https://www.cnbc.com/2018/02/07/most-cryptocurrencies-will-crash-to-zero-goldman-sachs-says.html

Most cryptocurrencies will crash to zero, Goldman Sachs says

Published 8 Hours Ago Updated 2 Hours Ago CNBC.com

Goldman Sachs: Most cryptocurrencies will crash to zero 1 Hour Ago | 00:39

Most cryptocurrencies are likely to fail with their value falling to zero, Goldman Sachs said in a note, comparing the current market to the "internet bubble of the late 1990s."

Steve Strongin, head of Goldman Sachs global investment research, said in a note dated Monday, that cryptocurrencies don't have "intrinsic value" adding that it's "unlikely" whether any of today's digital currencies are likely to survive in the long run.

"People seem to be trading cryptocurrencies as though they're all going to survive, or at least maintain their value. The high correlation between the different cryptocurrencies worries me. Contrary to what one would expect in a rational market, new currencies don't seem to reduce the value of old currencies; they all seem to move as a single asset class," Strongin said.

"But if you believe this is a 'few-winners take-most' situation, then the potential for retirement depreciation should be taken into account. And because of the lack of intrinsic value, the currencies that don't survive will most likely trade to zero."

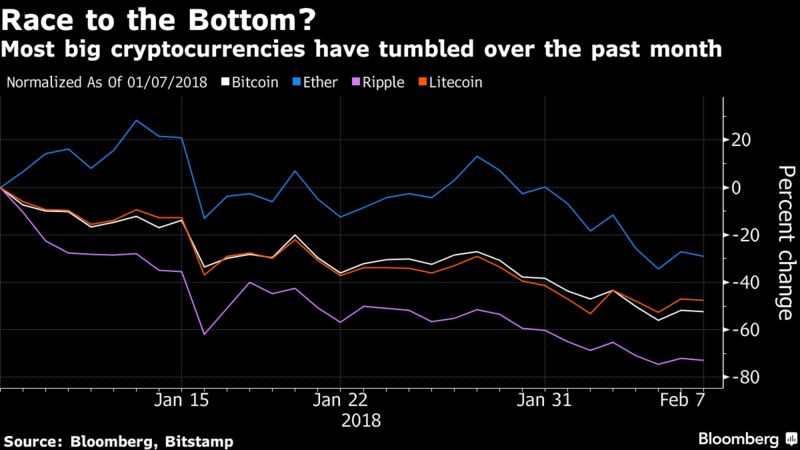

The Goldman research note comes after a violent sell-off in the cryptocurrency market over the past few days, which at its lowest point on Tuesday, saw over $550 billion of value wiped off the market. Bitcoin even dipped below $6,000 for the first time since November.

Should you invest in a cryptocurrency? 9:27 AM ET Thu, 26 Oct 2017 | 05:22

Strongin calls the current period of cryptocurrencies an experiment and compared it to the internet bubble of the late 1990s. He said that very few companies that existed then went on to become even more valuable. Both Google and Amazon did but in a "completely different form," he added.

"So, are any of today's cryptocurrencies going to be an Amazon or a Google, or will they end up like many of the now-defunct search engines? Just because we are in a speculative bubble does not mean current prices can't increase for a handful of survivors," Strongin said.

"At the same time, it probably does mean that most, if not all, will never see their recent peaks again."

Goldman's head of investment research said that the underlying technology behind cryptocurrencies called blockchain, "clearly has a role" in improving the ledgers underlying financial transactions.

Goldman has previously poured cold water on cryptocurrencies as an investment. In October, the investment bank released a note saying that bitcoin is not the new gold.

Other commentators have also cautioned on cryptocurrencies. Noted economist Nouriel Roubini, also known as "Dr Doom," said Tuesday that he thinks the price of bitcoin would crash to zero. And legendary investor Warren Buffett told CNBC in a recent interview that cryptocurrencies will "come to a bad ending."

