https://asia.nikkei.com/Business/China-tech/Huawei-launches-new-chipset-as-Intel-alternative

China tech Huawei launches new chipset as Intel alternative

Chinese company doubles down on 'chip security' as it seeks growth beyond mobile

TAKASHI KAWAKAMI and CHENG TING-FANG, Nikkei staff writers January 07, 2019 21:53 JST

Huawei's newly launched TaiShan server, powered by new chipsets, is seen during a launch event at the company's headquarters in Shenzhen on Jan. 7. © Reuters

SHENZHEN/TAIPEI -- Huawei Technologies, the world’s biggest telecom equipment maker, launched a new core processor chipset on Monday for use in data center servers, a move to provide an alternative for the market to Intel's products.

The chipset dubbed Kunpeng 920, jointly developed with SoftBank-controlled U.K. chip designer Arm Holdings, delivers improved performance and reduces power consumption, Huawei said. Such advanced chips will be produced using 7-nanometer process technologies developed by Taiwan Semiconductor Manufacturing Co., the world’s biggest contract chipmaker.

Intel controls more than 96% of the global market share in making chips for servers and its X-86 architecture, which is also used by another smaller server processor maker Advanced Micro Devices, was viewed by the tech industry as the best foundation for server chips.

Intel, which has been struggling to transition into the age of mobile gadgets, has so far maintained a tight grip on the data center sector but is facing more competition. Huawei still needs to purchase chips from Intel and AMD to build its own data center server products.

"Huawei and Intel will continue our long-term strategic partnerships and continue to innovate together," said William Xu, Huawei board director and chief strategy marketing officer.

Arm Holdings whose technology can be found in more than 90% of mobile devices has long aimed to break Intel’s monopoly. The company, acquired by Softbank in 2016, has teamed up with many of its clients including Huawei’s chip arm HiSilicon Technologies, Marvell, Cavium and Qualcomm to roll out server chips with TSMC's manufacturing support. For now, Arm-based servers account for less than 1% of the market.

Huawei’s venture into data center server chips follows the recent arrest of Chief Financial Officer Meng Wanzhou in Canada on suspicion of violating U.S. sanctions against Iran. The world’s top telecom gear provider and No. 2 smartphone maker, meanwhile, found itself increasingly shut out of global 5G network projects amid security concerns about its close ties to Beijing.

The Chinese company based in Shenzhen has reason to team up with Arm Holdings as it’s eager to slash dependence on U.S. chip providers such as Intel, Nvidia, and Qualcomm on fears that its supplies of American technologies will be cut off, a fate that its smaller peer ZTE faced in April 2018.

The production of data center server chips is a high-value sector and an essential technology for the future. Artificial intelligence and autonomous driving both require powerful data centers to capture, process and analyze enormous amounts of information.

Huawei already has expertise developing high-end core processors for its smartphones and HiSilicon is the country’s top chip designer by revenue and technology. The company also unveiled a wide range of artificial intelligence accelerator chips for servers and cars to wearables in October.

HiSilicon often uses the industry’s most advanced and most costly chip production technology provided by TSMC that Apple also adopts for its iPhone core processors.

The new chip has "unique advantages in performance and power consumption," said Chief Marketing Officer William Xu during a news conference on Monday at company headquarters. Huawei aims to "drive the development of the ARM ecosystem," in order to respond to the expansion of cloud services and big data, he added.

