-

IP addresses are NOT logged in this forum so there's no point asking. Please note that this forum is full of homophobes, racists, lunatics, schizophrenics & absolute nut jobs with a smattering of geniuses, Chinese chauvinists, Moderate Muslims and last but not least a couple of "know-it-alls" constantly sprouting their dubious wisdom. If you believe that content generated by unsavory characters might cause you offense PLEASE LEAVE NOW! Sammyboy Admin and Staff are not responsible for your hurt feelings should you choose to read any of the content here. The OTHER forum is HERE so please stop asking.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

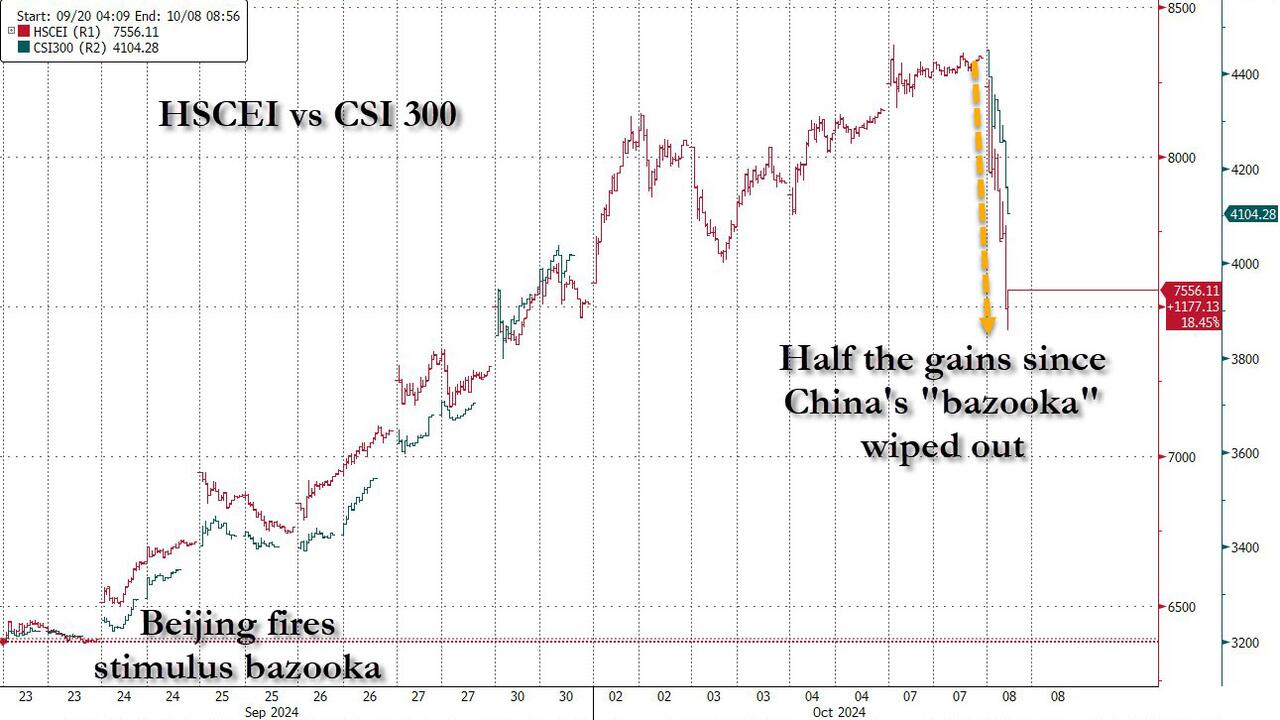

HK puked today, down 2000pts

- Thread starter Byebye Penis

- Start date

Just profit taking...Best performing index in Oct 2024...round 2 pumping starts tomorrow

what does this term mean?time to 割韭菜

I thought China communist is in the market to snap up cheap shares?

Oops...is this the Tiongkok Basooka?

Somebody need to buy HIGH n sell LOW before CCP can buy cheaplyI thought China communist is in the market to snap up cheap shares?

POssible...CCp will give some motivations againJust profit taking...Best performing index in Oct 2024...round 2 pumping starts tomorrow

Ang Mo say cut sheep hairwhat does this term mean?

Many LaoTze commrades tio heart attack?

Communist shithole country with centrally planned economy also play with stock market? What a laugh.

Chinese stocks suffer worst fall in 27 years over growth concerns

https://www.theguardian.com/world/2...r-worst-fall-in-27-years-over-growth-concerns

https://thediplomat.com/2015/03/lee-kuan-yew-the-father-of-modern-china/

Lee Kuan Yew: The Father of Modern China?

Lee Kuan Yew’s influence helped shape the China we know today.Subscribe for ads-free reading

China Power

Lee Kuan Yew: The Father of Modern China?

