- Joined

- Jan 5, 2010

- Messages

- 2,096

- Points

- 83

Means testing loophole. PAP government Squandering >$1224 p.a. on CHAS holders? (Up to >$2000/pax p.a.).

Pioneer don't need means testing and some very rich people staying in big bungalows just have to declare a tiny income to qualify for CHAS subsidies as the case may be.

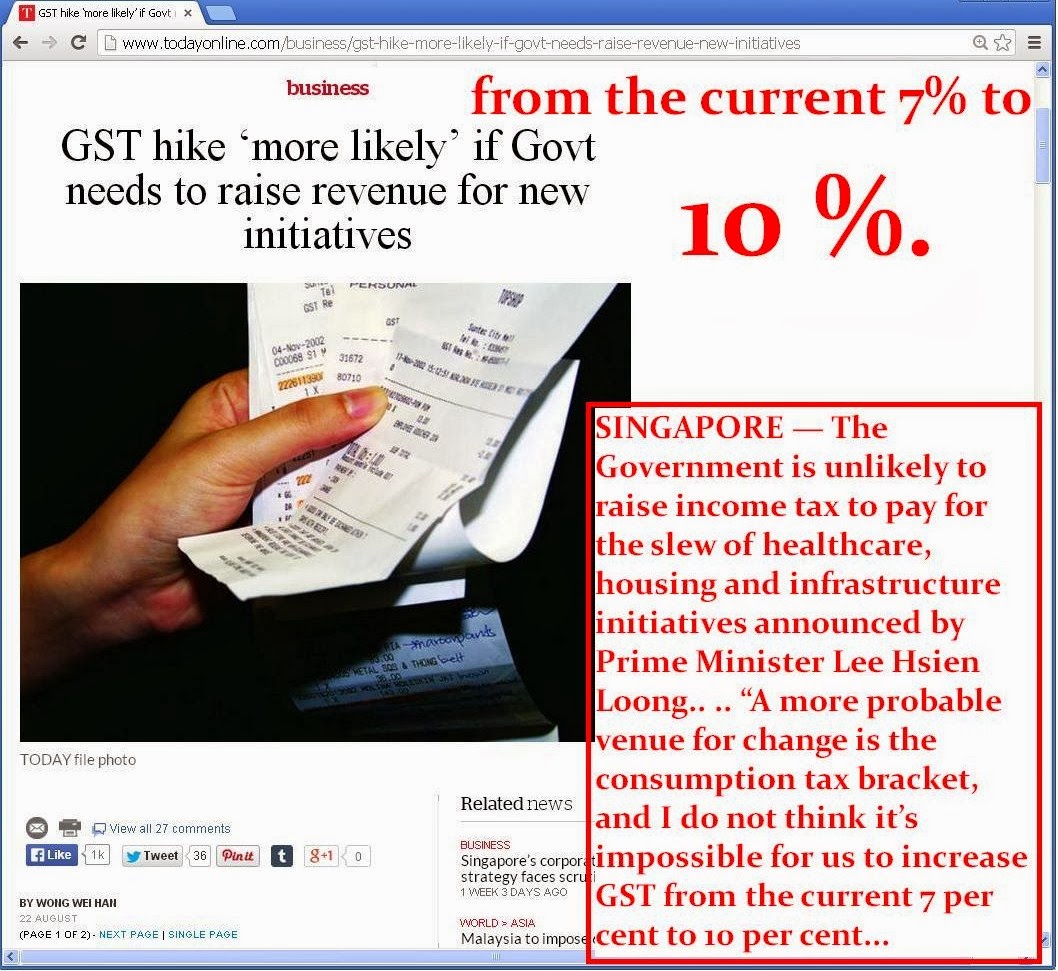

And government is gonna INCREASE GST to pay for the healthcare costs of these rich people???!!!

https://www.chas.sg/content.aspx?id=636

https://www.chas.sg/content.aspx?id=636

Why can't asset rich Singaporeans just reverse mortgage their properties to raise $$$ for healthcare costs; after all, the younger generation are already burdened with the high costs of property in Singapore as a consequence of property value gains from the surge in property prices since Singapore gained independence.

Why should the younger generation have to pay higher GST to subsidise asset rich Singaporeans/ retirees healthcare costs?

There is already no inheritance tax in Singapore (to help make the rich families richer), now the poor also have to pay increased GST to subsidise rich people's healthcare costs???!!!.

PS: Rich people staying in private property/ bungalows who earn lots of $$$ from capital gains from property trading, SGX stocks, foreign properties etc can always selectively declare these income sources and obtain the blue CHAS medical coverage card for themselves as they won't be means tested at all under the annual value of residence category. Pioneer generation don't even have to be means tested as they qualify for the highest subsidies instantly.