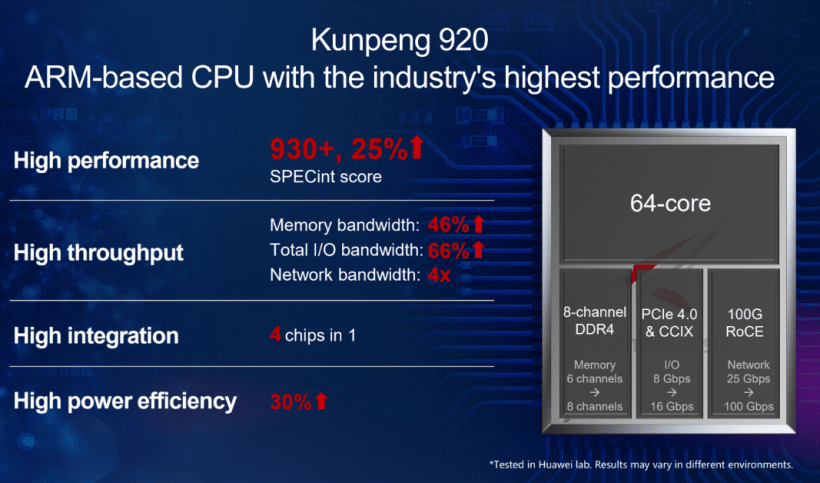

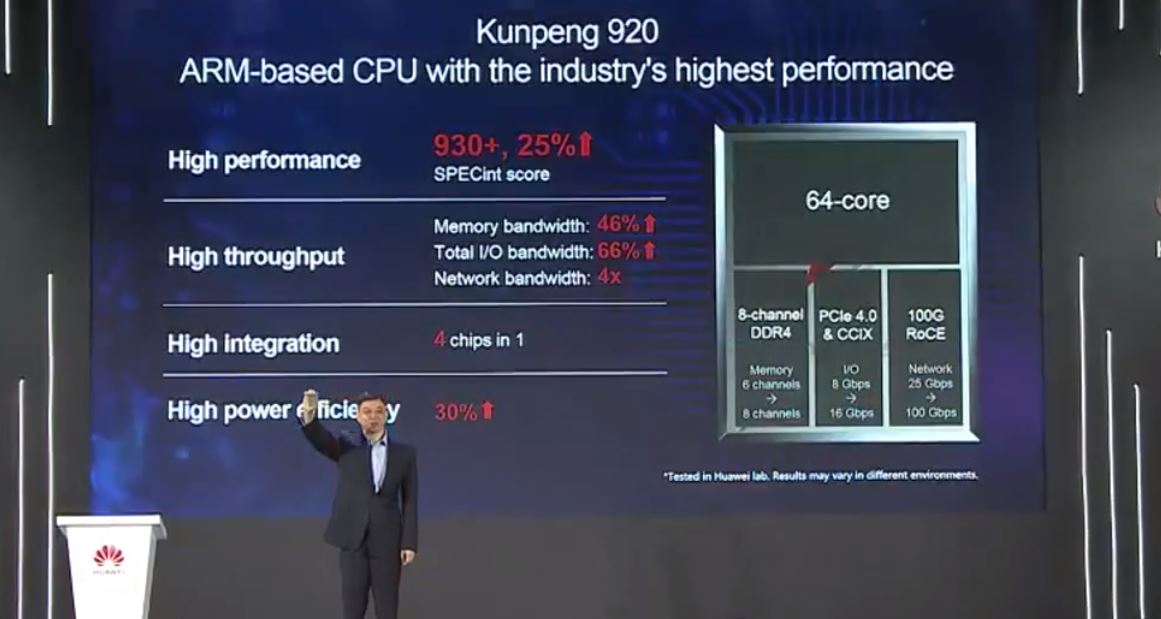

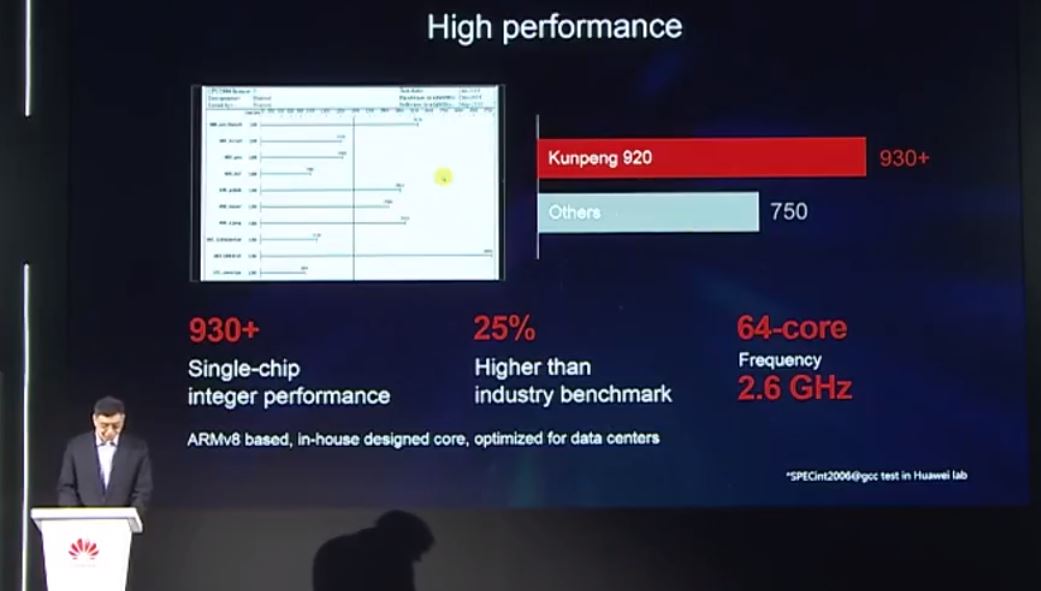

Huawei's Kunpeng 920 central processing unit features 25% better computing performance than its peers and reduces power consumption by 30%. The company will use the new central processing units in its own servers dubbed TaiShan, and has no plans to sell the technology to others.

Huawei is also the world’s leading server builder trailing Dell, HP, Lenovo Group, and holds a similar market share like Cisco and Inspur Group, according to Gartner.

The Chinese tech powerhouse’s semiconductor ambition also underscores Beijing’s grand hope to build a competitive chip sector, a key battleground of the ongoing tech spat between the world’s top two economies, as soon as possible by pouring in funds from central and local governments.

The Chinese government aims to produce 70% of its own chips in the near future, up from the current 10% to 20%.

https://www.servethehome.com/huawei-kunpeng-920-64-core-arm-server-cpu/

Huawei Kunpeng 920 64-Core Arm Server CPU with CCIX and PCIe Gen4 Launched

By

Patrick Kennedy

-

January 7, 2019

6

Share on Facebook

Tweet on Twitter

Huawei Kunpeng 920 Launch Cover

Huawei Kunpeng 920 Launch CoverToday Huawei announced a new 64-Core Arm Server CPU. The Huawei Kunpeng 920 is being billed as the fastest Arm CPU to date. One thing is for sure, there is going to be interest in this CPU not just for the 64 custom Arm cores, but also the I/O that the chip has onboard. We thought we would take a moment to show what Huawei is building, and why it is important.

Huawei Kunpeng 920 64-Core Arm Server CPU

Huawei has a design team that has been producing CPUs for years. We are going to get into the business reason for this in a bit, but what the company is doing seems far from gluing Arm cores together. Instead, the company is producing an integrated chip with high-speed I/O. Further, it is the first dual socket Arm 7nm server chip that has been publicly announced. It is also the first chip with DDR4-2933 support, a spec we expect companies like Intel and AMD to match with their 2019 parts.

Beyond the CPU cores and 8 channel DDR4-2933 memory controller, the company is also introducing PCIe Gen4 and CCIX support. We know that AMD EPYC Rome will support PCIe Gen4 this year (likely with CCIX), and Intel Cascade Lake will not. Like we saw Cavium do with the original ThunderX, Huawei is also integrating networking with a 100GbE RoCE NIC in the Kunpeng 920.

