Rise in private home ownership among those under 35

By Nur Hikmah Md Ali

/ EdgeProp Singapore |

August 21, 2024 6:55 PM SGT

https://www.edgeprop.sg/property-news/rise-private-home-ownership-among-those-under-35

The number of young private homeowners under 35 is increasing (Photo: Samuel Isaac Chua/EdgeProp Singapore)

Join our

Telegram channel and follow our

Facebook for the latest update.

SINGAPORE (EDGEPROP) - Lee Sze Teck, senior director of data analytics at Huttons Asia, observes an increasing trend of younger buyers opting to buy a private condo as their first home.

Huttons estimates that around 30% of buyers of new private homes are 35 and below compared to 20% five years ago. “Private homes are gaining popularity among youths as they offer more flexibility and are less restrictive than an HDB flat or Executive Condo (EC),” says Lee.

Additionally, Lee points out that the potential gains from the sale of a private home are higher than those from an HDB flat. Between 2009 and 2Q2024, private non-landed prices in the Outside Central Region (OCR) increased by 149.1%, while HDB resale prices increased by 87.9%.

Read also: Homeownership, desire to upgrade still strong among youths: ERA survey

The Department of Statistics figures show that the number of young residents (under 35) staying in private homes has risen steadily since 2011. In 2023, there were 380,459 private housing residents under 35, an increase from 375,651 in 2022.

“The attractiveness of facilities, lifestyle and exclusivity, as well as investment opportunities offered by private homes, are strong pull factors for youths to aspire to,” says Christine Sun, chief researcher and strategist at OrangeTee Group.

Can young people afford to upgrade to a condo?

