Progressive property taxes for a progressive society

Progressive property taxes for a progressive society

... because rich Singaporeans and Foreigners shouldn't luxuriate at the expense of the poor.

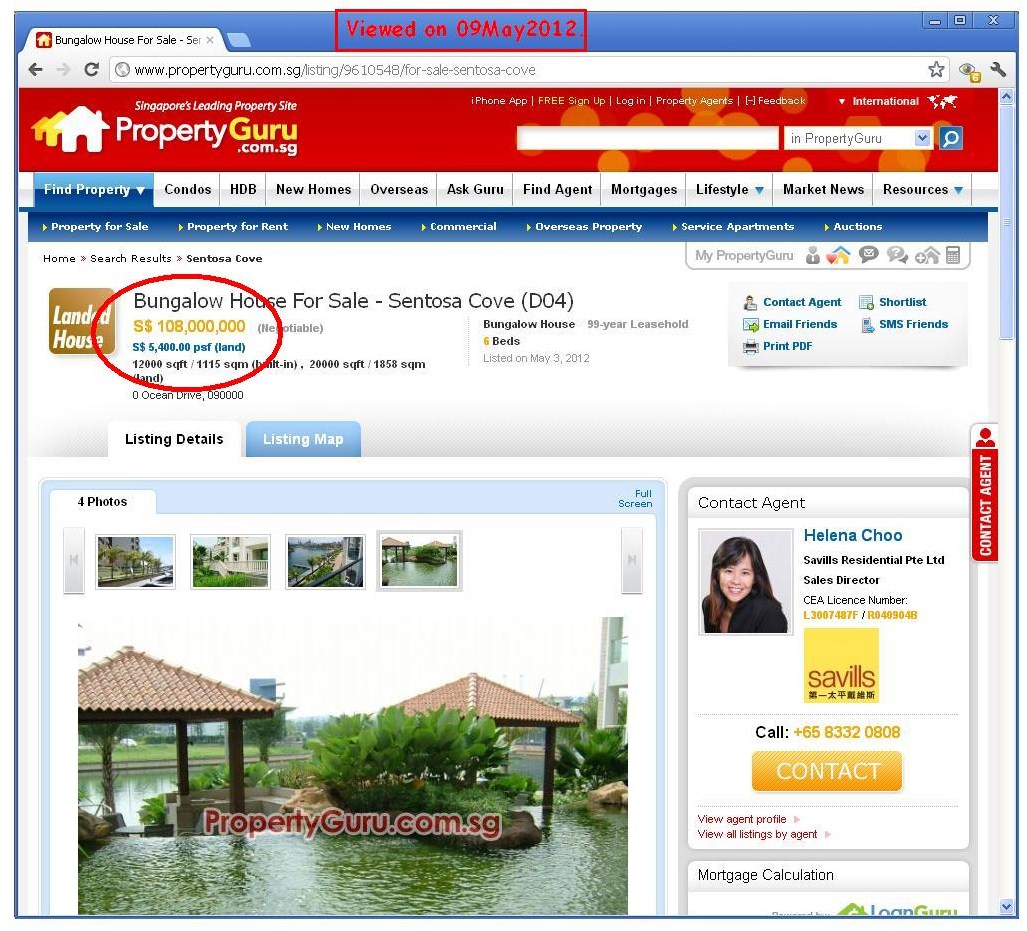

On 03May2012, a Singaporean offered to sell his 12000 sqft(built-in), 20000 sqft / (land) bungalow for $108Million 'S$108m for a Sentosa Cove home' [TODAY, 09May2012].

According to 'How is property tax computed' [IRAS, 2Dec2011], owner occupied residential properties [criteria] since 1Jan2011 are taxed as follows:

Annual Value:Tax Rate:

First $6,000:0%; Next $59,000:4%; Amount exceeding $65,000:6%

The current Goods and Services Tax (GST) rate in Singapore is a flat 7% for all goods and services provided by GST registered companies/ services. [Wiki:Goods and Services Tax (Singapore)]: "[GST] was increased to its current rate of 7% on 1 July 2007".

Thus begging the question, shouldn't a large and luxurious bungalow in Singapore, where according to 'Public housing in Singapore' [NLB, 15Oct2009]: "It is estimated that more than 80% of Singapore's resident population now live in public housing..." an obvious luxury be taxed at a rate equal or more than necessities utilized by all/ the poor (food, medicine, water)?

