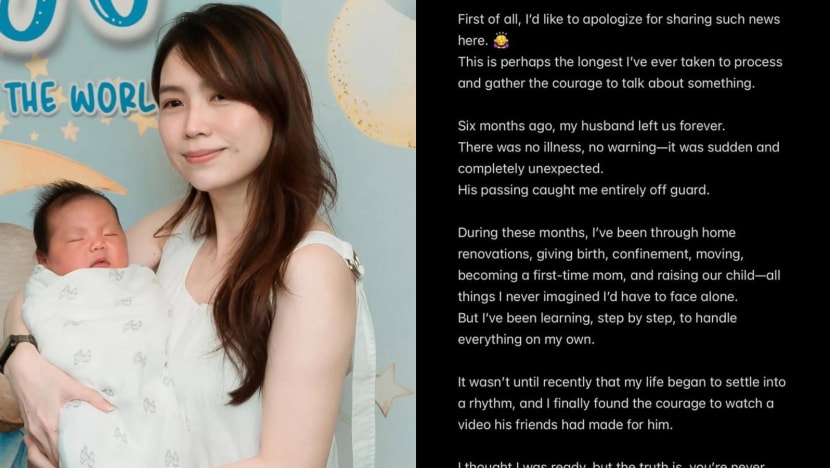

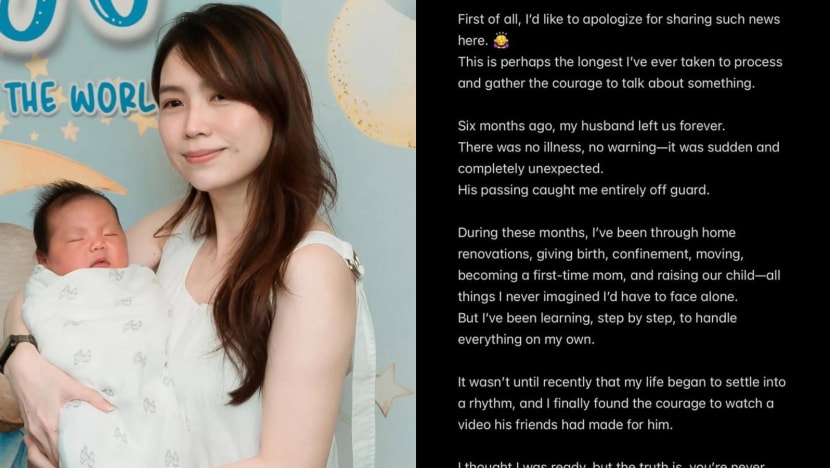

Actress Sora Ma reveals her husband died 6 months ago, before the birth of their son

Recommended by

DBS collaborates with the Singapore Police Force and leverages innovative solutions to detect fraud and safeguard customers' savings

Protects against 37 critical illnesses starting from an affordable S$5.72/month. T&Cs apply. DBS

Learn More

CancerCare: Get covered for cancer by answering 1 question. DBS

Learn More

2 to 5-Bedroom Available Nava Grove

Learn More

CNA Sections

- Asia

- Singapore

- Business

- Insider

- TODAY

- Lifestyle

- Luxury

- CNA938 Live

- Newsletters

- Commentary

- Interactives

- Live TV

- Sport

- World

- Special Reports

About CNA

Follow our news

Copyright© Mediacorp 2024. Mediacorp Pte Ltd. All rights reserved.

Official Domain | Terms & Conditions | Privacy Policy | Report Vulnerability

This browser is no longer supported

We know it's a hassle to switch browsers but we want your experience with CNA to be fast, secure and the best it can possibly be.To continue, upgrade to a supported browser or, for the finest experience, download the mobile app.

Upgraded but still having issues? Contact us

- Joined

- Sep 14, 2014

- Messages

- 6,418

- Points

- 113

Lol with papigs around U suffer but 70% song n high

As long as they continue to top up Medisave, the increase would be offset.Altogether now... Cham ah

My only buaysong is the deductible. Instead of reducing, they increase. KNNCCB.

Why should a healthy person paying higher premium? Instead of receiving no claim discount for keeping healthyAltogether now... Cham ah

- Joined

- Sep 2, 2023

- Messages

- 2,947

- Points

- 113

Fuck coolie gene sinkies

- Joined

- Jun 13, 2023

- Messages

- 6,480

- Points

- 113

Altogether now... Cham ah

For retiree (like me) there will be no more incoming but only outgoing.As long as they continue to top up Medisave, the increase would be offset.

My only buaysong is the deductible. Instead of reducing, they increase. KNNCCB.

For the working ones, the impact will not be an immediate one, just that when more are being contributed to their MA, less will be in their OA and SA.

The effect will only be seen much later.

What will happen to the premium when their medisave deplets and insufficient for the payment?

- Joined

- Jun 13, 2023

- Messages

- 6,480

- Points

- 113

I think should be many companies or even all in one.Which insurance company is behind medishield? NTUC Income?

- Joined

- Dec 6, 2018

- Messages

- 15,784

- Points

- 113

No problem. Sinkies love to be arse fucked.

- Joined

- Jan 16, 2014

- Messages

- 6,322

- Points

- 113

cheebye, they moved the fucking goalposts another 2 feet! AGAIN!!! FUCK PAP

Last edited:

The problem is the retarded sinkies have a misconception that CPF money is not their own money, just let them deduct whatever premium amount they wantNo problem. Sinkies love to be arse fucked.

- Joined

- Jun 13, 2023

- Messages

- 6,480

- Points

- 113

Very good catch.The problem is the retarded sinkies have a misconception that CPF money is not their own money, just let them deduct whatever premium amount they want

Majority think the cpf ma is not their money and they will not fall sick to need it later. Especially true for the brown skinned.

What will happen to the premium when their medisave deplets and insufficient for the payment?

There will be a new scheme called MediHang. Every citizen whose MediSave balance drops below $100 will get a Rope from MOH, and $10 will be deducted.

Similar threads

- Replies

- 7

- Views

- 603

- Replies

- 8

- Views

- 429

- Replies

- 7

- Views

- 531

- Replies

- 0

- Views

- 165