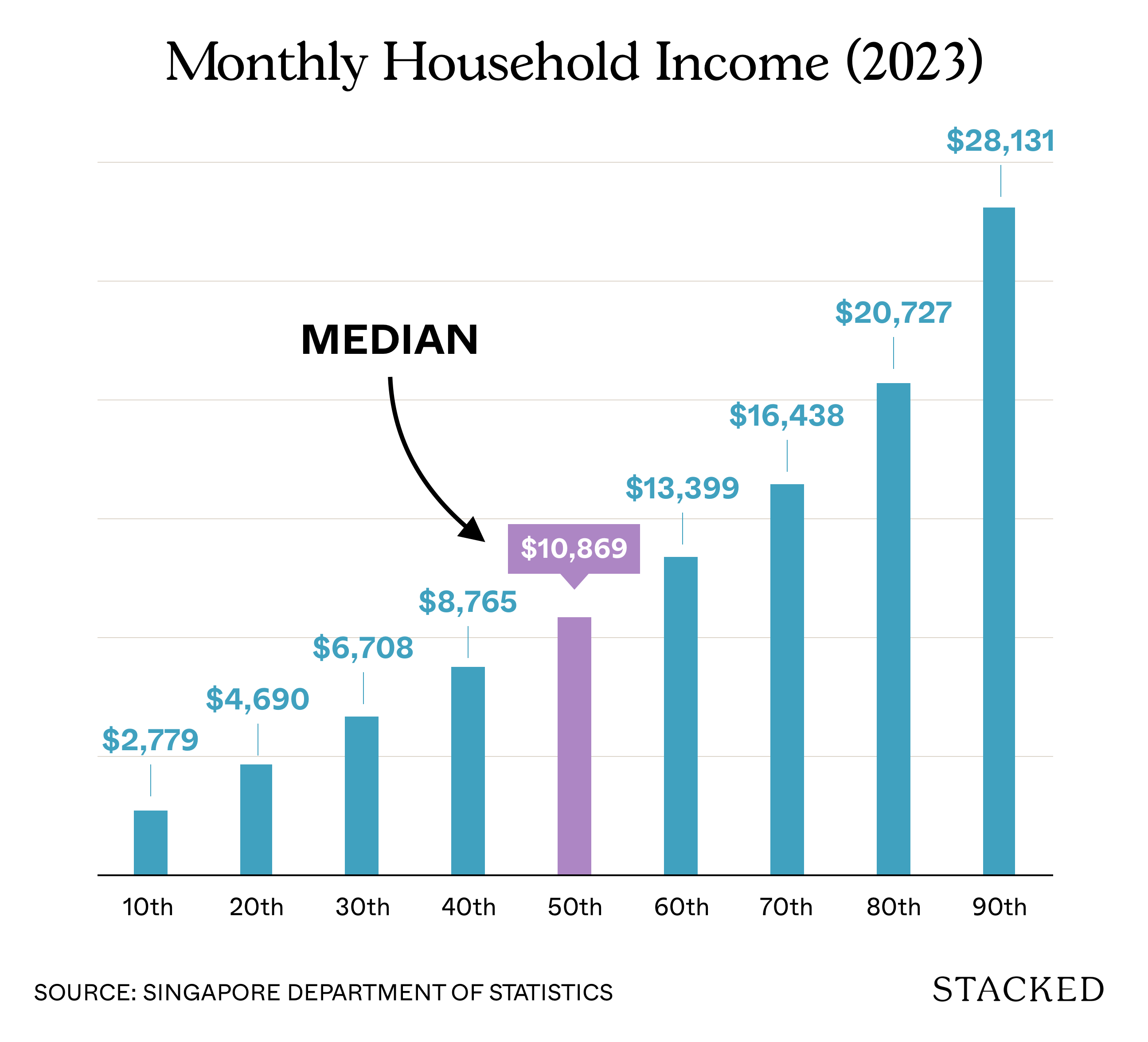

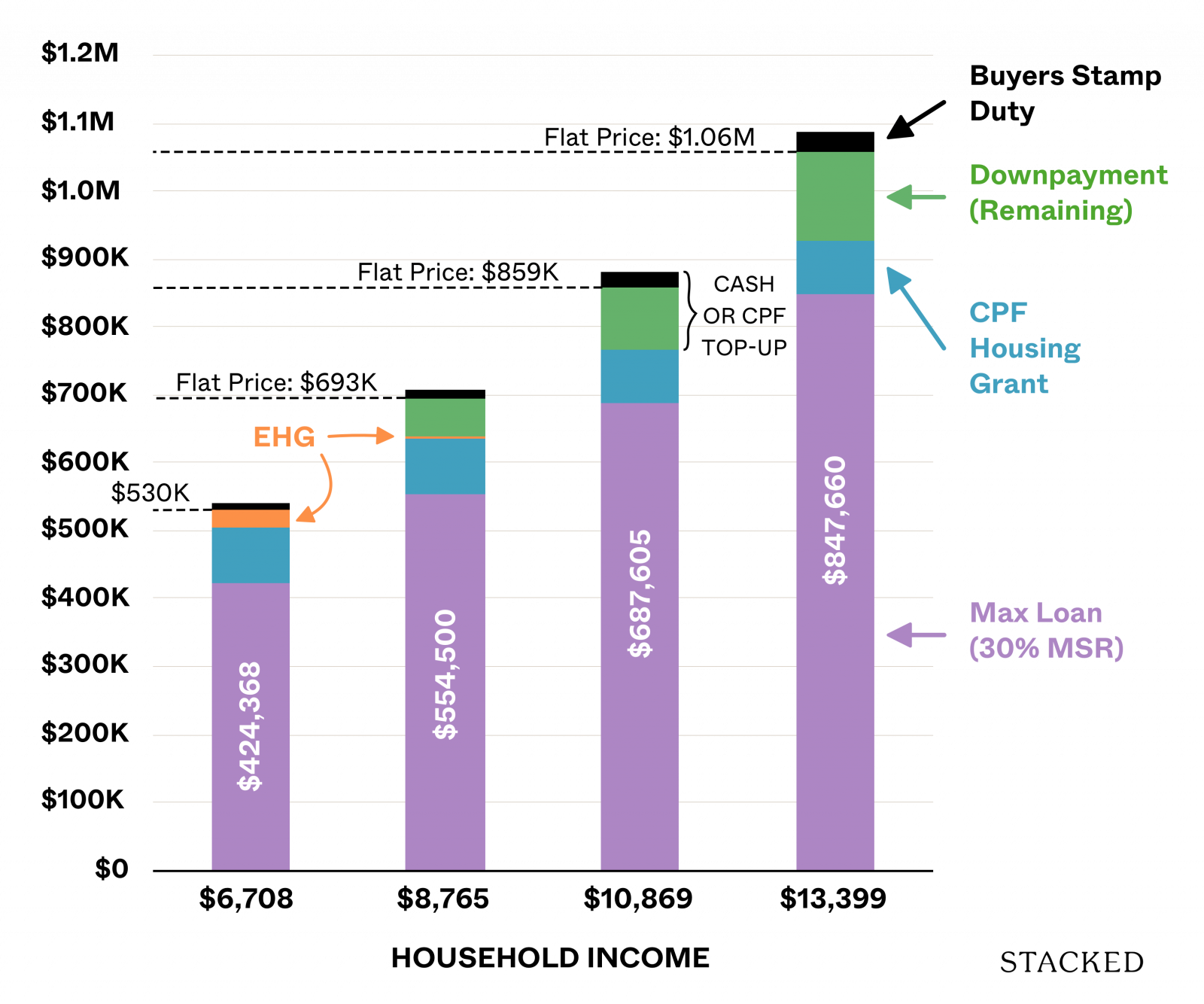

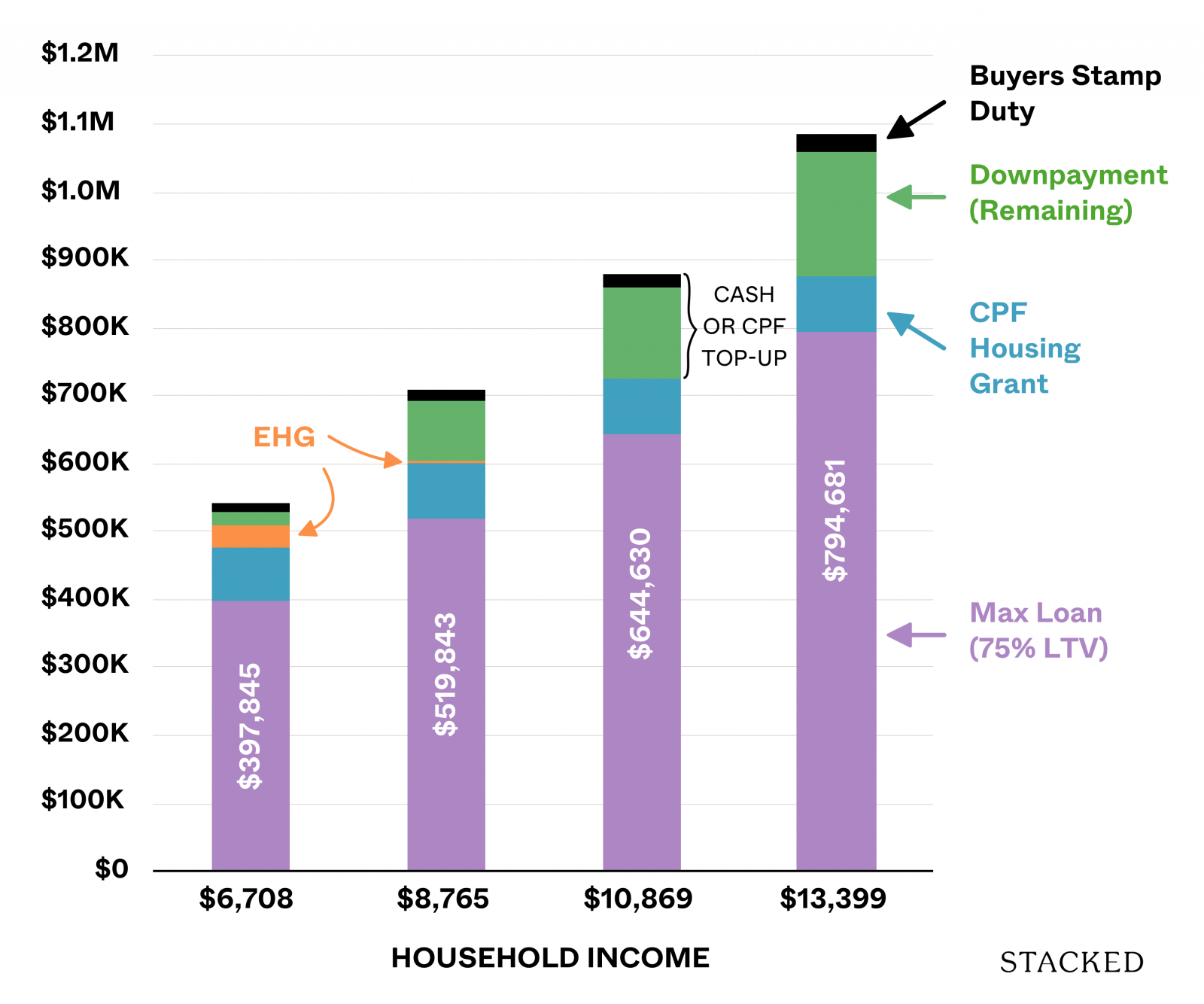

Housing affordability has improved against median household incomes in 1H2024, says Huttons’ Lee. In 2023, the median household income was $10,689 per month. “With rising income among the younger generation, the aim of buying a private home is achievable,” he adds.

For younger buyers who want to purchase a private home — and typically have a budget of around $1.2 million to $2 million — Lee suggests buying a two-bedroom unit. “This requires at least five years’ savings of at least $10,000 to $20,000 a year,” he says. “Together with their CPF contributions, they will be able to cover part of the downpayment for the private home.”

Chart: URA, HDB, Singstat, Huttons Data Analytics (as of July 15)

OrangeTee’s Sun notes that those with additional savings, financial assistance from their parents, or the ability to sell their existing flats for a good price have a better chance of affording a private condo.

However, she cautions against overspending on housing while underestimating other costs, especially for those with children, such as childcare fees and other expenses, leaving very little for other necessities. “It is important to purchase a home within one’s financial means and refrain from overleveraging, thus avoiding financial strain caused by excessive debt,” Sun adds.