Huawei believes the high core count and solid clock speeds of 2.6GHz will give it enough performance to be ahead of many of the competitive offerings out there. We will take a second to note that with both AMD and Intel pushing close to 4GHz, the 2.6GHz Arm cores are likely not going to match single thread performance. All of the numbers we have seen from Huawei are using multiple threads and the 25% faster claim is using the depreciated SPEC CPU2006 integer test, not the current generation SPEC CPU2017 that we used in our Cavium/ Marvell ThunderX2 launch piece.

Overall, this is an interesting Arm server offering, and we expect more high core count Arm CPUs to come out in the coming year(s). AMD will have a 64 core part this year and Intel will have a 48 core, higher clock speed part with Cascade Lake-AP.

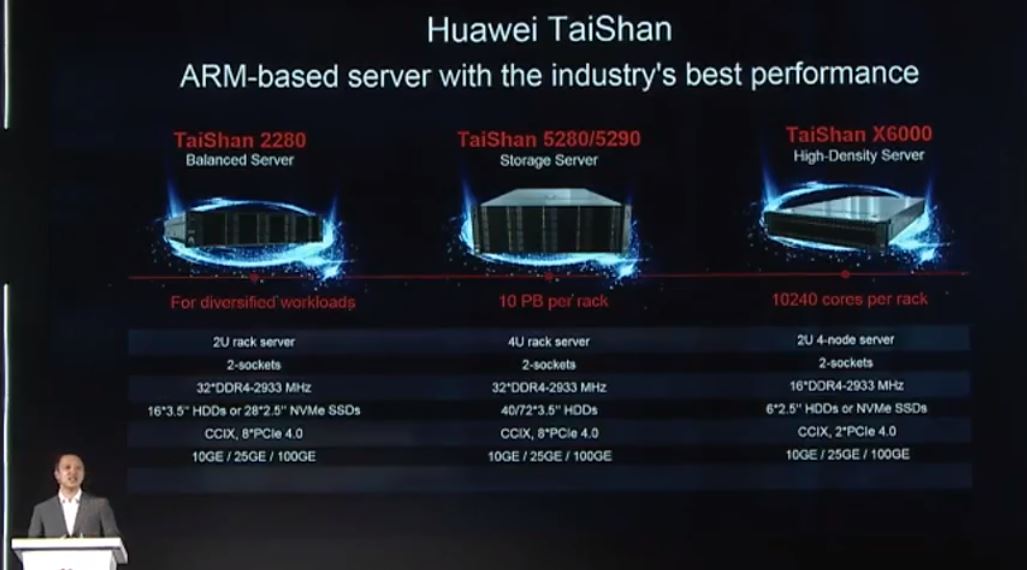

Business Side of the Kunpeng 920

Beyond the chip itself, there are a number of commercial questions raised by the Huawei Kunpeng 920. First is, where will they get used? A new Huawei TaiShan server line will utilize the chips. There are three servers that will include the chips. One is the Huawei TaiShan 2280 which is a traditional 2U dual socket form factor. The TaiShan 5280/ 5290 is a storage server platform in 4U 40-bay and 72-bay configurations. Finally, the Huawei TaiShan X6000 is a 2U 4-node server.

Although the spec was not listed in what we saw, the 32x DDR4-2933 maximum spec seems to indicate that the Huawei Kunpeng 920 is a two DIMM per channel design.

