The Crypto World Lands in Singapore in Search of Fresh Narrative

Photographer: Carolina Moscoso

By

Muyao Shen

September 18, 2024 at 5:00 AM GMT+8

Save

Muyao Shen wonders if Token2049 in Singapore will produce crypto’s next big narrative, or just more of the same.

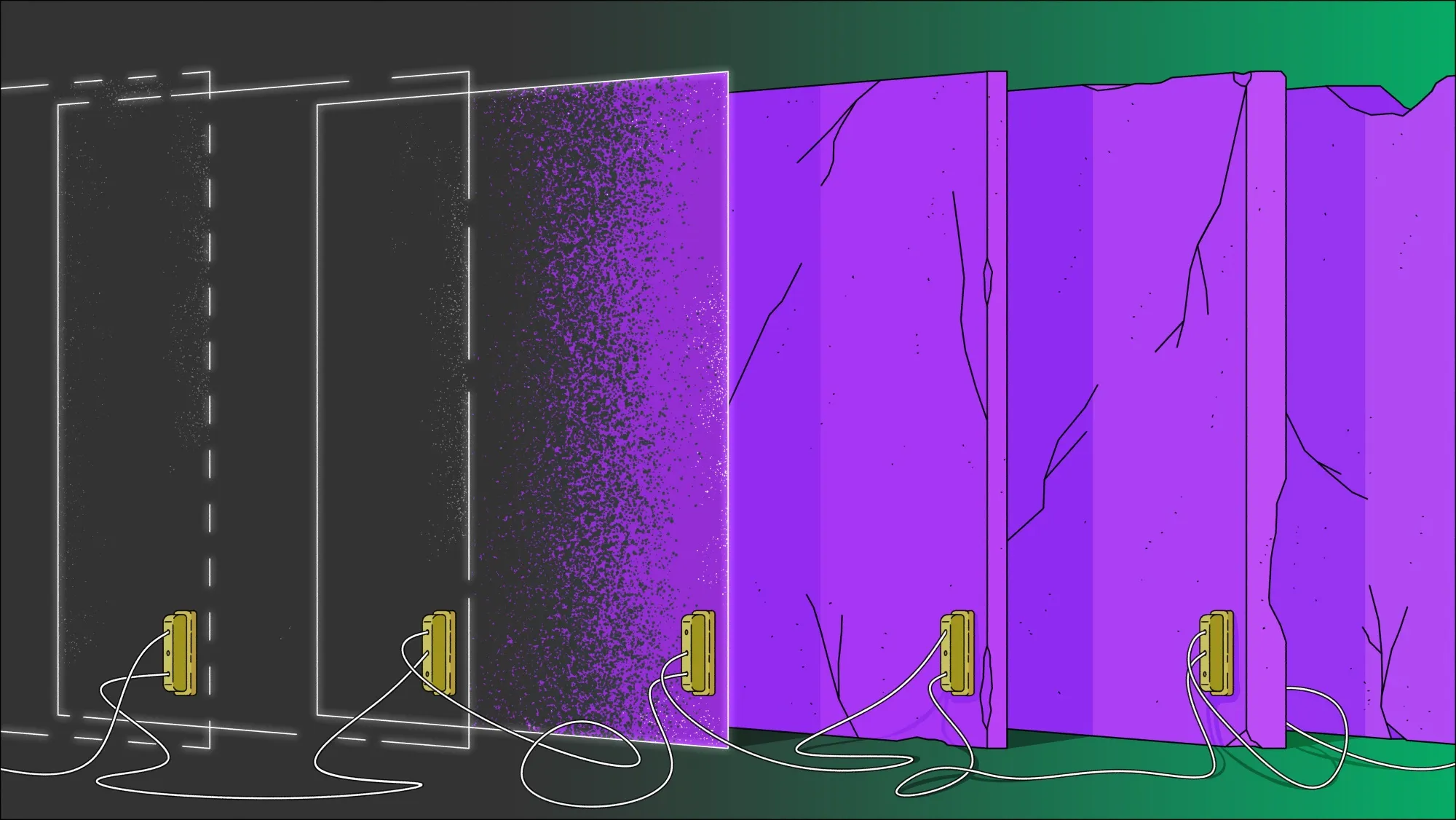

Narrative depletion

Welcome to the time of year when the entire crypto industry is descending on Singapore, the garden city of Southeast Asia, for the Token2049 conference. Like other big events in the digital-asset industry, it’s safe to expect some wild anecdotes will emerge. After all, this is the crypto industry, where there is always a bull market in wild anecdotes.

While crypto has long had a love affair with conferences, this year the hype in Singapore has reached a fever pitch. Yet outside of the parties, lavish dinners, and karaoke sessions, the industry is grappling with one pressing question: What’s the next big narrative?

Crypto thrives on narratives. In fact, the stories being told tend to drive the market more than any actual technological breakthroughs.

Three years ago, the buzz was around TerraUSD, an algorithmic stablecoin that promised a decentralized economy free from outside intervention. Two years ago, it was FTX and its empire aiming to disrupt global finance. Neither narrative ended well. But at the time, the stories were intriguing. Money flowed in, and prices soared.

Yet fresh narratives are hard to come by these days, and one sign of desperation for new plotlines is the recycling of old ones.

Lately, there’s renewed chatter around decentralized physical infrastructure networks,

or DePINs, an effort to use blockchains to decentralize ownership of pieces of real-world infrastructure.

Many are touting this sector as the next big thing, but similar ideas were hyped years ago by projects like

Helium’s efforts to create a decentralized wireless communications network.