The definition of 'Owner Occupied' also begs clarification. Does a foreigner using a Singapore property for property for investment (price appreciation)/ holiday use (2weeks/ annum) but otherwise vacant also qualify for the said owner occupied property tax concessions- how would IRAS know given that taxes are charged prospectively rather than retrospectively? Shouldn't the efficient use of space whether rented or private be equally rewarded? - Why are property renters being unnecessarily penalized?

According to IRAS, the usual property tax rate for tenanted and vacant residential properties is 10%: does this artificially distorted tax rate then cause property rentals to increase thus forcing all Singaporeans (PRs and foreigners) to own their own properties- a key source of inflation of property prices overall? Are the prices of property rentals in Singapore thus inflated, can property prices in Singapore be accurate if property rentals in Singapore are actually inflated?

If the intention of charging owners of vacant/ tenanted properties a higher tax rate was on the premise that such properties were owned by rich people, then wouldn't the owner of a $108Million Sentosa cove bungalow be a case of a very rich underpaying for his luxury in a land where food and medicine is taxed unwaveringly at 7%? The government must be nuts if not corrupt for tax rates on the poor to exceed those for the rich.

In 1Q2012, an Indian national bought surgeon Susan Lim's Sentosa bungalow for $39Million 'Indian national buys Susan Lim's Sentosa Cove home for $39 million' [BT, 02Mar2012], assuming a 3% rental pricing based on cost, the annual value of the S$39M bungalow would be $1.17Million. If the owner were to be charged standard 7%GST on $1.17M, the amount would be $81.9K but based on current owner occupied concessionary rates, the Indian national owning the said bungalow would pay only [(6k*0)+(59k*0.04)+(1.105M*0.06)]= $68.66K, which is a $13.24K discount compared to if a flat 7% had been charged. With necessities of poorer Singaporeans attracting 7% GST, for what reason should the rich Indian expat be luxuriating on Sentosa whilst enjoying tax discounts amounting $13.24K p.a.? Politicians have betrayed the poor in Singapore by choosing to tax necessities of the poor more than luxuries enjoyed by the rich.

The current high property prices in Singapore is also a significant depressant on Singaporean birth rates: 'Housing woes affecting birth rates' [ST, 05Sept2011]: "Although the fertility rate is stubbornly less responsive to many factors, it is possible that sustaining housing affordability may help at least in arresting the precipitous decline in the fertility rate" certainly requisites urgent reconsideration if Singaporean birth rates are to be encouraged.

In view of this significant asset inequality (as consequent to growing income inequality [link]) in Singapore, it is suggested that any increase in property taxes collected in going forwards be REDISTRIBUTED EQUALLY amongst ALL Singapore citizens (aged 0-120yrs) with PRs (residing here at least 182 days or more) receiving about half as a 'National Cohesion Dividend' (NCD) used firstly to settle property taxes/ rental of flats from HDB as the case might be with the excess channeled to CPF (some OA/ dividend account perhaps)- some low income households sharing cramped quarters might well find themselves with some extra cash given to the fact that the property taxes on their lodgings do not amount to much whilst singles living in expansive bungalows and foreigners speculating in Singapore properties would see their tax bill increased due to fewer (or zero) occupants sharing the tax- property would then be used more efficiently, perhaps freeing up some for the market. Those who want more comfort or prestige would just have to pay for the luxury whilst those who live with less would enjoy the fruits of this asset re-distribution procedure: overnight, Singaporeans would find citizenship TWICE as meaningful as it was before and foreigners would compete for Singapore citizenship/ PR status which of course Singaporeans must keep a finger on to avoid dilution of everyone's NCD- however, too steep a fall in property prices locally would also cause tax revenues to fall as conversely affect the NCD so Singaporeans cannot be too fussy either.

The CPF dividend account would then be usable for paying certain fees or withdrawal (joblessness/ insurance/ CC activities/ self improvement/ medical treatment/ other allowable dues within limits as assessed by government social workers)

[Bungalow House For Sale - THE ULTIMATE SENTOSA BUNGALOW(D04)]

[Bungalow House For Sale - THE ULTIMATE SENTOSA BUNGALOW(D04)]

Progressive property taxes for a progressive society

... because rich Singaporeans and Foreigners shouldn't luxuriate at the expense of the poor.

On 03May2012, a Singaporean offered to sell his 12000 sqft(built-in), 20000 sqft / (land) bungalow for $108Million 'S$108m for a Sentosa Cove home' [TODAY, 09May2012].