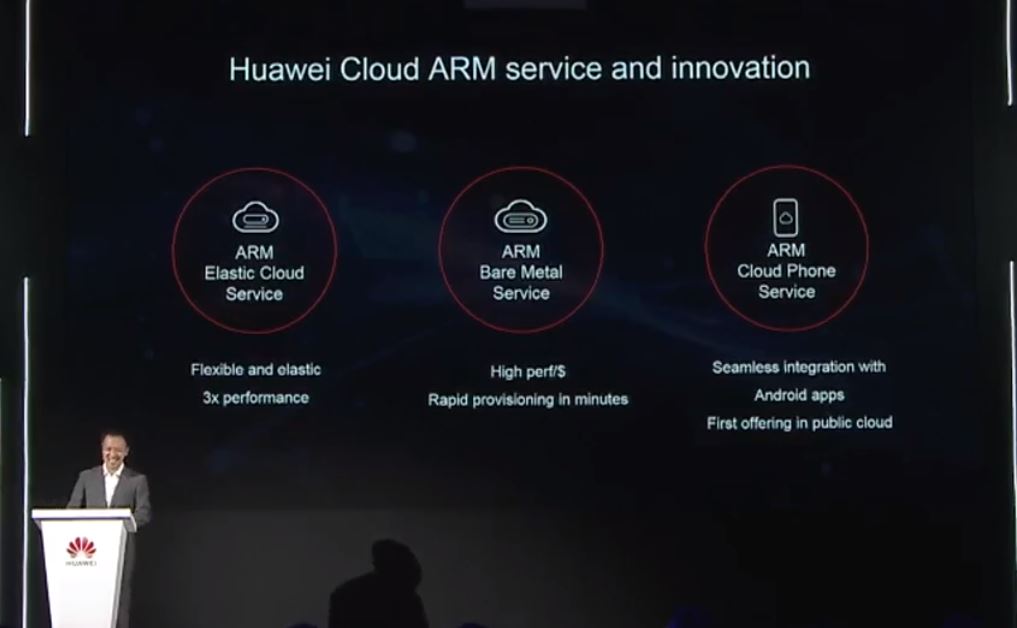

Beyond the traditional server form factors, the company is announcing their intent to offer the Huawei Cloud ARM service which will have elastic compute and bare metal provisioning for the Kunpeng 920 based servers. Companies can use this for things like Arm phone services. Huawei says that the cloud service will be up to 3x the performance of the AWS EC2 A1 Graviton based instances. We putting the AWS Graviton and its Arm CPU performance in context and found that AWS’s offering was not up to par with modern single socket performance.

A fascinating aspect to the presentation was the ecosystem slide, specifically the hardware swim lane.

One can see that Intel is in three of the five Huawei Arm hardware partner boxes. When we discussed how Intel is focused beyond just supplying CPUs to achieve higher TAM, for example in Intel One API to Rule Them All Is Much Needed, this is a great example. Even if the sever is using an Arm CPU, Intel has a number of other vectors to play in.

Final Words

In 2019, we are going to hear a lot more about the Arm Neoverse. Huawei is not aiming to be a merchant of silicon for others to use such as with the ThunderX2 and Ampere eMAG. Instead, Huawei is using the chips, like AWS is, to offer its own products and services. That is important for two reasons. First, it is a great bargaining tool for negotiations with Intel. Second, it is also setting up a dichotomy in the Arm space where there will be two types of Arm CPUs people use. There will be vendor specific CPUs and on the other end of the spectrum merchant CPUs. This is much like in the smartphone space where there are custom Apple SoC’s and merchant Qualcomm SoCs. Arm vendors are working on building a base infrastructure for compatibility purposes.

We look forward to companies pushing the CPU envelope with designs like the Huawei Kunpeng 920. While 2019 has just started, it is going to be one of the most interesting years in server CPUs in over a decade.

https://www.cnbc.com/2019/01/07/huawei-launches-kunpeng-920-chipset-for-servers-.html

Huawei launches next-generation chipset for servers as it aims to become a top 5 cloud player

- Huawei unveiled a new chipset called the Kunpeng 920 on Monday, designed to go into its new TaiShan servers, in a bid to boost its nascent cloud business.

- It's based on architecture from ARM, the company now owned by SoftBank.

- William Xu, chief strategy marketing officer at Huawei, told CNBC that he hopes the firm will become one of the top five cloud players in the world.

