https://www.datacenterdynamics.com/...ged-disagreements-over-management-of-company/

Technology

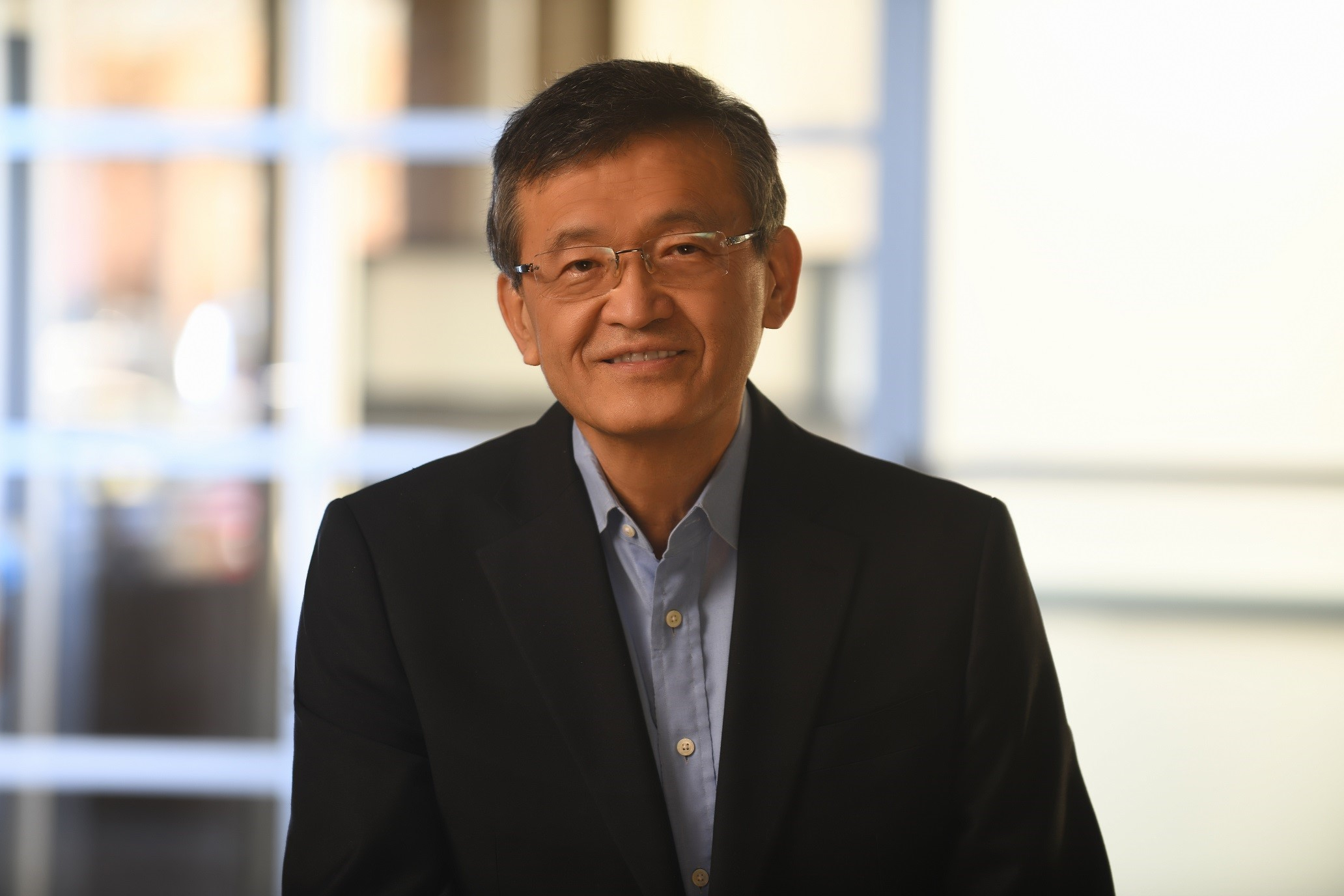

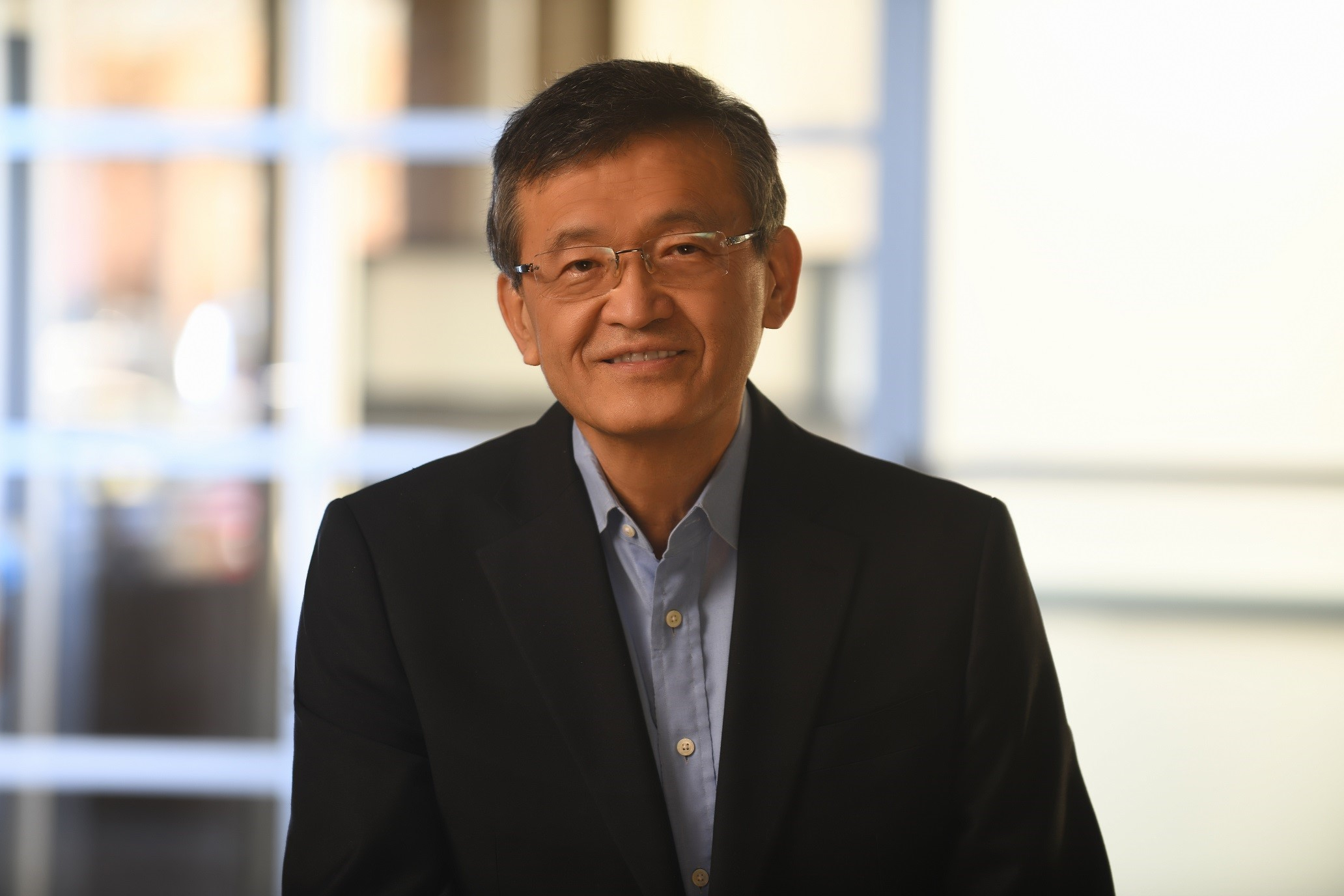

Lip-Bu Tan is departing Intel’s board after less than two years.Source: Intel

By Ian King and Jane Lanhee Lee

August 23, 2024 at 2:23 AM GMT+8

Updated on

August 23, 2024 at 4:41 AM GMT+8

Save

Translate

Intel Corp. director Lip-Bu Tan, a semiconductor industry veteran brought in two years ago to help with the chipmaker’s comeback effort, has stepped down from the board.

Tan informed the board on Aug. 19 that he would be leaving, effective immediately, Intel said in a filing on Thursday, confirming an earlier report by Bloomberg News. The director, a former chief executive officer of Cadence Design Systems Inc. who also runs an investment firm, cited “demands on his time” for driving the move.

Technology

Intel Director Lip-Bu Tan Leaves Board of Ailing Chipmaker

- The industry veteran had joined board in September 2022

- Company has been cutting jobs as its turnaround bogs down

Lip-Bu Tan is departing Intel’s board after less than two years.Source: Intel

By Ian King and Jane Lanhee Lee

August 23, 2024 at 2:23 AM GMT+8

Updated on

August 23, 2024 at 4:41 AM GMT+8

Save

Translate

Intel Corp. director Lip-Bu Tan, a semiconductor industry veteran brought in two years ago to help with the chipmaker’s comeback effort, has stepped down from the board.

Tan informed the board on Aug. 19 that he would be leaving, effective immediately, Intel said in a filing on Thursday, confirming an earlier report by Bloomberg News. The director, a former chief executive officer of Cadence Design Systems Inc. who also runs an investment firm, cited “demands on his time” for driving the move.