Lee Kuan Yew’s influence helped shape the China we know today.

By Shannon Tiezzi

March 24, 2015

Subscribe for ads-free reading

With the passing of Lee Kuan Yew, Singapore’s first prime minister and one of the most influential Asian politicians, leaders and media outlets all over the world have put in their two cents on his legacy.

In the Western world, analysis of his influence is generally mixed; the Washington Post, for example, led off its piece by calling Lee “the democratic world’s favorite dictator.” But in China, where Lee’s mix of authoritarian governance and economic reform proved hugely influential, reflections are far more glowing.

China’s Foreign Ministry issued a statement on March 23 saying that “the Chinese side deeply mourns the loss of Mr. Lee Kuan Yew.”

The statement praised Lee as “a uniquely influential statesman in Asia and a strategist embodying oriental values and international vision.”

For China, that high praise might actually be underestimating Lee’s importance. After the death of Mao Zedong, Beijing’s leaders knew that Maoist philosophy was not the way forward for China – but they were loath to adopt Western alternatives such as democracy and a free market economy.

In Lee’s Singapore, Chinese leaders found an alternative path, a path they could sell as being uniquely suited for Asian (or “oriental,” as China’s FM put it) values. That choice, to combine economic reforms with authoritarianism, shaped China as we know it today.

Jin Canrong of Renmin University told China Daily that Lee’s greatest contribution to China was “sharing Singapore’s successful experience in governance.” In his biography of Deng Xiaoping, Ezra Vogel wrote that China’s great reformed was inspired by the example of Lee’s Singapore.

Xi Jinping himself has said that China’s modernization process has been undeniably shaped by the “tens of thousands of Chinese officials” who went to Singapore to study Lee’s model. Lee himself visited China over 30 times and met with Chinese leaders from Mao to Xi Jinping, offering advice.

Xi Jinping himself has said that China’s modernization process has been undeniably shaped by the “tens of thousands of Chinese officials” who went to Singapore to study Lee’s model. Lee himself visited China over 30 times and met with Chinese leaders from Mao to Xi Jinping, offering advice.

Chinese Stocks Turn Volatile as Traders Wait for MOF Briefing

- CSI 300 swings between gains and losses in Thursday trading

- Traders look for forceful fiscal steps by the finance ministry

By Bloomberg News

October 10, 2024 at 9:46 AM GMT+8

Updated on

October 10, 2024 at 10:28 AM GMT+8

Save

Translate

Chinese stocks whipsawed amid heavy volumes in Thursday’s morning session as traders awaited the outcome of the government’s planned briefing on fiscal policy due Saturday.

The CSI 300 Index was down 0.3% as of 10:20 a.m. local time, reversing an earlier gain of as much as 2.2%. The benchmark plunged 7.1% in the prior session in its worst day since 2020. An index of Chinese stocks listed in Hong Kong gained more than 2% before a holiday in the city on Friday.

Have a confidential tip for our

Hong Kong stocks rebound on PBOC’s US$70 billion finance facility, fiscal stimulus hopes

The Chinese central bank’s liquidity boosting tool sparks a 3.2 per cent surge in Hong Kong’s Hang Seng IndexHong Kong and Chinese stocks both rebounded from sell-offs after China’s central bank kicked off a US$70 billion financing facility to fund institutional buying and traders’ bets on more fiscal stimulus to shore up growth.

The Hang Seng Index jumped 3.2 per cent to 21,303.65 as of 10.39am local time, set to snap a two-day, 11 per cent decline. The Hang Seng Tech Index gained 2.3 per cent.

The CSI 300 Index rose 1.1 per cent, bouncing back from a 7.1 per cent slump a day earlier. The Shanghai Composite Index added 1.2 per cent.

Sentiment on the Hong Kong and mainland’s markets stabilised after the People’s Bank of China (PBOC) started the swap facility with an initial size of 500 billion yuan (US$70.7 billion). Under the programme, qualified brokerages, mutual-fund firms and insurance companies will be able to swap their holdings of bonds, stock exchange-traded funds as collaterals for government bonds and central bank bills, the PBOC said in a statement on Thursday. The size can be expanded and applications from qualified institutional will be accepted immediately, it said

The swap facility is part of a combined 800 billion yuan in financial tools announced by the PBOC last month to boost liquidity on the stock market. The package also includes a 300 billion yuan relending programme to fund stock buy-backs and stake increases by listed companies and major shareholders.

Investors will closely scrutinise a press conference by Finance Minister Lan Foan on Saturday. Hopes are high that Lan will announce or offer clues on the much-heralded fiscal stimulus after top leaders signalled an all-out pivot to prop up economic growth.

Similar threads

- Replies

- 51

- Views

- 3K

- Replies

- 13

- Views

- 763

- Replies

- 2

- Views

- 447