Arjun Kharpal | @ArjunKharpal

Published 1:42 AM ET Mon, 7 Jan 2019 CNBC.com

Arjun Kharpal | CNBC

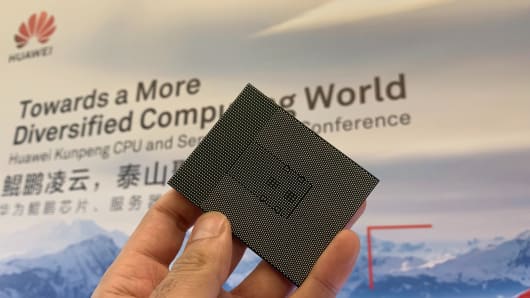

The Huawei Kunpeng 920 chipset on display at the company's headquarters in Shenzhen, China.

Huawei unveiled on Monday a next-generation chipset for servers, potentially pitting it against the likes of AMD, even as the Chinese technology giant faces political headwinds around the world.

The new chipset, called Kunpeng 920, is designed to go into data centers and will power the company's TaiShan server, which was also launched on Monday.

Huawei is keen to show it is pushing ahead with business despite major political headwinds, including the arrest of its CFO in Canada and continued accusations from the U.S. and others that the company's equipment could be used as a backdoor by the Chinese government to spy on citizens.

In response to a question from CNBC about whether political pressure could affect sales of the new server, William Xu, Huawei's chief strategy marketing officer and director of the board, told CNBC that the company hopes to attract customers by making good products.

"Only by achieving good-quality products can we win our customers. We will obey laws and restrictions in local markets, and eventually make products that are recognized and welcomed by customers," Xu told CNBC in a Monday interview.

Huawei's new silicon, known as a central processing unit (CPU), was designed by the company and based on a chipset architecture created by ARM, the U.K.-headquartered company now owned by SoftBank.

The Kunpeng 920 is a 7 nanometer chip, a designation tied to its size. Such technology is the latest in the semiconductor industry and allows for smaller components that are more powerful and energy efficient than their predecessors.

Huawei said its new servers with the Kunpeng 920 are designed to help process and store large amounts of data.

ARM has typically been a player in mobile devices with its chipsets, but it has of late tried to push into the server and cloud market. Huawei is not the only company with a 7 nanometer chipset designed for servers. AMD has its own product that it launched last year. Huawei's latest move puts it in competition with the likes of that semiconductor firm and NVIDIA.

It's also not Huawei's first 7nm chipset. The company has the Kirin 980, which is designed for its own mobile phones, and the Ascend 910, which was created to handle artificial intelligence applications run in the cloud. The Ascend 910 is also designed for data centers, but serves a different function than the new Kunpeng 920.

Arjun Kharpal | CNBC

William Xu, Huawei's chief strategy marketing officer and director of the board presents the new Kunpeng 920 chip.

Aiming for the top of the cloud

Huawei makes most of its money from selling telecommunications equipment. But it is searching for new avenues of growth such as consumer electronics and cloud computing. Huawei is hoping the TaiShan servers will help boost the latter business.

The technology giant has worked with Intel for many years on semiconductors for its servers, but the Kungpeng 920 is based off of ARM architecture. Xu said that Huawei will continue its relationship with Intel but it chooses the best option for each use case.

"Huawei and Intel are long-term strategic partners, in the past, now and will be in the future. The relationship between Huawei and Intel, though we have differences in our CPU structures, our products complement each other. We will keep using Intel CPU in areas where they perform better, and use ARM-based CPU in areas like cloud and servers where they are better," Xu told CNBC.

There has been a broad move by Chinese technology companies to wean themselves off of American technology, particularly semiconductors. Huawei has pushed its own chips extensively in smartphones and servers and hopes the latest addition to its portfolio will eventually make it one of the top cloud players on the planet.

"We hope to make our cloud service, together with our partners, one of the top five cloud services in the world," Xu said.

The current top cloud players are Amazon, Microsoft, IBM, Google and Alibaba, according to market insight firm Synergy Research.

Arjun KharpalAsia Technology Correspondent