Why Did Bitcoin Suddenly Plunge Below $60,000?

Published Jul 03, 2024

Why Trust Us

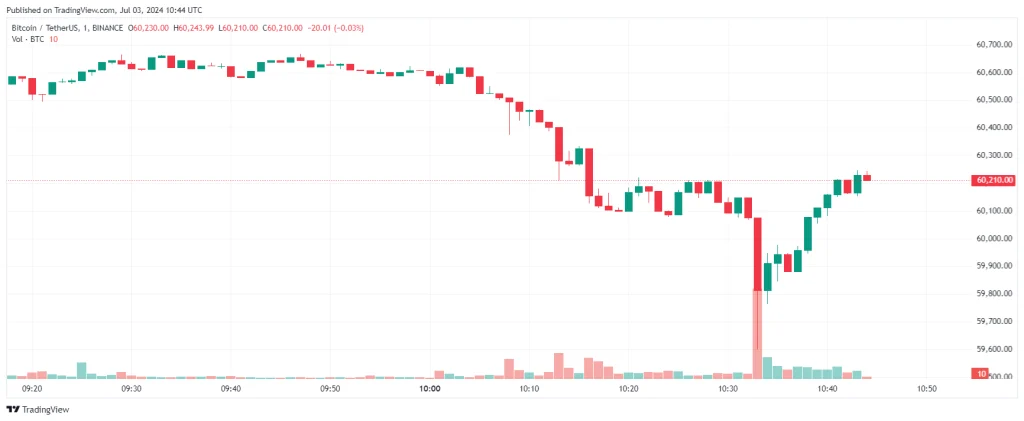

The Bitcoin market has recently experienced a sharp decline, pushing its price back toward $60,000. This downturn followed revelations from a previously bullish billionaire investor who has seemingly reversed their stance on the cryptocurrency.

Over the last month, Bitcoin has lost nearly 15% of its value, fueled by concerns of a potential “true correction” in the market.

Federal Reserve’s Economic Outlook

Federal Reserve Chair Jerome Powell highlighted a “critical period” for the U.S. economy during a speech at the European Central Bank’s conference in Portugal. Powell described the current level of U.S. debt as sustainable, but he criticized the fiscal trajectory as unsustainable.

He specifically pointed out the risks posed by the Biden administration’s policy of running substantial deficits at a time of full employment, a strategy he deemed unsustainable in economically favorable times.

These statements contributed to growing market anxiety, impacting both traditional and cryptocurrency markets.

Bitcoin (BTC) price chart (1 day). Source: CoinMarketCap

In the same vein, Treasury Secretary Janet Yellen issued a stark warning regarding the burgeoning $34 trillion U.S. debt. Analysts speculate that this escalating debt could potentially drive the Bitcoin price to an unprecedented $1 million over the next 18 months.

However, her warning also intensified fears of economic instability, further pressuring the crypto market.

Market watchers have been closely monitoring the Federal Reserve for any signs of interest rate adjustments. Although expectations initially included up to seven rate cuts in 2024, recent assessments have scaled these expectations back to just one or two cuts.

Powell, expressing his concerns, noted the importance of getting the balance on monetary policy right during this critical period, a topic that preoccupies him in the early hours. This cautious stance on rate cuts added to market uncertainty, contributing to the Bitcoin sell-off.