$1224 is calculated as 24*$28.50 for acute illness GP visits (total= $684) and $540 for up to 4 GP chronic complex condition visits.

The rest of the (unlimited) subsidy is in the form of dental treatment subsidies which can be up to $266.50 subsidy per dental procedure.

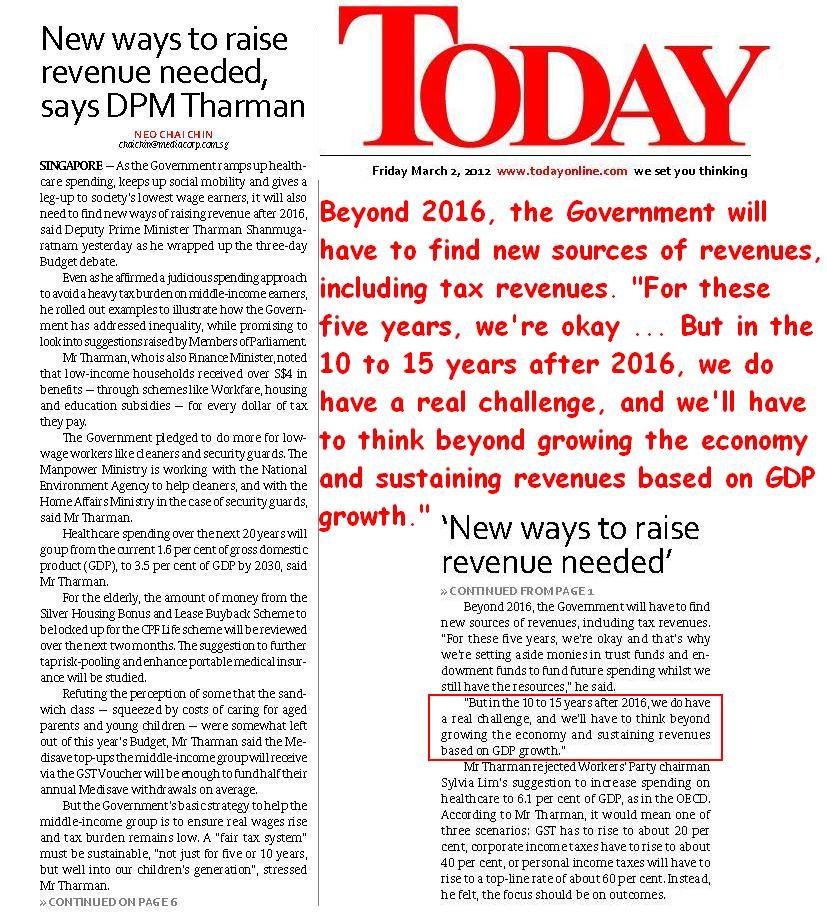

This loophole is created despite PAP/ Lee Hsien Loong knowledge that government finances will be in shortfall from healthcare costs and that GST needs to be raised to compensate for this shortfall:

"In the medium term, Singapore will have to find new ways to fund healthcare spending." (ST, 24.3.2019)

https://www.straitstimes.com/singap...ealthcare-sustainable-says-pm-lee-hsien-loong

https://www.straitstimes.com/singap...ealthcare-sustainable-says-pm-lee-hsien-loong

Pioneer don't need means testing and some very rich people staying in big bungalows just have to declare a tiny income to qualify for CHAS subsidies as the case may be.

And government is gonna INCREASE GST to pay for the healthcare costs of these rich people???!!!

Why can't asset rich Singaporeans just reverse mortgage their properties to raise $$$ for healthcare costs; after all, the younger generation are already burdened with the high costs of property in Singapore as a consequence of property value gains from the surge in property prices since Singapore gained independence.

Why should the younger generation have to pay higher GST to subsidise asset rich Singaporeans/ retirees healthcare costs?

There is already no inheritance tax in Singapore (to help make the rich families richer), now the poor also have to pay increased GST to subsidise rich people's healthcare costs???!!!.

PS: Rich people staying in private property/ bungalows who earn lots of $$$ from capital gains from property trading, SGX stocks, foreign properties etc can always selectively declare these income sources and obtain the blue CHAS medical coverage card for themselves as they won't be means tested at all under the annual value of residence category. Pioneer generation don't even have to be means tested as they qualify for the highest subsidies instantly.

$1224 is calculated as 24*$28.50 for acute illness GP visits (total= $684) and $540 for up to 4 GP chronic complex condition visits.

The rest of the (unlimited) subsidy is in the form of dental treatment subsidies which can be up to $266.50 subsidy per dental procedure.

This loophole is created despite PAP/ Lee Hsien Loong knowledge that government finances will be in shortfall from healthcare costs and that GST needs to be raised to compensate for this shortfall:

"In the medium term, Singapore will have to find new ways to fund healthcare spending." (ST, 24.3.2019)