Cryptocurrencies rebounded on Wednesday though many were still off their all-time highs. Still, experts told CNBC that the cryptocurrency market as a whole could hit $1 trillion this year.

WATCH: Carl Icahn says bitcoin and other cryptocurrencies are 'ridiculous'

Carl Icahn: Bitcoin and other cryptocurrencies are 'ridiculous' 2:17 PM ET Tue, 6 Feb 2018 | 02:00

Arjun KharpalTechnology Correspondent

Most cryptocurrencies will crash to zero, Goldman Sachs says

- Most cryptocurrencies are likely to fail with their value falling to zero, Goldman Sachs said in a note.

- The investment bank compared the current market to the "internet bubble of the late 1990s."

- Steve Strongin, head of Goldman Sachs global investment research, said that most cryptocurrencies are unlikely to see their recent peaks again.

Published 8 Hours Ago Updated 2 Hours Ago CNBC.com

Goldman Sachs: Most cryptocurrencies will crash to zero 1 Hour Ago | 00:39

Most cryptocurrencies are likely to fail with their value falling to zero, Goldman Sachs said in a note, comparing the current market to the "internet bubble of the late 1990s."

Steve Strongin, head of Goldman Sachs global investment research, said in a note dated Monday, that cryptocurrencies don't have "intrinsic value" adding that it's "unlikely" whether any of today's digital currencies are likely to survive in the long run.

"People seem to be trading cryptocurrencies as though they're all going to survive, or at least maintain their value. The high correlation between the different cryptocurrencies worries me. Contrary to what one would expect in a rational market, new currencies don't seem to reduce the value of old currencies; they all seem to move as a single asset class," Strongin said.

"But if you believe this is a 'few-winners take-most' situation, then the potential for retirement depreciation should be taken into account. And because of the lack of intrinsic value, the currencies that don't survive will most likely trade to zero."

The Goldman research note comes after a violent sell-off in the cryptocurrency market over the past few days, which at its lowest point on Tuesday, saw over $550 billion of value wiped off the market. Bitcoin even dipped below $6,000 for the first time since November.

Should you invest in a cryptocurrency? 9:27 AM ET Thu, 26 Oct 2017 | 05:22

Strongin calls the current period of cryptocurrencies an experiment and compared it to the internet bubble of the late 1990s. He said that very few companies that existed then went on to become even more valuable. Both Google and Amazon did but in a "completely different form," he added.

"So, are any of today's cryptocurrencies going to be an Amazon or a Google, or will they end up like many of the now-defunct search engines? Just because we are in a speculative bubble does not mean current prices can't increase for a handful of survivors," Strongin said.

"At the same time, it probably does mean that most, if not all, will never see their recent peaks again."

Goldman's head of investment research said that the underlying technology behind cryptocurrencies called blockchain, "clearly has a role" in improving the ledgers underlying financial transactions.

Goldman has previously poured cold water on cryptocurrencies as an investment. In October, the investment bank released a note saying that bitcoin is not the new gold.

Other commentators have also cautioned on cryptocurrencies. Noted economist Nouriel Roubini, also known as "Dr Doom," said Tuesday that he thinks the price of bitcoin would crash to zero. And legendary investor Warren Buffett told CNBC in a recent interview that cryptocurrencies will "come to a bad ending."

Cryptocurrencies rebounded on Wednesday though many were still off their all-time highs. Still, experts told CNBC that the cryptocurrency market as a whole could hit $1 trillion this year.

WATCH: Carl Icahn says bitcoin and other cryptocurrencies are 'ridiculous'

Carl Icahn: Bitcoin and other cryptocurrencies are 'ridiculous' 2:17 PM ET Tue, 6 Feb 2018 | 02:00

Arjun KharpalTechnology Correspondent

Bitcoin 'nuts' will hold cryptocurrency until price plummets to zero - ‘Dr Doom’ Nouriel Roubini

Bitcoin 'nuts' will hold cryptocurrency until price plummets to zero - ‘Dr Doom’ Nouriel Roubini