According to 'How is property tax computed' [IRAS, 2Dec2011], owner occupied residential properties [criteria] since 1Jan2011 are taxed as follows:

Annual Value:Tax Rate:

First $6,000:0%; Next $59,000:4%; Amount exceeding $65,000:6%

The current Goods and Services Tax (GST) rate in Singapore is a flat 7% for all goods and services provided by GST registered companies/ services. [Wiki:Goods and Services Tax (Singapore)]: "[GST] was increased to its current rate of 7% on 1 July 2007".

Thus begging the question, shouldn't a large and luxurious bungalow in Singapore, where according to 'Public housing in Singapore' [NLB, 15Oct2009]: "It is estimated that more than 80% of Singapore's resident population now live in public housing..." an obvious luxury be taxed at a rate equal or more than necessities utilized by all/ the poor (food, medicine, water)?

The definition of 'Owner Occupied' also begs clarification. Does a foreigner using a Singapore property for property for investment (price appreciation)/ holiday use (2weeks/ annum) but otherwise vacant also qualify for the said owner occupied property tax concessions- how would IRAS know given that taxes are charged prospectively rather than retrospectively? Shouldn't the efficient use of space whether rented or private be equally rewarded? - Why are property renters being unnecessarily penalized?

According to IRAS, the usual property tax rate for tenanted and vacant residential properties is 10%: does this artificially distorted tax rate then cause property rentals to increase thus forcing all Singaporeans (PRs and foreigners) to own their own properties- a key source of inflation of property prices overall? Are the prices of property rentals in Singapore thus inflated, can property prices in Singapore be accurate if property rentals in Singapore are actually inflated?

If the intention of charging owners of vacant/ tenanted properties a higher tax rate was on the premise that such properties were owned by rich people, then wouldn't the owner of a $108Million Sentosa cove bungalow be a case of a very rich underpaying for his luxury in a land where food and medicine is taxed unwaveringly at 7%? The government must be nuts if not corrupt for tax rates on the poor to exceed those for the rich.

In 1Q2012, an Indian national bought surgeon Susan Lim's Sentosa bungalow for $39Million 'Indian national buys Susan Lim's Sentosa Cove home for $39 million' [BT, 02Mar2012], assuming a 3% rental pricing based on cost, the annual value of the S$39M bungalow would be $1.17Million. If the owner were to be charged standard 7%GST on $1.17M, the amount would be $81.9K but based on current owner occupied concessionary rates, the Indian national owning the said bungalow would pay only [(6k*0)+(59k*0.04)+(1.105M*0.06)]= $68.66K, which is a $13.24K discount compared to if a flat 7% had been charged. With necessities of poorer Singaporeans attracting 7% GST, for what reason should the rich Indian expat be luxuriating on Sentosa whilst enjoying tax discounts amounting $13.24K p.a.? Politicians have betrayed the poor in Singapore by choosing to tax necessities of the poor more than luxuries enjoyed by the rich.

The current high property prices in Singapore is also a significant depressant on Singaporean birth rates: 'Housing woes affecting birth rates' [ST, 05Sept2011]: "Although the fertility rate is stubbornly less responsive to many factors, it is possible that sustaining housing affordability may help at least in arresting the precipitous decline in the fertility rate" certainly requisites urgent reconsideration if Singaporean birth rates are to be encouraged.

In view of this significant asset inequality (as consequent to growing income inequality [link]) in Singapore, it is suggested that any increase in property taxes collected in going forwards be REDISTRIBUTED EQUALLY amongst ALL Singapore citizens (aged 0-120yrs) with PRs (residing here at least 182 days or more) receiving about half as a 'National Cohesion Dividend' (NCD) used firstly to settle property taxes/ rental of flats from HDB as the case might be with the excess channeled to CPF (some OA/ dividend account perhaps)- some low income households sharing cramped quarters might well find themselves with some extra cash given to the fact that the property taxes on their lodgings do not amount to much whilst singles living in expansive bungalows and foreigners speculating in Singapore properties would see their tax bill increased due to fewer (or zero) occupants sharing the tax- property would then be used more efficiently, perhaps freeing up some for the market. Those who want more comfort or prestige would just have to pay for the luxury whilst those who live with less would enjoy the fruits of this asset re-distribution procedure: overnight, Singaporeans would find citizenship TWICE as meaningful as it was before and foreigners would compete for Singapore citizenship/ PR status which of course Singaporeans must keep a finger on to avoid dilution of everyone's NCD- however, too steep a fall in property prices locally would also cause tax revenues to fall as conversely affect the NCD so Singaporeans cannot be too fussy either.

The CPF dividend account would then be usable for paying certain fees or withdrawal (joblessness/ insurance/ CC activities/ self improvement/ medical treatment/ other allowable dues within limits as assessed by government social workers)

Last edited: